|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Fri. Jan. 8th, 2016

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

![]()

| JANUARY | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | |||||

| 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 10 | 11 | 12 | 13 | 14 | 15 | 16 |

| 17 | 18 | 19 | 20 | 21 | 22 | 23 |

| 24 | 25 | 26 | 27 | 28 | 29 | 30 |

| 31 | ||||||

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

| THEMES | |||

II-ECONOMIC |

|||

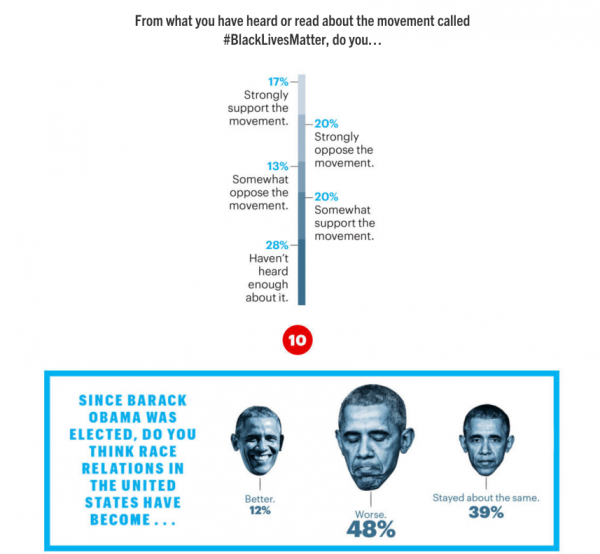

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | MA w/ CHS |

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MA w/ CHS |

|

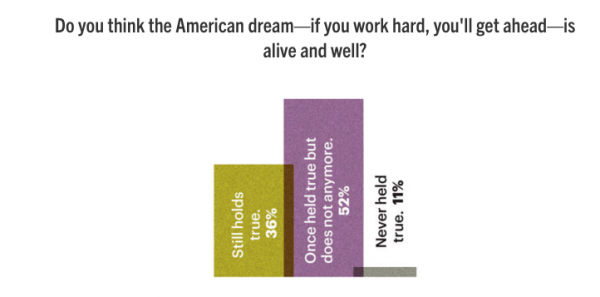

“The American Dream May Be DyingBut It Can Be Revived!” GORDON T LONG & CHARLES HUGH SMITH - Discuss CHS' new book

DECLINING LABOR PERTICIPATION RATE - Status quo has no solution!

New tech creates far fewer jobs than it replaces/destroys Today's Tech Giants Are Creating Loads Of Wealth But Pitifully Few Jobs PUBLIC NARRATIVE

"A Solution to Automation—Universal Basic Income for all"

Charles Hugh Smith says:

Gordon T Long says:

.....not just survive on the dole. UNIVERSAL BASIC INCOME => THE DOLE

We need new ways of understanding our systemic problems and new solutions. Going back to 1930 and super-welfare schemes are not real solutions.

CHS' solution is to build a community-based economy that provides funding, mentoring and ample opportunities to build capital and wealth. What we need (and what CHS book is about)

Blog essay does the heavy lifting on the financial analysis— but its really the social-economic differences between:

SUBSISTENCE SERFDOM

THE KEYNESIAN IDEOLOGY

New crypto-currencies offer a way to escape the financial repression of central bank-issued money, which flows to banks and financiers, not the real economy. |

|||

TIPPING POINTS, STUDIES, THESIS, THEMES & SII COVERAGE THIS WEEK PREVIOUSLY POSTED - (BELOW)

|

|||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Jan 3rd, 2016 - Jan 9th, 2016 | |||

| TIPPING POINTS - This Week - Normally a Tuesday Focus | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

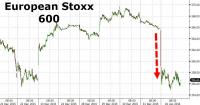

2- RISK REVERSAL HAPPY NEW YEARWhat a Start!

Submitted by Tyler Durden on 01/04/2016 - 12:53 |

01-15-16 | 2- Risk Reversal | |

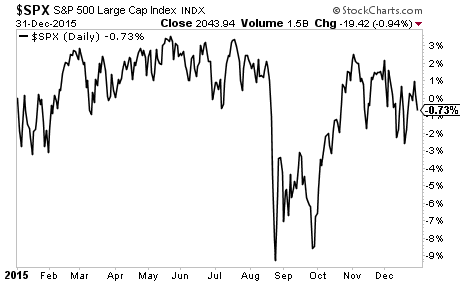

Three Reasons Stocks Will Crater in 2016Phoenix Capital Research on 01/04/2016 Last year (2015) likely will represent the top for the bull market that began in 2009. Stocks finished the year down, representing the first down year since the March 2009 bottom.

Many analysts will point to the August sell-off as the reason stocks performed so badly, however, looking at the chart, stocks struggled throughout the year, long before the August sell-off. Indeed, at best the S&P 500 was up 3% for the year! Things are only going to worsen from here. FIRST REASON - Fed Tightening

SECOND REASON - US Recession

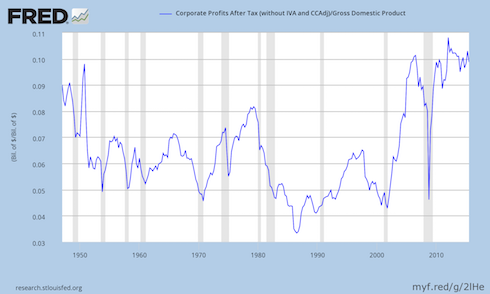

THIRD REASON - Profits Relative to GDP Rolling Over

With the US back in recession and the Fed tightening, both #s 1 and 2 are over. This leaves #3. And while productivity did increase marginally in first half of 2015, it’s now rolling over again towards 0%. In short, the sources of growth for US corporates have all dried up. Stocks have yet to adjust to this, but when they do it’s going to be an all out collapse. |

|||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market - WEDNESDAY STUDIES | |||

| STUDIES - MACRO pdf | |||

TECHNICALS & MARKET Once again, the S&P 500 catches down to The Fed's balance sheet...

|

01-06-1 |

STUDY | |

First $1.5 Billion Hedge Fund Casualty Of 2016

|

|||

| COMMODITY CORNER - AGRI-COMPLEX | |||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

FINANCIAL REPRESSION |

01-04-16 | FINANCIAL REPRESSION |

|

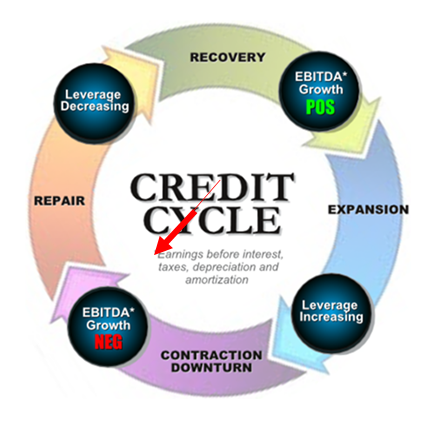

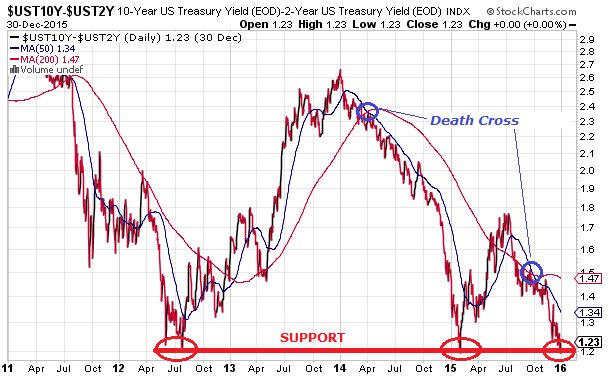

A “WITCH’S BREW” BUBBLING IN BOND ETFsWe believe the Credit Cycle has turned and with it will come some massive unexpected shocks. One of these will be the fall out in the Bond Market, centered around the dramatic growth explosion in Bond ETFs coupled with the post financial crisis regulatory changes that effectively removed banks from making markets in corporate bonds. It is a ‘Witch’s Brew’ with a flattening yield curve bringing it to a boil. 2000 – Flat to Inverted Yield Curve

2007 – Flat Yield Curve

TODAY – Signalling a Flattening at Seriously Lower Bound!

PRESSURES FLATTENING THE YIELD CURVE

In the last six weeks, the spread between the Ten Year and the Two year treasuries has flattened exactly 25 basis points, which is EXACTLY the same amount that the Fed just moved the Fed Funds target rate this past Wednesday. With investors starved for yield many are being forced further out on the yield curve taking rates down further and pushing prices up. Dan Norcini at http://traderdan.com lays it out pretty clearly:

THE “WITCH’S BREW” Many Including Morningstar Have Hyped “The Great New Yield Opportunity”

What has been sold to many investors, speculators and even desperate Fund Managers is using Bond ETFs to play the old “Roll Down the Yield Curve” Strategy. Here is how it works in case you are not familiar with the strategy.

YRA HARRIS WARNS “ALL HELL MAY BREAK LOOSE!” Legendary trader Yra Harris who we recently interviewed at the Financial Repression Authority has been pounding the table for some time but just issued this warning:

CONCLUSION What Yra doesn’t say is we now have $2.2 Trillion of troubled High Yield bonds peddled to yield starved investors since the financial crisis, which matches 2/3’s of the $3.5 Trillion increase in the Federal Reserves balance sheet during the same period. Additionally, there are well north of $60 Trillion of Bond ETFs out there with anyone guess on how many fast money speculators are playing the “Rolling Down the Yield Curve” Strategy now up against the warning Morningstar so clearly disclaimed: “the roll down strategy will lose a lot of steam if the yield curve flattens more than expected.” With serious liquidity issues clearly evident it should be interesting as a potential positioning scramble ensues. It somewhat reminds me of someone potentially shouting “FIRE” in a theater, except this times the theater doors will be barred and the only way out will be to have someone outside take your seat inside! ETF holders may find it easier to sell that old bridge over the East River in Brooklyn than get their money out of their ETFs. Maybe what we will actually soon hear is someone shouting “CUSTODIAL RISK!”

|

|||

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday "Themes" Post & a Friday "Flows" Post | |||

I - POLITICAL |

|||

CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM

MACRO MAP - EVOLVING ERA OF CENTRAL PLANNING

|

G | THEME | |

| - - CRISIS OF TRUST - Era of Uncertainty | G | THEME | |

CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION - RESENTMENT. |

US | THEME PAGE |  |

Submitted by Tyler Durden on 01/06/2016

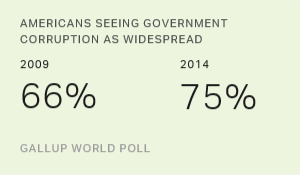

Gallup Explains Trump:"A Staggering 75% Of Americans Believe In Widespread Government Corruption"Back in July, when the HuffPo was covering Donald Trump's campaign in its "Entertainment Section" (they are not laughing now), and when not a single political pundit thought Trump had any chance of winning the GOP primary (now most of them do), we said that "Donald Trump's Soaring Popularity "Is The Country's Collective Middle Finger To Washington." Here is what we said:

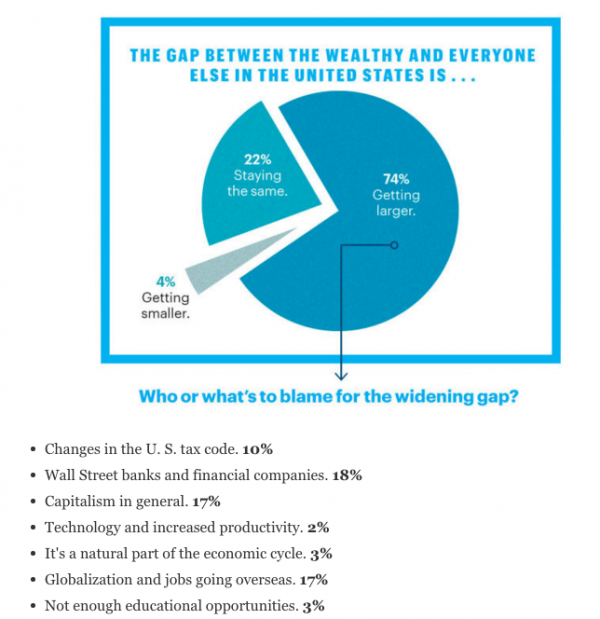

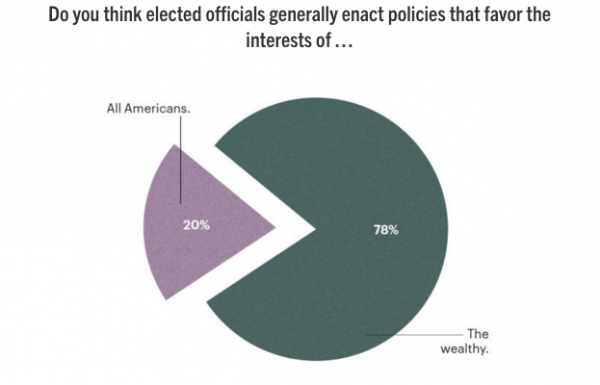

Six months later, virtually everyone recognizes and admits that this is the case: a vote for Trump is not "a vote for Trump", It is a vote against the broken, corrupt, crony-capitalist model. Which explains why increasingly more are terrified he just may win. But what explains America's revulsion with the existing system? The answer comes from the latest Gallup article: "Explaining Trump: Widespread Government Corruption" in which it finds that once the silent majority of the population can identify the object of their distrust and anger - in this case Congress and the political status quo - and once they can subsequently identify an object that represents its opposite, the latter object's distance to the Oval Office becomes considerably shorter. From Gallup: Explaining Trump: Widespread Government Corruption It's been fashionable to make jokes about Congress' historically low approval ratings, unbelievable incompetence in the government and now, unfortunately, the perception of widespread government corruption. Pundits and talk-radio hosts have a field day with this. So do late-night comics. It's not funny anymore.

This sense of corruption probably contributes to much of the extreme anxiety and unrest we see today - including protests, lower voter turnout and increased interest in guns. Guns -- a symbol of freedom from government tyranny to many people -- are now a key voting issue. A quarter of U.S. voters say the presidential candidate they vote for must share their view on guns. Protests are growing in cities and campuses all around the country. Students and citizens generally have lost faith in their national institutions -- the biggest and most powerful of which is, of course, the federal government. The last presidential election had

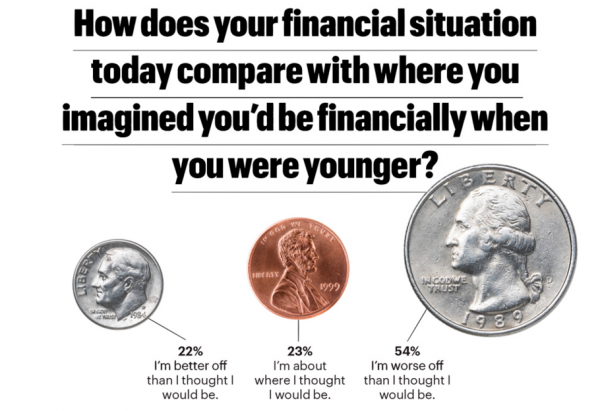

The perception that there's widespread corruption in the national government could be a symptom of citizen disengagement and anger. Or it could be a cause -- we don't know. But it's very possible this is a big, dark cloud that hangs over this country's progress. And it might be fueling the rise of an unlikely, non-traditional leading Republican candidate for the presidency, Donald Trump. To make matters worse, that dark cloud appears to be hanging over the growth of small business, which is where virtually all new GDP growth and good jobs originate. Simply put, startups and shootups (small businesses that grow larger) have been in a death spiral. The U.S. Census Bureau reported that the total number of business startups and business closures per year crossed for the first time in 2008. And the economy isn't growing nearly fast enough -- it's been running at an average rate of 2% since the 2008 financial collapse and the Great Recession. Just to compare, following the recession of 1981-1982, GDP grew for six years at 4.5% -- one of our greatest economic eras in history. Jobs haven't come back. According to the U.S. Bureau of Labor Statistics, the percentage of the total adult population that has a full-time job has been hovering around 48% since 2010 -- the lowest full-time employment level since 1983. This is why the middle class has been dangerously shrinking. You don't have to connect too many dots to conclude that if a government has an alarmingly high appearance of widespread corruption -- and that same government creates regulations that businesses cite as a leading barrier to growth -- then entrepreneurs might be reluctant to stick their necks out to start a business. Or to boom the businesses they already have. Why would they start or boom a business if they think a corrupt government is creating rules and regulations that don't serve their interests -- but rather rules that serve the interests of

Any wonder why so many Americans want a candidate who's outside of that system? |

|||

Submitted by George Washington on 01/06/2016 How Corrupt Is the American GovernmentGovernment corruption has become rampant:

The biggest companies own the D.C. politicians. Indeed, the head of the economics department at George Mason University has pointed out that it is unfair to call politicians “prostitutes”. They are in fact pimps … selling out the American people for a price. Government regulators have become so corrupted and “captured” by those they regulate that Americans know that the cop is on the take. Institutional corruption is killing people’s trust in our government and our institutions. Neither the Democratic or Republican parties represent the interests of the American people. Elections have become nothing but scripted beauty contests, with both parties ignoring the desires of their own bases. Indeed, America is no longer a democracy or republic … it’s officially an oligarchy. And the allowance of unlimited campaign spending allows the oligarchs to purchase politicians more directly than ever. No wonder polls show that the American people say that the system is so thoroughly corrupt that government corruption is now Americans’ number one fear. And politicians from both sides of the aisle say that corruption has destroyed America. And see this. Moreover, there are two systems of justice in America … one for the big banks and other fatcats … and one for everyone else. Indeed, Americans have less access to justice than Botswanans … and are more abused by police than Kazakhstanis. Big Corporations Are Also Thoroughly CorruptBut the private sector is no better … for example, the big banks have literally turned into criminal syndicates engaged in systemic fraud. Wall Street and giant corporations are literally manipulating every single market. And the big corporations are cutting corners to make an extra penny … wreaking havoc with their carelessness. For example:

(Further examples here, here, here, here and here.) We’ve Forgotten the Lessons of HistoryThe real problem is that we need to learn a little history:

Beyond Partisan PoliticsConservatives and liberals tend to blame our country’s problems on different factors … but they are all connected. The real problem is the malignant, symbiotic relationship between big corporations and big government. |

|||

Authored by Paul Craig Roberts, The Rule Of Law No Longer Exists In Western CivilizationMy work documenting how the law was lost began about a quarter of a century ago. A close friend and distinguished attorney, Dean Booth, first brought to my attention the erosion of the legal principles on which rests the rule of law in the United States. My columns on the subject got the attention of an educational institution that invited me to give a lecture on the subject. Subsequently, I was invited to give a lecture on “How The Law Was Lost” at the Benjamin Cardozo School of Law in New York City. The work coalesced into a book, The Tyranny Of Good Intentions, coauthored with my research associate, Lawrence M. Stratton, published in 2000, with an expanded edition published in 2008. We were able to demonstrate that Sir Thomas More’s warning about prosecutors and courts disregarding law in order to more easily convict undesirables and criminals has had the result of turning law away from being a shield of the people and making it into a weapon in the hands of government. That is what we witness in the saga of the Hammonds, long-time ranchers in the Harney Basin of Oregon. With the intervention of Ammon Bundy, another rancher who suffered illegal persecution by the Bureau of Land Management but stood them off with help from armed militia, and his supporters, the BLM’s decades long persecution of the innocent Hammonds might have come to a crisis before you read this. Bundy and militiamen, whose count varies from 15 to 150 in the presstitute media, have seized an Oregon office of the BLM as American liberty’s protest against the frame-up of the Hammonds on false charges. As I write the Oregon National Guard and FBI are on the way. The militiamen have said that they are prepared to die for principles, and the rule of law is one of them.Of course, the presstitute media is making the militiamen into the lawbreakers—and even calling them terrorists—and not the federal government’s illegal prosecution of the Hammonds, whose crime was their refusal to sell their ranch to the government to be included in the Masher National Wildlife Refuge. If there are only 15 militiamen, there is a good chance that they will all be killed, but if there are 150 armed militiamen prepared for a shootout, the outcome could be different. I cannot attest to the accuracy of this report of the situation (the resources required to verify the information in this account of how the government escalated a “crisis” out of the refusal of a family to bend is beyond the resources of this website) - However, the story fits perfectly with everything Lawrence Stratton and I learned over the years that we prepared our book on how the law was lost. This account of the persecution of the Hammonds is the way government behaves when government has broken free of the rule of law. I can attest with full confidence that the United States no longer has a rule of law. The USA is a lawless country. By that I do not mean what conservative Republicans mean, which is, if I understand them, that racial minorities violate law with something close to impunity. What I mean is that only the mega-banks and the One Percent have legal protection, and that is because these people control the government. For everyone else law is a weapon in the hands of the government to be used against the American people. The fact that the shield of law no longer exists for American citizens is why, according to US Department of Justice statistics, only 4 percent of federal felonies ever go to trial. Almost the entirety of federal felonies are settled by coerced plea bargains that force defendants to admit to crimes that they did not commit in order to avoid “expanded indictments” that, if presented to the typical stupid, trusting, gullible American “jury of their peers,” would lock them away for hundreds of years. American justice is a joke. It does not exist. You can see this in the American prison population. “Freedom and Democracy” America not only has the largest percentage of its population in prison than any country on the planet, but also the largest number of prisoners. If you consider that “authoritarian” China has four times the population of the United States but fewer prisoners, you understand that “authoritarian” China has a more protective rule of law than the United States. Compared to “freedom and democracy America,” Russia has hardly anyone in prison. Yet, Washington and its media whores have defined the President of Russia as “the new Hitler.” The only thing we can conclude from the facts is that the United States Government and those ignorant fools who worship it are evil incarnate. Out of evil comes dictatorship. The White House Fool, at best a two-bit punk, has decided that he doesn’t like the Second Amendment to the US Constitution any more than he likes any of the other constitutional protections of US citizens. He is looking for dictatorial methods, that is, unlegislated executive orders, to overturn the Second Amendment. He has the corrupt US Department of Justice, a criminal organization, looking for ways for the dictator to overturn both Congressional legislation and Supreme Court rulings. The media whores have fallen in line with the would-be dictator. All we hear is “gun violence.” If only Karl Marx were still with us. He would ridicule those who turn inanimate objects into purposeful actors. It is extraordinary that the American left-wing thinks that guns, not people, kill people. The position of the “progressive left-wing” in the United States is perplexing. Here are Americans, immersed into a police state, as are the Hammonds, and the progressive left-wing wants to disarm the population. Whatever this “progressive left-wing opposition” is, it has nothing in common with revolutionaries. The American left-wing is totally irrevelant, a defeated force that sold out and no longer represents the people or the truth. If protesting the murder of a young black American by Ferguson police is not legitimate and the protesters are “terrorists,” why aren’t the Oregon protestors terrorists for trying to protect jailbirds from their “lawful sentence”? This is the wrong question. It really is discouraging that the American black community is unable to understand that if any American can be dispossessed, all Americans can be dispossessed. It is also discouraging that RT decided to play the race card instead of comprehending that law is no longer a shield of the American people but is a weapon in the hands of Washington. Why doesn’t RT at least listen to the President of Russia, who states repeatedly that America and the West are lawless. Putin is correct. America and its vassals are lawless. No one is safe from the government. |

|||

|

|||

Submitted by Tyler Durden on 01/06/2016 "We The People Are Pissed"New Poll Finds Whites And Republicans Are Angriest Americans

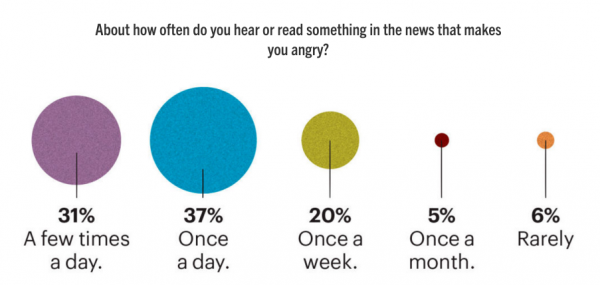

If Donald Trump’s poll numbers tell us anything, it’s that Americans are angry. Angry with what they perceive to be government ineptitude, angry with the economy, angry with US foreign policy, angry with just about everything. The palpable sense of rage has manifested itself in support for dark horse presidential candidates like Donald Trump and Bernie Sanders and is also apparent in “incidents” like that which occurred on Saturday when armed militiamen seized a remote government building in Oregon. Just how mad are Americans? Very, according to a new poll conducted by Esquire, SurveyMonkey, and NBC News. Here’s the preface from Esquire:

Below, find some of the highlights which include the fact that when it comes to being "pissed", no one is angrier than white people and Republicans. "Overall, 49 percent of Americans said they find themselves feeling angrier now about current events than they were one year ago," NBC writes. "Whites are the angriest, with 54 percent saying they have grown more outraged over the past year [while] sixty-one percent of Republicans say current events irk them more today than a year ago, compared to 42 percent of Democrats."

|

|||

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | G | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MA w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MA w/ CHS |

III-FINANCIAL |

|||

|

FLOWS - Liqudity, Credit & Debt

|

MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | 12-31-15 | THEME | |

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

|||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP

A staggering

A staggering