|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Thurs. Dec. 10th, 2015

Follow Our Updates

onTWITTER

https://twitter.com/GordonTLong

ARCHIVES

| DECEMBER | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | ||

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 13 | 14 | 15 | 16 | 17 | 18 | 19 |

| 20 | 21 | 22 | 23 | 24 | 25 | 26 |

| 27 | 28 | 29 | 30 | 31 | ||

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?We have analyzed & included

these in our latest research papers Macro videos!

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

TODAY'S TIPPING POINTS

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

II-ECONOMIC |

|||

STANDARD OF LIVING - SUB-PRIME ECONOMY

|

US | THEME | MACRO w/ CHS |

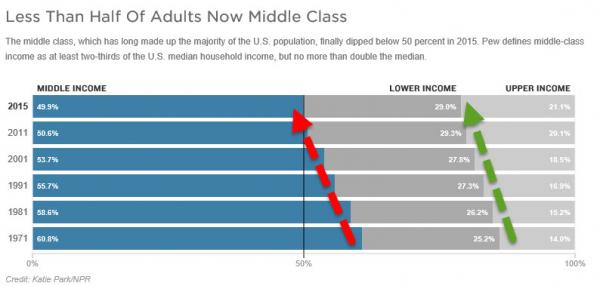

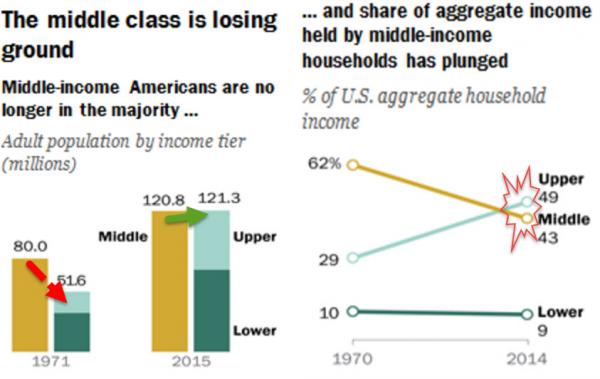

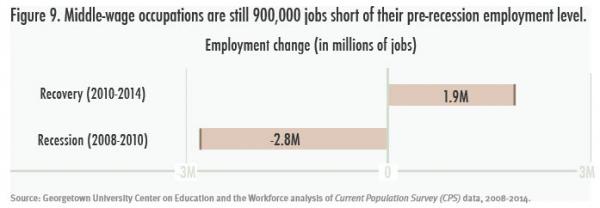

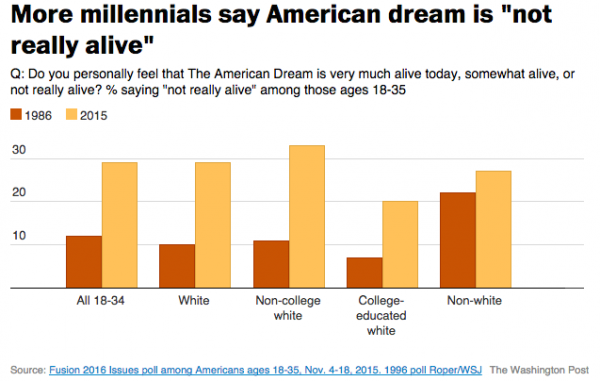

America Crosses The Tipping Point: The Middle Class Is Now A MinorityAmericans have long lived in a nation made up primarily of middle-class families, neither rich nor poor, but comfortable enough, notes NPR's Marilyn Geewax, but this year - for the first time in US history, that changed. A new analysis of government data shows that as of 2015, middle-income households have become the minority, extending a multi-decade decline that confirms the hollowing out of society as 49% of all Americans now live in a home that receives money from the government each month. Sadly, the trends that are destroying the middle class in America just continue to accelerate. Back in 1971, about 2 out of 3 Americans lived in middle-income households. Since then, the middle has been steadily shrinking. Today, just a shade under half of all households (about 49.9 percent) have middle incomes. Slightly more than half of Americans (about 50.1 percent) either live in a lower-class household (roughly 29 percent) or an upper-class household (about 21 percent). As NPR explains, thanks to factory closings and other economic factors, the country now has 120.8 million adults living in middle-income households, the study found. That compares with the 121.3 million who are living in either upper- or lower-income households. "The hollowing of the middle has proceeded steadily for the past four decades," Pew concluded. And middle-income Americans not only have shrunk as a share of the population but have fallen further behind financially, with their median income down 4 percent compared with the year 2000, Pew said. Since 1970, the U.S. economy has been growing, and we all have been getting wealthier. But people who have the biggest incomes have been pulling away from the pack in a trend that shows no sign of slowing... asmiddle-income jobs are still 900,000 short of pre-recession employment levels... And if you’re a millennial, you’d be forgiven for being disillusioned with the American dream. As we recently noted, compared to young Americans in 1986, you’re three times as likely to think the American dream is dead and buried. As WaPo notes, "young workers today are significantly more pessimistic about the possibility of success in America than their counterparts were in 1986, according to a new Fusion 2016 Issues poll - a shift that appears to reflect lingering damage from the Great Recession and more than a decade of wage stagnation for typical workers.” While there are numerous reasons for the collapse of the American Middle Class (most appear driven by political 'fairness' or monetary policy intended consequences), though we suspect politicians learned long ago that it's easier to just import non-Americanized voters to vote for you, than, as FutureMoneyTrends notes, to get naturalized citizens who still cherish the idea of America to vote for things like national healthcare systems, higher taxes on business owners, and the catering to every little tribal group that declares themselves a minority. It is only a matter of time before the middle class is wiped out and America begins to resemble the poverty, violence and tyranny so often associated with the countries from which many illegal migrants originate. It appears that time is drawing near as Charles Hugh-Smith recently noted, the mainstream is finally waking up to the future of the American Dream: downward mobility for all but the top 10% of households.

If you don't think these apply, please check back in a year. We'll have a firmer grasp of social depression in December 2016. |

|||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK -Dec 6th, 2015 - Dec 12th, 2015 | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

| 20 - RISING US Dollar | 12-08-15 | 20 | |

39 - FALLING Oil Price Pressures |

12-08-15 | 39 |

|

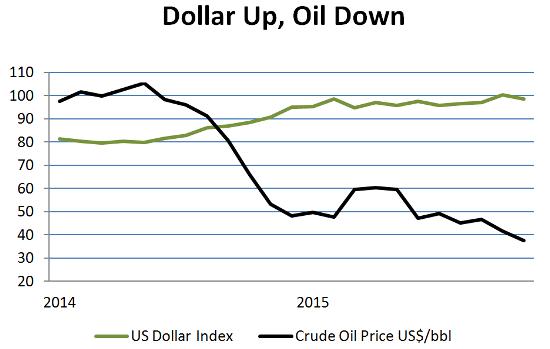

Falling Oil + Rising Dollar= Crisis For A Whole Lot Of Peopleby John Rubino on December 7, 2015 Oil is plunging again, this time in the wake of OPEC’s inability to limit its members’ production. The US dollar, meanwhile, is up on the divergence between Fed tightening and ECB/BoJ/BoC easing. This widening gap is a perfect storm for the many, many entities that have borrowed dollars to speculate in foreign currencies or drill for oil. Some examples:

To summarize, the world is entering a classic credit crunch, in which lending dries up for marginal borrowers first before tightening for core entities like multinational corporations and developed world governments. And it’s just beginning. Most of today’s crises evolved with oil considerably higher and the dollar somewhat lower, so current conditions are actually a lot worse than those that, for instance, caused emerging market debt issuance to evaporate and shoved Brazil into existential crisis. And since oil overproduction will likely to continue while the differences in central bank policies are etched in stone for the next few months at least, it’s possible that the performance gap between oil and the dollar will widen going forward. This will turbo-charge today’s crises and add a few more, as oil producing US states hit financial walls and big chunks of the developing world follow Brazil down the drain.

|

|||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market | |||

| TECHNICALS & MARKET |

|

||

| STUDIES - MACRO pdf | |||

WHAT BUYBACKS HAVE HIDDEN

|

12-09-15 | ||

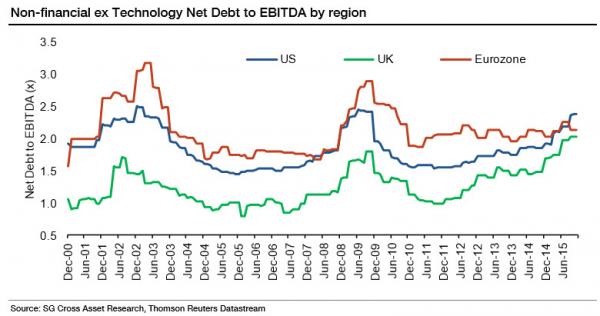

In 8 Years, Developed Market Stocks Have Gained NothingGlobal equity markets, as measured by the MSCI Developed World index, are above the lows hit in early October but remain on a downtrend that began after markets peaked at the end of May this year. As SocGen's Andrew Lapthorne notes, the current level is now only just above where the index stood at the beginning of 2013 and less than 1% above the 2007 peak. In other words, as he warns, "the equity market has run out of momentum," and the 'bill' for the debt overhang is coming due. The recovery since 2007 has been very one-sided with only Denmark, Switzerland and the US indices exceeding their October 2007 US dollar price levels. The UK is down 34% in US dollar terms and the MSCI Eurozone is 40% down. The reasons for this weak performance is fairly clear, unlike Japan neither the UK or Eurozone have experienced an earnings recovery in either US dollar terms or in local currency terms. Profits in both regions are still 45-55% down from the 2007 high according to MSCI reported profits. The Eurozone of course has many problems, but at least Eurozone companies have not been boosting leverage as a consequence of disappointing profits, as is the case in the US and apparently the UK as well! As we have remarked upon on numerous occasions, the US equity market has been boosting leverage with record levels of debt-financed share buybacks, resulting in a significant increase in leverage among US corporates. However with all the focus on the US, many investors may have missed the major corporate debt problem now emerging in the UK stock market. Devoid of the headline-grabbing buybacks, many may not have noticed that both nominal net debt and net debt to EBITDA have never been higher in the UK. The bulk of that increase has come from a huge rise in Mining sector debt at a time when profits have collapsed, but leverage ratios in other sectors are also elevated. The US is not the only market now facing a corporate debt overhang. Source: SocGen |

|||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

Brett Rentmeester Outlines:APPROACHES TO SOLVING YIELD CHASING& HIGH VALUATION RISKS

|

|||

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

I - POLITICAL |

|||

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | THEME | ||

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MACRO w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

| STANDARD OF LIVING - SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

III-FINANCIAL |

|||

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| THEMES - 2016 RECESSION | 11-26-15 |

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

SII | ||

| 12-05-15 | SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP