|

JOHN RUBINO'SLATEST BOOK |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Wed. Feb. 10th , 2016

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

![]()

| FEBRUARY | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | 6 | |

| 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| 14 | 15 | 16 | 17 | 18 | 19 | 20 |

| 21 | 22 | 23 | 24 | 25 | 26 | 27 |

| 28 | 29 | |||||

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

| Market - WEDNESDAY STUDIES | |||

| STUDIES - MACRO pdf | |||

TECHNICALS & MARKET |

02-10-16 |

||

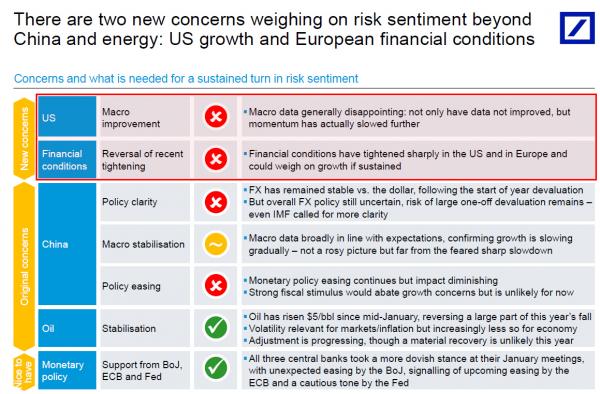

Two New Concerns Weighing On Risk

The biggest worries challenging that bull case in January were twofold: China and commodities, mostly oil. However, over the past week, two new big concerns appear to have emerged. Here, ironically, is Deutsche Bank explaining what these are (for those confused, "tightening in financial conditions in European financial credit" is a euphemism for plunging DB stock among others):

And here is the matrix breaking down all the recent conditions weighing on risk. We wish we could be as optimistic as DB that monetary support from central banks which are now running on fumes in terms of credibility, and that oil, which continues to gyrate with grotesque daily volatility, are "supportive. In fact, we are confused that DB is optimistic on central bank support: after all it was, drumroll, Deutsche Bank, which over the weekend warned against any more "easing" from central banks whose NIRP is now weighing on the German bank's profitability, something the market has clearly realized judging by the price of its public securities.

|

|||

TIPPING POINTS, STUDIES, THESIS, THEMES & SII COVERAGE THIS WEEK PREVIOUSLY POSTED - (BELOW)

|

|||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Feb 7th, 2016 to Feb 13th, 2016 | |||

| TIPPING POINTS - This Week - Normally a Tuesday Focus | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 02-09-6 | 2 | |

22 Signs That The Global Economic Turmoil We Have Seen So Far In 2016Is Just The BeginningSubmitted by Michael Snyder via The Economic Collapse blog, As bad as the month of January was for the global economy, the truth is that the rest of 2016 promises to be much worse. Layoffs are increasing at a pace that we haven’t seen since the last recession, major retailers are shutting down hundreds of locations, corporate profit margins are plunging, global trade is slowing down dramatically, and several major European banks are in the process of completely imploding. I am about to share some numbers with you that are truly eye-popping. Each one by itself would be reason for concern, but when you put all of the pieces together it creates a picture that is hard to deny. The global economy is in crisis, and this is going to have very serious implications for the financial markets moving forward. U.S. stocks just had their worst January in seven years, and if I am right much worse is still yet to come this year. The following are 22 signs that the global economic turmoil that we have seen so far in 2016 is just the beginning… 1. The number of job cuts in the United States skyrocketed 218 percent during the month of January according to Challenger, Gray & Christmas. 2. The Baltic Dry Index just hit yet another brand new all-time record low. As I write this article, it is sitting at 303. 3. U.S. factory orders have now dropped for 14 months in a row. 4. In the U.S., the Restaurant Performance Index just fell to the lowest level that we have seen since 2008. 5. In January, orders for class 8 trucks (the big trucks that you see shipping stuff around the country on our highways) declined a whopping 48 percent from a year ago. 6. Rail traffic is also slowing down substantially. In Colorado, there are hundreds of train engines that are just sitting on the tracks with nothing to do. 7. Corporate profit margins peaked during the third quarter of 2014 and have been declining steadily since then. This usually happens when we are heading into a recession. 8. A series of extremely disappointing corporate quarterly reports is sending stock after stock plummeting. Here is a summary from Zero Hedge of a few examples that we have just witnessed…

9. Junk bonds continue to crash on Wall Street. On Monday, JNK was down to 32.60 and HYG was down to 77.99. 10. On Thursday, a major British news source publicly named five large European banks that are considered to be in very serious danger…

11. Deutsche Bank is the biggest bank in Germany and it has more exposure to derivatives than any other bank in the world. Unfortunately, Deutsche Bank credit default swaps are now telling us that there is deep turmoil at the bank and that a complete implosion may be imminent. 12. Last week, we learned that Deutsche Bank had lost a staggering 6.8 billion euros in 2015. If you will recall, I warned about massive problems at Deutsche Bank all the way back in September. The most important bank in Germany is exceedingly troubled, and it could end up being for the EU what Lehman Brothers was for the United States. 13. Credit Suisse just announced that it will be eliminating 4,000 jobs. 14. Royal Dutch Shell has announced that it is going to be eliminating 10,000 jobs. 15. Caterpillar has announced that it will be closing 5 plants and getting rid of 670 workers. 16. Yahoo has announced that it is going to be getting rid of 15 percent of its total workforce. 17. Johnson & Johnson has announced that it is slashing its workforce by 3,000 jobs. 18. Sprint just laid off 8 percent of its workforce and GoPro is letting go 7 percent of its workers. 19. All over America, retail stores are shutting down at a staggering pace. The following list comes from one of myprevious articles… -Wal-Mart is closing 269 stores, including 154 inside the United States. -K-Mart is closing down more than two dozen stores over the next several months. -J.C. Penney will be permanently shutting down 47 more stores after closing a total of 40 stores in 2015. -Macy’s has decided that it needs to shutter 36 stores and lay off approximately 2,500 employees. -The Gap is in the process of closing 175 stores in North America. -Aeropostale is in the process of closing 84 stores all across America. -Finish Line has announced that 150 stores will be shutting down over the next few years. -Sears has shut down about 600 stores over the past year or so, but sales at the stores that remain open continue to fall precipitously. 20. According to the New York Times, the Chinese economy is facing a mountain of bad loans that “could exceed $5 trillion“. 21. Japan has implemented a negative interest rate program in a desperate attempt to try to get banks to make more loans. 22. The global economy desperately needs the price of oil to go back up, but Morgan Stanley says that we will not see $80 oil again until 2018. It is not difficult to see where the numbers are trending. Last week, I told my wife that I thought that Marco Rubio was going to do better than expected in Iowa. How did I come to that conclusion? It was simply based on how his poll numbers were trending. And when you look at where global economic numbers are trending, they tell us that 2016 is going to be a year that is going to get progressively worse as it goes along. So many of the exact same things that we saw happen in 2008 are happening again right now, and you would have to be blind not to see it. Hopefully I am wrong about what is coming in our immediate future, because millions upon millions of Americans are not prepared for what is ahead, and most of them are going to get absolutely blindsided by the coming crisis. |

|||

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market - WEDNESDAY STUDIES | |||

| STUDIES - MACRO pdf | |||

TECHNICALS & MARKET |

|

||

| COMMODITY CORNER - AGRI-COMPLEX | |||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

|

2016 | THESIS 2016 |  |

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

| 02-08-16 | |||

John Charalambakis:IT’S ABOUT RISK MITIGATION & CAPITAL PRESERVATION!

John Charalambakis is the Managing Director of Group, a boutique style asset and wealth management firm, which focuses on risk mitigation, capital preservation and growth through strategies that are rule based. Dr. Charalambakis has been teaching economics and finance in the US for the last twenty years. Currently he teaches economics at the Patterson School of Diplomacy & International Commerce at the University of Kentucky. FINANCIAL REPRESSION“The outcome of financial repression is when the role of the markets is diminished because of the actions of central authorities, such as central banks.” Fed: Central banks of the United States, ECB: European central bank, and BoJ Bank of Japan Assets under management have skyrocketed from about 7% in 2007 for the U.S Fed, to over 20% as of the end of 2015, increasing 3 times. Over this time, the GDP did not equally increase 3 times. This increase eventually leads to a greater role of central authorities. Looking at Japan in 2007, they had about 20% of their GDP in their balance sheet, currently they have over 90%, meaning the role of the markets is diminishing and the role of central authorities is increasing, creating financial repression. Gord asks John what assets people should invest in, in this era of financial repression that would create a store of value, which may not bring in a yield, but would preserve their money. GOLD – INTRINSIC VALUE ASSETS “I think the goal of any pension fund, institutional or private investor should be capital preservation. Assets should have intrinsic value.” “Assets that have intrinsic value such as gold or silver, historically have retained their value especially in times of crisis.” John mentions how the price of gold in 2009 rose from about $500-$500 to $1900 because investors were seeking a safe haven of intrinsic value assets. “There is not enough gold for everyone. Only 1/3 of 1%, a miniscule number, is invested in precious metals.” Hypothetically if every manager by the end 2016 would invest just 3% of their wealth into precious metals, the price of gold would rise to an estimated $2700. Growing demand and financial stress can, and likely eventually will, create a financial crisis. KEY PRINCIPLES OF THE AUSTRIAN SCHOOL OF THOUGHT

“Unfortunately risks and stresses are being built up and portfolios are suffering the consequences. People think because they have wealth on a financial statement, that wealth can be preserve. When the markets collide, that wealth is destroyed because it is paper wealth, not real wealth.” INFASTRUCTURE INVESTMENT “Infrastructure investment needs to be financed, usually countries finance infrastructure through deficit spending, and that cannot happen due to big holes in their budgets.” John questions whether or not the internal rate of return justifies infrastructure. He doesn’t believe the environment is mature enough currently, due to the possibility of a looming crisis in the next couple years. This would push back infrastructure spending. PREPARING FOR A POSSIBLE CRISIS

“Since we are in an era of financial repression you cannot expect the income from treasuries or CDs, explore all sources of income”

Kamilla Guliveva

|

|||

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday "Themes" Post & a Friday "Flows" Post | |||

I - POLITICAL |

|||

CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM

MACRO MAP - EVOLVING ERA OF CENTRAL PLANNING

|

G | THEME | |

| - - CRISIS OF TRUST - Era of Uncertainty | G | THEME | |

CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION - RESENTMENT. |

US | THEME PAGE |  |

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | G | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MA w/ CHS |

|

| 01-08-16 | THEME | MA w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MA w/ CHS |

III-FINANCIAL |

|||

|

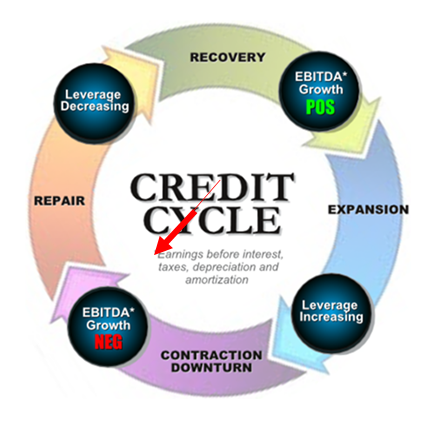

FLOWS - Liqudity, Credit & Debt

|

MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | 12-31-15 | THEME | |

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

|||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP