|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Thurs. Oct. 15th, 2015

Follow Our Updates

onTWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

ARCHIVES

| OCTOBER | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | ||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | 31 |

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar Weakness |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?We have analyzed & included

these in our latest research papers Macro videos!

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

TODAY'S TIPPING POINTS

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

9 - CHRONIC UNEMPLOYMENT |

10-15-15 | US CATALYST

|

9 - Chronic Unemployment |

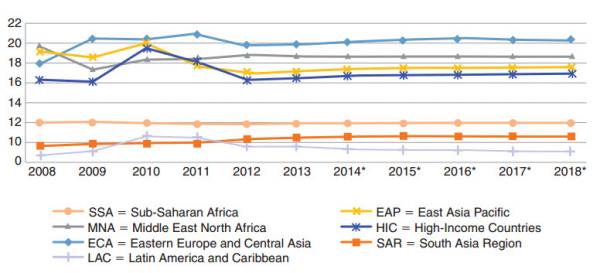

"A Generation In Crisis" - The World Needs 5 Million Jobs/Month To Stymie Youth ExtremismThe global economy will need to create 600 million jobs over the next 10 years: that’s 5 million jobs each month simply to keep employment rates constant. For over 3 years we have pointed out that the surging youth unemployment was Europe's (if not the world's) scariest chart, because the last thing Europe needs is a discontented, disenfranchised, and devoid of hope youth roving the streets with nothing to do, easily susceptible to extremist and xenophobic tendencies: after all, it must be "someone's" fault that there are no job opportunities for anyone. Well, as Bloomberg reports, The World Bank has an unsettling message for young people around the globe: unless we create 5 million jobs a month, the situation is going to get worse. As The World Bank notes, Unemployment in any form is a drag on an economy and society.

In other words, even with that 'growth' we are going nowhere!!

* * * Full World Bank Report below...

|

|||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Oct 11th, 2015 - Oct 17th, 2015 | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

US BANKING CRISIS II |

22 - US Banking Crisis II |

||

Bloomberg Briewf 10-12-15 Having bailed them out and then helped to repair their balance sheets with record-low interest rates and bond-buying, policy makers may assist the financial industry once more when the U.S. Federal Reserve begins tightening monetary policy. That’s according to two recently published reports by the Bank for International Settlements and McKinsey & Co., both of which have highlighted the downsides of ultra-easy borrowing costs in the past. Based on seven years of data from 109 large international banks in 14 countries, the BIS confirmed a relationship between short-term rates and the slope of the curve for bond yields with bank profitability. The conclusion drawn by Claudio Borio, the head of the monetary and economic department at the BIS, and colleagues is that the positive impact of being able to earn income by lending money out for higher rates over time is bigger than the hit of defaults and income that doesn’t carry interest. Even better news for the banks is that the effect is strongest when rates are lower and the yield curve isn’t that steep, as is now the case. That provides another reason for the BIS’s economists to again decry the unintended side-effects of accommodative monetary policy. They reckon that between 2011 and 2014, the average bank of those studied lost one year of profits as a result of low rates. “All this suggests that over time, unusually low interest rates and an unusually flat term structure erode bank profitability,” said Borio, Leonardo Gambacorta and Boris Hofmann in the report, which was published on Oct. 1. Return on equity at 500 global lenders was unchanged in 2014 at 9.5 percent, about the average of the last 35 years, according to the Sept. 30 study by McKinsey. Profit margins also continued a steady decline, dropping by 185 basis points in 2014, in part because of lower rates. It reckons tighter policy would boost return on equity by about 2 percentage points. “Many in the industry are waiting for an interest rate rise or some other structural lift to profits,” McKinsey said. There is a sting in the tale. It warned that even if rates do rise, profit margins may still not return to their pre-crisis highs. “Much of the benefit will get competed away, and risk-costs will likely increase, especially in economies where the recovery is still fragile,” McKinsey said. |

|||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market | |||

| TECHNICALS & MARKET |

|

||

| Market | |||

| TECHNICALS & MARKET | 10-14-15 |

STUDY | 1- Bond Bubble |

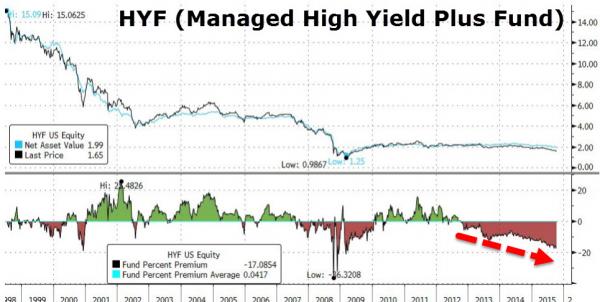

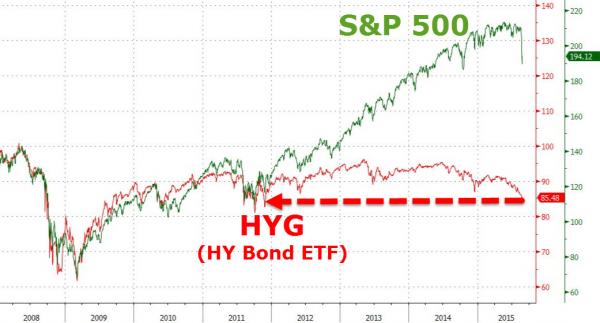

It Begins - Managed High Yield Bond Fund Liquidates After 17 YearsPosted:Wed, 14 Oct 2015 01:30:00 GMTSince inception in June 1998, UBS' Managed High Yield Plus Fund survived through the dot-com (and Telco) collapse and the post-Lehman credit carnage but, based on the press release today, has been felled by the current credit cycle's crash. After 3 years of trading at an increasingly large discount to NAV, and plunging to its worst levels since the peak of the financial crisis, the board of the Fund has approved a proposal to liquidate the Fund. While timing is unclear, this is the worst case for an increasingly fragile cash bond market as BWICs galore are set to hit with "liquidty thin to zero." Having survived 17 years... It's Over... (as The Fund Statement reads):

* * *

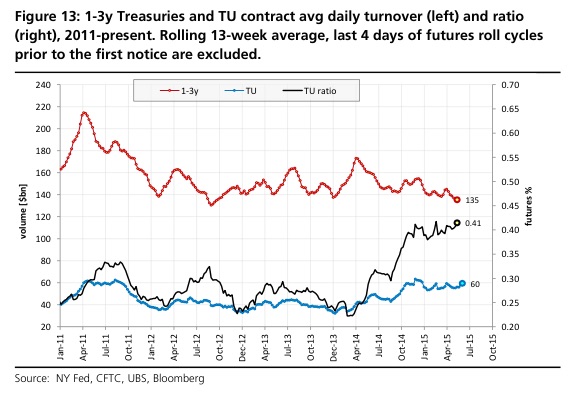

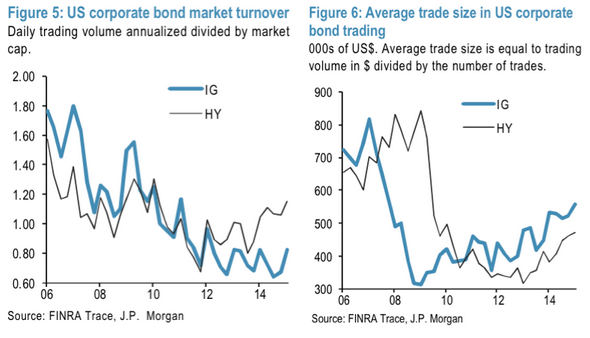

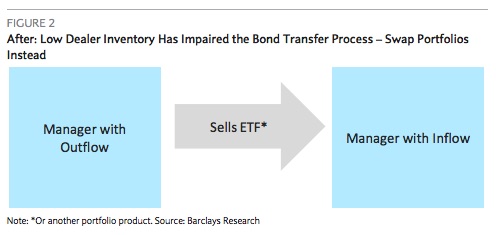

In Treasury markets, traders have turned to futures to mitigate illiquidty... ...while corporate bond fund managers utilize ETFs and other portfolio products to avoid trading the underlying assets... With the stage thus set, Bloomberg has more on the move to smaller trades and cash market substitutes:

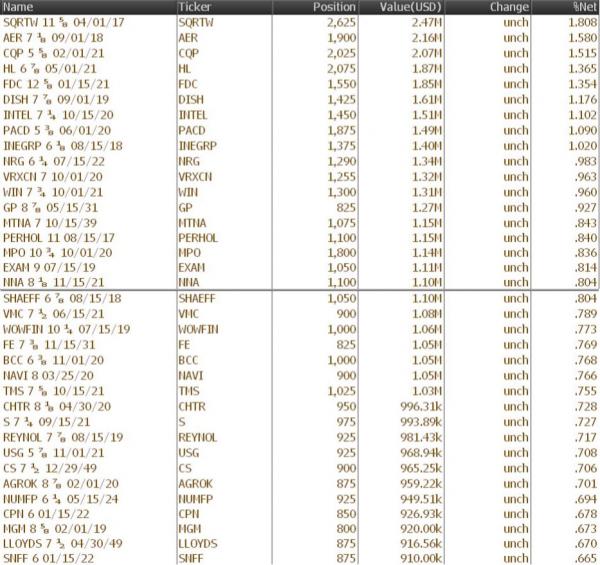

The conundrum here is that the more reluctant market participants are to venture into increasingly illiquid cash markets, the more illiquid those markets become. And here are the fund's largest holdings... * * * Of course, this should not be a total surprise, in light of the near-record up/downgrade ratio...

Deteriorating fundamentals... U.S. companies have increased borrowing to levels exceeding those just before the financial crisis, as firms pursue big acquisitions and seek to boost stock prices by buying back shares. According to one metric, the ratio of debt to earnings before interest, taxes, depreciation and amortization for companies that carry investment-grade ratings, meaning triple-B-minus or above, was 2.29 times in the second quarter. That’s higher than the 1.91 times in June 2007, just before the crisis, according to figures from Morgan Stanley.

* * * And as we noted earlier, the credit cycle has well and truly rolled over... And no lesser market veteran than Art Cashin is concerned, What are the signals you are looking for to stay on top in such a market? I continue to monitor the high yield market and see where that goes. The high yield market has been of some concern of the last several weeks. If that begins to show appreciable weakness than I would think the caution flags stay up. Charts: Bloomberg

|

|||

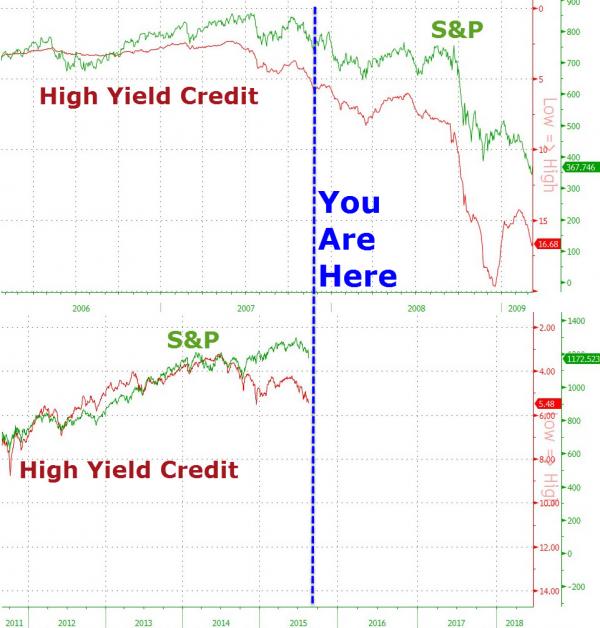

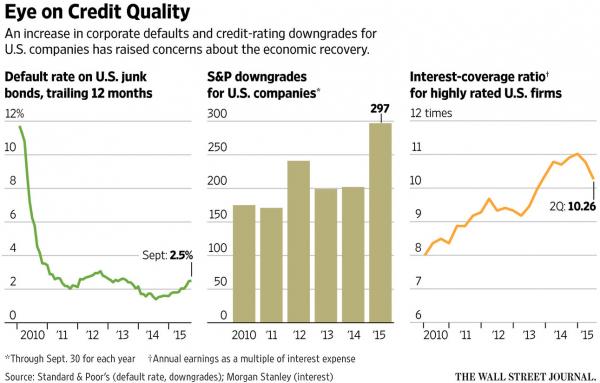

Bond Market Breaking Bad - Credit Downgrades Highest Since 2009Posted:Tue, 13 Oct 2015Despite The Fed's best efforts to crush the business cycle, the crucial credit-cycle has reared its ugly headas releveraging firms (gotta fund those buybacks) and deflationary pressures (liabilities fixed, assets tumble) have led to a surging market cost of capital. As WSJ reports, softening U.S. corporate fundamentals have been largely overlooked but the markets for riskier debt have become snarled with rising downgrades and an increase in U.S. corporate defaults indicate “some cracks on the surface” of the domestic-growth outlook. In fact, in the latest quarter, theratio of upgrades-to-downgrades is its weakest since the peak of the financial crisis in 2009.

U.S. companies have increased borrowing to levels exceeding those just before the financial crisis, as firms pursue big acquisitions and seek to boost stock prices by buying back shares. According to one metric, the ratio of debt to earnings before interest, taxes, depreciation and amortization for companies that carry investment-grade ratings, meaning triple-B-minus or above, was 2.29 times in the second quarter. That’s higher than the 1.91 times in June 2007, just before the crisis, according to figures from Morgan Stanley.

* * * You Are Here... |

|||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

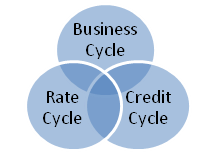

FINANCIAL REPRESSION JEFF DAVIS Talks FINANCIAL REPRESSION & THE EFFECTS ON THE US BANKING SECTOR FRA Co-Founder Gordon T. Long interviews Jeff Davis of Mercer Capital, and discusses financial repression and its effects on the banking sector. Davis is currently a Managing Director of Financial Institutions Group at Mercer Capital. Davis also provides financial advisory services primarily related to the valuation of privately-held equity and debt issued by financial services companies and advisory related to capital structures and M&A. FINANCIAL REPRESSION’S EFFECT ON THE US BANKING SECTOR “Financial repression is a price control that relates to all facets of the economy and has profound impact.” The 3 major cycles: Business Cycle, Credit Cycle and Rate Cycle.

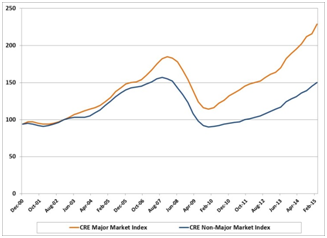

“The banks straddle all 3 to be a key contributor of capital in the US economy. Financial repression impacts at a very base level for all 3 cycles.” “Financial repression has artificially pumped up asset value. “Commercial real estate values really pivoted in 2010. There is additional risk in the system now that asset values are pumped up” Commercial Real Estate Values

Leverage Ratio “If you look at the leverage ratio we can see that over the last 20 years the industry has been raising capital. I don’t think that’s a bad thing. We are significantly much better capitalized than Europe which is a good thing, but as it relates to an investor there is a lower return on equity.” “Regarding financial repression, if you think about interest rates today, it is very painful for an institution to hold cash. There is significant risk taking occurring amongst commercial banks in taking additional credit risk and duration risk. Structurally banks aren’t as spread in terms of their assets relative to their borrowings that fund these assets.” “Companies don’t go broke because they don’t make money. Companies go broke when they have no liquidity, so what financial repression has done is push liquidity into the system. So now heavily indebted companies are able to borrow money and we will soon see the consequences of that.” HOW BANKS FUNCTION “The banks are special for being separated from commerce.” SHADOW BANKING “Over the last several decades the shadow banking system has developed into an alternative lender as well as another place for people to put their money.” The term “shadow bank” was coined by economist Paul McCulley in a 2007 speech at the annual financial symposium hosted by the Kansas City Federal Reserve Bank in Jackson Hole, Wyoming. In McCulley’s talk, shadow banking referred mainly to nonbank financial institutions that engaged in what economists call maturity transformation. Commercial banks engage in maturity transformation when they use deposits, which are normally short term, to fund loans that are longer term. Shadow banks do something similar. “Shadow banking system is separate from commercial banking system, but is a very large piece of the credit allocator. A lot of risk has been pushed out of commercial banks and is now in the shadow banking system, where it is not as opaque as a commercial bank.” CONCERNS WITH SUSTAINED LOW INTEREST RATES One day there will be a reckoning. It’s simply a buildup of risk; an attempt by central authorities to guide the economy. Malinvestment: A mistaken investment in wrong lines of production, which inevitably lead to wasted capital and economic losses, subsequently requiring the reallocation of resources to more productive uses. “A delay of lost recognition and mass malinvestment which is all a credit risk within the banking systems. However, my biggest concern is a dramatic slowdown in the economy, short rates at zero.”

|

10-12-15 | THESIS | |

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

I - POLITICAL |

|||

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | THEME | ||

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MACRO w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

| STANDARD OF LIVING - SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

III-FINANCIAL |

|||

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP