|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

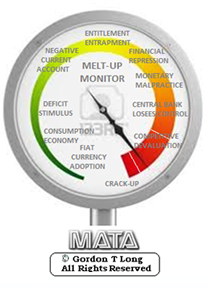

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Thurs. Nov 19th, 2015

Follow Our Updates

onTWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

ARCHIVES

| NOVEMBER | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | |||||

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?We have analyzed & included

these in our latest research papers Macro videos!

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

TODAY'S TIPPING POINTS

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

Moody’s Warns about Credit Crunch, Unnerves with Parallels to 2008!The US bond market has swollen to $40 trillion. Over $8 trillion are corporate bonds, up a mind-boggling 50% from when the Fed unleashed its zero-interest-rate policy and QE seven years ago. So far this year, $1.34 trillion in new corporate bonds have been issued, up 6.8% from last year at this time, which had already been a record year, according to the Securities Industry and Financial Markets Association (SIFMA). Bond issuance in 2012, 2013, and 2014 set ever crazier records; 2015 is on track to set an even crazier one: close to $1.5 trillion. That’s a lot of newly borrowed moolah. Much of it is being used to pay for dividends, stock buybacks, M&A, and other worthy financial engineering projects designed to inflate stock prices, though that strategy has turned into a sorry dud this year. Junk bonds now make up $1.8 trillion of this pile of corporate debt, nearly double the $944 billion in junk bonds outstanding at the end of 2008 before the Fed saved the economy, so to speak. But what happens when this flood of cheaply borrowed money begins to dry up as an ever larger percentage of that $1.8 trillion in junk bonds begins to default, while ever more high-grade bonds get downgraded to junk? That’s the end of the credit cycle – and the beginning of financial nightmares. It’s the phase the bond market has already entered, according to a report by John Lonski, Chief Economist at Moody’s Capital Markets Research. One metric that marks turning points in the credit cycle is the credit upgrade ratio. In Q2 this year, the ratio of ratings upgrades to total ratings revisions for junk bonds was still 49%. By Q3, this upgrade ratio had fallen to 39%, the worst level since Q2 2009 when it was 30%. Halfway into Q4, there have been 18 upgrades and 57 downgrades, a ratio of 24%, the worst since Q1 2009. Among investment-grade bonds, the ratio is even more terrible: 1 upgrade and 11 downgrades. “A convincing negative trend may be emerging,” the report said gingerly. To reduce quarter-to-quarter volatility in the metric, Lonski looks at the upgrade-ratio of two quarters combined. In Q3 and Q4 so far, the combined upgrade ratio is 35%, a hair better than the 34% from the two quarters ended September 2009. The ratio had bottomed out in the two quarters ended March 2009 at 13%. But here’s the thing: the last two times when the upgrade ratio fell from above 40% to below 40% was in Q4 2007 (at 37%) as exploding debt was already putting cracks into the financial system, and in Q4 1998 (at 29%) as the dotcom bubble was approaching its final year. “Both episodes constituted important turning points in the corporate credit cycle. Thereafter, not only did high-yield bond spreads remain relatively wide, but both projected and actual default rates trended higher,” the report pointed out – a hilarious understatement, given the fiascos that followed. And these “projected and actual default rates” are already taking off. The Expected Default Frequency (EDF) of US and Canadian junk-rated companies, a metric of future defaults, hit 5.6%, the highest since the 6.4% of August 2009. Moody’s unnerving parallels to 2008, 2009! “Given the surge in the number of downgrades, plunging upgrades, and the likelihood of significantly more defaults,” the all-important spread between the yields of junk bonds to US Treasuries is likely to widen, especially given last quarter’s “decidedly subpar showings by business sales and operating profits.” These dynamics in the bond markets are spooking banks – and bank regulators. They’re seeing them as a deterioration of credit quality. And so they tighten their lending standards, and they widen the rate spreads on business loans. Thus they make borrowed money scarcer and more expensive. Banks have been pushing risky borrowers into issuing bonds and use the proceeds to pay down their credit lines. This is a way for banks to roll off risk to bondholders. But when companies have trouble issuing bonds at survivable yields, banks get worried about extending loans to them. In turn, when banks get spooked, bondholders panic. These companies need new money to service their debts, and when the money spigot gets turned off, default rates and projected default rates rise, thus triggering even tighter lending standards…. The vicious circle of the credit crunch sets in. “Typically, the downward spiral continues until the weak credits have been sufficiently culled and the business outlook improves,” Moody’s explains. Last two times this happened, it was mayhem. It’s already happening. The Fed reported in its quarterly Senior Loan Officer Opinion Survey of October that banks have begun to tighten lending standards on commercial and industrial loans – the first tightening after three years of loosening lending standards, and after tightening throughout the Financial Crisis. But the last two times when lending standards switched from loosening to tightening to a similar degree, according to Moody’s, was in, well, the infamous Q3 2007 and Q4 1998. We know what came after both occasions. Only this time, the pile of debt is far larger, and the risks – thanks to the Fed’s ingenious policies that have encouraged all this – far greater. Debt is the key in commercial real estate. Low interest rates make it happen. Banks are eager to lend. They repackage this debt into Commercial Mortgage Backed Securities and sell them to yield-desperate investors. It has performed miracles, once again.

|

|||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Nov. 15th, 2015 - Nov 21st, 2015 | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

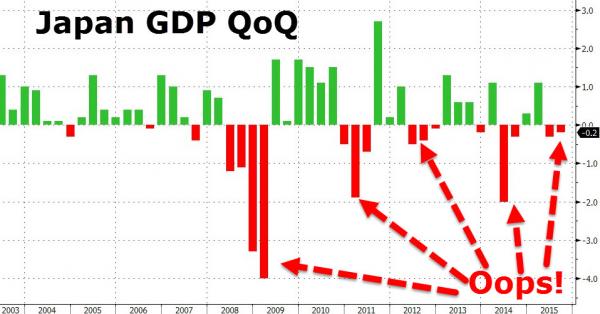

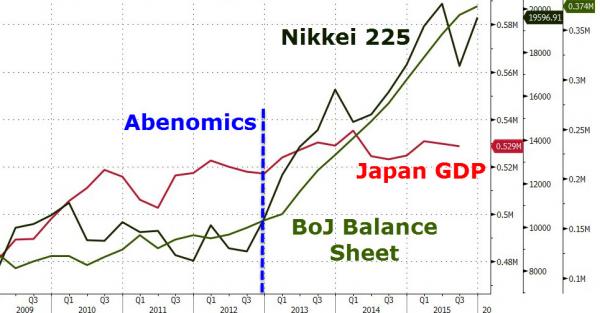

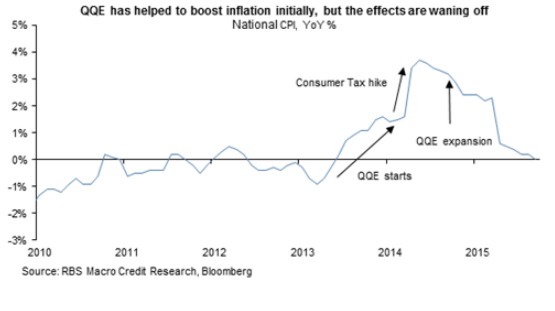

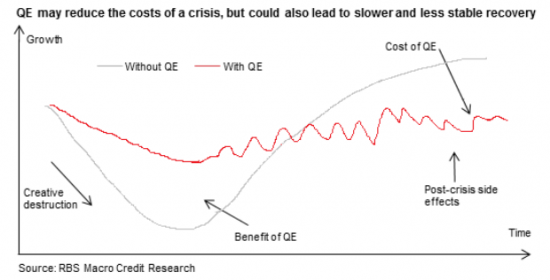

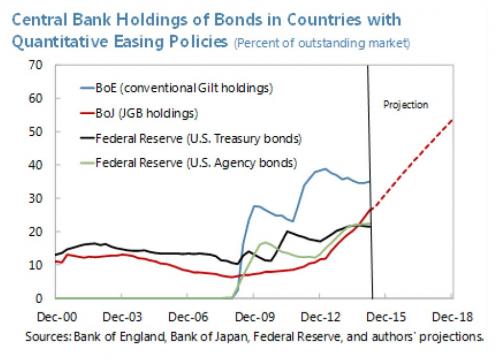

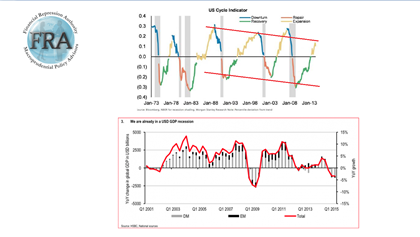

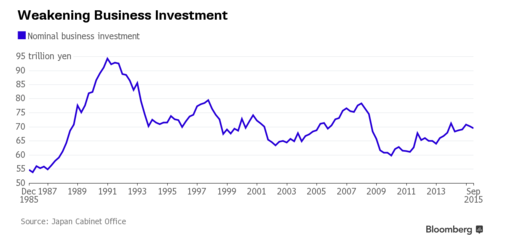

Submitted by Tyler Durden on 11/16/2015 Japan's Problems Will Not Be Solved By More QE, RBS WarnsOne thing that became abundantly clear about QE long ago even if it hasn’t yet dawned on Mario Draghi or Haruhiko Kuroda, is that the practice of monetizing anything and everything that isn’t tied down (or that you can’t pry from the cold dead hand of an institutional investor), is subject to the law of diminishing returns. Put simply: eventually it just stops working in terms of stimulating aggregate demand and/or boosting growth and inflation expectations. Unfortunately, the deleterious effects of QE are not subject to the same dynamic. That is, when you print another say, €750 million to monetize everything from periphery EGBs to SSAs to munis, you invariably impair market liquidity on the way to creating the conditions for dangerous bouts of volatility (see the great bund VaR shock for instance). Of course when you go full-Kuroda and simply corner the market for ETFs by stepping in to provide plunge protection at the first sign of Nikkei weakness, there’s no telling what kind of chaos you’ve set everyone up for once you step out of the market. Meanwhile, the mad dash to inflate the value of stocks and bonds has served to create enormous bubbles not only in those assets, but also in the things people who hold those assets are likely to buy when they get bored - like real estate and high end art. In short, the drug addiction analogy (as cliche as it now is) still holds up remarkably well. For a drug addict, the benefits (i.e. the high) diminishes the more the addiction grows, but the harmful effects on the body do not. It’s the same thing with QE. The initial “high” wears off, but the asset bubbles only grow. Nowhere is this more apparent than in Japan where just last night, we witnessed the unprecedented "quintuple recession": As if that wasn't bad enough, Japanese business spending dropped 1.3% QoQ - its worst drop since Q2 2014. Of course the Nikkei is doing just fine, surging right alongside the BoJ's balance sheet. In honor of Kuroda and his special brand of Peter Pan-inspired, neo-Keynesian madness, we present a bit of color from RBS' Alberto Gallo on Japan and QQE.:

Ok, so in other words: Kuroda isn't going to be able cure the country's structural problems which include the well worn issue of Japanese demographics as well the much maligned "deflationary mindset" which seems largely immune to the hum of the BoJ's prinitng press. Nevertheless, Japan is all-in and is apparently prepared to keep the pedal to the floor until 2018 when, as we've documented extensively, the game will officially be up (see here for instance). In the meantime, as Gallo rightly points out, you can expect an impaired secondary market for JGBs, asset bubbles, and rising inequality (all outcomes we've discussed at great length) as Kuroda triples, quadruples, and quintuples down on policies that now seem to be producing around one recession per QE iteration. Summed up...

|

|||

Bloomberg

Japan Falls Into Recession for Second Time Under 'Abenomics'

Japan’s economy contracted in the third quarter as business investment fell, confirming what many economists had predicted: The nation fell into its second recession since Prime Minister Shinzo Abe took office in December 2012. Gross domestic product declined an annualized 0.8 percent in the three months ended Sept. 30, following a revised 0.7 percent drop in the second quarter, meeting the common definition of a recession. Economists had estimated a 0.2 percent decline for the third quarter. Weakness in business investment and shrinking inventories drove the contraction as slow growth in China and a weak global outlook prompted Japanese companies to hold back on spending and production. While growth is expected to pick up in the current quarter, the GDP report could put pressure on Abe and Bank of Japan Governor Haruhiko Kuroda to boost fiscal and monetary stimulus. The BOJ holds a policy meeting later this week. “This report shows the increasing risk that Japan’s economy will continue its lackluster performance,” said Atsushi Takeda, an economist at Itochu Corp. in Tokyo.“The weakness in capital spending is becoming a bigger concern. Even though their plans are solid, companies aren’t confident about the resilience of economy at home and abroad.”

The reduced investment is a rebuff for Abe, who called on Japanese companies to put more of their record cash holdings into capital spending. From the previous quarter, business investment fell 1.3 percent in the July-September period, following a revised 1.2 percent contraction, according to the report. Abe has made bolstering the economy a priority and advocated for reflationary policies that weakened the yen and boosted corporate profits. Kuroda had said in September it wouldn’t be unusual for the economy to grow in the July-September quarter. Bank of Japan officials didn’t see the GDP report as likely to change their outlook for an improving trend in inflation, people familiar with discussions at the central bank said last week. Hiroaki Muto, chief economist at Tokai Tokyo Research Center Co., said that while he thinks the economy “might have hit the bottom” in the third quarter, there’s a strong chance that the government will compile an economic package to shore up growth. Yen StrengthensThe yen strengthened after the data was announced and was up 0.1 percent at 122.52 per dollar at 11:50 a.m. in Tokyo. Investors have purchased the yen as a haven following the terrorist attacks in Paris. The Topix stock index dropped 0.8 percent in the morning session amid a broad-based decline in Asian share markets. In a string of somber economic reports in the past few months, Kuroda’s core price gauge fell, household spending unexpectedly dropped, vehicle production declined, retail sales slipped and imports fell while exports stagnated. One bright spot: Industrial output advanced 1.1 percent in September from the previous month, yet wasn’t enough to make up for contractions in July and August. “The BOJ should act now if they are looking at economic fundamentals: prices are falling and economy isn’t growing, giving no sign for inflation expectations to rise,” said Itochu’s Takeda. “As for the question of whether they will act, it’s hard to say.” Economy MinisterAbe has told Economy Minister Akira Amari to compile measures this month to help achieve his goal of expanding Japan’s nominal GDP by 20 percent to 600 trillion yen over five years. Amari said Monday after the data that an extra budget may focus on addressing Japan’s demographic issues and to help alleviate the effects of the Trans Pacific Partnership trade pact and the government would take a flexible approach to fiscal and economic management. Amari also said GDP was likely expand in the current quarter. |

|||

EU BANKING CRISIS |

6 |

||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market | |||

| TECHNICALS & MARKET |

|

||

| STUDIES - MACRO pdf | |||

| Six Strange Things That Have Been Happening in Financial Markets | 11-18-15 | ||

"May you live in interesting times" is sometimes said to be an ancient Chinese curse. Interesting things have certainly been happening in the underpinnings of global markets—things that either run counter to long-standing financial logic, or represent an unusual dislocation in the "normal" state of market affairs, or were once rare occurrences but have been happening with increasing frequency. Here's a rundown. 1. Negative swap spreads

Source: Bloomberg

What's new, and negative, and makes no sense? Swap spreads below zero, of course. While the term may mean little to your average retail investor, swap spreads have become the talk of financial markets in recent weeks as they plumb historic lows and seemingly defy market logic. At issue is the fact that swap rates—or rates charged for interest rate swaps—have dipped below yields on equivalent U.S. Treasuries, indicating that investors are charging less to deal with banks and corporations than with the U.S. government. Such a thing should never happen, as U.S. Treasuries theoretically represent the "risk-free" rate while swap rates are imbued with significant counterparty risk that should demand a premium. That may have changed, however, as new financial market rules require interest rate swaps to be run through central clearing houses, effectively stripping them of counterparty risk and leaving just a minimal funding component. At the same time, funding costs for U.S. Treasuries are said to have gone up due to a host of post-financial crisis rules that crimp bank balance sheets (more on this later) causing costs to go up. "The people who can arbitrage it away, their costs just went up a whole lot," Amrut Nashikkar, a Barclays analyst, said in an interview. "We wouldn't expect a dramatic reversal in the moves," he added. 2. Fractured repo ratesThe difference between different repo rates has been widening.

Source: Barclays

The repo market is the lubricant for the global financial system, allowing banks and investors to pawn their assets—typically U.S. Treasuries and other high-quality paper—in exchange for short-term financing. While there used to be little distinction between the rates at which counterparties raised money against their U.S. Treasury collateral, there is now an increasing divergence. "You no longer have a single repo rate," Joseph Abate, Barclays analyst, said in an interview last week. "The market itself is fracturing." You can see the trend in the above charts. The first shows the rate for General Collateral Financing trades (GCF) vs. the Bank of New York Mellon triparty repo rate. The second shows the GCF repo rate minus the rate that money market funds earn on their own U.S. Treasury repos. All are slightly different repo constructs against the same collateral, yet the difference between the rates paid on each has been widening. Abate argues that much of this has to do with new regulation that requires banks to hold more capital against all their assets, regardless of their riskiness. The so-called supplementary leverage ratio makes it more expensive for banks to facilitate repo trades, placing more emphasis on quality of the counterparty and leading to ructions in rates. That is especially true at the end of financial quarters, when banks are encouraged to limit their leverage and "window dress" their balance sheets ahead of scrutiny from regulators and investors. This odd occurrence might not mean much for markets right now, but it could come into play when the Federal Reserve finally moves to raise interest rates. Much of the central bank's exit policy will rely on using a new overnight repo facility to withdraw excess liquidity from the financial system. "At a minimum, analysts and the Fed may need to be more precise when they refer to repo and fed funds," Abate said. 3. Corporate bond inventories below zeroSource: Bloomberg

Analysts at Goldman Sachs made waves this week when they highlighted the fact that inventories of some corporate bonds held by big dealer-banks had gone negative for the first time since the Federal Reserve began collecting such data. That means big banks are now net short corporate bonds with a maturity greater than 12 months equivalent to $1.4 billion, bucking the longer-term trend of net positive positions. The record-breaking event revived a flurry of concerns about so-called liquidity, or ease of trading, in the $8.1 trillion corporate bond market. Similar to the repo market, a confluence of new rules is said to have made it more difficult for banks to hold corporate bonds on their balance sheets. At the same time, years of low interest rates have encouraged investors to herd into corporate bonds and hold onto them tightly. That has worried some people who fear a lack of liquidity could worsen turmoil in the market, especially if interest rates rise. "I was somewhat of a contrarian about the liquidity worries, but the evidence is starting to pile up," Charles Himmelberg, the Goldman analyst, told Bloomberg. "The trend reflects the rising cost of holding corporate-bond positions. This looks increasingly like a growing headwind that will be with us for some time." 4. Synthetic credit is trading tighter than cash credit

Source: Barclays

Meghan Trainor may be "all about that bass," but market participants are squarely focused on that basis. Investors struggling to trade bonds amid an apparent dearth of liquidity have turned to a bevy of alternative products to gain or reduce exposure to corporate debt. Such instruments include derivatives like credit default swap (CDS) indexes, total return swaps (TRS) and credit index swaptions. The rush for derivatives that are supposed to be more liquid than the cash market they track has produced another odd dislocation in markets. Above is the so-called basis between the CDX IG, an index that includes CDS tied to U.S. investment-grade companies, and the underlying cash bonds. The basis has been persistently wide and negative in recent years, as spreads on the CDX index trade at tighter levels than cash. "In exchange for the substantial liquidity of derivative indices, investors are often giving up spread right now, as most indices trade at a negative basis versus the comparable cash market," Barclays' Bradley Rogoff wrote in research published today. "The negative basis right now is near the largest we have witnessed at a time when there was not a funding crisis." Investors may be ogling such synthetic tools not just because of their purported liquidity benefits but also because of funding benefits, a similar dynamic to the one currently pushing swap spreads into negative territory. "These dynamics are part of a broader pattern whereby cash bonds that require balance sheet financing underperform their synthetic counterparts (e.g. ... CDX vs. corporate bonds)," Goldman Sachs's Francesco Garzarelli and Rohan Khanna said today in reference to sub-zero swap spreads. 5. Market moves that aren't supposed to happen keep happening

Source: BofAML

Much of Wall Street runs on mathematical models that abhor statistical anomalies. Unfortunately for the Street, such statistical anomalies have been happening more frequently, with short-term moves in many assets exceeding historical norms. Barnaby Martin, a credit strategist at Bank of America Merrill Lynch, made this point earlier this year. The number of assets registering large moves—four or more standard deviations away from their normal trading range—has been increasing. Such moves would normally be expected to happen once every 62 years. While Martin blamed much of the confusion on unexpected decisions by central banks—such as the Swiss National Bank's surprise decision to scrap its long-standing currency cap—there have been sharp market moves with seemingly little reasons behind them. Perhaps the best-known example is Oct. 15, 2014, when the yield on the 10-year U.S. Treasury briefly plunged 33 basis points—a seven standard-deviation move that should happen once every 1.6 billion years, based on a normal distribution of probabilities. Some market participants have also blamed lower market liquidity for the wild moves. At TD Securities, analysts Priya Misra and Gennadiy Goldberg argued that similar liquidity issues to the ones related to corporate bonds could also be extending into the $12.8 trillion U.S. Treasury market. "The argument is that an unexpected macro event or large-size risk transfer has the potential of creating much larger market moves today compared with the past," TD Securities analysts TD Priya Misra and Gennadiy Goldberg said in late September. "The taper tantrum and the Oct. 15, 2014, event where Treasury rates moved amid very little news would be some examples of these events in recent times." 6. Volatility is itself more volatileSource: Bloomberg

In October 2008, Lehman Brothers had just collapsed, interbank lending had ground to a halt, the repo market seized up, and the future of the entire financial system was in question. At that time, a measure of expected volatility in the Chicago Board Options Exchange Volatility Index, or the VIX, hit 134.87. In August, 2015 the stock market fell 5.3 percent and the same measure of implied volatility in the VIX closed at 168.75, after reaching an all-time intraday record. Whatever one's opinions of the stock market selloff, you'd be hard-pressed to argue that global markets were more stressed in August than they were during the depths of the financial crisis. Instead, the vacillations in the VIX underscore a post-financial-crisis trend that has seen volatility explode into its own asset class. A host of exchange-traded funds, futures, and derivatives products are now enjoyed by both big, professional fund managers and mom and pop retail investors. Meanwhile, some large investors have been pumping up their returns by selling volatility, with Pimco under Bill Gross perhaps the best-known example. "The volatility market that exists today is much more complex than it used to be; ETFs, indices, futures, and options traded on all of the above have complex relationships that haven't been fully tested," George Pearkes, analyst at Bespoke Investment Group, said in an interview. He added: "Eventually, as we saw in the wake of last August, equilibrium is found when dislocations occur. But getting there can be complicated. Volatility, in my view, hasn't changed. What's changed is how it's warehoused and shifted." A similar sentiment could be applied to much of the market as it grapples with huge changes wrought on the financial system and its respective players. Markets, it seems, are living in interesting times indeed. |

|||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

ROUND TABLE

Charles Hugh Smith is an American writer and blogger. He is the chief writer for the site "Of Two Minds", which started in 2005. His work has been featured on a number of highly acclaimed sites including: Zerohedge.com., The American Conservative and Peak Prosperity. Rick Ackerman has professional background including 12 years as a market maker on the floor of the Pacific Coast Exchange, three as an investigator with renowned San Francisco private eye Hal Lipset, seven as a reporter and newspaper editor, three as a columnist for the Sunday San Francisco Examiner, and two decades as a contributor to publications ranging from Barron’s to The Antiquarian Bookman to Fleet Street Letter and Utne Reader. Rick Ackerman is the editor of Rick’s Picks and a partner in Blue Fin Financial LLC, a commodity trading advisor.

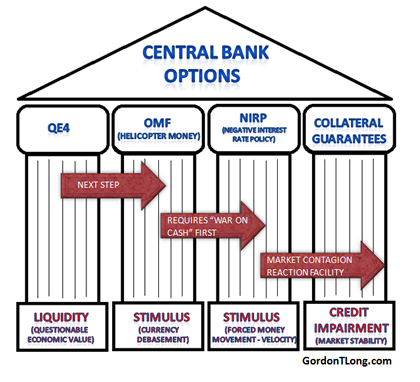

Co-founder of The Financial Repression Authority, Gordon T. Long has an in-depth discussion on the current financial situation with Charles Hugh Smith, of OfTwominds.com and with Rick Ackerman, trader and forecaster of Rickackerman.com. THE OUTLOOK ON QUANTITATIVE EASING Rick: “I’ve been shouting from the rooftops that the fed will never raise interest rates.” If you want to find out if QE is working the first person you have to go to is the retiree. The whole idea of stimulus should have been refuted simply by the fact that savers have been cheated for so long. Charles: They may go ahead and do the quarter point rates increase because they have built up so many expectations to that. They will need to do this to create the allusion that the economy is recovering or else it’s robust. Gordon: The market may be a key driving factor, not because of the wealth effect; but because of collateral. THE STATE OF JAPAN: Charles: “The Juggernaut of deflation is so huge now, that there isn’t going to be any time to react. Keep a shoebox full of cash because on that day we might wake up and the banks won’t be open, we will need that cash.” I don’t see the possibility of massive inflation. The only viable way of getting money into the system is to borrow it into existence. Japan, is a developed economy that has been in a deflationary setting for almost 25 years now. We can see what they’ve done and what effects it has. They have attempted to stimulate their economy by improving roads and infrastructure. But it has not worked. Japan refuses to cleanse their financial system to allow real investment so they have consequently brought in mal-investment with borrowed money. Rick: Japan had something over the last 20 years that we didn’t have, and that is us. Japan has a global economy to export into; we were the buyer of last resort. NEGATIVE INTEREST RATES Rick: “If you can extrapolate a somehow positive benefit from negative interest rates, where would this benefit be and how long would it last?” The idea is if people can no longer park money anywhere, they can only spend it or invest it, we have to ask, where are they going to invest or spend it? It’s inconceivable that money can find itself into somewhere in the economy that would promote growth and economic health. Charles: In a current example of negative interest rates we see what is happening with Sweden who is actively pursuing negative rates. The net result is that it is taking their housing bubble and inflating it even further. Basically it is pricing everybody out of housing and creating a credit bubble. COLLATERAL GUARANTEES Gordon: “It is in the cards, in the middle of the next crisis.” We have an approximately $500 trillion swaps market that is underpinned with collateral. So if bond prices were to drop it would be a horrendous situation. We were able to stop the 2008 crisis, we did not fix it we only stopped it. Now it will be a global issue, and the central banks will be forced to come in and pay attention to these collateral values. We have a huge pool of bond ETF’s that have exploded in the past few years, somebody has to sell these bonds but they are not easily transferred. The central banks will have to intervene in a massive way. I believe many people are betting on this, and are therefore taking risk adjusted positions. Rick: “We are really talking about a quadrillion dollar bubble.” Much of borrowing and leveraging shifted into rehypothecation. It occurred mostly in London markets that were more unregulated than US markets. So when we had the real estate bust in 2008 we needed something to pledge as collateral. When you look at the entire quadrillion dollar enchilada, somebody may say the actual size of the bubble is only several hundred trillion dollars. When in reality the gross amount is something everyone involved in the daisy chain thinks they have a claim on a particular asset. Charles: We must own real assets, and have no debt. Whatever financial wormhole we are going to go through,we must own the right tools, because the tools will still exist after we get through the wormhole. THE INDIRECT EXCHANGE: Regarding a recent show with Warren Buffet, and Ty Andros, Editor at Tedbits Newsletter, Warren Buffet so masterfully utilizes the indirect exchange. He takes paper, which is his entire insurance side of business and plows it back into real hard assets that will sustain themselves at a fair price. Buffet has don’t this so consistently for so many years and that is why balances; paper products (insurances, bonds, and structures against real assets). Buffet has certainly been a consistent winner without question. Rick: Buffet has also resisted the temptation of going after easy money. His money is not in Uber, Dropbox, and Instagram etc. It’s simple to see that it is not going to end well, not only for the companies but for the whole city, if I were to short any city in this country it would be San Francisco. Everything is so pumped up in that city because there are companies that hire these people that are extremely overvalued. Buffet has demonstrated amazing restraint and discipline for sticking with the nuts and bolts, instead of going after the alluring high attraction companies. He has found real businesses with real products that have a sustaining capability to survive during good times and bad. Charles: Raising the issue of risk, how do we deal with the kind of systemic global risk that we currently have? Risk is extremely misrepresented to the average middle class American. We are trying to help people make a realistic assessment of the global risk they are engaged in by having a 401k that is involved in these risky financial assets. Rick: “You can’t look at what’s in prospect as hypothetical, if you don’t think there is going to be a collapse then you don’t understand the problem.” There is no way we can continue to muddle on, for one its taking a lot more debt to create the dollars’ worth of GDP growth at the margin. We are really going to face a day of reckoning. The most important thing is for us to be resourceful and ready for when it comes. Charles: “This enormous supernova of debt is going to implode and whatever is left will not be a financial instrument.” Gordon: “Crisis is nothing more than change trying to happen.” We have so many global imbalances. We have political, economic, and financial systems that are not correct, we are still running from a Bretton Woods; post WWII model. And during this process, mal-investment, lack of price discovery and mispricing are rampant. But on the flip side, for those who have prepared themselves for this storm, I think the world is going to see its greatest years. The advancements in technology, and so many other endeavors is staggering. !5-25 years out will be an incredible time for the world but meanwhile we are going to go through some rough times, but there will be winners and there will be losers, and the winners are always the ones who prepare.

|

|||

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

I - POLITICAL |

|||

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | THEME | ||

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MACRO w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

| STANDARD OF LIVING - SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

III-FINANCIAL |

|||

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP