|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Wed June 17th, 2015

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

![]()

| MAY | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | 6 | |

| 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| 14 | 15 | 16 | 17 | 18 | 19 | 20 |

| 21 | 22 | 23 | 24 | 25 | 26 | 27 |

| 28 | 29 | 30 | ||||

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar Weakness |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

TODAY'S TIPPING POINTS

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

GLOBAL RISK -The Biggest Risk To Global Equities According To Bank of America, This Is "The Biggest Risk To Global Equities" 06-16-15 BOAML via ZH On Monday evening we brought you “Bank Of America Begins 66-Day Countdown Until The 'Ghost Of 1937'" Returns,” in which we discussed why, if history is any guide, a rate hike cycle will be a disaster for equities. As a refresher, here’s the narrative:

So, now that Janet Yellen has the green light for liftoff courtesy of the BEA, Steve Liesman, and her friends at the San Francisco Fed, who have conspired to pass off an epic perversion of statistical analysis as a legitimate attempt to do away with what they would like the public to believe is a statistical aberration called “residual seasonality”, we can now look nervously towards mid-2016 when, after rates have been hiked by a total of 50bps or so, the elusive correction will finally come, only instead of a “healthy” 10% move to the downside, it may well be a gut wrenching, QE4-inducing firesale. But if the Fed does use a post-hike recessionary tailspin as an excuse to implement yet another round of bond buying (which should please the Boston Fed who, you'll recall, thinks QE should be moved from the "unconventional" policy toolbox into the bin labeled "use as necessary to micromanage business cycle"), expect the diminishing returns which everyone has now become accustomed to associating with QE to be readily apparent. Here's BofAML on why "another round of QE [is] the biggest risk to global equities":

In other words, the Fed is cornered. Normalizing policy rates could well risk destabilizing financial markets and the economy, both of which are addicted to central bank liquidity and haven't seen a rate hike in nearly a decade. But because the Fed needs to at least be able to say it tried to pull off an exit, the FOMC will gingerly tighten until it sees evidence that the wheels are coming off. At that point, the addict will fall off the wagon as the Fed delivers a fresh dose of monetary heroin. The addict, having developed a tolerance, will not respond as planned, necessitating still more QE as the Fed chases the dragon while the BoJ and ECB watch in horror as the future of PSPP and Abenomics suddenly becomes crystal clear. As for what happens next, we'll reiterate our warning from Monday: "If the S&P is cut in half the Fed will launch not just QE4, but 5, 6 and so on, resulting in every other central bank doing the same as global currency war goes nuclear, and the race to the final currency collapse enters its final lap.

|

06-17-15 | STUDIES | 2 - Risk Reversal |

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - June 14th, 2015 - June 20th, 2015 | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

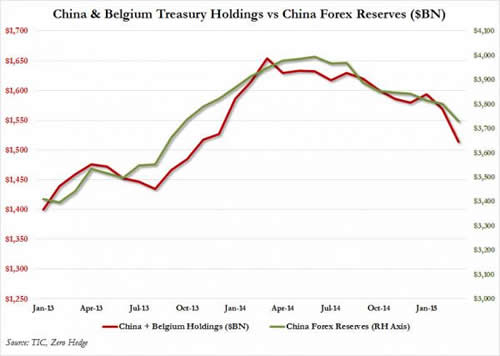

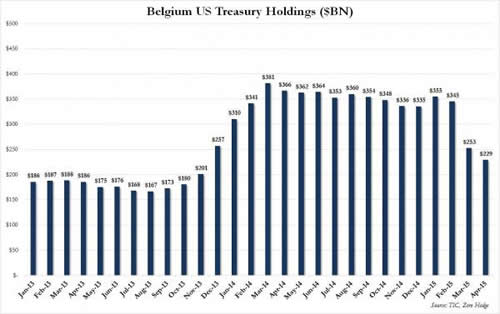

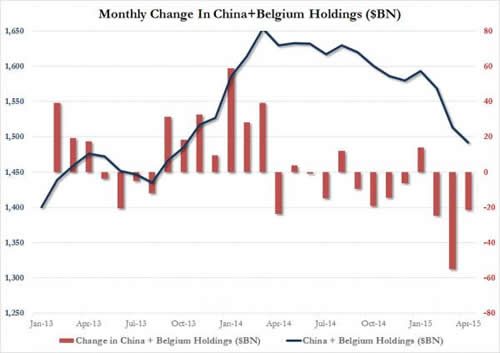

GLOBAL RISK - China Selling US TReasury Holdings - But Who Is Buying? China Dumps Record $120 Billion In US Treasurys In Two Month Via Belgium 06-15-15 ZH Those who have been following the saga of "Belgium's" US Treasury holdings learned last month that the "mysterious buyer" behind Belgium's Euroclear was, as some speculated, China all along. Nowhere was this more evident than when showing an overlay of China and Belgium's combined TSY holdings versus China's forex reserves. This is what we concluded last month:

It wasn't precisely clear just why China, which had historically used UK-based offshore banks to transact in US paper in addition to the mainland, would pick Belgium or why it chose to hide its transactions in such a crude way, however the recent accelerated capital outflow from China manifesting in a plunge in Chinese forex reserves, coupled with a record monthly liquidation in total Chinese holdings, exposed just where China was trading. And while we have yet to get an update from Beijing of its April forex reserves, we know that China's Treasury liquidation has continued. Enter: Belgium, only this time it is not a "mystery" buyer behind the small central European country, but a seller. As the chart below shows, after a record $92.5 billion drop in March, "Belgium" sold another $24 billion in April, bringing the total liquidation to a whopping $116.4 billion for the months of March and April. This means that after adding mainland China's token increase of $2 billion in April after a $37 billion increase the month before, net of Belgium's liquidation China has sold a record $77 billion in Treasurys in the most recent two months. And while we eagerly await the monthly update of Chinese official forex reserves, we can estimate that the drop will be another $50-60 billion in the month of April. The good news, for those tracking the story of China's unprecedented capital outflows, is that after "Belgium's" record March dump, in April Chinese Treasury sales slowed to the slowest pace in the past three months. In other words, China may finally be getting its capital outflow problem under control, which, incidentally is bad news for the Chinese stock market because if true, it means the PBOC can now step back from micro-managing the stock market bubble and its "beneficial" current account inflows to offset the declining capital account. But what is perhaps most curious is that even with China liquidating such a massive amount of US paper into a very illiquid market, the yield on the 10Y did not blow out far more in the months of March or April. And the last question: who did China sell all this paper to? |

06-16-15 | CHINA US MONETARY |

19 - US Reserve Currency |

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

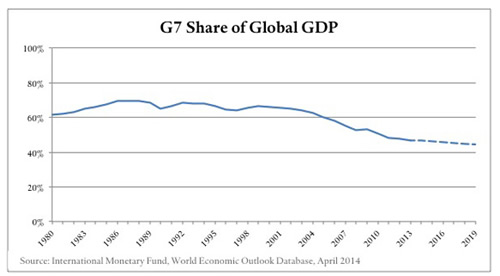

CHINA - Mocks G7 As "Gathering Of Debtors" China Mocks G7 As "Gathering Of Debtors", Warns "Confrontation Will Be A Disaster For Europe" 06-15-15 ZH

Vladimir Putin didn’t get an invite to the Angela Merkel-hosted G7 Summit in Bavaria last week, which means the Russian President not only missed out on two days at the scenic Castle Elmau, but also on lederhosen shopping with US President Barack Obama who, judging from eyewitness accounts and a variety of amusing photo ops, channeled his inner Clark Griswold upon touching down in the Bavarian town of Krun. The G7 isn’t pleased with Russia’s ‘behavior’ in Eastern Europe and so, Moscow has been expelled from the cool kids club until such a time as the Kremlin agrees to uphold Western democratic values. But the G7 is an equal opportunity exclusionist which means it’s not just former superpowers that aren’t welcome, but rising superpowers as well, which means you won’t be seeing Xi Jinping at the table either. But “Big Uncle Xi” (as he is affectionately known in China) likely isn’t losing any sleep because in the eyes of Beijing, the G7 — much like the IMF and the ADB — is a relic of a global economic and political order that is well on its way to obsolescence if it isn’t there already. The Global Times (which, it should be noted, is owned by the ruling Communist Party’s official newspaper, the People’s Daily) has more on why the G7 is largely irrelevant in the modern world. Via The Global Times:

Obviously this is to be taken with a grain of salt considering it comes directly from the politburo, but nevertheless, there are some important observations here that deserve attention. For instance,

Further, the assertion that “the economic performance of G7 members [means] the summit [is] a gathering of debtors” is on the one hand hypocritical (China, after all, is sitting on $28 trillion in debt) but on the other hand speaks to the fact that, even as China’s economic growth slows as Beijing marks a difficult transition from an investment-led economy to a consumption driven model, economic growth in the West has simply stalled out altogether and as for Japan, well, Tokyo has been grappling with a deflationary nightmare for decades, something Abenomics has so far failed to correct. In other words, China’s economic miracle may be “landing hard” so to speak, but there’s certainly an argument to be made that even in its crippled state, the Chinese economic machine is still capable of outperforming the West. Finally, and perhaps most importantly, China suggests Washington’s dominance has led the G7 to pursue myopic foreign policies that have conspired to stoke sectarian chaos in the Middle East (it’s now almost impossible for the US to keep track of where it supports Shiite militias and where it backs Sunni militants) and create the conditions for a second Cold War in Eastern Europe. The deliberate exclusion of Russia, Beijing says, risks transforming the G7 into what is effectively the political arm of NATO, which undercuts the institution's ability the foster peace and cooperation. Again, some of this is propaganda served hot and fresh straight from the Communist Party kitchen. That said, the underlying geopolitical analysis is spot-on even if it's presented with a hyperbolic veneer. The G7, like the IMF and the World Bank, is quickly falling victim to the arrogance of its most powerful members. If an overriding sense of Western exceptionalism is allowed to create the same type of complacency and rigidity that has paralyzed the IMF, it may not be long before the world's emerging powers supplant entrenched political bodies much as they have moved to supersede ineffectual economic institutions.

|

06-16-15 | GLOBAL RISK COLD WAR

CHINA |

GLOBAL MACRO |

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market | |||

| TECHNICALS & MARKET |

|

||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

Cashless Society Needed for Negative RatesBy Greg Hunter On June 14, 2015 In Political Analysis 40 Comments

By Greg Hunter’sUSAWatchdog.com (Early Sunday Release) Macroeconomist Gordon Long says elite bankers want and need negative interest rates. How do they get them? Long says, “We need a cashless society in order to get negative interest rates. We have had negative real interest rates for some time. That’s the whole premise of paying down the government debt by effectively debasing it. But we have run up against a wall, and we have run up against that wall. Clearly, quantitative easing isn’t working.” Long says the bankers are not through distorting the system, and a cashless society is the next step. Long explains, “We are still early in the second or third innings of what’s to come. We are trapped in a globalization trap. With quantitative easing . . . we are bringing demand forward. Debt is nothing but future demand. So, we are really pushing at demand, but we can’t bring anymore forward. In fact, real disposable income is falling. People don’t have money to spend, and jobs are not there. The issue now is not demand. . . .The issue is oversupply. Cheap money doesn’t just allow you to buy something, it also allows producers to produce.” So, will a cashless society put off the next crash? Long says, “We have run out of runway, but never underestimate the ingenuity of a trapped politician and central bankers to come out with new policies and new ways to extend this. We are going to see some pretty violent volatility and corrections. We are going to be in there guaranteeing collateral because our issue is . . . there is a shortage of collateral. The Fed sucked all of the bonds out of the market. There is a shortage of them. So, we have a major liquidity problem. That’s the runway we are running out of, and flows are starting to slow dramatically. Now, that says it’s getting unstable, but that doesn’t mean the world is coming to an end. It does mean we are going to do something else, and one of those things is negative nominal rates and cashless society. That’s the reason why we are going to have a cashless society. You are going to see this (cashless society idea) accelerate in the next six months.” Long predicts, “The next crisis is going to be in sovereign debt, and it’s going to be in the bond market. I think it will stem out of the insurance and pension problem where they can’t fund it. Credit is going to collapse around muni bonds, who are using this money to pay pensions. Yes, we are out of runway. . . . We have north of $200 trillion in debt structures. Right now, it’s paying on average 4% or $8 trillion a year. The global GDP is only $72 trillion. The debt is now consuming our seed corn, so to speak. We are not only eating the seed corn, we are borrowing the money; and at some point, somebody is no longer going to lend you money. That’s kind of where we are right now.” So, is hyperinflation what is coming next? Long says, “It’s coming, but not next. Hyperinflation is a currency event. Hyperinflation is not about prices going up but your currency going down, which means things are more expensive to you. When hyperinflation happens, it is very quick and very short. It is a lack of confidence. What triggers a lack of confidence? All of a sudden, you have an alternative to the debasement in these developed countries. . . . I believe we are going to have more deflation. We are going to have both inflation and deflation, but we are going to have more deflation first because of this oversupply I talked about. Excess supply is going to start to collapse collateral values which are going to hurt assets (bonds held as collateral). I believe, very quickly, that governments will move to guarantee collateral. When that happens, then we get into the hyperinflation. So, there is a down, then a panic and then we go up. We could have a Minsky melt-up, but not Long adds that it will be “2008 all over again, but on steroids.” Join Greg Hunter as he goes One-on-One with financial expert Gordon T. Long. (There is much, much more in the video interview.)

After the Interview:

|

|||

FINANCIAL REPRESSION SPECIAL GUEST: JAYANT BHANDARI is constantly traveling the world looking for investment opportunities, particularly in the natural resource sector. He advises institutional investors about his finds. Earlier, he worked for six years with US Global Investors (San Antonio, Texas), a boutique natural resource investment firm, and for one year with Casey Research. Before emigrating from India, he started and ran Indian subsidiary operations of two European companies. He still travels multiple times a year to India. He is an MBA from Manchester Business School (UK) and B. Engineering from SGSITS (India). He has written on political, economic and cultural issues for the Liberty magazine, the Mises Institute (USA), Mises Institute (Canada), Casey Research, International Man, Mining Journal, Zero Hedge, Lew Rockwell, the Dollar Vigilante, Fraser Institute, Le Québécois Libre, Mauldin Economics, Northern Miner, Mining Markets etc. He is a contributing editor of the Liberty magazine. He runs a yearly seminar in Vancouver titled Capitalism & Morality.

GLOBAL MINING ANALYST JAYANT BHANDARI

"ITS AN OVER SUPPLY PROBLEM!"

FINANCIAL REPRESSION "There are two parts of the world in my opinion. One is the western developed civilization and the other is the non-western civilization. The western civilization was primarily based on reason and respect for the individual. This has considerably deteriorated over the last few decades. Increasingly the coming of the police state in particularly the USA. In the West-European part of the western civilization the regulatory controls have become particularly horrendous as well. The welfare system of these economies is deteriorating these societies now. Culturally the western civilizations are increasingly on a slippery slope." "The non Western civilizations have adopted the consumerism and wealth creating mechanism of the western civilizations, but I am not sure they have really adopted these things properly! Democracy has not done well in these countries. As a result consumerism is making these countries very unstable. The only countries I feel relatively positive about right now are China and some of the smaller countries like Singapore, Hong Kong, Mauritius - these countries are doing very well."

The problem is with the investors who have over-funded mining. They shouldn't have ramped up mining as much as has been done! 'The places to invest are places like Canada, Scandinavia, Australia and parts of South America. You need consistency in the political climate. You want the stability for people to invest billions of dollars in these countries." "I don't think global demand has fallen. If you look at Iron Ore the world is using three times more Iron Ore. The world requires three times more Iron Ore than it used to 10-15 years ago. What is changed is that we have started to supply more commodities than the world demand is there for it. The problem is with the investors who have overfunded mining. They shouldn't have ramped up mining as much as has been done! PERVASIVE GLOBAL OVER-REGULATION "Global western economies are stagnating and this is a direct result of over regulating business in those countries." "Businesses are suffocating in the west now. There is pretty much zero growth. You need to understand the off balance sheet liabilities these businesses have, and continue to increase. They have benefited from technological evolution and the low hanging fruit over the last twenty years." This has now changed. The US$ shows that though the US is deteriorating according to Jayant Bhandari "it is deteriorating slower than the rest of the world!" "Economic repression is a fact of the day everywhere in the world" Where growth is happening it is because of increasing consumerism and this is not good for the future because growth should be happening as a result of the increase in supply of products - which would mean we should be saving more - which would mean we should be producing more than we are consuming!" INCREASINGLY BULLISH ABOUT GOLD "I have never been too bullish about gold but increasingly I am very bullish about gold. The reason is a lot of people misunderstand why Indians buy gold. The reason Indians and Chinese buy so much gold is that for example in India the yield on investment is negative. It pays them to invest in something that gives them positive real yield. In my view India is going to increase its consumption of gold and the Chinese will keep doing it." "Once the US$ becomes too over-valued people will begin putting their money in precious metals!" .... and much more in the video interview. Listen to the whole interview.

AUDIO ONLY - choose an alternate listening method... Please report any

problems |

06-15-15 | THESIS | |

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

I - POLITICAL |

|||

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | THEME | ||

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MACRO w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

III-FINANCIAL |

|||

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP

HARD ASSETS & NATURAL RESOURCES

HARD ASSETS & NATURAL RESOURCES