|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Fri. Nov 13th, 2015

Follow Our Updates

onTWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

ARCHIVES

| NOVEMBER | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | |||||

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?We have analyzed & included

these in our latest research papers Macro videos!

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

TODAY'S TIPPING POINTS

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

|

|||

| 11-13-15 | FLOWS |

||

|

|

|||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Nov. 8th, 2015 - Nov 14th, 2015 | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 10-29-15 | GLOBAL RISK SIGNALS | 2 |

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

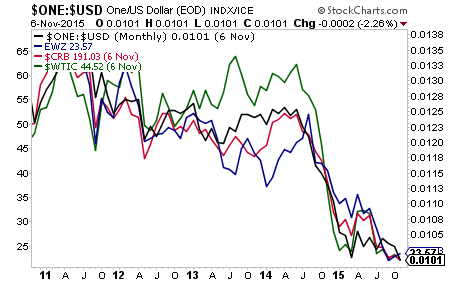

US DOLLAR Strong $ = Implosion in “Risk On” Assets

An inverted US Dollar chart (so when the US Dollar rallies, the chart falls),

|

11-10-15 | 20 - US Dollar | |

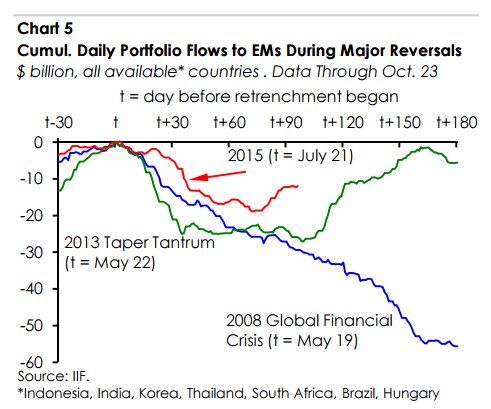

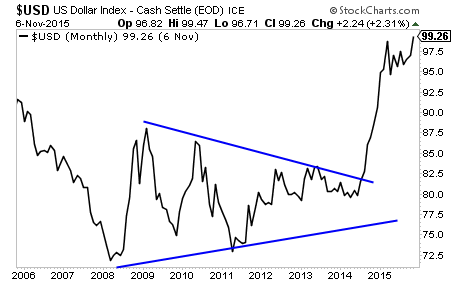

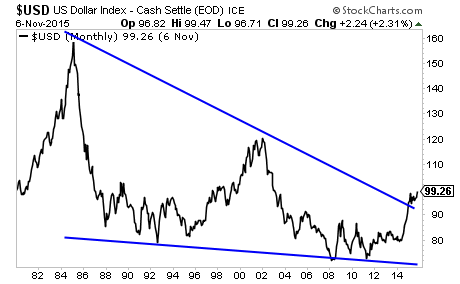

Submitted by Phoenix Capital Research on 11/09/2015 The US Dollar Bull Market Could Trigger a $9 Trillion Debt ImplosionThe US Dollar rally, combined with the ECB’s policies and the Fed’s hint at raising rates in December, is at risk of blowing up a $9 trillion carry trade. When the Fed cut interest rates to zero in 2008, it flooded the system with US Dollars. The US Dollar is the reserve currency of the world. NO matter what country you’re in (with few exceptions) you can borrow in US Dollars. And if you can borrow in US Dollars at 0.25%... and put that money into anything yielding more… you could make a killing. A hedge fund in Hong Kong could borrow $100 million, pay just $250,000 in interest and plow that money into Brazilian Reals which yielded 11%... locking in a $9.75 million return. This was the strictly financial side of things. On the economics side, Governments both sovereign and local borrowed in US Dollars around the globe to fund various infrastructure and municipal projects. Simply put, the US Government was practically giving money away and the world took notice, borrowing Dollars at a record pace. Today, the global carry trade (meaning money borrowed in US Dollars and invested in other assets) stands at over $9 TRILLION (larger than the economy of France and Brazil combined). This worked while the US Dollar was holding steady. But in the summer of last year (2014), the US Dollar began to breakout of a multi-year wedge pattern:

Why does this matter? Because the minute the US Dollar began to rally aggressively, the global US Dollar carry trade began to blow up. It is not coincidental that oil commodities, and emerging market stocks took a dive almost immediately after this process began. The below chart shows an inverted US Dollar chart (so when the US Dollar rallies, the chart falls), Brazil’s stock market (blue line), Commodities in general (red line) and Oil (green line). As you can see, as soon as the US Dollar began to rally, it triggered an implosion in “risk on” assets.

This process is not over, not by a long shot. As anyone who invested during the Peso crisis or Asian crisis can tell you, when carry trades blow up, the volatility can be EXTREME. Indeed, the US Dollar as broken out of a MASSIVE falling wedge pattern that predicts a multi-year bull market.

The market drop in August triggered by China devaluing the Yuan (another victim of the US Dollar bull market) was just the start. Once the US Dollar rally really begins picking up steam, we could very well see a crash. |

|||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market | |||

| TECHNICALS & MARKET |

|

||

| Market - WEDNESDAY STUDIES | |||

| TECHNICALS & MARKET |

|

||

| STUDIES - MACRO pdf | |||

| 11-12-15 | STUDIES | ||

Submitted by Tyler Durden on 11/11/2015

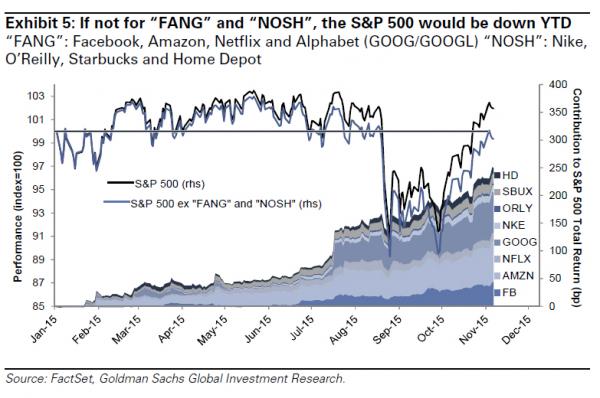

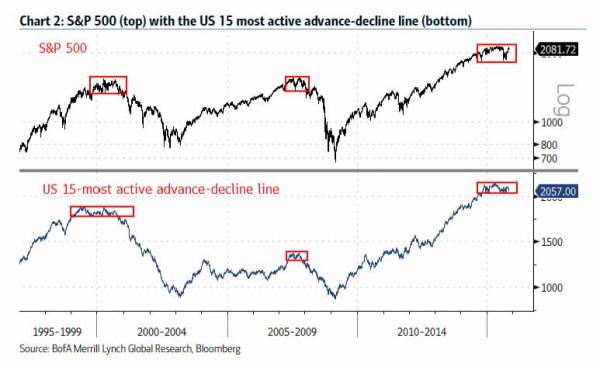

When Does The Market Breakdown Again? The Answer Is In The A-D LineA few days ago we explained just how the dramatic divergence between the broader market and the number of stocks which are actually up and leading this rally has become, when we showed a chart of the NYSE advance/decline line overlaid on the S&P500. The simple explanation of the above is that there are fewer and fewer stocks propelling the market higher. In fact, as we showed yesterday, if one removes just 8 stocks, AMZN, NFLX, FB, GOOG, NKE, ORLY, SBUX and HD, the S&P500 would be the red for the year. Today, BofA's new chief technician Stephen Suttmeier picks up on this dramatic divergence and gives out the following warning: "A month-long bearish divergence for the US 15 most active advance-decline line has the potential to limit S&P 500 upside." His details:

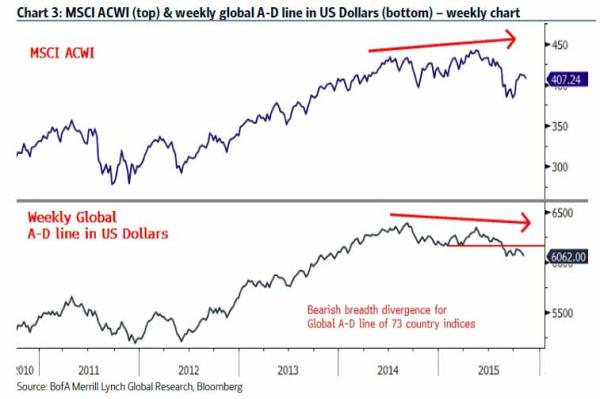

Suttmeier then warns what our readers are already aware of, however extended to the global market, namely that there now exists "a major bearish divergence for global A-D line in US Dollars"

Most importantly, it appears that historically changes in the A-D line have been a useful advance indicator of major market breakdowns. To wit:

Which means that the central banks, whose only mandate is to keep the global market from crashing, will have to buy - either directly like the SNB and BOJ or indirectly/spoof like the NY Fed via Citadel - much more than just the E-mini and a handful of stocks to give the impression that the market is healthy when in fact, it is not. Whether they can pull this off will determine if the Fed's long telegraphed "rate hike" is executed, or if come December 16 Yellen chickens out one more time, and the next thing the market will have to look forward to is the inevitable arrival of negative interest rates. |

|||

| 11-11-15 | STUDIES | ||

Submitted by Tyler Durden on 11/10/2015 If It Wasn't For These 8 Companies The Market Would Be Down In 2015While FANG (Facebook, Amazon, Netflix, Google) has become ubiquitous among the retail investing public still 'trading stocks', now it is time to meet NOSH (Nike, O'Reilly, Starbucks, Home Depot). The reason is simple -without these 8 stocks, the S&P 500 would be down year-to-date... "solid foundation" for the next leg in the bull market? Or teetering inverted pyramid scheme? Finally, we couldn't help but notice that this list of 8 stocks is basically all the names that Jim Cramer is jamming down retail investors' throats (and thus hedge fund momo chasers) as the only stocks "that work." Such 'weak' hands do not bode well if this whole ponzi scheme turns down once again. Chart: Goldman Sachs |

|||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

|

THE CORE TENETS OF THE AUSTRIAN SCHOOL OF ECONOMICS FRA Co-Founder, Gordon T. Long interviewed Robert Blumen, noted follower of the Austrian School of Economics, on the Core Tenets of the Austrian School and the Key Elements for investing in an Era of Financial Repression. CORE TENETS 1. All economic understanding must be based on individual action 24. Austrian business cycle theory – the theory of unsustainable booms drive by fractional reserve banking and central banking.

25. Deflation:

26. An Austrian understanding of recessions and depressions through Say’s Law, entrepreneurship, and market price theory

KEY ELEMENTS IN AN ERA OF FINANCIAL REPRESSION 1. Entrepreneurs create wealth by employing scarce resources in production within the context of the price system. This requires real markets with real prices. 2. Central planning can not replace market prices. 3. Central bankers have it backwards. Counter-cyclical policies create the business cycle. 4. Interest is not a number you can set to anything you like for “policy” reasons. It is a price and it cannot be zero. 5. Attempting to keep interest rates at zero creates unsustainable distortions in the productive part of the economy. 6. Something that is unsustainable must stop - at some point. 7. In the end there are two choices – market prices or destruction of the monetary system 8. Investors think in terms of money, but money itself is unstable. 9. The path from fake prices to real prices will be difficult.

|

2013 2014 |

||

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

I - POLITICAL |

|||

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | THEME | ||

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MACRO w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

| STANDARD OF LIVING - SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

III-FINANCIAL |

|||

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP