|

JOHN RUBINO'SLATEST BOOK |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Tues. Mar. 1st , 2016

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

![]()

| FEBRUARY | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | 6 | |

| 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| 14 | 15 | 16 | 17 | 18 | 19 | 20 |

| 21 | 22 | 23 | 24 | 25 | 26 | 27 |

| 28 | 29 | 1 | 2 | 3 | 4 | 5 |

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

| CHINA BUBBLE | 4 | ||

China Faces 15 Trillion BombshellAs Shadow Banking Sector CollapsesWe’ve spent more time than most documenting China’s wealth management product problem. WMPs are part and parcel of Beijing’s sprawling shadow banking complex which, until 2014 that is, helped pump trillions of yuan into China’s economy and shouldered the burden when it came to propping up the most important economy on the planet. But WMPs are dangerous. In fact, we flagged them as an 8 trillion black swan back in August on the way to asking what would happen if China’s shadow banking sector were to collapse altogether. This is space that’s running what amounts to an enormous maturity mismatched fraud. Of course the describes the entire fractional reserve banking system, but in the case of China’s WMPs, it’s all on the verge of implosion. Don’t believe us? Just ask anyone who bought into products sold by Fanya Metals’ Shan Jiuliang. This is a very real threat to the Chinese banking sector. The multifarious nature of the space's liabilities makes it virtually impossible for anyone to assess what the embedded risks are. As we first documented last summer, some 40% of credit risk is carried off balance sheet and that figure might well have grown recently, especially considering mid-tier bank's propensity to extend new credit through new cateogries of channel loans that are classified as "investments" and "receivables" In any event, China is desperate to revive the credit impulse and that means keeping the shadow banking space alive. Here's BofA with more on China's ticking WMP time bomb:

The bottom line is this: if this implodes, it will not only tank the entire Chinese banking system but the global economy as well, as the amount of liabilities here is quite frankly enormous. |

|||

TIPPING POINTS, STUDIES, THESIS, THEMES & SII COVERAGE THIS WEEK PREVIOUSLY POSTED - (BELOW)

|

|||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Feb 21st, 2016 to Feb 27th, 2016 | |||

| TIPPING POINTS - This Week - Normally a Tuesday Focus | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market - WEDNESDAY STUDIES | |||

| STUDIES - MACRO pdf | |||

TECHNICALS & MARKET |

|

||

| COMMODITY CORNER - AGRI-COMPLEX | |||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

|

2016 | THESIS 2016 |  |

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

Reggie Middleton: OBSOLETING BANKS, BROKERS, CLEARINGHOUSES & EXCHANGES

FRA Co-Founder Gordon T. Long has an in-depth discussion on the future of Bitcoins and Block Chain technology with serial entrepreneur, Reggie Middleton. Middleton’s experience has given him the ability to recognize value, or the lack thereof, well before much of the professional populace. His ability to identify opportunity and his “out-the-box” mind-set are due to years of entrepreneurial pursuits in insurance, financial valuation/modeling, technology, media, and real estate. He is the founder of Veritaseum and the finance and technology blog, Boom Bust Blog. Until 2011, he wrote about financial evaluation and the global financial crisis at the Huffington Post.

THE EUROPEAN BANKING SYSTEM “The problems from 2006-2009 are the same problems we have now.” I call it the great global macro experiment. Authorities attempted to do things they have never done before. Things such as negative interest rates and particularly QE which was a practise adopted from the Japanese. It is important to note that Japan began QE within their economy 30 years ago and still to this day the desired results from it have not been achieved; Japan is still fighting inflation. “Central bankers believe that if they prolong the problem long enough they can export their economic problems to other countries, not realizing that it is a global economy.” The way it works is, we have a bubble; and a bubble is defined as an instance when prices shoot above the fundamental value of the good or service. Once this bubble pops and instead of allowing a natural reset of prices and value, instead people try to further push prices up. Blockchain Technology “It is essentially bitcoin revamped with a different name.” Bitcoins underlying foundation is essentially a new way of dealing with databases. It is a database that is distributed amongst many individuals. In essence it is a database run by 3 million machines which each shares a full copy of the database and each having full functionality of the database. With this much territory, you get a system which cannot be taken down by a single or even multiple authorities. In addition it solves something called the “double spending problem” which is the risk that a digital currency can be spent twice. Double-spending is a problem unique to digital currencies because digital information can be reproduced relatively easily. Physical currencies do not have this issue because they cannot be easily replicated, and the parties involved in a transaction can immediately verify the bona fides of the physical currency. With digital currency, there is a risk that the holder could make a copy of the digital token and send it to a merchant or another party while retaining the original. This was a concern initially with Bitcoin, since it is a decentralized currency with no central agency to verify that it is spent only once. However, Bitcoin has a mechanism based on transaction logs to verify the authenticity of each transaction and prevent double-counting. Bitcoin requires that all transactions, without exception, be included in a shared public transaction log known as a “block chain.” This mechanism ensures that the party spending the bitcoins really owns them, and also prevents double-counting and other fraud. The block chain of verified transactions is built up over time as more and more transactions are added to it. “The bitcoin and block chain technology now parallels what the internet was in 1993. Most people didn’t get it and if they did get it they strictly thought of the internet as email; fast forward and look where we are now with the internet. Bitcoins and digital currencies are a way of transferring value.” INDEPENDENT GLOBAL BANKING Certain strong regimes such as the US, Germany and Britain have attempted to impose their limitations. An example would be the US with peer-to-peer file sharing halting the activities of The PirateBay. This was possible because it was a centralized server which was easy to target. But now we are in an environment that has similar things with millions of hubs and files are transferred in a huge web. This is near impossible to take down therefore the law was broken and governments and authorities resorted to illegal means to halt these new developments, it is unclear still as to how successful they were. “It is about adapting to paradigm shifts. History shows that entities that fight or prevent these shifts will not be successful and eventually be forgotten. Microsoft is a good example of a top tier company which sustained two paradigm shifts and this was because of all their patents and so much of the world using their services.” The banks are taking bitcoin technology and trying to incorporate it into their business models. It will make many processes faster but at the same time, you do not need banks to make transactions anymore. Therefore no matter how much more efficient banks become, if they become obsolete than the increased efficiency is of no good. “The banks are following the same route with banking as AOL did with the internet. Ultimately the end result will be no different as well.” If you charge a correct risk payment for capital, a bank could never get big enough to take down the world because it wouldn’t be able to afford to take that risk. If I can get money at 75 basis points then I would take all the risk in the world and if I mess up I only have to pay 75 basis points; there is no reason not to take risk. But if I paid 18-25% for that money I would become far less risk averse. “Bring back true fundamental market analysis, natural market economics and the system solves itself.” FUTURE OF BITCOIN AND BLOCKCHAIN At the end of the quarter we are launching an HTML client which allows you to hold assets in your device on a webpage. It is like having a bank account on a webpage that sits on your device and it cannot be stolen unless it is stolen from you directly. Additionally we will be launching applications of block chain technology to capital markets. We plan to have applications for credit, peer-to-peer swaps and for real estate transactions in beta of md-year but definitely by year end. There are legal issues but we can get passed these issues by putting actual cash within the block chains. It will increase the efficiency to facilitate cash flows from various kinds of investments. It is a way of eliminating banks from the equation.

Abstract written by, Karan Singh

|

|||

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday "Themes" Post & a Friday "Flows" Post | |||

I - POLITICAL |

|||

CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM

MACRO MAP - EVOLVING ERA OF CENTRAL PLANNING

|

G | THEME | |

| - - CRISIS OF TRUST - Era of Uncertainty | G | THEME | |

CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION - RESENTMENT. |

US | THEME PAGE |  |

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | G | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MA w/ CHS |

|

| 01-08-16 | THEME | MA w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MA w/ CHS |

III-FINANCIAL |

|||

|

FLOWS - Liqudity, Credit & Debt

|

MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | 12-31-15 | THEME | |

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

|||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

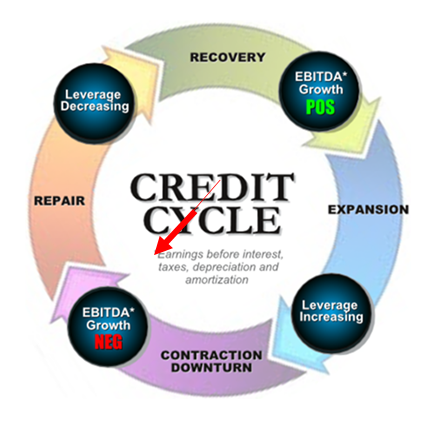

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP