|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Tue. June 2nd, 2015

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

![]()

| MAY | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | |||||

| 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 10 | 11 | 12 | 13 | 14 | 15 | 16 |

| 17 | 18 | 19 | 20 | 21 | 22 | 23 |

| 24 | 25 | 26 | 27 | 28 | 29 | 30 |

| 31 | 1 | 2 | 3 | 4 | 5 | 6 |

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar Weakness |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

TODAY'S TIPPING POINTS

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

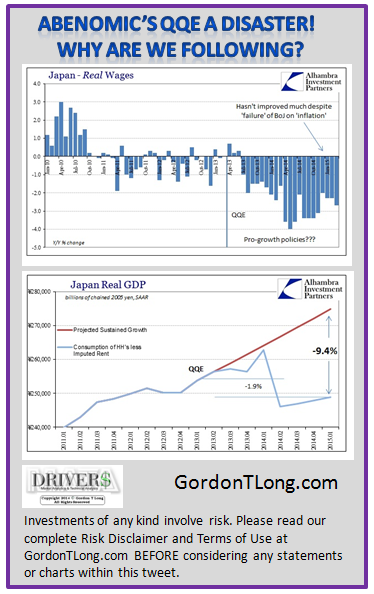

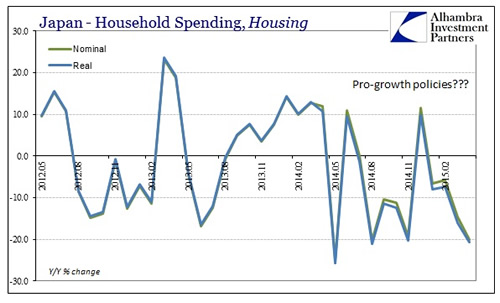

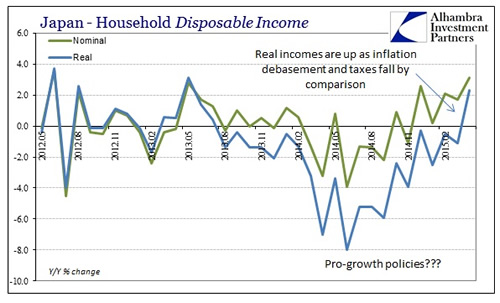

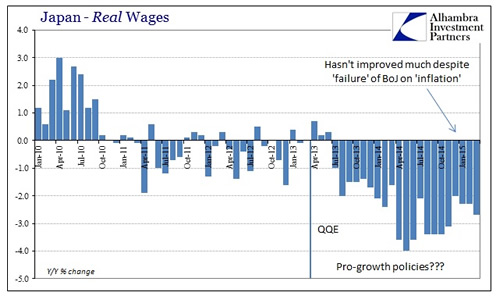

JAPAN - Abenomic's QQE Phiosophically Unsound

From Money To Psychology, Japan Reveals The Basis Of Economic Policy Corruption 06-01-15 Submitted by Jeffrey Snider via Alhambra Investment Partners, At some point in the middle of the last century, economics of money shifted to economics of psychology. When Milton Friedman wrote his 1963 book, A Monetary History, it was an effort that uncovered the role of money in the collapse of the Great Depression as he and his co-author, Anna Schwartz, saw it. Whether or not it was a full explanation, it wasn’t, it became widely adopted as the model for central bank behavior. At its heart, however, it was a treatise about the role of currency and liquidity. It was still largely faithful to the Bagehot paradigm of central banks as agents of elasticity, with some modification about the terms at which that would be available. It is, however, nothing like what central banks around the world do today, even though outwardly there is a rough resemblance. Almost as soon as A Monetary History was published there was a shift underway in more general economic theory about taking what was believed the next step – from monetary management to economic management. The impulse in that direction was not new, but the academy about its possibilities was. In 1958, AW Phillips in the UK put together an empirical analysis of a seeming durable correlation between inflation and employment. That was expanded in 1960 by Paul Samuelson and Robert Solow in the United States that posited the Phillips Curve, as it came to be known, as the means to exploit economic factors to introduce greater management and command. Samuelson, in particular, was immediately welcomed into the Kennedy and then Johnson administrations as an advisor on the subject of that “exploitable Phillips Curve.” What we got out of it was the Great Inflation, a 15-year period of nearly unrelenting disaster that wasn’t just limited to economic malaise, it destroyed the last vestiges of the dollar and introduced the world to credit-based money in the eurodollar standard – the “dollar.” Coming to terms with the Great Inflation was perfectly reasonable with a reasonable outlook free of determined bias for absolute control and command. Milton Friedman himself played a central role in discrediting the Phillips Curve, but that still left monetary theory short of the ancient Platonic ideal of the central banker as Philosopher King, if only in a limited capacity for creating and nurturing the “optimal” economic results. Despite the Great Inflation, economists did not turn away from trying to attain utopian command ideas, they only set about finding the “right” ones. Robert Lucas was heavily invested in exactly that, as the allure of “general equilibrium” was so tantalizing to potential economic theory. It meant, as we know all too well now, that, if correct, there was some range of regression equations that could be assembled and constituted such that perfect predictability was possible. That is the idea of general equilibrium in the first place, to be able to model the utterly complex and heretofore mystifying nature of the true economy.

The generation of economists that undertook Lucas’ rational expectations assumptions saw its promise limited to the mathematical world of econometrics. The generation thereafter, including Ben Bernanke, sought to exploit it not unlike Samuelson and Solow’s attempt with Phillip’s scholarship. Rational expectations become the centerpoint of economic theory, and it has led the “discipline” in very strange directions.

Because of this one mathematical property designed only to “save” general equilibrium largely from its own very real limitations, rational expectations has been taken as a real phenomenon to be abused in monetary policy, and thus economic command. If prices are always rational, then the influence of prices will be the same. Monetary policy left money behind and become strictly a tool for influencing behavior – from money and currency to nothing but psychology and the equivalent of happy pills (placebos at that). We see the results of this shift all around us, especially where economists and “experts” are always so upbeat no matter how ludicrous and isolated such an attitude may be. And then there are the asset prices, going higher and higher to “stimulate” some “wealth effect” of not actual income but, again, happiness over not the direction of the true economy but of what its makers want of your perceptions of it all. It is taken as self-revealing now that even recessions are not much more than “irrational pessimism.” The lack of recovery everywhere QE is being tried is not actually surprising to anyone but those still believing that rational expectations is anything but a mathematical shortcut. That is true in the US but most especially Japan, where even the mighty QQE has failed to live up to its “unquestionable” power and has thus become to engender very dangerous doubts – unhappy feelings that are the dread of all central bankers under the rational expectations paradigm:

Reading that economist’s summary would lead you to think that it really is nothing but psychology at work. It is, after all, fully consistent with the stated purpose of QQE to begin with.

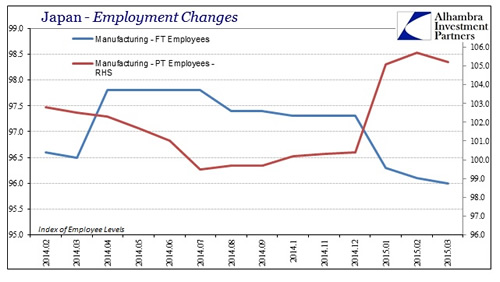

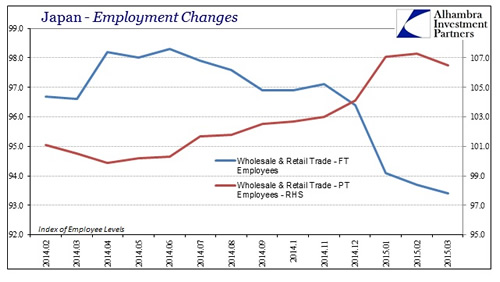

If you think that Japan, or the US for that matter, is suffering from an insufficiency of happiness, a quarter-century funk of nothing but a “deflationary mindset”, then QQE seems a consistent course (never mind the nine prior attempts). If, however, you look at Japan as suffering just madness emanating from monetary policy that is the equivalent of pop psychology, the malaise starts to make perfect sense. The Japanese must be the happiest recipients of impoverishment ever conceived, and the results show. The greatest trick about rational expectations is that it seems so plausible because confidence is a good part of the real economy, but hollow appeals to unrelated factors are not in any way the same as “animal spirits.” Last month was a difficult comparison because of the April 2014 tax change which pulled forward spending activity into March 2014, and thus the base of the year-over-year comparison was off. So it was expected that household spending would rise in April, with average expectations for +2.8%. Instead, spending declined yet once more, as economists missed their prediction by an enormous 4.1%. The problem with being reliant on illusions is that you can’t spend them; the Japanese, for all the ultra-low unemployment rate jubilee, have very little actual income. Even more recently, real DPI has ticked up but more as a matter of lower CPI and tax comparisons. Instead, in what matters most, real wages have shown absolutely no tendency toward everything that was expected. When starting QQE more than two years ago, it was fully intended that by now real wages would not just be rising but rising steadily and robustly. Japanese workers have suffered the opposite. The reason for that is the very way in which the unemployment rate is misleadingly “happy”, connecting wages to what really looks like a still-gathering recession. In the past few months, when this post-tax recovery was supposed to materialize, Japanese businesses have been degrading their labor force, shifting a huge proportion at the margins out of full-time and into part-time. The Japanese still don’t do mass layoffs, instead they just cut hours strenuously while maintaining the “happy” unemployment rate. I find it very revealing that this remaking of marginal labor utilization is largest in the wholesale and retail trade segments, further confirming the decimation of internal Japanese economics (in the truest sense, not the mathematical theories that dominate). The Japanese people are clearing buying less “stuff” meaning that those who sell stuff are requiring much less of workers in 2015. That is how recessions are made, in that they become self-feeding trends of reduced “demand” and then reduced labor utilization leading to further cuts in income and then demand again. The problem for econometrics and rational expectations is that any scientific endeavor, and economics very much fancies itself as that, is governed by observation rather than academic stylings even of the most elegant and sophisticated math. Clear observation, now two full years into the emotional bastardization, rejects all conclusions and intentions of the orthodox theories right down to their base foundation. Yet, as noted by the quoted economist above, it will never be falsified by anything other than counter-emotion; rational expectations is so irrational in its persistence because it is no longer even a scientific-like pursuit but a full-blown ideology of religious fervor. No matter how back Japan gets, orthodox economists still say that recovery is later in the year, or next year, or just around some unspecified corner. And it never is; maybe not all prices, especially those highly managed and cajoled, are market-clearing? The Japanese economy, to any clear mind, took a huge turn for the worst under Abenomics yet its practitioners are still, somehow, given the final word on judging its performance, meaning that the mainstream still, somehow, subscribes to the religion.

By all scientific observation, there was nothing unexpected about the “gloom” in April. |

06-02-15 | JAPAN | |

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - May 31st, 2015 - June 6th, 2015 | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market | |||

| TECHNICALS & MARKET |

|

||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

FINANCIAL REPRESSION - Coming Capital Controls PROTECTING BANKS FROM THE PEOPLE The Coming Capital Controls Are Designed To Protect The Banks From You 05-26-15 Submitted by Simon Black via Sovereign Man blog, Of all the peculiarities about human nature, one of the most interesting in my opinion is that we’re so resistant to change. Humans simply don’t deal with it well. We tend to root. We find comfort in familiarity. And, even when the familiar becomes unpleasant, we still put up with it. We prefer to suffer through something that we know rather than change things and risk the unknown. This is why people stay in bad relationships. Or why they continue working for bosses they dislike at jobs they despise. It’s the fear of change. But everyone… absolutely everyone… has a breaking point. It’s a point where the status quo becomes so uncomfortable, so painful, that we snap. And walk away. It’s the same in finance. People stick with what they know, even if they have to endure a little pain and suffering. Today’s current banking environment is the perfect example. In the US, interest rates for most bank accounts are so low that they fail to keep up with inflation. You are doing very well if you can generate a whopping 0.5% interest. In Canada rates can be a bit higher. But when you compare these rates to even the official rates of inflation, it’s clear that savers are guaranteed to lose money. In Europe it’s even worse. Interest rates at many banks are negative… so savers are actually paying the banks. In theory there’s nothing wrong with paying your banker, presuming that they’re providing a real service. Traditionally, banks were no different than a secure storage facility: depositors would pay a fee in exchange for the bank safeguarding their savings. These days a lot of people might pay 50 bucks a month at a U-Store-It place to store $10,000 worth of junk. So why not pay a small fee for a banker to store $10,000 worth of cash? The reason is that banks don’t operate like a storage facility. It’s not like the proprietor of the U-Store-It is loaning out your sofa to make a few bucks on the side. If he were, it would be called fraud, and he’d go to jail for it. Banks, on the other hand, are actually ENCOURAGED to take your hard earned savings and make a few extra bucks on the side. In fact they have a history of making often absurd loans and wild, overleveraged bets using your money. Not theirs. So just consider how insulting this is to actually to pay them interest; paying for the privilege of them gambling with your savings. It’s obscene. But like I said, we all have a breaking point. And there will reach a level where rates get so low (or negative) that no rational person would continue holding money at a bank. Why bother? You could just withdraw most of your balance, then pay a small fee for a safety deposit box that you stuff full of cash. Cheaper. Easier. Better. Cash in your hand might pay 0% interest… but at least it doesn’t cost you. But there’s a huge problem with this approach: there’s very little physical cash in the system. According to the Federal Reserve, the amount of physical US currency in circulation is about $1.3 trillion. Yet the amount of “M2” money supply is nearly ten times that amount. So just imagine if even 10% of people hit their breaking points and withdrew their money in cash– there wouldn’t be enough cash in the system to support this demand. And the banks would subsequently collapse. If governments have proven anything to us over the last seven years, it is that they will do anything to keep the banks from going down. This is a major reason why they’re trying to get rid of cash, and in some cases even criminalize it under the ridiculous auspices of the war on terror. In the US, some of the more prevalent names in finance have started calling for an outright ban of cash, including a prominent economist from Citigroup. (This is a rather convenient position for Citigroup.) Greece is another great example– they’ve already implemented a tax on cash withdrawals and wire transfers. And further restrictions will inevitably follow. These measures are all different forms of capital controls, designed to prevent you from taking your money away from such a destructive system. In fact, I expect the next round of capital controls will be designed to protect the banks… from you. When a government is bankrupt, the central bank is nearly insolvent, the banking system is illiquid, and an entire population suffers from interest rates that are either negative or below the rate of inflation, capital controls are a foregone conclusion. They’ll hit just as soon as enough people reach their breaking points… when they say ‘enough is enough’ and they take their money out of the banking system. Governments have done it before: they’ll declare a ‘bank holiday’ and then impose some sort of freeze on withdrawals. Just like we saw in Cyprus in 2013. Or the US in 1933. The data and history are very clear on what will likely happen. We just can’t pinpoint the date. Very few people will guess correctly and withdraw their cash the day before capital controls are imposed. That’s why it makes sense to take certain steps now.

|

06-01-15 | THEMES | |

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

I - POLITICAL |

|||

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | THEME | ||

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MACRO w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

III-FINANCIAL |

|||

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP