|

pdf Download

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

|

|

Theme Groupings |

|

We post throughout the day as we do our Investment Research for:

LONGWave - UnderTheLens - Macro

Scroll TWEETS for LATEST Analysis Scroll TWEETS for LATEST Analysis

|

"BEST OF THE WEEK "

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

|

|

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - May 10th, 2015 - May. 16th, 2015 |

|

|

|

| BOND BUBBLE |

|

|

1 |

BOND BUBBLE - $5T Worth of Government Debt Trading with Negative Yields

Over HALF of ALL Government bonds in the world yield less than 1%.

Over $5 trillion in government debt has negative yields:

The ECB is Attempting to Corner the Bond Market… Buckle Up 05-11-15 Graham Summers, Phoenix Capital

In 2012, during the depth of the EU banking crisis which nearly took the entire EU financial system down, Mario Draghi stated that he would do “whatever it takes” to hold the EU together.

Anyone paying attention knew that this was a bluff. True, the ECB and EU leaders had already defied if not broken every condition of the Maastricht Treaty and the Schengen Treaty (the legislation that formed the EU proper). However, even to the most cynical analyst, Mario Draghi’s claim was pushing the envelope a little too hard.

Implementing capital controls and border controls limit freedom, but from the perspective of monetary policy, they’re secondary items. The REAL power is that of the printing press.

This is how Draghi’s promise to save the EU was different from every other action: it addressed the structure of the EU in its most critical component, namely the control of the currency.

It took the EU two years to cobble together its reasoning for how something that went completely against the Maastricht Treaty would be permitted. As usual it was the Germans (the ultimate holders of the purse strings) who gave the “OK.”

Now given the green light, Draghi has embarked upon a €60 billion a month QE program. Somehow this is meant to:

1) Reboot a €46 TRILLION banking system that is totally insolvent.

2) Generate lower interest rates when most EU-member sovereign bonds are at multi-century lows.

3) Bring the EU economy back to growth.

The whole idea is absurd. But it does reveal one important thing: that we are much closer to the end of the Central Bank-fueled $100 trillion bond bubble than ever before.

BOND MARKET HAS TRIPLED IN SIZE IN 14 YEARS

The bond market has tripled in size in the last 14 years. This has been fueled by the issuance of debt at an astounding pace as Governments attempted to paper over the massive decline in living standards plaguing the West.

Today, the bond bubble is over $100 trillion in size. When you include derivatives based on interest rates (bonds) it’s over $555 trillion.

To put this into perspective, the CDS market which nearly took down the financial system in 2008 was a mere $50-$60 trillion in size. So the bond bubble is literally 10X this in size and scope.

The derivatives story is key here, because all of those $555 trillion in trades are backstopped by sovereign bonds (Japanese bonds, German Bunds, US Treasuries, etc.). These are the very bonds that Central Banks have been BUYING over the last five years (thereby shrinking the amount available to the banks to backstop those trades).

Put another way, the amount of high quality collateral backstopping this mess has shrunken dramatically. On top of this, traders have been piling into sovereign bonds in anticipation of various QE programs, forcing yields to multi-decade if not multi-century lows.

Currently over HALF of ALL Government bonds in the world yield less than 1%. Over $5 trillion in government debt has negative yields:

This is not only unsustainable… it is a clear sign of a bubble. A bubble that when it bursts when involve over $555 trillion worth of trades imploding. |

05-12-15 |

STUDY |

1- Bond Bubble |

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates |

|

|

2 |

| GEO-POLITICAL EVENT |

|

|

3 |

| CHINA BUBBLE |

|

|

4 |

| JAPAN - DEBT DEFLATION |

|

|

5 |

EU BANKING CRISIS |

|

|

6 |

| TO TOP |

| MACRO News Items of Importance - This Week |

GLOBAL MACRO REPORTS & ANALYSIS |

|

|

|

US ECONOMIC REPORTS & ANALYSIS |

|

|

|

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES |

|

|

|

|

|

|

|

| Market |

| TECHNICALS & MARKET |

|

|

|

AN EARNIGS RECESSION - No Pricing Power Due to an Excess Debt Payments Drain

The Debt, ZIRP, and Valuation Comstock

As we write the US stock market, as measured by the S&P 500 and Nasdaq Composite Index, hovers at or near new highs. We will take this as an opportunity to reiterate that this is a bubble that is the direct creation of the Federal Reserve. We continue to refer to this phenomenon as the “Central Bank Bubble”.

EARNINGS RECESSION

Just under one year ago, analysts were estimating S&P 500 operating earnings to increase for the first quarter of 2015 by over 10%. That number is now substantially lower and has gone negative for the entire index.

- According to “FactSet Earnings Insight”, both Q1 and Q2 2015 earnings are now expected to be lower.

- Through May 1, the blended result of companies that have reported and have yet to report for Q1 2015 stood at -.4%.

- Analysts are in fact expecting year over year declines through Q3 2015 but are then expecting a strong rebound in Q4 2015.

We agree with the former and strongly disagree with the latter. But whether attributed to weather, the west coast port strike, or dollar strength, the fact remains that for whatever the reason, two declining quarters constitutes an “earnings recession”.

We have had 13 “earnings recessions” since 1945, and all but three of those have led to an economic recession. We continue to believe corporate earnings will not grow as a whole at a meaningfully different rate than US Gross Domestic Product (GDP), as corporate earnings are a proxy for economic growth.

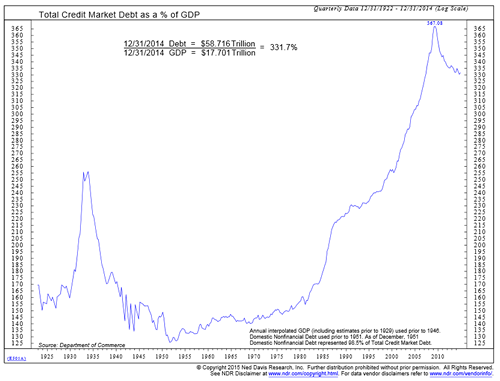

Growth in the economy, in turn, is heavily influenced by “Total Credit Market Debt”, which is the sum of government, corporate and household debt.

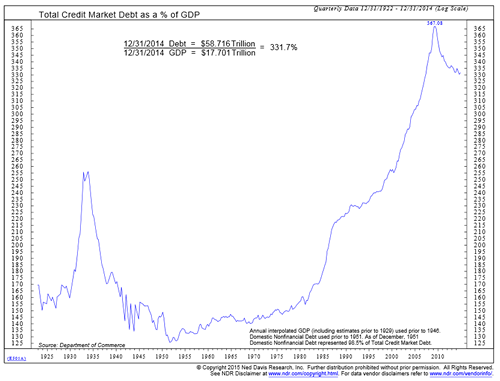

Only at the time of the great depression of the 1930’s has “Total Credit Market Debt” been greater than 200% of GDP in the United States (see attached chart from Ned Davis Research)).

That is, of course, until the middle 1980’s when this metric again penetrated that barrier. After that time it went on an inexorable march to a whopping 367% of GDP just prior to the bursting of the “Housing Bubble” and stood at just under 332% as of the end of 2014. The level of debt continues to be a headwind to economic growth that will persist until the debt is paid down.

FED BUBBLE - Flawed Policy

What has acted to somewhat mask this headwind is, what we believe, is the most reckless policy ever adopted by the Fed. The Fed was wrong on the “Dot Com Bubble”; was wrong on the “Housing Bubble”; and we believe will be wrong in the creation of the current “Central Bank Bubble”. This Fed is in a major experimentation mode which is very dangerous. The policy of which we speak is, of course, Zero Interest Rate policy, or (ZIRP). This policy has driven the Fed’s Balance Sheet from $800 billion in 2008 to $4.4 trillion currently.

It is because of ZIRP that stocks do not appear, to some, to be expensive. After all, if the alternative is a 2% ten year treasury or 2.6% thirty year treasury, maybe a 2% dividend yield isn’t so bad; or so the thinking goes. But as stated above, the growth in corporate profits in the long run is a proxy for the growth in the economy, or GDP. And right now stocks, measured by market capitalization, are near the highest they have ever been relative to GDP. Every major market bottom and top has been coincident with very low or very high ratios of “Stock Market Capitalization to GDP”(see attached chart from Ned Davis Research).

It is likely the reason is that this metric has purported to be a favorite of Warren Buffet. In fact, the only time this metric has been higher was just before the” Dot Com Bubble” burst. It comes at a time when deflation is playing out all over the world. The dollar is strengthening, which hinders multinational companies from exporting goods abroad. In addition, it appears that companies do not have enough pricing power to increase margins.

LIQUIDITY TRAP

We at Comstock have been telling our viewers that we have been in a deflationary environment for years. It seems the markets now are agreeing with us as there are currently few countries that are expecting any material inflation over the next ten years. This is evident by the yields in ten year sovereign paper.

The following are yields as of the date of this writing:

- United States 2.19%;

- United Kingdom 1.97%;

- Italy 1.81%;

- Spain 1.78%;

- France .82%;

- Japan .36%, and

- Germany .52%.

What all of these countries have in common, in addition to being democracies, is that their respective central banks are in a “Liquidity Trap” situation, where low and even negative interest rates do not encourage consumer spending but rather consumer savings.

Businesses in turn do not have the confidence to invest in new plant and equipment. This is particularly true in the United States, where the average age of private fixed assets is the oldest in the past fifty years.

So, to our viewers we say, we have been early on this, as we were with the Dot Com and Housing Bubbles, but we are confident this will end the same way as those bubbles.

The US stock market is historically expensive and financial assets have been inflated by an experimental central bank policy.

It is an error that is now being repeated by central banks in Europe, Japan and just recently, China. These markets are being influenced in similar ways as ours, rather than fiscal and tax policies that would stimulate sustainable growth.

We will hold our view that stocks are expensive until they become priced more reasonably relative to the growth prospects of the economy.

We have maintained consistently that high levels of debt are the main problem affecting growth and those debt levels will not be going away any time soon.

A SUPPORTING RESEARCH PAPER BY THE BIS

Leverage dynamics and the real burden of debt

Working Papers No 501

May 2015 |

In addition to leverage, the aggregate debt service burden is an important link between financial and real developments. Using US data from 1985 to 2013, we find that it has sizable negative effects on credit and expenditure growth. Strong interactions between leverage and the debt service burden lead to large and protracted cycles in credit and expenditure that match the stylised facts of credit booms and busts. Even with real-time estimates, the predicted adjustment to leverage and the debt service burden from 2005 onwards imply paths for credit and expenditure that closely match actual developments before and during the Great Recession.

|

05-11-15 |

STUDY |

|

|

|

|

|

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur |

2012 - FINANCIAL REPRESSION |

2012

2013

2014 |

|

|

FINANCIAL REPRESSION - Cashless Society

GOVERNMENT'S LAUNCH "TRIAL BALLOONS" IN THE PUBLIC MEDIA

READ BELOW AND WEEP

How to end boom and bust: make cash illegal 05-

13-15 The Telegraph

Forcing everyone to spend only by electronic means from an account held at a government-run bank would give the authorities far better tools to deal with recessions and economic booms - Jim Leaviss

Gordon Brown promised to 'end boom and bust' but a cashless world would have given him far more chance to achieve it, academics suggest Photo: Getty Images

This story is part of our "Money Lab" series, in which respected figures from the world of finance put forward controversial ideas for improving our personal finances or the economy.

A proposed new law in Denmark could be the first step towards an economic revolution that sees physical currencies and normal bank accounts abolished and gives governments futuristic new tools to fight the cycle of “boom and bust”.

The Danish proposal sounds innocuous enough on the surface – it would simply allow shops to refuse payments in cash and insist that customers use contactless debit cards or some other means of electronic payment.

Officially, the aim is to ease “administrative and financial burdens”, such as the cost of hiring a security service to send cash to the bank, and is part of a programme of reforms aimed at boosting growth – there is evidence that high cash usage in an economy acts as a drag.

But the move could be a key moment in the advent of “cashless societies”. And once all money exists only in bank accounts – monitored, or even directly controlled by the government – the authorities will be able to encourage us to spend more when the economy slows, or spend less when it is overheating.

This may all sound far-fetched, but the idea has been developed in some detail by a Norwegian academic, Trond Andresen*.

In this futuristic world, all payments are made by contactless card, mobile phone apps or other electronic means, while notes and coins are abolished. Your current account will no longer be held with a bank, but with the government or the central bank. Banks still exist, and still lend money, but they get their funds from the central bank, not from depositors.

Having everyone’s account at a single, central institution allows the authorities to either encourage or discourage people to spend. To boost spending, the bank imposes a negative interest rate on the money in everyone’s account – in effect, a tax on saving.

Faced with seeing their money slowly confiscated, people are more likely to spend it on goods and services. When this change in behaviour takes place across the country, the economy gets a significant fillip.

The recipient of cash responds in the same way, and also spends. Money circulates more quickly – or, as economists say, the “velocity of money” increases.

What about the opposite situation – when the economy is overheating? The central bank or government will certainly drop any negative interest on credit balances, but it could go further and impose a tax on transactions.

So whenever you use the money in your account to buy something, you pay a small penalty. That makes people less inclined to spend and more inclined to save, so reducing economic activity.

Such an approach would be a far more effective way to damp an overheated economy than today’s blunt tool of a rise in the central bank’s official interest rate.

If this sounds rather fanciful, negative interest rates already exist in Denmark, where the central bank charges depositors 0.75pc a year, and in Switzerland.

At the moment it’s easy for individuals to avoid seeing their money eroded this way – they can simply hold banknotes, stored either in a safe or under the proverbial mattress.

But if notes and coins were abolished and the only way to hold money was through a government-controlled bank, there would be no escape.

Apart from the control over the economy, there would be many other advantages of a cashless society. Such a system is much cheaper to run than one based on banknotes and coins. Forgery is impossible, as are robberies.

Electronic money is an inclusive and convenient system, giving poor and rural sectors of an economy – where cash machines and bank branches may be few and far between and not all people have accounts – a tool for easy participation in the economy.

Finally, the “black economy” will be hugely diminished, and tax evasion made all but impossible.

Jim Leaviss is head of retail fixed interest at M&G Investments.

|

05-14-15 |

MACRO MONETARY

War on Cash |

GLOBAL MACRO |

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post |

I - POLITICAL |

|

|

|

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM |

G |

THEME |

|

| - - CORPORATOCRACY - CRONY CAPITALSIM |

|

THEME |

|

THEMES - Corporatocracy - Crony Capitalism

CORPORATOCRACY - CRONY CAPITALSIM

C O R P O R A T O C R A C Y

Hedge Fund schemers are the modern version of robber barons. At the top of the list of unscrupulous manipulators is George Soros. With reports like in Forbes that George Soros May Owe Billions In Taxes, an alarm should go off to all investors.

“By the early 2000s, hedge funds were considered de rigeur for sophisticated investors willing to take a risk in exchange for potential wealth. As that potential wealth grew, so did the potential tax bill, and managers began looking at other options. The solution? Investing in offshore hedge funds. Hedge fund managers are generally taxed on income in the country where the fund is located making relocating to the usual offshore suspects such as the Caymans, Bermuda and Ireland attractive. Tax was essentially deferred on fees from these funds until it landed in the hands of those in the U.S.”

The 2008 financial meltdown had all the Wall Street elites scrambling to protect their investment, while avoiding the day of reckoning with the tax man. One such effort as Forbes cites allowed for another deferred work around.

The change was inserted into the Emergency Economic Stabilization Act of 2008 (Public Law 110-343) – and if that sounds familiar, you’re not imagining it. That law was also instrumental in the administration of the Troubled Assets Relief Program, or TARP. The new law essentially banned the deferral of fees and compensation by these offshore hedge funds.

Moving the domicile for the Soros fund to Ireland was an attempt to circumvent the intent of an ill-written law.

The Street lays out the basis for the enormous tax bill coming due.

“At the end of 2013, Soros—through Soros Fund Management—had amassed $13.3 billion through the use of deferrals, according to Irish regulatory filings by Soros.

Congress closed the loophole in 2008 and ordered hedge fund managers who used it to pay the accumulated taxes by 2017. A New York-based money manager such as Soros would be subject to a federal rate of 39.6 percent, combined state and city levies totaling 12 percent, and an additional 3.8 percent tax on investment income to pay for Obamacare, according to Andrew Needham, a tax partner at Cravath, Swaine & Moore. Applying those rates to Soros’s deferred income would create a tax bill of $6.7 billion.”

Now this background provides the business analysis but far more important is the relevance of the political clout that Soros has wheeled for decades and how that influence will effect if he will actually pay his tax bill.

Review the long laundry list of Organizations Funded Directly by George Soros and his Open Society Institute that have received direct funding and assistance from George Soros.

Note that the deadline for payment is 2017, just after the next election. Image the next puppet taking office using an executive order to further delay or water down the actual collection of the Soros tax obligation.

It should be self-evident that the weight of Wall Street influence will be enormous in the 2016 Presidential coronation.

Dismiss the obvious hypocrisy of advocating for higher taxes while avoiding your own tax payment and focus on the actual results.

“A manager with Soros’s track record who started with $12 million from investors, took 20 percent of the profits, and reinvested that money tax-free over 40 years, would end up with $15.9 billion. If that same manager paid federal, state, and local taxes on the fees and related investment gains before reinvesting them, the figure would shrink to $2.4 billion…”

This strategy is not unique but it is symbolic of the way the financial elites benefit from their extraordinary influence over the biased tax regulations that favors the politically well connected.

The difficulty for leftist supporters of the Soros mind numbing collectivist culture is that they are unable to separate between the rhetoric and the reality of actual actions.

Soros is a pied piper for the naïve and misguided. All the millions he spends on altering the political landscape have a financial component to protect his own fortune.

Restructuring tax law and regulations never reforms the system. This one example, how hedge funds circumvent taxes, should illustrate that inserting loopholes into statutes is the function of lobbying and providing campaign contributions.

George Soros has a long record of avoiding paying taxes, while undermining political regimes. But he is not alone in avoiding taxes. Bankers Anonymous outlines how the game is played.

“If you set up a traditional hedge fund, first things first: you’ll want to charge the traditional “2/20.”Embedded in this short-hand lingo of “2/20” for hedge fund fees are two types of income.

With the two types of income, you need the two entities to keep the income tracked separately. Entity #1 collects the “2,” which is taxed like regular business income, and Entity #2 collects the “20,” which collects your totally awesome income at a lower tax rate.

The “2” refers to an annual management fee of 2% of assets under management. On a small/medium-sized hedge fund of, for example, $500 million under management, you will collect $10 million in management fees per year.”

Since the standard format for a hedge fund treats fees as different tax rates, the hidden deception is why such hedge funds go unregulated by the SEC? The sweet heart tax treatment deal that allows circumvention of normal rates is a profound offence. Moving the venture offshore just adds to the outrage. Targeting 2017 for final settle up will be forgotten as the next deferment exception is adopted.

Unless people admit the elite as the real power behind the political charade, there will never be equitable tax accountability. Soros plots to overthrow governments. Ignoring the tax bill should be a cake walk. A better solution is to institute serious and comprehensive oversight over the 2-20 tax dodge and apply the same rules to the financial privileged that ordinary citizens must observe. If you agree, keep the pressure on Soros and demand a long overdue resolution.

James Hall – May 13, 2015

|

- See more at: http://www.batr.org/corporatocracy/051315.html#sthash.7u1hE88e.dpuf |

05-13-15 |

THEME |

|

II-ECONOMIC |

|

|

|

| GLOBAL RISK |

|

|

|

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY |

G |

THEME |

|

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT |

US |

THEME |

|

| - - ECHO BOOM - PERIPHERAL PROBLEM |

M |

THEME |

|

| - -GLOBAL GROWTH & JOBS CRISIS |

|

|

|

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK |

|

THEME |

MACRO w/ CHS |

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY |

US |

THEME |

MACRO w/ CHS |

III-FINANCIAL |

|

|

|

| FLOWS -FRIDAY FLOWS |

MATA

RISK ON-OFF |

THEME |

|

FLOWS - Liqudity, Credit and Debt

ETF Issuers Quietly Prepare For "Market Meltdown" With Billions In Emergency Liquidity 05-13-15 Zero Hedge

Between the dramatic sell-off in German Bunds that unfolded over the course of three weeks beginning on April 21 and the erratic trading that ensued on Tuesday following the weakest JGB auction since 2009, the chickens, as they say, have come home to roost in government bond markets where thanks the ECB, the Fed, and the BoJ’s efforts to monetize anything that isn’t tied down, the market has become hopelessly thin.

As we’ve documented exhaustively — and as every pundit and Wall Street CEO is now suddenly screaming about — the secondary market for corporate credit faces a similar dearth of liquidity and at just the wrong time. Issuance is at record levels and money is pouring into IG and HY thanks to CB-induced herding (i.e. quest for yield) and record low borrowing costs (again courtesy of central planners), but thanks to the new regulatory regime which ostensibly aims to curtail systemic risk by cutting out prop trading, banks are no longer willing to warehouse corporate bonds (i.e. dealer inventories have collapsed), meaning that in a rout, investors will be selling into a thin market. The result will be a firesale.

So while policymakers are still willfully ignorant when it comes to honestly assessing the effect their actions are having on government bond markets, the entire financial universe seems to have recently become acutely aware of the potentially catastrophic conditions prevailing in corporate credit. These concerns have now officially moved beyond the realm of lip service and into the realm of disaster preparedness because as Reuters reports, some of the country’s largest ETF providers are arranging billion dollar credit lines that can be tapped to keep illiquidity from turning an ETF sell-off into a credit market meltdown:

The biggest providers of exchange-traded funds, which have been funneling billions of investor dollars into some little-traded corners of the bond market, are bolstering bank credit lines for cash to tap in the event of a market meltdown.

Vanguard Group, Guggenheim Investments and First Trust are among U.S. fund companies that have lined up new bank guarantees or expanded ones they already had, recent company filings show.

The measures come as the Federal Reserve and other U.S. regulators express concern about the ability of fund managers to withstand a wave of investor redemptions in the event of another financial crisis.

They have pointed particularly to fixed-income ETFs, which tend to track less liquid markets such as high yield corporate bonds or bank loans.

"You want to have measures in place in case there are high volumes of redemption so you can meet those redemptions without severely impacting the liquidity of the underlying securities," said Ryan Issakainen, exchange-traded fund strategist at First Trust…

Under the Wall Street reform act known as Dodd-Frank, banks have been shedding their bond inventories, resulting in less liquidity in fixed-income markets. Because there are fewer bonds available for trading, a huge selloff in the bond markets could worsen the effect of a liquidity mismatch in bond ETFs.

Vanguard, the second-largest U.S. ETF provider, lined up its first committed bank line of credit last year and now has a $2.89 billion facility backed by multiple banks and accessible to all of Vanguard's funds, covering some $3 trillion in assets, the Pennsylvania-based fund company told Reuters. The new setup is to "make sure that funds will be available in time of market stress when the banks themselves may have liquidity concerns," Vanguard said.

Essentially, ETF providers are worried that in a pinch (i.e. when ETF sellers outnumber ETF buyers), they will be forced to liquidate assets into structurally thin markets at fire sale prices in order to meet redemptions, triggering a collapse in the underlying securities (like HY bonds). In the pre-crisis days, this would have been mitigated by banks’ willingness to purchase what the ETF providers are looking to sell, but in the post-Dodd-Frank world this isn’t the case so the idea now is that bank credit lines will essentially allow the ETF providers to become their own dealers, meeting redemptions with borrowed cash while warehousing assets and praying waiting for a more opportune time to sell.

In case it isn’t clear enough from the above that ZIRP is in large part responsible for this, consider the following:

"These funds offer daily or even intraday liquidity to investors while holding assets that are hard to sell immediately, thus making the funds vulnerable to liquidity risk," U.S. Federal Reserve Vice Chair Stanley Fischer said in a speech in March in Germany, pointing directly to ETFs and saying they have mushroomed in size while tracking indexes of "relatively illiquid" assets.

That is all exacerbated because investors have been pouring money into bond ETFs, while banks, under regulatory pressure to limit their own holdings, have been slashing their bond inventories.

Growth in fixed-income ETFs also means there are now more products tied to corners of the bond market previously untapped by ETFs. Assets in U.S.-listed fixed-income ETFs are up nearly six-fold since 2008, to $335.7 billion at the end of April, according to Thomson Reuters Lipper data.

And why, one might ask, are investors suddenly interested in exploring “corners” of the bond market where they had previously never dared to tread thus creating demand for ever more esoteric ETF products? Because when risk-free assets are at best yielding an inflation-adjusted zero and at worst have a negative carry, investors are forced into credits they would have never considered before just so they can squeeze out some semblance of yield without simply dumping everything into equities.

Of course liquidity protection comes at a cost:

Banks facing their own reserve requirements against these lines are charging commitment fees that can range from 0.06 percent to 0.15 percent, according to company filings. If a line is actually drawn upon, there would be additional interest charged on any amount borrowed. In many cases, these costs are included in the ETF's annual expense ratio, and borne by the funds' investors.

To recap: central banks have created a hunt for yield that's driven investors into fixed income categories they wouldn't have normally considered, creating demand for ever more esoteric ETF products. Thanks to curtailed prop trading, the market for the underlying assets is even thinner than it would have otherwise been, meaning fund managers would be forced into a firesale should a wave of redemptions suddenly rear its ugly head. To mitigate this, ETF issuers are setting up credit lines with the very same banks who in the pre-crisis world would have acted as liquidity providers. The cost of these credit lines is passed on to investors via higher expense ratios meaning fund holders can go ahead and shave another 15bps off of their fixed income ETF returns which are already pitifully low thanks to ZIRP.

In the final analysis, these liquidity lines are essentially distressed loans when drawn down, and the effect is to create yet another delay-and-pray ponzi scheme whereby liquidation is temporarily forestalled by borrowed money.

Recall that Howard Marks recently warned investors against ignoring the fact that an ETF can't be more liquid than the underlying assets and the underlying assets can be highly illiquid. So while Marks may have wondered rhetorically what could happen in a worst case scenario, the market is itself now quietly taking steps to avoid that moment as long as possible |

05-15-15 |

THEMES |

FLOWS

|

| GENERAL INTEREST |

|

|

|

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage |

RETAIL - CRE

|

|

SII |

|

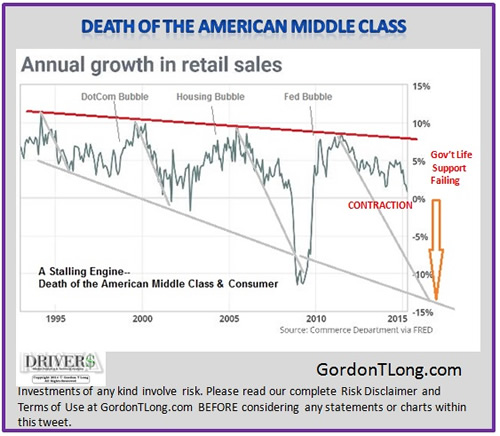

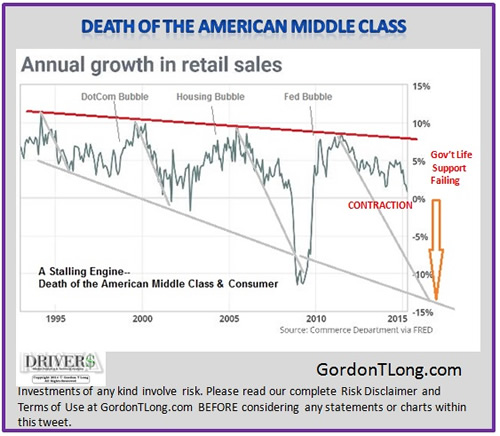

Death of the American middle class and its insatiable consumption levels.

Is a 70% Consumption Economy the Peak?

Households are borrowing in attempt to maintain consumption

Insufficent as 6K store closing announced @LanceRoberts

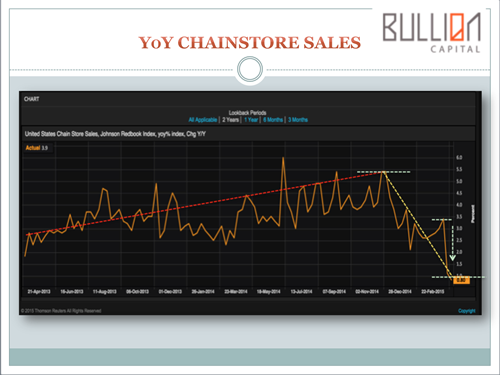

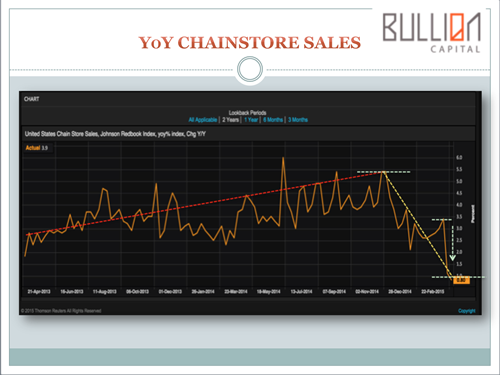

I want to hone in on the category of consumer spending that is first to go away so that we may capture the first signals of a consumer spending pull back. A good proxy for this is the Johnson Redbook Chain Store yoy sales. This captures the consumer spending taking place at large department stores (Macy’s, Kohls, Walmart, Kmart, etc). This is going to be where the real discretionary retail spending takes place, as in do I have enough space on my credit card for that sassy blue dress and groceries or just groceries? And don’t think that is just a theatrical example. I remember the days of asking myself those very same questions (ok maybe not the blue dress but you get the idea). That is just real life here in the US (and Canada for that matter).

So this category does well to target the true discretionary spending. Now if the chart trend appears strong or even flat then we can be confident consumers have not yet pulled back on even the most discretionary of items and so any variations in the overall spending patterns are likely not worrisome. However, if we see a sharp pull back here it is indicative that a downturn in the overall spending trend is likely substantive rather than nuance. Let’s have a look.

What we find is that over the past 6 months we had a tremendous drop in true discretionary consumer spending. Within the overall downtrend we do see a bit of a rally in February but quite ominously that rally failed and the bottom absolutely fell out. Again the importance is it confirms the fundamental theory that consumer spending is showing the initial signs of a severe pull back. A worrying signal to be certain as we would expect this pull back to begin impacting other areas of consumer spending. The reason is that American consumers typically do not voluntarily pull back like that on spending but do so because they have run out of credit. And if credit is running thin it will surely be felt in all spending.

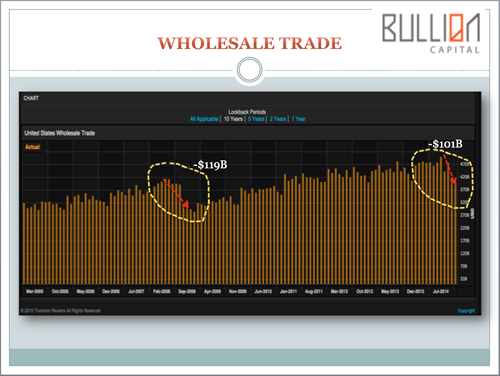

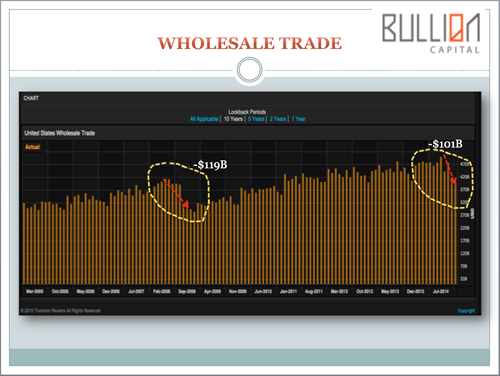

But one chart doesn’t a story tell, and so we must continue in our quest to determine whether or not we are on the precipice of another crisis. Another early indicator I like to look at is wholesale trade. If any sector has its finger on the pulse of the consumer it’s the wholesale/distribution sector. These guys are constantly talking to retailers to gauge where the consumer is at any given time. So let’s have a look to see if wholesale trade is giving out any clues.

Currently we find ourselves on the bottom of the latest peak to trough draw down which has given up more than $100B in wholesale trade. Interestingly we should note that the last time we saw a $100B peak to trough draw down was between June 2008 and January 2009. However, while it took 7 months to give up $100B in wholesale trade during the Credit Crisis, we’ve just done it in only 4 months. What this means is that the wholesale trade sector has recognized what the chain store yoy sales chart above depicts, namely that the US consumer has begun to max out. This is further supported by the inventory levels as per the latest GDP print, which made up 1.24% of the .2% print (wait doesn’t that mean then…. yes you get it). |

05-16-15 |

SII

US CONSUMPTION |

|

RETAIL - CRE

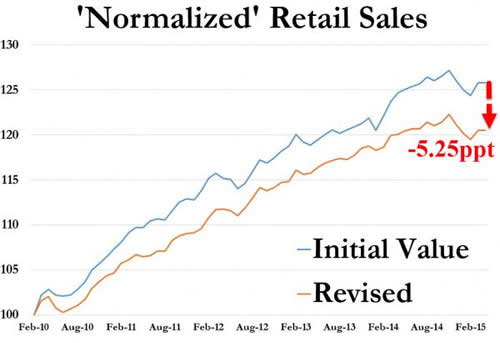

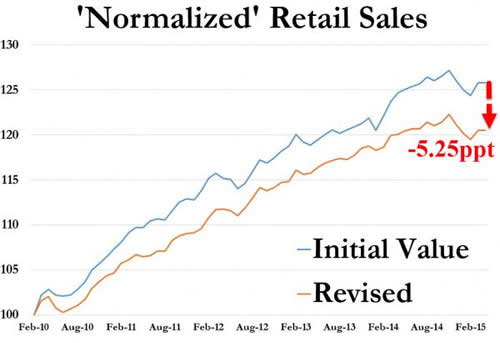

The Big Lie: Serial Retail Sales Downward Revisions Hide Ugly Truth 05-15-15 ZH

Over the last 5 years, over 20% of the initial gains in Retail Sales have been 'removed' by serial downward revisions in later months.

For over 65% of the time, a 'good' number prints, stocks rally, the everything-is-awesome meme is confirmed, and then a month later (or more) retail sales data is downwardly revised.

35 downward revisions and 19 upward (and 8 of last 9 downward) for an aggregate spread between initial data and revised of over 5 percentage points (of a 25% gain).

It is all too easy to point the finger at China's 'manufactured' data, but perhaps some reflection on the home truths in America is worthwhile.

Charts: Bloomberg

|

|

SII

US CONSUMPTION |

|

US DOLLAR

|

|

SII |

|

YEN WEAKNESS

|

|

SII |

|

OIL WEAKNESS

|

|

SII |

|

| TO TOP |

| |

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

|

YOUR SOURCE FOR THE LATEST

GLOBAL MACRO ANALYTIC

THINKING & RESEARCH

|

�

|