|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Wed. Dec. 23rd, 2015

Follow Our Updates

onTWITTER

https://twitter.com/GordonTLong

ARCHIVES

| DECEMBER | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | ||

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 13 | 14 | 15 | 16 | 17 | 18 | 19 |

| 20 | 21 | 22 | 23 | 24 | 25 | 26 |

| 27 | 28 | 29 | 30 | 31 | ||

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?We have analyzed & included

these in our latest research papers Macro videos!

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

TODAY'S TIPPING POINTS

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

| Market - WEDNESDAY STUDIES | |||

| TECHNICALS & MARKET |

|

||

| STUDIES - MACRO pdf | |||

When Is The Crash Going To Happen? |

12-23-15 | STUDIES | |

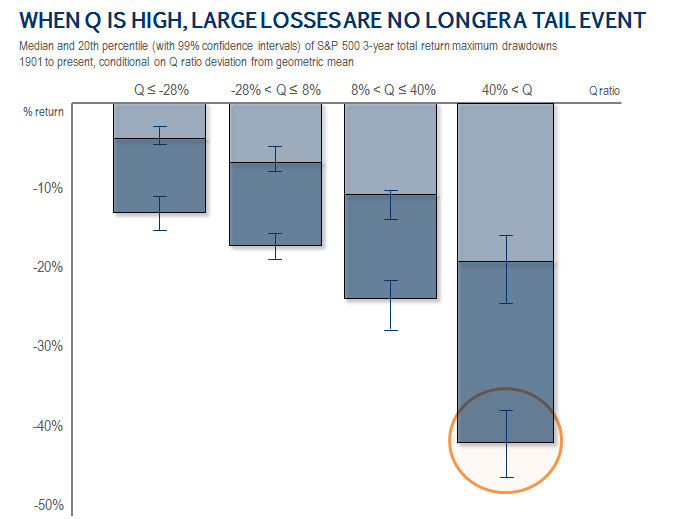

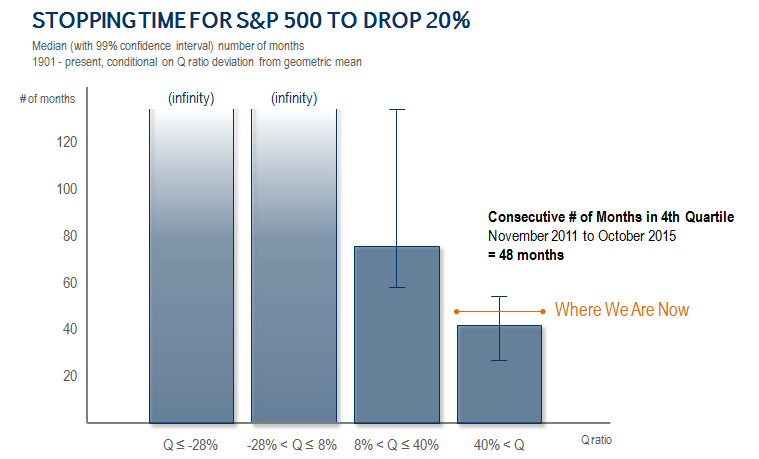

Submitted by Mark Spitznagel via Pensions & Investments, "When Is The Crash Going To Happen?" - Mark Spitznagel Revisits "The Ticking Time Bomb"Since the question “when is the crash going to happen?” is always asked, we thought it particularly timely to update the research we have done on the topic. Timing a crash can be a fool's errand, and fortunately such efforts are largely irrelevant if you are tail hedging (though they are quite relevant if you aren't). When tail hedging efficiently, the extreme asymmetries in payoffs, by definition, removes any need to time the top. But this doesn't mean that exercises in timing are without merit. As we showed in previous research, without a doubt (or at least with over 99% confidence), bad things happen with increasing expectation when conditioning on higher Q ratios ex ante. That is, when Q is high, large stock market losses are no longer a tail event but become an expected event. Factoring time into the equation, and again based on history, the confidence interval around the median time would point to an expectation that the crash should commence right about now. Monetary policy has proven to be very effective over the past seven years in elevating asset markets. However, its effect has been limited to the price of assets (the “title” to existing capital), but not the price of new capital. This differential is depicted in the Q ratio, where one can think of the numerator as representing the aggregate price of the stock market and the denominator as the aggregate book value. The higher the ratio, the further the stock market is priced relative to the reality of the underlying capital, and the greater the implied return on that aggregate capital above the average aggregate cost of capital. This ratio has always had its breaking point, much to the frustration of interventionist monetary policy, as the numerator ultimately crashes back to the denominator, rather than the denominator catching up to the numerator (a fact that Keynesians from Paul Krugman to James Tobin himself have considered a central puzzle of economics). Indeed, the continued deviation of this ratio from its long run historical average is something that both economic history and, best of all, economic logic dictate as unsustainable. The question becomes how deviations and extremes in the Q ratio are ultimately corrected. The short answer is: they are corrected via the numerator, i.e., through corrections in the aggregate stock market value. The further the Q ratio has deviated from its long run historical average, simply put, the further the stock market has to fall to correct that deviation (this is what the market's homeostatic process does so predictably well).

There are regularities in the “stopping time” to the market's homeostatic correcting of extreme Q deviations, and as we saw recently in China, even massive interventions can't ultimately stop such corrections. An equity holder should be very aware of the current valuation environment, the magnitude of the drop that is to be expected, and the inherent cyclicality behind the amount of time between crashes. We are currently beyond the median amount of time, historically, before we would expect to see at least a 20% correction of the stock market (the numerator). Most importantly perhaps, the majority of the losses tend to happen in a concentrated plunge at the tail end of the path down to minus 20%. For instance, in just the last two months before the market passes through our 20% drawdown trigger, it typically (on average) has experienced a loss of nearly the entire 20%.

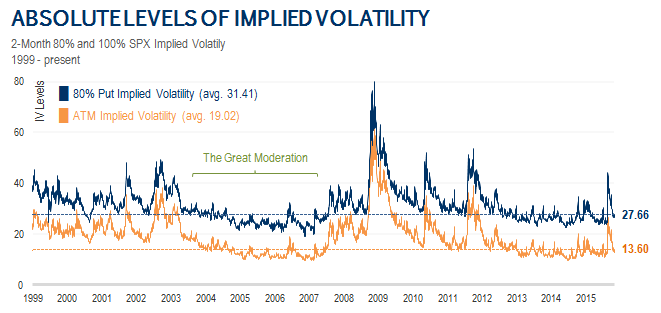

The very high probability of a crash currently implied by history flies in the face of a very low probability of a crash currently implied by the options market. The same beliefs that have pushed the market to extreme valuations have also returned option prices back to near record lows. If there is elevated risk in the equity market to the degree we have seen, counter-intuitively, it is not at all priced into options markets.

To use my favorite investing metaphor, the pot odds - the payoff, or the size of the pot relative to the price of calling - are very favorable compared to the hand odds - the likelihood of making the best hand; that is, we are getting the best of it. In the recent August volatility (or in any other crashes we have seen), the tide turned both too surprisingly and too quickly for most to fully re-position until it was much too late. The future need not look like the past, but for an equity holder (or an opportunistic trader), the price of equity tail risk is not currently representative of that which has proven itself throughout history under similar (if not far less risky!) circumstances. How much further the rally stretches, whether another 10% or 100%, does not matter to an efficient tail hedger; it only adds to the expected magnitude and timing of a pending crash—which grows larger and sooner with each uptick in the stock market and tick of the clock—thus adding to the expected profitability and strategic advantage of the hedge.

|

|||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK -Dec 20th, 2015 - Dec 26th, 2015 | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

SOVEREIGN DEBT CRISIS |

7 |

||

Submitted by Tyler Durden on 12/21/2015

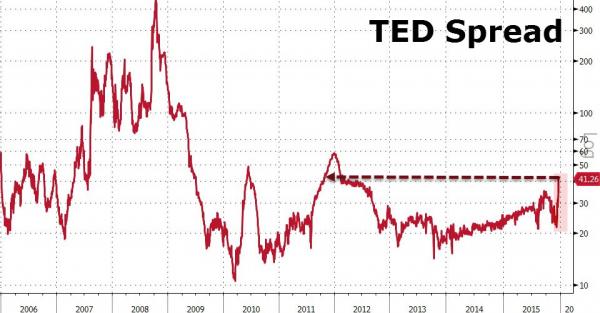

Bank Counterparty Risk Surges To 4-Year HighIn September, interbank credit markets flashed a quick and brief warning that something was up... and Janet folded. Three months later and following The Fed's oddly-timed rate-hike, interbank counterparty risk - as proxied by the TED-Spread - has spiked over 45% in 2 days, the most since Sept 2008 (Lehman). The TED Spread is the difference between the interest rates on interbank loans and on short-term U.S. government debt and as such offers a proxy for how banks themselves perceive the relative creditworthiness of the financial system. The last time TED spread was surging to this level was late 2011, as Europe's crises was exploding. Which makes one wonder whether The Fed rate hike was - as we detailed here - an implicit bailout for foreign (read European) banks? But the pace of increase is extremely worrisome historically (h/t Brendan Ferro) The Fed just hiked into this massive two-week surge in TED spreads; as opposed cutting by 75 bps in 2008 and unleashing more QE at Jackson Hole in 2011! That hike seems akin to what happened in Sep-08 when Lehman went Bankrupt. US financials credit risk continues to push wider (with stocks remaining cognitively disssonant for now).

Charts: Bloomberg With the Fed's own National Activity Index tumbling, its own Financial Stress Index soaring, and now major concerns about the US financial system's stability looming, one has to ask, how long before Janet unleashes the next QE?

|

|||

What are the banks nervous about? The same thing the Fed appears to be worried about! Inability for US Government to handle its debt as the passage of the new US Fisical Budget glaringly illustrated! Dan Amerman: Financial Repression & The New Interest Rate HikePeak Prosperity's Chris Martenson interviews Daniel Amerman who sees the Federal Reserve announcement as another confirmation of continued financial repression to control the burden of debt & allow a transfer of wealth from savers to the government "I just read the statement from the Federal Reserve and what they clearly showed was this was not normal. And, one of the clear ways that they showed it is that they made crystal clear that they would be keeping their current holdings of U.S. government and agency debt in roughly the 2.4 to 2.5 trillion dollar range . If you want to drive interest rates up, you want to tighten the system and you might remove money from the system let’s say by selling many of those assets. And, they’ve made clear on the front end that they’re not doing that .. What governments typically do, their most popular choice when they get deeply into debt is they increase their control over the markets so they knock out the interest rate risk for themselves, they push rates way down as they’ve done to historical lows. There’s more to it than that (we'd need another full hour more to talk about financial repression), but basically, they transfer wealth from savers to the government in the process of paying down the debt, in a process that most people don’t understand." |

|||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market | |||

| TECHNICALS & MARKET |

|

||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

Morgan Stanley’s Ronnie Lapinsky Sax: “Interest rate normalization will provide headwind for investors using bonds for principal preservation” |

|||

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

I - POLITICAL |

|||

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | THEME | ||

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MACRO w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

| STANDARD OF LIVING - SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

III-FINANCIAL |

|||

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| THEMES - 2016 RECESSION | 11-26-15 |

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP