|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

RECAP

Weekend Dec. 27th, 2015

Follow Our Updates

onTWITTER

https://twitter.com/GordonTLong

ARCHIVES

| DECEMBER | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | ||

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 13 | 14 | 15 | 16 | 17 | 18 | 19 |

| 20 | 21 | 22 | 23 | 24 | 25 | 26 |

| 27 | 28 | 29 | 30 | 31 | ||

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?We have analyzed & included

these in our latest research papers Macro videos!

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

TODAY'S TIPPING POINTS

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK -Dec 20th, 2015 - Dec 26th, 2015 | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

SOVEREIGN DEBT CRISIS |

7 |

||

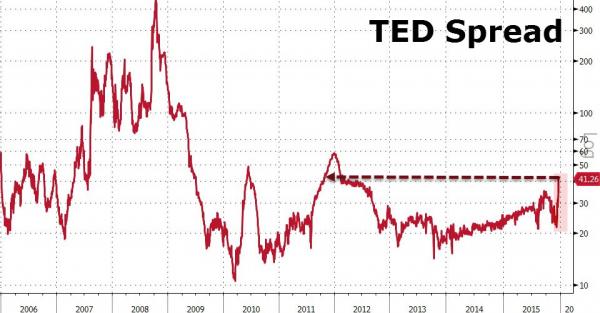

Submitted by Tyler Durden on 12/21/2015

Bank Counterparty Risk Surges To 4-Year HighIn September, interbank credit markets flashed a quick and brief warning that something was up... and Janet folded. Three months later and following The Fed's oddly-timed rate-hike, interbank counterparty risk - as proxied by the TED-Spread - has spiked over 45% in 2 days, the most since Sept 2008 (Lehman). The TED Spread is the difference between the interest rates on interbank loans and on short-term U.S. government debt and as such offers a proxy for how banks themselves perceive the relative creditworthiness of the financial system. The last time TED spread was surging to this level was late 2011, as Europe's crises was exploding. Which makes one wonder whether The Fed rate hike was - as we detailed here - an implicit bailout for foreign (read European) banks? But the pace of increase is extremely worrisome historically (h/t Brendan Ferro) The Fed just hiked into this massive two-week surge in TED spreads; as opposed cutting by 75 bps in 2008 and unleashing more QE at Jackson Hole in 2011! That hike seems akin to what happened in Sep-08 when Lehman went Bankrupt. US financials credit risk continues to push wider (with stocks remaining cognitively disssonant for now).

Charts: Bloomberg With the Fed's own National Activity Index tumbling, its own Financial Stress Index soaring, and now major concerns about the US financial system's stability looming, one has to ask, how long before Janet unleashes the next QE?

|

|||

What are the banks nervous about? The same thing the Fed appears to be worried about! Inability for US Government to handle its debt as the passage of the new US Fisical Budget glaringly illustrated! Dan Amerman: Financial Repression & The New Interest Rate HikePeak Prosperity's Chris Martenson interviews Daniel Amerman who sees the Federal Reserve announcement as another confirmation of continued financial repression to control the burden of debt & allow a transfer of wealth from savers to the government "I just read the statement from the Federal Reserve and what they clearly showed was this was not normal. And, one of the clear ways that they showed it is that they made crystal clear that they would be keeping their current holdings of U.S. government and agency debt in roughly the 2.4 to 2.5 trillion dollar range . If you want to drive interest rates up, you want to tighten the system and you might remove money from the system let’s say by selling many of those assets. And, they’ve made clear on the front end that they’re not doing that .. What governments typically do, their most popular choice when they get deeply into debt is they increase their control over the markets so they knock out the interest rate risk for themselves, they push rates way down as they’ve done to historical lows. There’s more to it than that (we'd need another full hour more to talk about financial repression), but basically, they transfer wealth from savers to the government in the process of paying down the debt, in a process that most people don’t understand." |

|||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market | |||

| TECHNICALS & MARKET |

|

||

| Market - WEDNESDAY STUDIES | |||

| TECHNICALS & MARKET |

|

||

| STUDIES - MACRO pdf | |||

When Is The Crash Going To Happen? |

12-23-15 | STUDIES | |

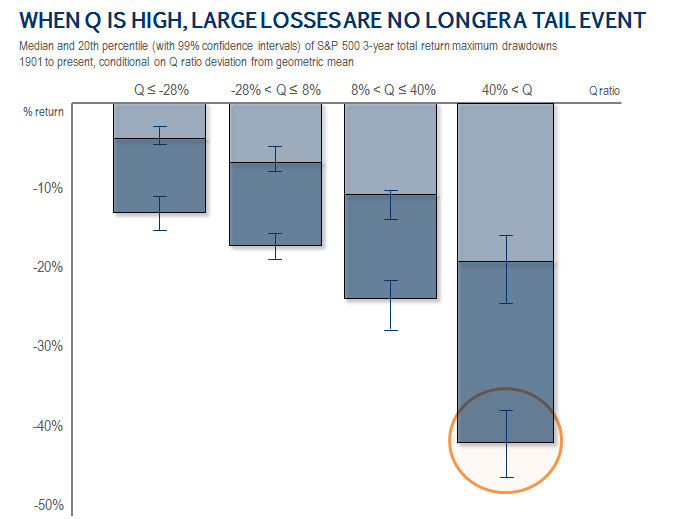

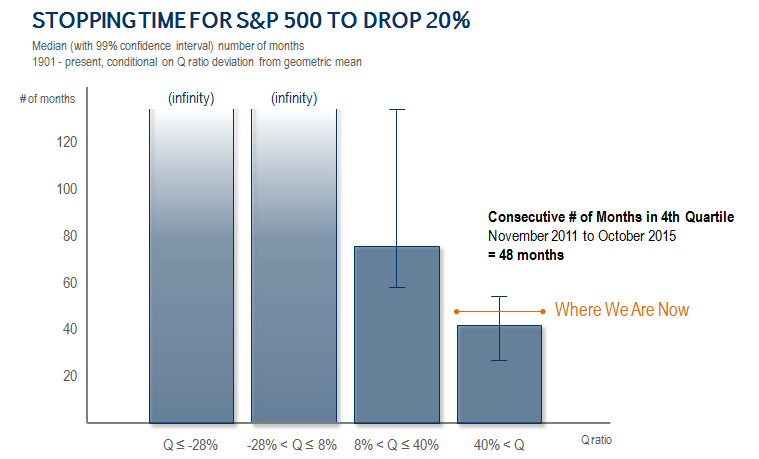

Submitted by Mark Spitznagel via Pensions & Investments, "When Is The Crash Going To Happen?" - Mark Spitznagel Revisits "The Ticking Time Bomb"Since the question “when is the crash going to happen?” is always asked, we thought it particularly timely to update the research we have done on the topic. Timing a crash can be a fool's errand, and fortunately such efforts are largely irrelevant if you are tail hedging (though they are quite relevant if you aren't). When tail hedging efficiently, the extreme asymmetries in payoffs, by definition, removes any need to time the top. But this doesn't mean that exercises in timing are without merit. As we showed in previous research, without a doubt (or at least with over 99% confidence), bad things happen with increasing expectation when conditioning on higher Q ratios ex ante. That is, when Q is high, large stock market losses are no longer a tail event but become an expected event. Factoring time into the equation, and again based on history, the confidence interval around the median time would point to an expectation that the crash should commence right about now. Monetary policy has proven to be very effective over the past seven years in elevating asset markets. However, its effect has been limited to the price of assets (the “title” to existing capital), but not the price of new capital. This differential is depicted in the Q ratio, where one can think of the numerator as representing the aggregate price of the stock market and the denominator as the aggregate book value. The higher the ratio, the further the stock market is priced relative to the reality of the underlying capital, and the greater the implied return on that aggregate capital above the average aggregate cost of capital. This ratio has always had its breaking point, much to the frustration of interventionist monetary policy, as the numerator ultimately crashes back to the denominator, rather than the denominator catching up to the numerator (a fact that Keynesians from Paul Krugman to James Tobin himself have considered a central puzzle of economics). Indeed, the continued deviation of this ratio from its long run historical average is something that both economic history and, best of all, economic logic dictate as unsustainable. The question becomes how deviations and extremes in the Q ratio are ultimately corrected. The short answer is: they are corrected via the numerator, i.e., through corrections in the aggregate stock market value. The further the Q ratio has deviated from its long run historical average, simply put, the further the stock market has to fall to correct that deviation (this is what the market's homeostatic process does so predictably well).

There are regularities in the “stopping time” to the market's homeostatic correcting of extreme Q deviations, and as we saw recently in China, even massive interventions can't ultimately stop such corrections. An equity holder should be very aware of the current valuation environment, the magnitude of the drop that is to be expected, and the inherent cyclicality behind the amount of time between crashes. We are currently beyond the median amount of time, historically, before we would expect to see at least a 20% correction of the stock market (the numerator). Most importantly perhaps, the majority of the losses tend to happen in a concentrated plunge at the tail end of the path down to minus 20%. For instance, in just the last two months before the market passes through our 20% drawdown trigger, it typically (on average) has experienced a loss of nearly the entire 20%.

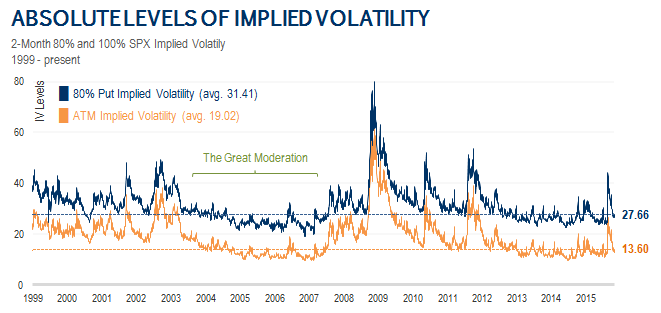

The very high probability of a crash currently implied by history flies in the face of a very low probability of a crash currently implied by the options market. The same beliefs that have pushed the market to extreme valuations have also returned option prices back to near record lows. If there is elevated risk in the equity market to the degree we have seen, counter-intuitively, it is not at all priced into options markets.

To use my favorite investing metaphor, the pot odds - the payoff, or the size of the pot relative to the price of calling - are very favorable compared to the hand odds - the likelihood of making the best hand; that is, we are getting the best of it. In the recent August volatility (or in any other crashes we have seen), the tide turned both too surprisingly and too quickly for most to fully re-position until it was much too late. The future need not look like the past, but for an equity holder (or an opportunistic trader), the price of equity tail risk is not currently representative of that which has proven itself throughout history under similar (if not far less risky!) circumstances. How much further the rally stretches, whether another 10% or 100%, does not matter to an efficient tail hedger; it only adds to the expected magnitude and timing of a pending crash—which grows larger and sooner with each uptick in the stock market and tick of the clock—thus adding to the expected profitability and strategic advantage of the hedge.

|

|||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||

| THESIS - Mondays Posts for Financial Repression & Posts on Thursday for Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

Morgan Stanley’s Ronnie Lapinsky Sax: “Interest rate normalization will provide headwind for investors using bonds for principal preservation” |

|||

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

I - POLITICAL |

|||

CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM

MACRO MAP - EVOLVING ERA OF CENTRAL PLANNING

|

G | THEME | |

| - - CRISIS OF TRUST - Era of Uncertainty | G | THEME | |

Submitted by Paul Philips via NewParadigm.ws, 7 Examples Of Demonizing Dissension & Public Opinion As the Western world's "powers that be" tighten their tyrannical controlling noose on humanity's dissension and public opinion, it has never been more important to remember the quote from Orwell‘s novel 1984: "In a time of universal deceit, telling the truth is a revolutionary act." To countermeasure this much-needed dissension and free public opinion to raise awareness and free humanity the powers that be have taken a severe stance on punishing those who oppose their views regardless of truth or untruth to advance an oppressive agenda. So, in response, during these times of universal deceit and oppression, here are 7 examples of unjustly demonizing dissension and public opinion. 1. Medical dissention and the AMA’s gagging orders To get an even larger slice of the medical monopoly the highly influential AMA (American Medical Association) a wing of the medical/pharmaceutical establishment has announced plans to put in gag ordersdesigned to control and prevent doctors from speaking out publically on ‘dubious alternative medical practices.’ Should doctors go outside of the AMA’s guidelines then they could face having their licenses revoked while being unjustly accused of quackery... -This unfairly biased stance will even further hit integral doctors offering help and advice on track-record proven effective alternative medical practices. What has the US come to? People, are you going to allow this suppression of free speech? History has shown us time after time that medical advancements resulting in humanitarian contribution has come from challenging medical orthodoxy. 2. Climate change At a recent talk in Austin, Texas for the yearly South by Southwest Festival (SXSW) Al Gore, former vice-president, made a number of pseudo-scientific statements provably wrong about climate change with all itsdata manipulation in support of this monumental hoax. Gore described climate change as ‘settled science’ but nothing could be further from the truth. Climate change is far from settled... No doubt the audience was filled with supporters of the church of climatology who I doubt would be able to answer these questions challenging climate change. The powers that be want you to believe in climate change because it’s part of their hidden agenda for power, profit and political gain. Their modus operandi is to punish those who disagree, regardless of the facts contradicting climate change. As more and more people realise they’ve been had when it comes to climate change the powers that be resort to extreme countermeasures: In the talk Gore told his audience to ramp up their angst against climate change "deniers," Some, in support of this extremist left-wing agenda have made films which includes calling global warming critics as as loathsome and villainous. -The idea that someone should be punished for differences of opinion is the ultimate tyrannical approach. But what do you expect from a bunch of hysterical authoritarians pushing an agenda based on false pretexts who fear having their lies exposed? 3. War objection Another case of demonizing dissension or opinion exists through clamping down on anti-war activists. In the UK, the indefinable terms ‘non-violent extremist’ or ’domestic extremist’ could be used to stigmatize or even criminalize individuals as part of a newly developed aggressive anti-terrorist deradicalization programme called PREVENT which could for example target anti-war activists. Through country-wide legislation PREVENT has made it the statutory duty for educational establishments, local authorities, NHS trust, police and prisons services to provide ongoing information on those deemed as suspects ‘drawn into terrorism.’ Besides unjustly stigmatizing or even making criminals out of entire Muslim communities PREVENT has been described as flawed with vague definitions while threatening to erode civil liberties. For instance, officials representing the Child Protection Agency, from a number of signs listing identifiable behavioural characteristics have warned parents that their children may be at risk of being radicalized, which has been met with much criticism. As a response a number of organizations such as Together Against Prevent have united to campaign against PREVENT. 4. Shutting up the Political dissenters Democracy’s long-term moral decline is exemplified by silencing political dissenters on a scale more reminiscent than ever of a dictatorship. The alternative media has reported many cases where peaceful protesters have been met with extreme pettiness, violence and overreaction from authorities. Take, for example, the recent case of a woman who was apprehended then convicted and fined under the public order act for shouting out “Cameron has blood on his hands” as he switched on the Christmas lights at her home town. At the time the woman wasprotesting over disability benefit cuts. Then there’s the authorities’ agent provocateurs deployed to create unscrupulous violent reactions leading to unjustified arrests and bad reputation, deliberately manufactured to unfairly justify the clampdown on peaceful protesters. 5. Political correctness

Political correctness has little to do with protecting minority people or groups from being offended. It’s really about shutting people up, not granting them the right to justly criticise anything while accusing them of something should they talk out. 6. Whistleblower suppression In these truly dark times universal deceit and propaganda affects us all. Political reality has been bought and sold as a mass-media package made to manipulate the masses’ and their general consensus reality with all the needed cliché’s and falsehoods. -Through artful mass-media censorship the powers that be have created the perfect illusion to gain approval from the masses on the actions they take, allowing them to slyly advance their hidden enslavement agenda. In true Bernaysian fashion the masses have been programmed and brainwashed through mass media propaganda. Controlled by a small number of elite individuals the masses will never see known as the ‘invisible government.’ Thus, we have an illusory enemy, illusory war, illusory retribution, illusory diversion and distraction; the illegitimate has been made legitimate... My point Against the backdrop of insidious forever accelerating modern fascism I doff my cap to those courageous whistleblowers. The masses not only need to understand the secrets that the powers that be have been harbouring as revealed by whistleblowers like Julian Assange and Edward Snowden, but should also understand how they fit into the modern-day context. That way the awakened masses, having connected the dots, can then spread the word on what’s really happening in the world to others. Raising awareness, peaceful activism and becomingconscious is the key to world change. 7. Vaccinations The fact that mandatory vaccinations such as SB 271 are being forced on people regardless of their circumstance; by authorities not giving any consideration to the threat of potential injury for some from vaccine toxicity, that it’s based on pseudoscience, ignoring religious objection, or discarding the alternative opinion that immunity is better handled from a naturopathic point of view... should be enough to send a red flag warning... -I have written extensively on why vaccinations should be avoided at all costs (see SB 271). * * * All in all As consistent with the above quote from Orwell‘s novel 1984 dissension and public opinion has never been so needed to bring back sanity into an insane world by exposing the lies and ulterior motives of the powers that be. Those in positions of authority involved in demonizing dissension or opinion need to understand that they’ve been deceived and are being played like others as pawns in a very big game. |

|||

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

US | THEME PAGE |  |

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | G | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | M | ||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MA w/ CHS |

|

| STANDARD OF LIVING - SUB-PRIME ECONOMY | US | THEME | MA w/ CHS |

| - - SUB-PRIME AUTO | |||

| - - SUB-PRIME STUDENT LOANS | |||

| - - SUB-PRIME MORTGAGE LENDING | |||

| A 2016 RECESSION | 11-26-15 |

||

III-FINANCIAL |

|||

|

-- 2016 CREDIT CYCLE CHANGE |

MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL - UNCATEGORIZED |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

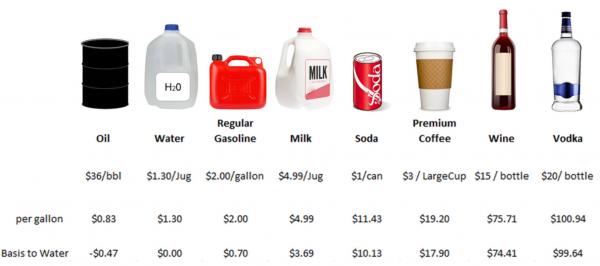

FACTOIDS:

As a result, OPEC revenue is down some $500 billion a year, and counting.

..... and Energy spreads spike to recod highs... As Energy Fwd P/Es begin to fall back to reality... WATCH LIST - Shorts:

|

12-26-15 | SII | |

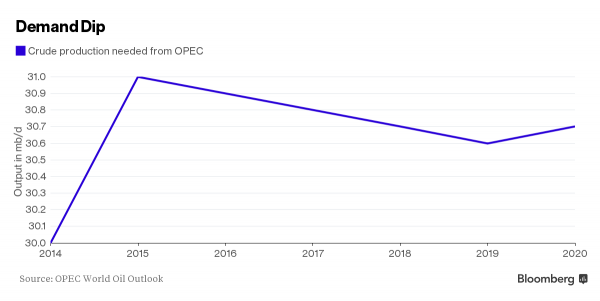

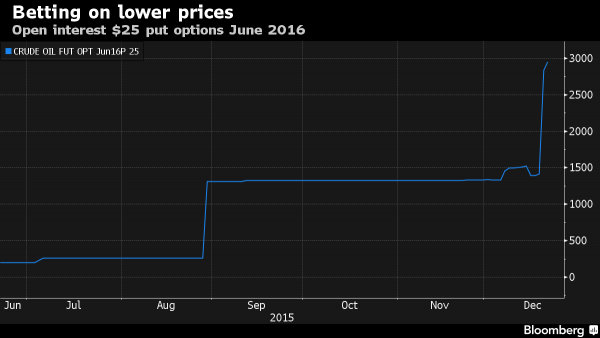

Someone Bets Big On $15 CrudeAs OPEC Forecasts Oil Demand Slumping Until 2020In OPEC's latest annual World Oil Outlook released on Wednesday, the now defunct cartel (courtesy of Saudi Arabia's insistence on vetoing any production limit) said that demand for its crude will slide to 2020, as rival supplies continue to grow. On the supply side, OPEC said it would need to pump 30.7 million barrels a day by the end of the decade, which is 1.7 million barrels more than it projected a year ago but well below, or some 1 million barrels less than the group pumped in November. As Bloomberg notes, this latest forecast underlines the struggle faced by OPEC as it seeks to defend market share against a surge in output from rivals such as the U.S. and Russia. As a reminder, one of the most unexpected outcomes of the recent collapse in oil prices is that while the Saudis had hoped non-OPEC production would plunge, the opposite has happened in the race to the bottom in which Russian oil production just hit a record while US shale production has remained steady even as the number of oil rigs has plunged to multi-year lows. "Although lower oil prices continue to foster some demand growth, their impact seems to be limited by other factors,” the group said. “The removal of subsidies and price controls on petroleum products in some countries and ongoing efficiency improvements will all likely continue restricting oil demand growth.” As a result of the frail balance between declining demand and rising supply, the 30.7 million barrels of daily output needed from 12 of OPEC’s members in 2020 is about 300,000 a day less than required this year, when it repeatedly pumped above its production target before scrapping the limit altogether earlier this month. Needless to say, OPEC forecasts are about as bad as those made by the Federal Reserve, and even so over the long run OPEC assumes that prices will rise to average $80 a barrel in nominal terms in 2020, and $70.70 in real terms. As Bloomberg reminds us, last year it had anticipated nominal prices of $110 and real levels of $95.40. That means the value of the group’s output in 2020 would be $218 billion less than estimated a year ago, when it first embarked on the policy to protect market share. That is nearly a quarter trillion gap which oil exporting countries, whose budgets are heavily reliant on oil production and prices, have to fill by other means such as selling reserves which they have been doing as part of the demise of the Petrodollar, something we previewed over a year ago. The optimism in the latest OPEC report comes on the demand side, as the organization increases its estimate for global oil demand in 2020 by 500,000 barrels a day to 97.4 million a day. By then, fuel consumption in emerging nations will overtake that in the industrialized economies of the Organization for Economic Cooperation and Development, it said. OPEC is also hopeful that the shale revolution will finally end, and that non-OPEC supply in 2020 will fall by 1 million barrels a day to 60.2 million a day as “market instability” leads to reductions in spending and drilling. Still, non-OPEC supply will still grow by 2.8 million barrels a day this decade, including 800,000 barrels of additional U.S. shale oil. OPEC said the outlook, which incorporated some data set in the middle of the year, was “clouded by uncertainties.” And while OPEC, tired of being very wrong in its near-term forecasts laid out forecasts going through 2040 which have absolutely zero chance of being even remotely accurate, it is notable that according to Bloomberg almost $10 trillion will need to be invested in the oil industry through to 2040 to develop the required supplies, with $7.2 trillion of this in exploration and production. Producers outside OPEC will need to do the bulk of the spending, investing $250 billion a year. Where this CapEx will come from in an age when producers are slashing exploration and production outlays is not exactly clear. * * * Perhaps it is as a result of "cloudied uncertainty" and ongoing race to the bottom by all oil producers, OPEC and non-OPEC alike, that someone is betting that OPEC will be woefully wrong in its price forecasts, and is buying puts that see oil plunging as low as $15 a barrel next year, the latest sign some investors expect an even deeper slump in energy prices. The bearish wagers come as OPEC’s effective scrapping of output limits, Iran’s anticipated return to the market and the resilience of production from countries such as Russia raise the prospect of a prolonged global oil glut. This ties in with the recent forecast by Goldman Sachs which has said $20 oil is not impossible: "We view the oversupply as continuing well into next year," Jeffrey Currie, head of commodities research at Goldman Sachs Group Inc., wrote in a note on Tuesday, adding there’s a risk oil prices would fall to $20 a barrel to force production shutdowns if mild weather continues to damp demand. As the chart below shows, the bearish outlook on oil prices has prompted investors to buy put options at strike prices of $30, $25, $20 and even $15 a barrel, according to data from the New York Mercantile Exchange and the U.S. Depository Trust & Clearing Corp. With WTI currently trading at about $36 a barrel, this means someone is wagering on a drop which could be greater than 50% in the coming months. As Bloomberg points out, investors have bought increasing volumes of put options that will pay out if the price of WTI drops to $20 to $30 a barrel next year. The largest open interest across options contracts - both bullish and bearish - for December 2016 is for puts at $30 a barrel. The number of outstanding contracts below $30 a barrel is relatively small. But the open interest for June 2016 put options at $25 a barrel has nearly doubled over the last week. Investors have even bought put options that will pay if WTI drops below $15 a barrel by December next year. The volume of financial bets at that level is tiny - 640,000 barrels in total. While the position may be simply a hedge instead of a direction bet, it reveals that the prevailing mood is hardly one of OPEC-ian exuberance. “Overall it’s still very bearish,” Gareth Lewis-Davies, a London-based energy strategist at BNP Paribas SA, said. Of course, for every put buyer there is a put seller: it remains to be seen who will end up right, although as Victor Shum, a vice president IHS Inc., says in Bloomberg Television interview said "with WTI now pretty much at parity with Brent and Brent being the global oil benchmark, that really indicates a massive oversupply situation in the world." Finally, since oil has become a key coincident signal for the entire market, should oil indeed plunge another 50% from here, all those bullish "strategist" forecasts for a low double digit in the S&P will promptly have to be scrubbed, again, should the black gold resume its downward trajectory from this latest dead cat bounce. |

|||

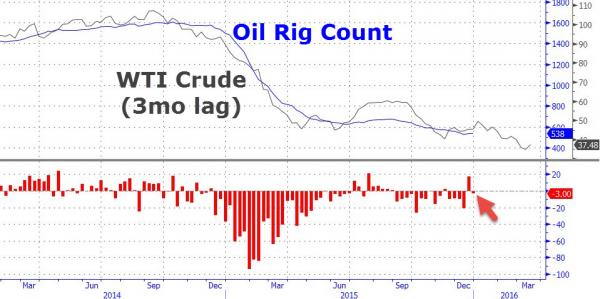

Oil Rig Count Continues to DeclineAfter a surprise surge last week, the US oil rig count resumed its decline this week (dropping 3 to 538). Gas rigs dropped 6 in the last week (as the Nattie glut continues). Crude oil prices fell very modestly on the rig count data (having run stops to FOMC day gaps). Rig count continues to track lagged oil price almost perfectly... Ran stops to last week's major inventory build... Charts: Bloomberg |

|||

| TO TOP | |||

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP