|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Tue. Oct. 20th, 2015

Follow Our Updates

onTWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

ARCHIVES

| OCTOBER | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | ||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | 31 |

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar Weakness |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?We have analyzed & included

these in our latest research papers Macro videos!

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

TODAY'S TIPPING POINTS

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

CREDIT CONTRACTION II |

10-20-15 | 16 - Credit Contraction II |

|

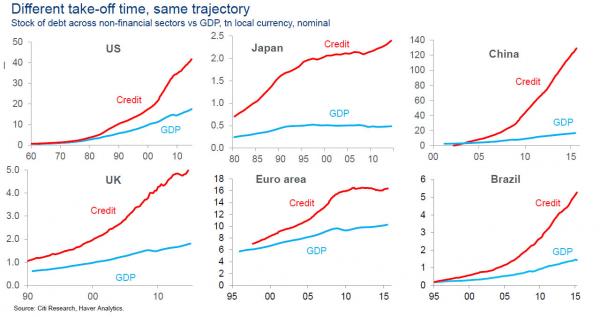

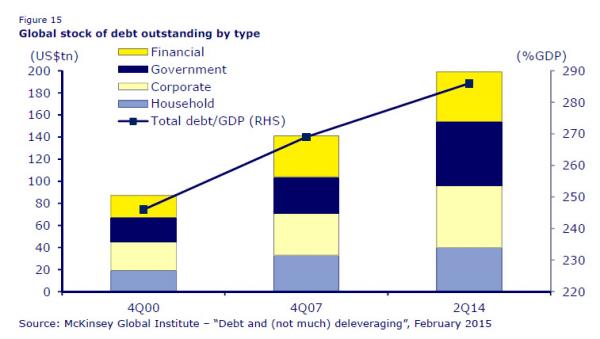

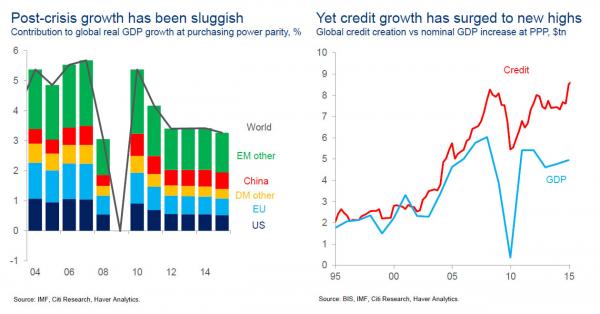

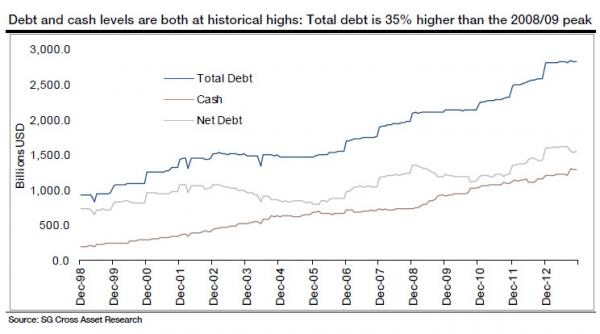

Source: Citi The core reason that velocity has continued to decline. The core reason is the excessive amount of debt in the system, an amount that has continued to grow since the financial crisis in 2008 as highlighted in a McKinsey report which attracted a lot of publicity when published earlier this year (see McKinsey Global Institute report “Debt and (not much) deleveraging”, February 2015). For the record, McKinsey estimated that aggregate global debt has grown by US$57tn from US$142tn in 2007 to US$199tn at the end of 2Q14, raising the ratio of global debt to GDP by 17 percentage points to 286% (see Figure 15). The only way to get velocity to pick up in a benign way is to write off the debt by a meaningful amount. That would have helped in the 2008 global financial crisis if more losses had been imposed on creditors. There then would have been a V-shaped rebound in velocity similar to what happened in the Asian Crisis....

|

|||

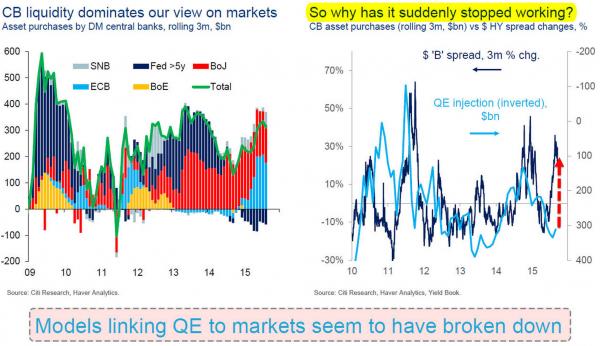

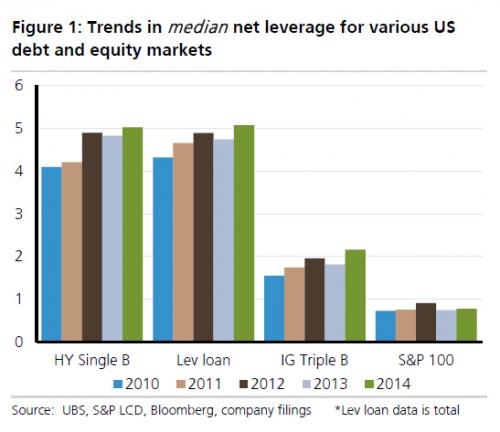

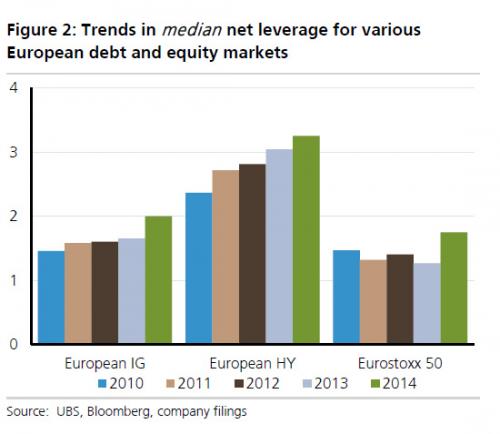

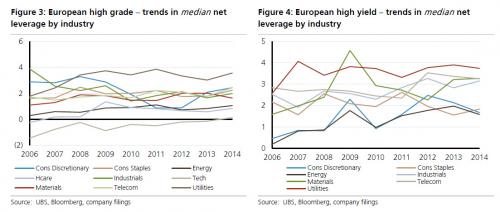

The World Hits Its Credit Limit, And The Debt Market Is Starting To Realize ThatOne month ago, when looking at the dramatic change in the market landscape when the first cracks in the central planning facade became evident and it appeared that central banks are in the process of rapidly losing credibility, and the faith of an entire generation of traders whose only trading strategy is to "BTFD", we presented a critical report by Citigroup's Matt King, who asked "has the world reached its credit limit" summarized the two biggest financial issues facing the world at this stage. The first is that even as central banks have continued pumping record amount of liquidity in the market, the market's response has been increasingly shaky (in no small part due to the surge in the dollar and the resulting Emerging Market debt crisis), and in the case of Junk bonds, a downright disaster. As King summarized it "models linking QE to markets seem to have broken down." Needless to say this was bad news for everyone hoping that just a little more QE is all that is needed to return to all time S&P500 highs. And while this concern has faded somewhat in the past few weeks as the most violent short squeeze in history has lifted the market almost back to record highs even as Q3 earnings season is turning out just as bad, if not worse, as most had predicted, nothing has fundamentally changed and the fears over EM reserve drawdown will shortly re-emerge, once the punditry reads between the latest Chinese money creation and capital outflow lines. The second, and far greater problem, facing the world is precisely what the Fed and its central bank peers have been fighting all along: too much global debt accumulating an ever faster pace, while global growth is stagnant and in fact declining. King's take: "there has been plenty of credit, just not much growth." Our take: we have - long ago - crossed the Rubicon where incremental debt results in incremental growth, and are currently in an unprecedented place where economic textbooks no longer work, and where incremental debt leads to a drop in global growth. Much more than ZIRP, NIRP, QE, or Helicopter money, this is the true singularity,because absent wholesale debt destruction - either through default or hyperinflation - the world is doomed to, first, a recession and then a depression the likes of which have never been seen. By buying assets and by keeping the VIX suppressed (for a phenomenal read on this topic we recommend Artemis Capital's "Volatility and the Allegory of the Prisoner’s Dilemma"), central banks are only delaying the inevitable. The bottom line is clear: at the macro level, the world is now tapped out, and there are virtually no pockets for credit creation left at the consolidated level, between household, corporate, financial and government debt. What about at the micro level, because while the world has clearly hit its debt-saturation point, corporations - at least the highly rated ones - seem to have no problems with accessing debt markets and raising capital, even if the biggest use of proceeds is stock buybacks, thereby creating a vicious, Munchausenesque close loop scheme, in which the rising stock prices courtesy of more debt, is giving debt investors the impression that the company is far healthier than it actually is precisely because it has more, not less, debt! The reality, as we first showed in January of 2014, is that for all the talk of "fortress" balance sheets, and record cash buffers, the debt build up among US corporations has more than surpassed the increase in cash. In fact, as of early 2014, total debt was 35% higher than its prior peak, as was net debt. Therefore, to us, the answer whether debt markets are once again approaching (or have crossed into) full capacity was clear; just look at what happened to IBM when, as we predicted, it bought back so much stock its investment grade rating was put in jeopardy and the company has seen its stock languish ever since unable to lever up any more just to repurchase its own stock. Others, of the "more serious people" variety, have finally caught up, and as UBS' Matt Mish asks in a note late last week, "Releveraging: are debt markets approaching full capacity?" His take:

It should be clear to most what this means, but since "most" haven't seen a rate hike in their Wall Street careers, here is UBS' summary "This is textbook later stages of the credit cycle." * * * Having seen the light, Mish asks why what is now so obvious to him, is so confusing to everyone else:

For those who missed our preview of all of this from April 2012 "How The Fed's Visible Hand Is Forcing Corporate Cash Mismanagement", here is UBS' far simpler summary which even 17-year-old hedge fund managers should get:

And that is the real countdown, because while the Fed may or may not have any credibility left, the only thing that matters is what is left of the once proud "bond vigilantes", virtually all of whom have been euthanized by the Fed's steamrolling of every last fundamental tenet of the market held dear by the bond trades and analysts of the world. According to UBS this, too, is now coming to an end, and even in IG the relentless issuance of one record debt deal after another, will soon hit a brick wall. That, coupled with the peak debt at the macro level described on top, will be the catalyst for the next phase in the evolution of centrally-planned capital "markets", whatever it may be. |

|||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Oct 18th, 2015 - Oct 24th, 2015 | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market | |||

| TECHNICALS & MARKET |

|

||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

FINANCIAL REPRESSION

LELAND MILLER Talks QUALITY OF CHINA'S ECONOMIC REPORTING FRA Co-Founder Gordon T. Long interviews Leland miller, the president of the china beige book international and discusses financial repression in the context of the Chinese economy. He describes himself as a Lifelong china watcher who decided to do something about the complete lack of data in china. “One of the things that the china beige book plans to do is to give people a real picture of not just the growth dynamics, but also the labor market, the credit dynamics, the macro implications of Chinese growth, indications of future Chinese demand, implications of commodity markets around the world, we try to give the people a much better picture on what’s actually happening instead of just relying on official data and press release”. FINANCIAL REPRESSION Leland describes the Chinese reform as a reversal of financial repression and this repression in the context of the Chinese economy is the oppression of consumers and households by state organizations through its economic systems. “It means reversing this long time economic model, where the state will profit through the economic system at the expense of the consumers and household, and one of the things that the new leadership is intent on doing in order to create consumption is to empower consumers, so they spend more and stop empowering state organizations which are fuelling the overcapacity and the massive debt bubble”. What should investor know about china? He explains the biggest misconception concerning the Chinese economy is believing the GDP tells you much about how china is doing. “It is a broad, blunt indicator that doesn’t measure productive growth or credit dynamics”. On some of the challenges of getting reliable data in china, Leland explains that he and his team had to ask Chinese firms and consumers on ground what is happening in the country, and set up a number of polling units across sectors in order to get reliable and accurate information. Economic trends in china “For years we have been talking about the Chinese slowdown; it’s inevitable, despite the fact that the economy has been slowing”. He goes on to explain that although the market sentiment has gone from optimism to “Armageddon” in recent months, the actual data is at odds with these sentiments. As a result of china’s economic slowdown, there is great vulnerability among emerging markets. Now, the reason for this is that for years these markets have relied on china’s demand without factoring the likelihood of a decline or certainty of a decline in china’s demand. On China’s view of America, Leland has this to say “The Chinese look at America as a model that they are interested in taking pieces from; they like the dynamism of the economy and the global status. On one hand, they see us as a model to learn a lot of things from but also as a serious threat that is looking to constrain their inevitable and ultimate rise”. Abstract written by chukwuma uwaga [email protected]

|

10-19-15 | ||

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

I - POLITICAL |

|||

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | THEME | ||

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MACRO w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

| STANDARD OF LIVING - SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

III-FINANCIAL |

|||

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP