|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Thurs. May 7th, 2015

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

STRATEGIC INVESTMENT INSIGHTS

2015 THESIS: FIDUCIARY FAILURE

2015 THESIS: FIDUCIARY FAILURE

NOW AVAILABLE FREE to Trial Subscribers

174 Pages

What Are Tipping Poinits?

Understanding Abstraction & Synthesis

Global-Macro in Images: Understanding the Conclusions

![]()

| MAY | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | |||||

| 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 10 | 11 | 12 | 13 | 14 | 15 | 16 |

| 17 | 18 | 19 | 20 | 21 | 22 | 23 |

| 24 | 25 | 26 | 27 | 28 | 29 | 30 |

| 31 | ||||||

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar Weakness |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

TODAY'S TIPPING POINTS

|

![]() Scroll TWEETS for LATEST Analysis

Scroll TWEETS for LATEST Analysis ![]()

HOTTEST TIPPING POINTS |

Theme Groupings |

|||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro |

||||

|

|

Posting Date |

Labels & Tags | TIPPING POINT or THEME / THESIS or INVESTMENT INSIGHT |

|

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

|||

BOND BUBBLE - Showing Serious Leakage

“Bunds have been selling off as the market re-prices the ‘term premium’ [risk factors affecting bonds over and above the outlook for inflation and rates], which has been held down by a combination of ECB QE and uncertainties surrounding Greece,” said David Tan, Global Head of Rates at J.P. Morgan Asset Management. “Liquidity has been very poor and this has exacerbated the price action. It is difficult to say when the selling will stop. The combination of higher bond yields in both [eurozone] core and periphery, weaker equities and stronger euro will ultimately arrest this sell-off in bonds as people worry about the pass-through into slower economic growth.” ‘’The thinking was that given there is limited issuance coming through the pipeline this year from core countries and the ECB is buying, then effectively net supply will be negative, so yields fall. It was a no-brainer people would have had us believe.” Mohamed El-Erian warns of trouble as bond liquidity dries up 05-06-15 MarketWatch The leap in German bund yields over the last two weeks is another sign that liquidity issues could eventually present serious problems for financial markets, former Pimco Chief Executive Mohamed El-Erian on Wednesday warned at the annual SALT investment conference in Las Vegas. “There isn’t the countercyclical risk-taking we need,” said El-Erian, chief economic adviser at Pimco parent Allianz. That could spell trouble when there is a big shift market positioning, he warned at SALT, a gathering of around 1,800 hedge-fund and investment-industry professionals. That is because "Investors may not be able to reposition at a low cost. Bond liquidity is a “delusion, not an illusion” El-Erian’s remarks came during SALT’s opening panel, which included Peter Schiff, CEO of Euro Pacific Capital, and Gene Sperling, a former economic adviser to President Barack Obama and the Clinton White House. Sperling argued that a lackluster U.S. economic recovery is the aftermath of a financial crisis, which typically gives way to less robust recoveries as banks, businesses and consumers focus on eliminating debt. Meanwhile, the Federal Reserve was left to do much of the heavy lifting as the federal government’s stimulus efforts were offset by fiscal contraction at the state and local level. Schiff, a persistent Fed critic, charged that the U.S. economy is witnessing a bubble rather than a recovery and that the Fed was crowding out small businesses who would otherwise be creating jobs. Fed Chairwoman may not entirely disagree with Schiff’s bubble assessment, On Wednesday, Yellen referred to stock valuations as “quite high,” and hinted that bond values may be even higher during a conversation with International Monetary Fund head Christine Lagarde sponsored by the Institute for New Economic Thinking. Schiff, who has long argued that quantitative easing would be a disaster for the dollar, compared being long the U.S. currency now with being long subprime mortgages back in 2006. In other words, doomed to implode. El-Erian later waded into the debate, saying that Schiff and Sperling were engaged in a backward-looking conversation. He likened quantitative easing to a “painkiller” that initially worked, but that policy makers now have become dependent. On the fiscal front, El-Erian sounded more sympathetic to Sperling, saying that the appeal of investing in infrastructure building projects at near-zero interest rates shouldn’t be overlooked Global Bond Rout Spreads to Japan as Three-Day Break Ends 05-06-15 Bloomberg Japan’s government bonds joined a worldwide rout in sovereign debt as investors in Tokyo returned from a three-day national holiday. Benchmark 10-year yields were set for their biggest increase since Feb. 3 after losses in U.S. Treasuries mounted following comments by Federal Reserve Chair Janet Yellen on Wednesday that long-term government debt is overpriced. Yields on 10-year German bunds rose to their highest level this year as investors bet whether European yields were too low given rising oil prices and a deadlock in Greece’s debt talks. “Japan’s bonds will start with a big drop after yields surged in the U.S. and Germany,” Kazuhiko Sano, the chief bond strategist at Tokai Tokyo Securities Co., wrote in a research note to clients. Japan’s 10-year yields yield may rise to as high as 0.4 percent, according to Sano. The yield on the 10-year bond jumped seven basis points to 0.43 percent as of 8:52 a.m. in Tokyo from May 1, according to Japan Bond Trading Co., the nation’s largest inter-dealer debt broker. The price of the 0.4 percent debt due March 2025 fell 0.665 yen to 99.716. A basis point is 0.01 percentage point. The lead 10-year JGB futures contract dropped 0.4 percent to 146.87 in Tokyo from May 1. Japan’s financial markets were closed from May 4 to May 6 for national holidays. Why Are Bonds Taking a Dive? 05-07-15 Ed Yardeni US bond yields have jumped recently. The 10-year Treasury is up from a recent low of 1.87% on April 17 to 2.26% yesterday. Everyone is blaming that development on the spike in Eurozone bond yields, particularly the surge in the 10-year German government yield from its all-time low of 0.033% on April 17 to 0.58% yesterday. That’s despite the implementation of QE by the ECB starting on March 9. That could stall the already lackluster recovery in the housing industry, which might explain why lumber prices are falling. So maybe the Fed should postpone its lift-off given the lift-off in bond yields?

|

05-06-15 |

STUDIES | 1- Bond Bubble | |

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - May 2nd, 2015 - May. 9th, 2015 | ||||

| BOND BUBBLE | 1 | |||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | |||

| GEO-POLITICAL EVENT | 3 | |||

| CHINA BUBBLE | 4 | |||

| JAPAN - DEBT DEFLATION | 5 | |||

EU BANKING CRISIS |

6 |

|||

GLOBAL RISK - World Economic Forum CURIOUS SIGHTINGS! Same Old Lessons Published 05-02-15 THE "WANNA GET RICH QUICK" CROWD In the old days you knew a market top was at hand when your local barber starting giving you stock tips. In our global market it is different as new people discover trading (and will soon learn some old lessons) .... It appears US barbers are too smart, too broke and too afraid of no pension income to fall for this trap again.

MEANWHILE THE GOLDMAN SACHS "NOUVEAU RICH" BANKERS COULDN'T FIND PARKING SATURDAY The rich discovered a new problem Saturday! They can't find parking spaces for their tax deductible private jets during their weekend "boon doogles" FINDING PARKING FOR THE SATURDAY "KENTUCKY DERBY" FIGHT AT THE VEGAS AIRPORT WAS IMPOSSIBLE!

SO WAS FINDING PARKING SATURDAY FOR THE MAYWEATHER-PACQUUIAO" FIGH AT THE VEGAS AIRPORT

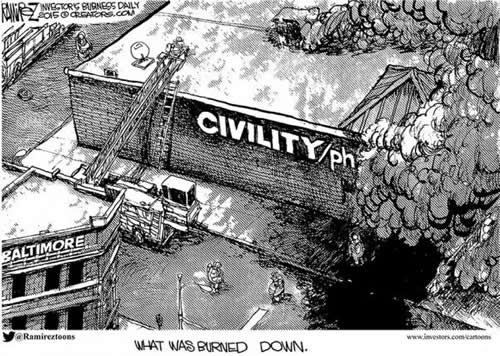

Some had EVEN MORE serious problems. Tom Brady attended BOTH events Saturday?? No wonder they call him Tom Terrific! THE REST OF US SIMPLY TRIED TO AVOID THE INEQUALITY RIOTS AND RALLIES Rallies in Baltimore have spread to more than 20 US cities

GOD BLESS AMERICA!!! LAND OF THE FREE?

|

05-05-15 | THEMES INEQUALITY

US PUBLIC POLICY |

13 - Growing Social Unrest | |

| TO TOP | ||||

| MACRO News Items of Importance - This Week | ||||

GLOBAL MACRO REPORTS & ANALYSIS |

||||

US ECONOMIC REPORTS & ANALYSIS |

||||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | ||||

| Market | ||||

| TECHNICALS & MARKET |

|

|||

| STUDIES -THE NEW PARANORMAL | ||||

In The New Paranormal, Junk Bonds Are A "Haven Asset" When you devalue money and distort the supposed risk-free rate, you devalue every aspect of the capital structure, and of society itself. We are now in the terminal stages of QE, during which the practical limitations of this fatuous and discredited policy are being revealed. The practical outcome of QE is that it turns the bond market into a no-go area for any rational investor. Quantitative easing is a squalid little lie. It appeals to economists with no grasp of history. It pretends that too much debt can be simply resolved through futile attempts at price controls and money printing. At some point, the free market returns with a vengeance, like a coiled spring made out of pure risk. That time may be coming soon. There is one thing riskier than investing in a free market: investing in a rigged market when you think the central bank has your back. In The New Paranormal, Junk Bonds Are A "Haven Asset" 05-05-15 ZH "What's even more dangerous than the actual stock market is the high yield market,” Carl Icahn (who is perhaps talking his book) recently warned, before saying he “feels sorry” for all of those throwing their money into junk bonds in a desperate search for yield. We have of course long warned that a half decade of easy money policies have had the unfortunate side effect of allowing otherwise insolvent companies (most notably energy producers) to stay afloat by keeping rates artificially low, thus creating demand for HY debt while simultaneously ensuring that borrowing costs for issuers remain (very) favorable. Indeed, HY issuance is quite clearly correlated with successive rounds of QE as the following charts show: More specifically, UBS notes that “the picture is crystal clear: In both periods, issuance was $130bn more than average, or about 50% greater than the average amount expected, over an 11 month period. The main drivers were lower yields, sharp drops in yields (we find that the speed of yield changes plays a significant role in impacting issuance), and strong inflows.” Over time, this has had the effect of, in Citi’s words: ... destroying creative destruction by creating a legion of zombie companies which have continued to produce when they likely should have been long buried, contributing to a global supply glut and ultimately, to deflation. Unfortunately, this dynamic will persist as long as the Fed keeps rates suppressed, as investors have virtually no alternative but to look for yield wherever they can find it, especially when many risk-free assets have a negative carry. It’s no surprise then that Bloomberg is out calling junk bonds “the new haven asset”: The new fixed-income haven is, of all things, the market for junk bonds.

While all of this may be true, the simple fact is that HY is HY for a reason — from a fundamental perspective, the issuers are not as sound as their IG counterparts. Combine this with the fact that in a pinch, HY will be the first to suffer and holders will be selling into a secondary market with no liquidity, and you have a scenario that could quickly turn into a rout. This is especially true for HY energy names which, as Barclays notes, look particularly overbought:

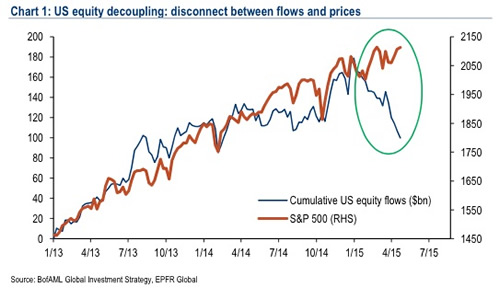

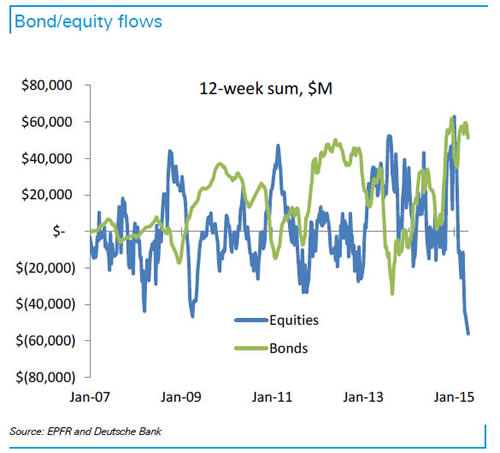

So while everything is currently awesome (S&P energy sector is now trading at 28X forward earnings, the highest level since 1999), we would be cautious about following the crowd into what one asset manager told Bloomberg is the "best strategy to generate total return in today's low rate environment," because when the cycle turns, there will be quite a few people trying to exit through a very narrow doorway. No Really, Who Is Buying? 05-04-15 ZH One week ago, when showing a BofA chart demonstrating the record divergence between the S&P500 and US equity flows... ... and which BofA itself prefaced by saying "big decoupling in recent weeks between US equity flows and prices ...correction risks will grow in absence of fresh inflows in coming weeks" we asked: "who is buying?" We bring this up because over the weekend we say a different manifestation of the same chart, this time from Deutsche Bank. This is what the German bank with the €50+ trillion in derivatives had to say:

Except for stocks, of course, based on where the equity flows are not going. Because as the chart below shows, the cumulative three-month net flows into, or rather out of equities, is now the largest on record. So, again, we ask: just who is "buying" stocks? Because the greatest rotation is here, and as far as non-central bank participants are involved, it is into bonds and out of stocks.

|

05-06-15 |

STUDIES | ||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | |||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | |||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | ||||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

|

| 2014 - GLOBALIZATION TRAP | 2014 |  |

||

|

2013 2014 |

||||

CUSTODIAL RISK- There is Counterparty Risk PLUS Custodial Risk QUESTION TO ANSWER: What do you really own when you buy an investment? In our complex financial world of securities, derivatives, counterparty agreement and rehypothecation of the collateral of assets under management virtually no one has the actual physical share certificates of stocks or other assets held by their custodial financial investment firm. "Custody Risk is one of the biggest, most important issues to consider if you want to maintain your wealth when the next round of systemic risk hits!" Graham Summers - Phoenix Capital TWO PROBLEMS 1- CUSTODIANS OFTEN DON'T KNOW WHERE YOUR ASSETS ARE HELD The SEC recently performed a study of some 400 investment advisor firms. As the SEC itself stated in its report - approximately one-third (140) failed to meet custody rule requirements. What this says is custodians don't know where their clients funds are! Many didn't even know they themselves were legal custodians of their clients funds! 2- YOUR ASSETS WILL LIEKLY BE FROZEN WHEN YOU NEED THEM MOST Even if an appropriate legal framework is in place to eliminate the risk of loss of value of the securities held by the custodian in the event of its failure, it can take weeks or even months to transfer the securities to new custodians. During that time, you cannot close out open positions .. they are effectively frozen. In the case of MF Global, some investors were locked out of their accounts and couldn't trade their positions for weeks. As a result many of them incurred massive losses.

|

05-04-15 | THESIS | ||

2011 2012 2013 2014 |

||||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | ||||

I - POLITICAL |

||||

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | G | THEME | ||

| - - CORPORATOCRACY - CRONY CAPITALSIM | THEME |  |

||

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

||

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | ||

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | ||

II-ECONOMIC |

||||

| GLOBAL RISK | ||||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | ||

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | ||

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | ||

| - -GLOBAL GROWTH & JOBS CRISIS | ||||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MACRO w/ CHS |

||

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

|

III-FINANCIAL |

||||

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | ||

| CRACKUP BOOM - ASSET BUBBLE | THEME | |||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | ||

| GENERAL INTEREST |

|

|||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | ||||

|

SII | |||

|

SII | |||

|

SII | |||

|

SII | |||

| TO TOP | ||||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP