|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

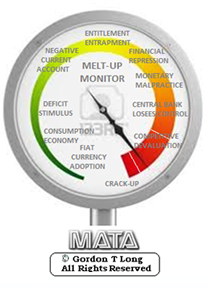

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Tues. June 30th, 2015

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

![]()

| JUNE | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | 6 | |

| 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| 14 | 15 | 16 | 17 | 18 | 19 | 20 |

| 21 | 22 | 23 | 24 | 25 | 26 | 27 |

| 28 | 29 | 30 | ||||

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar Weakness |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

TODAY'S TIPPING POINTS

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

GEO-POLITICAL EVENT RISK - Greece, Puerto Rico, China and France Greece Will Default To IMF Tomorrow, Government Official SaysTyler Durden on 06/29/2015Earlier today, as the exchange between Greece and its creditors got increasingly belligerent, Estonian Prime Minister Taavi said that "Greece’s debt would still remain outstanding and creditors would expect this money back." So did this latest antagonism change the Greek mind? According to a flash headline by the WSJ released moments ago, not all. In fact, Greece just made it official that it would default to the IMF in just over 24 hours: "Greece won't pay IMF tranche due Tuesday, government official says" Puerto Rico Announces Bond Payment "Moratorium" Tyler Durden on 06/29/2015 Tyler Durden on 06/29/2015

Having concluded last night that Puerto Rico debt is "unpayable," and that his government could not continue to borrow money to address budget deficits while asking its residents, already struggling with high rates of poverty and crime, to shoulder most of the burden through tax increases and pension cuts, Padilla confirmed tonight that: PUERTO RICO TO SEEK "NEGOTIATED MORATORIUM", 'YEARS' OF POSTPONEMENT IN DEBT PAYMENTS. Likening his state's situation to that of Detroit and New York City (though not Greece), Padilla concluded, the economic situation is "extremely difficult," which is odd because just a few years ago when they issued that bond - everything was awesome? Strap In! China Is Crashing Again Tyler Durden on 06/29/2015 Tyler Durden on 06/29/2015

In the last 2 days, PBOC has thrown everything at the ponzi-fest they call a rational market. An RRR cut, a Benchmark rate cut, a rev repo rate cut, a CNY50 Bn rev repo injection, a stamp duty cut, IPO halts (cut supply), and last but not least permission to speculate with a reassurance that shares on a solid foundation. The outcome of all this policy-panic - CHINEXT (China's Nasdaq) is down another 6% today (down 25% in 3 days) and aside from CSI-300 futures, all other major Chinese indices are in free-fall. Add to that the fact that industrial metals are collapsing with steel rebar limit down and it appears Central Bank Omnipotence is under threat. French Economy In "Dire Straits", "Worse Than Anyone Can Imagine", Leaked NSA Cable Reveals Tyler Durden on 06/29/2015 Tyler Durden on 06/29/2015

Moscovici who served as French finance minister until 2014 and then became European commissioner for Economic and Financial Affairs, Taxation and Customs, used some very colorful language, i.e., the French economic situation was "worse than anyone [could] imagine and drastic measures [would] have to be taken in the next two years”. |

06-30-15 | GLOBAL RISK | 3 - Geo-Political Event |

| THEMES | |||

The Euro Crisis - Posted by Cliff Küle at 6/30/2015 05:58:00 AM

Alasdair Macleod sees the criticality of the Greek crisis as being central to the solvency of the European Central Bank (ECB) itself & therefore confidence in the euro currency .. "The ECB's balance sheet, which is heavily dependent on Eurozone bond prices not collapsing, is itself extremely vulnerable to the knock-on effects from Greece. As the situation at the ECB becomes clear to financial markets, the euro's legitimacy as a currency may be questioned, given it is no more than an artificial construct in circulation for only thirteen years. In conclusion, the upsetting of the Greek applecart risks destabilizing the euro itself, and a sub-par rate to the U.S. dollar beckons." |

|||

Europeans Rush to Gold Coins as Bank of Greece Stops Sales - Posted by Cliff Küle at 6/30/2015 05:56:00 AM

Bloomberg reports that European investors are increasing their purchases of gold as Greece's crisis intensifies .. "Investors are searching for a safe haven after Greece imposed capital controls, closed banks and stopped selling gold coins to the public until at least July 6." |

|||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - June 28th, 2015 - July 4th, 2015 | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market | |||

| TECHNICALS & MARKET |

|

||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

I - POLITICAL |

|||

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | THEME | ||

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MACRO w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

III-FINANCIAL |

|||

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | |

FINANCIAL REPRESSION Is Financial Repression Here to Stay?

The First Chairman of the UK's Financial Services Authority Howard Davies writes an essay on financial repression .. "Maybe it is unreasonable for investors to expect positive rates on safe assets in the future. Perhaps we should expect to pay central banks and governments to keep our money safe, with positive returns offered only in return for some element of risk." .. Davies worries about the consequences of financial repression on the economy .. he sees distortions from the prudential regulation adopted in reaction to the financial crisis - "The question for regulators is whether, in responding to the financial crisis, they have created perverse incentives that are working against a recovery in long-term private-sector investment."

BCA Research Chief Economist Martin Barnes: "Financial Repression is Here to Stay" BCA Research's Chief Economist Martin Barnes sees financial repression as "here to stay" for the long-term, given the challenges of low economic growth & high debt globally .. Barnes has written a special report to explain why debt burdens are moe likely to rise than fall over the short & long run given demogaphic trends & the low odds of another economic boom .. BCA Research: "If governments cannot easily bring debt ratios down to more sustainable levels, then the obvious solution is to make high debt levels easier to live with. This can be done be keeping real borrowing costs down and by regulatory pressures that encourage financial institutions to hold more government securities. In other words, financial repression is the inevitable result of a world of low growth and stubbornly high debt. Martin argues that central banks are not overt supporters of financial repression, but they certainly are enablers because they have no other options other than to keep rates depressed if they cannot meet their growth and/or inflation targets. A world of financial repression is an uncomfortable world for investors as it implies continued distortions in asset prices, and it is bound to breed excesses that ultimately will threaten financial stability." LINK HERE to the Article & Link to Report

The Era of Financial Repression: Norway's Sovereign Wealth Fund says Monetary Policy is a Risk to Watch

“Monetary policy does affect pricing in today’s market to such an extent that monetary policy itself has been a risk you have to watch .. Investors are focused more on monetary policy changes than has been generally the case, than at any time, as far as I can remember .. As anything that moves prices is a risk that has to be monitored, here the effects of monetary policy affect prices dramatically .. It’s of course always been the case with long rates, and now more significantly with the currency. That’s just a fact of the current market." - Yngve Slyngstad, chief executive officer of Norway’s $890 billion sovereign-wealth fund "Financial repression is not a conspiracy theory, it is rather a collective set of macroprudential policies focused on controlling and reducing excessive government debt through 4 pillars - negative interest rates, inflation, ring-fencing regulations and obfuscation - to effectively transfer purchasing power from private savings." - The Financial Repression Authority

|

06-29-15 | ||

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP