|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Fri. Feb. 27th , 2015

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

STRATEGIC INVESTMENT INSIGHTS

2015 THESIS: FIDUCIARY FAILURE

2015 THESIS: FIDUCIARY FAILURE

NOW AVAILABLE FREE to Trial Subscribers

174 Pages

What Are Tipping Poinits?

Understanding Abstraction & Synthesis

Global-Macro in Images: Understanding the Conclusions

![]()

| FEBRUARY | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

KEY TO TIPPING POINTS |

| 1 - Risk Reversal |

| 2 - Japan Debt Deflation Spiral |

| 3- Bond Bubble |

| 4- EU Banking Crisis |

| 5- Sovereign Debt Crisis |

| 6 - China Hard Landing |

| 7 - Chronic Unemployment |

| 8 - Geo-Political Event |

| 9 - Global Governance Failure |

| 10 - Chronic Global Fiscal ImBalances |

| 11 - Shrinking Revenue Growth Rate |

| 12 - Iran Nuclear Threat |

| 13 - Growing Social Unrest |

| 14 - US Banking Crisis II |

| 15 - Residential Real Estate - Phase II |

| 16 - Commercial Real Estate |

| 17 - Credit Contraction II |

| 18- State & Local Government |

| 19 - US Stock Market Valuations |

| 20 - Slowing Retail & Consumer Sales |

| 21 - China - Japan Regional Conflict |

| 22 - Public Sentiment & Confidence |

| 23 - US Reserve Currency |

| 24 - Central & Eastern Europe |

| 25 - Oil Price Pressures |

| 26 - Rising Inflation Pressures & Interest Pressures |

| 27 - Food Price Pressures |

| 28 - Global Output Gap |

| 29 - Corruption |

| 30 - Pension - Entitlement Crisis |

| 31 - Corporate Bankruptcies |

| 32- Finance & Insurance Balance Sheet Write-Offs |

| 33 - Resource Shortage |

| 34 - US Reserve Currency |

| 35- Government Backstop Insurance |

| 36 - US Dollar Weakness |

| 37 - Cyber Attack or Complexity Failure |

| 38 - Terrorist Event |

| 39 - Financial Crisis Programs Expiration |

| 40 - Natural Physical Disaster |

| 41 - Pandemic / Epidemic |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

TODAY'S TIPPING POINTS

|

![]() Scroll TWEETS for LATEST Analysis

Scroll TWEETS for LATEST Analysis ![]()

HOTTEST TIPPING POINTS |

Theme Groupings |

|||||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro |

||||||

"BEST OF THE WEEK " |

Posting Date |

Labels & Tags | TIPPING POINT or THEME / THESIS or INVESTMENT INSIGHT |

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

|||||

|

||||||

FLOWS - Liqudity, Credit & Debt QE Is Debt Cancellation02-17-15 Richard Duncan When a central bank prints money and buys a government bond, it is the same thing as cancelling that bond (so long as the central bank does not sell the bond back to the public). That means governments have far less debt than is generally understood. It also has very important policy implications. The new Macro Watch video, QE Is Debt Cancellation, explains in detail how the US central bank earns vast profits on its bond portfolio – and then hands those profits over to the US government, thereby reducing the government’s budget deficit every year. Last year, the Fed gave the government $99 billion. It has given the government $500 billion since 2008. We also look at what this means for other countries. The Bank of England owns 26% of all UK government debt. That means the ratio of government debt to GDP is not 84% as it is reported to be. It is actually 58%. This reality completely undermines the case for growth-retarding austerity in the UK. The Bank of Japan owns Japanese government bonds equivalent to 22% of Japan’s GDP. When it is understood that QE is debt cancellation, the BOJ’s very aggressive Quantitative Easing program makes sense. It may be the only way to prevent a fiscal crisis in Japan. The European Central Bank’s plans to create €1.1 trillion over the next 20 months will effectively cancel the combined budget deficits of the Eurozone national governments in both 2015 and 2016, with a considerable amount left over. Quantitative Easing has only been possible because it has occurred at a time when Globalization is driving down the price of labor and industrial goods. The combination of fiat money and Globalization creates a unique moment in history where the governments of the developed economies can print money on an aggressive scale without causing inflation. They should take advantage of this once-in-history opportunity to borrow more in order to invest in new industries and technologies, to restructure their economies and to retrain and educate their workforce at the post-graduate level. If they do, they could not only end the global economic crisis, but also ensure that the standard of living in the developed world continues to improve, rather than sinking down to third world levels. If you are a Macro Watch subscriber, log in and watch QE Is Debt Cancellation now. If you are a subscriber to my video-newsletter, Macro Watch, log in and learn how the crisis in the global economy will affect you. If not, join here: http://www.gordontlong.com/RichardDuncan/Macrowatch.htm For a 50% subscription discount, hit the “Click Here to Subscribe Now” tab and use the coupon code: flows

|

02-27-15 | FLOWS | FLOWS |

|||

MONETARY POLICY - NIRP Why the Bond Market Is Yielding Negative and What Negative Yields Mean for You PIMCO Negative yields on bonds are no longer unicorns. In Switzerland, Germany, Denmark and several other European countries, government bonds are trading at negative nominal yields. There are four potential reasons that can explain the negative yield conundrum and can also illustrate the trade-offs between different investment strategies. SUPPLY SHORTAGE AS A RESULT OF MONETARY POLICY BUYING

FORECASTING ECONOMIC DECLINE - DEFAULTS & DFLATION

PERFORMANCE METRICS

INVESTMENT HORIZON

As investors, our response to the negative yield conundrum may depend in part on which one of these four explanations is the most important. And since the examples above are not necessarily mutually exclusive, and are, in fact, interrelated, the simple and straightforward solution we would always like to find, as usual, remains elusive. For now, investors should pay close attention to the signals from policy makers, economic data, and anecdotes from other participants to create a flexible framework for investing in a world of negative yields. Despite the uncertainty, there is a logical approach to constructing robust portfolios.

|

02-27-15 | STUDY NIRP |

||||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Feb. 22nd, 2015 - Feb. 28th, 2015 | ||||||

| RISK REVERSAL | 1 | |||||

| JAPAN - DEBT DEFLATION | 2 | |||||

| BOND BUBBLE | 3 | |||||

EU BANKING CRISIS |

4 |

|||||

| SOVEREIGN DEBT CRISIS [Euope Crisis Tracker] | 5 | |||||

CHINA BUBBLE |

6 | |||||

THESIS 2015 - Fiduciary Failure If Debt Was The Problem…

02-22-15 John Rubino

Confounded Interest just posted a nice summary of a McKinsey report on the growth of global debt during what some persist in calling the “great deleveraging.” Turns out that since the crisis of 2008, debt has actually risen by $57 trillion, and the ratio of debt to GDP is up 17 percentage points to 286%. Meanwhile, central banks are monetizing 100% of newly-issued sovereign debt. The obvious response to this is

But unfunded liabilities must be getting better, what with the stocks and bonds in pension fund portfolios soaring lately. Right? Since that’s an effortless Google search, that’s what I did. And the results were both counterintuitive and scary. It seems that even with pension fund investment portfolios booming, obligations to future retirees are rising even faster, making these entities even more underfunded today than in 2007. Here’s a sampling of the headlines just from February, in the order they appear in the search window:

Absent from this list is the US federal government’s number, though that’s also easy to find. From Forbes: You Think The Deficit Is Bad? Federal Unfunded Liabilities Exceed $127 Trillion. That’s about 6 times the reported federal debt. Now, easy money advocates argue that the solution to this and all other unbalanced economic equations is to borrow and spend enough new cash to get asset prices up and put people back to work. But stocks and bonds are currently at record highs and the unemployment rate is below 6% (peak-of-the-cycle kinds of numbers that have historically preceded corrections in which investment returns and tax receipts both plunge, raising unfunded liabilities). So it looks like we’ve thrown our best punch and the problem is still standing there, wondering if that’s all we’ve got. Which leaves the US and the rest of the world — where debt and unfunded liabilities also continue to rise — with the question: If debt was the thing that nearly destroyed the global financial system in 2008 and debt — both narrowly and broadly defined — is way up since then, what happens in the next downturn? The answer is who knows, because this is uncharted territory both in terms of the size of the imbalances and governments’ policy responses. The only thing that’s certain is that there are more cities, states and related pension funds poised to blow up than ever before.

|

02-24-15 | THESIS FIDUCIARY FAILURE |

30 - Pension - Entitlement Crisis | |||

THESIS 2015 - Fiduciary Failure President Obama Explains The "Changes" He'd Like To Make To Retirement Accounts - Live Feed � Speaking at AARP headqusrters in Washington, President Obama will announce ORDERS to the Labor Department to write new rules for financial managers who handle retirement accounts for working Americans. THE COVER

THE AGENDA White House officials said they want new fiduciary standards that would require financial advisers to put clients' interests ahead of their own... and "buy our bonds." We wonder how long before there will be an official asset allocation by dictat...

|

02-24-15 | THESIS FIDUCIARY FAILURE |

30 - Pension - Entitlement Crisis | |||

| TO TOP | ||||||

| MACRO News Items of Importance - This Week | ||||||

GLOBAL MACRO REPORTS & ANALYSIS |

||||||

US ECONOMIC REPORTS & ANALYSIS |

||||||

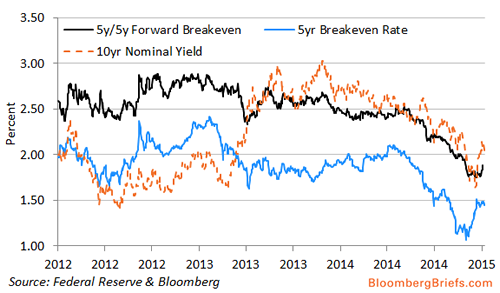

US MONETARY - Humphrey Hawkins Testimony Yellen Secures More Flexibility for 'Patient' Fed Janet Yellen clarified yesterday that while the Fed will remove "patient" from its forward guidance before going ahead with its first rate increase, that change in wording will be insufficient for investors to assume a hike is imminent. The Fed chair's remarks before the Senate Banking Committee suggest a June liftoff remains a distinct possibility and that “patient” is therefore likely to be dropped from the March FOMC statement. There was no new information provided about the post-lift off path of policy. Yellen’s comments featured relatively upbeat assessments of labor conditions, inflation expectations and international risks. This may reflect an attempt to speak for an aggregate FOMC view, rather than detailing the disagreement notable in the January meeting minutes. In discussing forward guidance, Yellen said that “patient” would be removed ahead of any rate hike. While she reiterated the definition of “patient” as meaning “the Committee considered it unlikely that economic conditions will warrant an increase in the target range for the federal funds rate for at least the next couple of meetings,” she also noted that once that key word is removed, the Fed will be evaluating the data on a meeting-by-meeting basis. Her point: removing “patient” does not mean the Fed will hike in two meetings — instead, it will remain data dependent. The effect: giving the FOMC more flexibility to fine-tune the final decision on liftoff. By downplaying “patient,” Yellen is recapitulating a previous strategy of marginalizing an element of forward guidance before removing it. It’s also a reiteration of the FOMC’s theme of data-dependent over calendar-dependent formulations. In discussing the data, Yellen stated that the employment situation “has been improving along many dimensions,” rather than emphasizing underutilization of resources (slack). Here she went into more detail than the January FOMC minutes, which brushed over the improvement in labor conditions and noted that “some” participants saw involuntary part-time work as a sign of considerable remaining slack. Yellen named several key indicators of slack that had seen improvement, including long-term unemployment, involuntary part-time work and the quit rate. The only indicators she called out as lagging were the labor force participation rate and wage growth, so these are likely the labor indicators the FOMC will focus on henceforward. Yellen’s assessment of inflation expectations showed an incrementally positive shading as well. She reiterated the familiar point that survey-based inflation expectations have remained stable, but was more definitive in dismissing the signals from market-based measures of inflation compensation (TIPS breakevens), saying that “as best we can tell… [this] mainly reflects factors other than a reduction in longer-term inflation expectations.” The January FOMC minutes indicated substantial disagreement on this point, but Yellen may be emboldened by the recent rebound in TIPS breakevens — particularly the five-year/five-year forward breakeven rate — and how that move has paralleled a move in the nominal 10-year Treasury yield. The international outlook also received a more positive assessment, with Yellen noting upside risks (from oil-decline tailwinds and foreign central bank stimulus) complementing the widely cited downside risks that the January FOMC minutes listed. Also of note, Yellen did not discuss the strength of the U.S. dollar or how it weighs on exports, as the January minutes did. Finally, Chair Yellen made a few points about the process of raising rates, noting that the FOMC does not intend to actively manage its balance sheet during “policy normalization.” This could be a blow to St. Louis Fed President James Bullard’s idea of dynamically managing the reinvestment of principal from securities maturing out of the Fed’s QE portfolio. Instead, she said, the FOMC will reduce its securities holdings in a “gradual and predictable manner.” Conceivably, that would leave some room for smoothing the Fed’s maturities, but the general thrust of these comments was clearly toward a vanilla approach to both the Fed’s balance sheet and rate-raising tools, consistent with previous official FOMC communications. Market-Based Inflation Expectations on the Rebound

|

02-26-15 | US MONETARY | US ECONOMICS |

|||

US MONETARY - Audit the Fed During testimony before Congress , she made “central bank independence” sound like it was the holy grail. Michael Snyder - The End of The American Dream blog 02-25-15 Janet Yellen is very alarmed that some members of Congress want to conduct a comprehensive audit of the Federal Reserve for the first time since it was created. If the Fed is doing everything correctly, why should Yellen be alarmed? What does she have to hide? During testimony before Congress on Tuesday, she made “central bank independence” sound like it was the holy grail. Even though every other government function is debated politically in this country, Yellen insists that what the Federal Reserve does is “too important” to be influenced by the American people. Does any other government agency ever dare to make that claim? But of course the Federal Reserve is not a government agency. It is a private banking cartel that has far more power over our money and our economy than anyone else does. And later on in this article I am going to share with you dozens of reasons why Congress should shut it down. The immense power wielded by the Federal Reserve is clearly demonstrated whenever Janet Yellen speaks publicly. On Tuesday, her comments about interest rates sent stocks to brand new record highs…

But Yellen was also unusually defensive on Tuesday. The “Audit the Fed” bill that is being sponsored by Rand Paul (among others) has her really freaked out. The following comes from the Hill…

In fact, she went so far as to mention the “Audit the Fed” bill by name…

So what is she so concerned about? We are all accountable to someone. What is so wrong about the Federal Reserve being accountable to Congress? Why can’t we find out what is really going on inside the Fed? And of course it isn’t just Yellen that is freaking out. Just consider these comments from Richard Fisher, the president of the Federal Reserve Bank of Dallas…

Obviously this is a very, very touchy subject over at the Fed. It is quite clear that they do not want the rest of us to be able to see what they are really up to. And the truth is that if the American people really did know how the Federal Reserve works and what it has been doing behind closed doors, most Americans would want it shut down tomorrow. At the end of the day, the reality of the matter is that we don’t even need a Federal Reserve. I really like how David Stockman made this point the other day…

The Federal Reserve has been around for just over a hundred years, and it has done an absolutely abysmal job for the American people. I want to share with you some facts and figures that I have shared before, but they bear repeating. Please share this list of 100 reasons why the Federal Reserve should be shut down with everyone that you know… #1 We like to think that we have a government “of the people, by the people, for the people”, but the truth is that an unelected, unaccountable group of central planners has far more power over our economy than anyone else in our society does. #2 The Federal Reserve is actually “independent” of the government. In fact, the Federal Reserve has argued vehemently in federal court that it is “not an agency” of the federal government and therefore not subject to the Freedom of Information Act. #3 The Federal Reserve openly admits that the 12 regional Federal Reserve banks are organized “much like private corporations“. #4 The regional Federal Reserve banks issue shares of stock to the “member banks” that own them. #5 100% of the shareholders of the Federal Reserve are private banks. The U.S. government owns zero shares. #6 The Federal Reserve is not an agency of the federal government, but it has been given power to regulate our banks and financial institutions. This should not be happening. #7 According to Article I, Section 8 of the U.S. Constitution, the U.S. Congress is the one that is supposed to have the authority to “coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures”. So why is the Federal Reserve doing it? #8 If you look at a “U.S. dollar”, it actually says “Federal Reserve note” at the top. In the financial world, a “note” is an instrument of debt. #9 In 1963, President John F. Kennedy issued Executive Order 11110 which authorized the U.S. Treasury to issue “United States notes” which were created by the U.S. government directly and not by the Federal Reserve. He was assassinated shortly thereafter. #10 Many of the debt-free United States notes issued under President Kennedy are still in circulation today. #11 The Federal Reserve determines what levels some of the most important interest rates in our system are going to be set at. In a free market system, the free market would determine those interest rates. #12 The Federal Reserve has become so powerful that it is now known as “the fourth branch of government“. #13 The greatest period of economic growth in U.S. history was when there was no central bank. #14 The Federal Reserve was designed to be a perpetual debt machine. The bankers that designed it intended to trap the U.S. government in a perpetual debt spiral from which it could never possibly escape. Since the Federal Reserve was established 100 years ago, the U.S. national debt has gotten more than 5000 times larger. #15 A permanent federal income tax was established the exact same year that the Federal Reserve was created. This was not a coincidence. In order to pay for all of the government debt that the Federal Reserve would create, a federal income tax was necessary. The whole idea was to transfer wealth from our pockets to the federal government and from the federal government to the bankers. #16 The period prior to 1913 (when there was no income tax) was the greatest period of economic growth in U.S. history. #17 Today, the U.S. tax code is about 13 miles long. #18 From the time that the Federal Reserve was created until now, the U.S. dollar has lost 98 percent of its value. #19 From the time that President Nixon took us off the gold standard until now, the U.S. dollar has lost 83 percent of its value. #20 During the 100 years before the Federal Reserve was created, the U.S. economy rarely had any problems with inflation. But since the Federal Reserve was established, the U.S. economy has experienced constant and never ending inflation. #21 In the century before the Federal Reserve was created, the average annual rate of inflation was about half a percent. In the century since the Federal Reserve was created, the average annual rate of inflation has been about 3.5 percent. #22 The Federal Reserve has stripped the middle class of trillions of dollars of wealth through the hidden tax of inflation. #23 The size of M1 has nearly doubled since 2008 thanks to the reckless money printing that the Federal Reserve has been doing. #24 The Federal Reserve has been starting to behave like the Weimar Republic, and we all remember how that ended. #25 The Federal Reserve has been consistently lying to us about the level of inflation in our economy. If the inflation rate was still calculated the same way that it was back when Jimmy Carter was president, the official rate of inflation would be somewhere between 8 and 10 percent today. #26 Since the Federal Reserve was created, there have been 18 distinct recessions or depressions: 1918, 1920, 1923, 1926, 1929, 1937, 1945, 1949, 1953, 1958, 1960, 1969, 1973, 1980, 1981, 1990, 2001, 2008. #27 Within 20 years of the creation of the Federal Reserve, the U.S. economy was plunged into the Great Depression. #28 The Federal Reserve created the conditions that caused the stock market crash of 1929, and even Ben Bernanke admits that the response by the Fed to that crisis made the Great Depression even worse than it should have been. #29 The “easy money” policies of former Fed Chairman Alan Greenspan set the stage for the great financial crisis of 2008. #30 Without the Federal Reserve, the “subprime mortgage meltdown” would probably never have happened. #31 If you can believe it, there have been 10 different economic recessions since 1950. The Federal Reserve created the “dotcom bubble”, the Federal Reserve created the “housing bubble” and now it has created the largest bond bubble in the history of the planet. #32 According to an official government report, the Federal Reserve made 16.1 trillion dollars in secret loans to the big banks during the last financial crisis. The following is a list of loan recipients that was taken directly from page 131 of the report…

#33 The Federal Reserve also paid those big banks $659.4 million in “fees” to help “administer” those secret loans. #34 During the last financial crisis, big European banks were allowed to borrow an “unlimited” amount of money from the Federal Reserve at ultra-low interest rates. #35 The “easy money” policies of Federal Reserve Chairman Ben Bernanke have created the largest financial bubble this nation has ever seen, and this has set the stage for the great financial crisis that we are rapidly approaching. #36 Since late 2008, the size of the Federal Reserve balance sheet has grown from less than a trillion dollarsto more than 4 trillion dollars. This is complete and utter insanity. #37 During the quantitative easing era, the value of the financial securities that the Fed has accumulated is greater than the total amount of publicly held debt that the U.S. government accumulated from the presidency of George Washington through the end of the presidency of Bill Clinton. #38 Overall, the Federal Reserve now holds more than 32 percent of all 10 year equivalents. #39 Quantitative easing creates financial bubbles, and when quantitative easing ends those bubbles tend to deflate rapidly. #40 Most of the new money created by quantitative easing has ended up in the hands of the very wealthy. #41 According to a prominent Federal Reserve insider, quantitative easing has been one giant “subsidy” for Wall Street banks. #42 As one CNBC article stated, we are seeing absolutely rampant inflation in “stocks and bonds and art and Ferraris“. #43 Donald Trump once made the following statement about quantitative easing: “People like me will benefit from this.” #44 Most people have never heard about this, but a very interesting study conducted for the Bank of England shows that quantitative easing actually increases the gap between the wealthy and the poor. #45 The gap between the top one percent and the rest of the country is now the greatest that it has beensince the 1920s. #46 The mainstream media has sold quantitative easing to the American public as an “economic stimulus program”, but the truth is that the percentage of Americans that have a job has actually gone down since quantitative easing first began. #47 The Federal Reserve is supposed to be able to guide the nation toward “full employment”, but the reality of the matter is that an all-time record 102 million working age Americans do not have a job right now. That number has risen by about 27 million since the year 2000. #48 For years, the projections of economic growth by the Federal Reserve have consistently overstatedthe strength of the U.S. economy. But every single time, the mainstream media continues to report that these numbers are “reliable” even though all they actually represent is wishful thinking. #49 The Federal Reserve system fuels the growth of government, and the growth of government fuels the growth of the Federal Reserve system. Since 1970, federal spending has grown nearly 12 times as rapidlyas median household income has. #50 The Federal Reserve is supposed to look out for the health of all U.S. banks, but the truth is that they only seem to be concerned about the big ones. In 1985, there were more than 18,000 banks in the United States. Today, there are only 6,891 left. #51 The six largest banks in the United States (JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, Goldman Sachs and Morgan Stanley) have collectively gotten 37 percent larger over the past five years. #52 The U.S. banking system has 14.4 trillion dollars in total assets. The six largest banks now account for67 percent of those assets and all of the other banks account for only 33 percent of those assets. #53 The five largest banks now account for 42 percent of all loans in the United States. #54 We were told that the purpose of quantitative easing is to help “stimulate the economy”, but today the Federal Reserve is actually paying the big banks not to lend out 1.8 trillion dollars in “excess reserves” that they have parked at the Fed. #55 The Federal Reserve has allowed an absolutely gigantic derivatives bubble to inflate which could destroy our financial system at any moment. Right now, four of the “too big to fail” banks each have total exposure to derivatives that is well in excess of 40 trillion dollars. #56 The total exposure that Goldman Sachs has to derivatives contracts is more than 381 times greaterthan their total assets. #57 Federal Reserve Chairman Ben Bernanke has a track record of failure that would make the Chicago Cubs look good. #58 The secret November 1910 gathering at Jekyll Island, Georgia during which the plan for the Federal Reserve was hatched was attended by U.S. Senator Nelson W. Aldrich, Assistant Secretary of the Treasury Department A.P. Andrews and a whole host of representatives from the upper crust of the Wall Street banking establishment. #59 The Federal Reserve was created by the big Wall Street banks and for the benefit of the big Wall Street banks. #60 In 1913, Congress was promised that if the Federal Reserve Act was passed that it would eliminate the business cycle. #61 There has never been a true comprehensive audit of the Federal Reserve since it was created back in 1913. #62 The Federal Reserve system has been described as “the biggest Ponzi scheme in the history of the world“. #63 The following comes directly from the Fed’s official mission statement: “To provide the nation with a safer, more flexible, and more stable monetary and financial system.” Without a doubt, the Federal Reserve has failed in those tasks dramatically. #64 The Fed decides what the target rate of inflation should be, what the target rate of unemployment should be and what the size of the money supply is going to be. This is quite similar to the “central planning” that goes on in communist nations, but very few people in our government seem upset by this. #65 A couple of years ago, Federal Reserve officials walked into one bank in Oklahoma and demanded that they take down all the Bible verses and all the Christmas buttons that the bank had been displaying. #66 The Federal Reserve has taken some other very frightening steps in recent years. For example, back in 2011 the Federal Reserve announced plans to identify “key bloggers” and to monitor “billions of conversations” about the Fed on Facebook, Twitter, forums and blogs. Someone at the Fed will almost certainly end up reading this article. #67 Thanks to this endless debt spiral that we are trapped in, a massive amount of money is transferred out of our pockets and into the pockets of the ultra-wealthy each year. Incredibly, the U.S. government spentmore than 415 billion dollars just on interest on the national debt in 2013. #68 In January 2000, the average rate of interest on the government’s marketable debt was 6.620 percent. If we got back to that level today, we would be paying more than a trillion dollars a year just in interest on the national debt and it would collapse our entire financial system. #69 The American people are being killed by compound interest but most of them don’t even understand what it is. Albert Einstein once made the following statement about compound interest…

#70 Most Americans have absolutely no idea where money comes from. The truth is that the Federal Reserve just creates it out of thin air. The following is how I have previously described how money is normally created by the Fed in our system…

#71 What does the Federal Reserve do with those U.S. Treasury bonds? They end up getting auctioned offto the highest bidder. But this entire process actually creates more debt than it does money…

#72 Of course the U.S. government could actually create money and spend it directly into the economy without the Federal Reserve being involved at all. But then we wouldn’t be 17 trillion dollars in debt and that wouldn’t serve the interests of the bankers at all. #73 The following is what Thomas Edison once had to say about our absolutely insane debt-based financial system…

#74 The United States now has the largest national debt in the history of the world, and we are stealing roughly 100 million dollars from our children and our grandchildren every single hour of every single day in a desperate attempt to keep the debt spiral going. #75 Thomas Jefferson once stated that if he could add just one more amendment to the U.S. Constitution it would be a ban on all government borrowing…

#76 At this moment, the U.S. national debt is sitting at $18,141,409,083,212.36. If we had followed the advice of Thomas Jefferson, it would be sitting at zero. #77 When the Federal Reserve was first established, the U.S. national debt was sitting at about 2.9 billion dollars. On average, we have been adding more than that to the national debt every single day since Obama has been in the White House. #78 We are on pace to accumulate more new debt under the 8 years of the Obama administration than we did under all of the other presidents in all of U.S. history combined. #79 If all of the new debt that has been accumulated since John Boehner became Speaker of the House had been given directly to the American people instead, every household in America would have been able to buy a new truck. #80 Between 2008 and 2012, U.S. government debt grew by 60.7 percent, but U.S. GDP only grew by a total of about 8.5 percent during that entire time period. #81 Since 2007, the U.S. debt to GDP ratio has increased from 66.6 percent to 101.6 percent. #82 According to the U.S. Treasury, foreigners hold approximately 5.6 trillion dollars of our debt. #83 The amount of U.S. government debt held by foreigners is about 5 times larger than it was just a decade ago. #84 As I have written about previously, if the U.S. national debt was reduced to a stack of one dollar bills it would circle the earth at the equator 45 times. #85 If Bill Gates gave every single penny of his entire fortune to the U.S. government, it would only cover the U.S. budget deficit for 15 days. #86 Sometimes we forget just how much money a trillion dollars is. If you were alive when Jesus Christ was born and you spent one million dollars every single day since that point, you still would not have spent one trillion dollars by now. #87 If right this moment you went out and started spending one dollar every single second, it would take you more than 31,000 years to spend one trillion dollars. #88 In addition to all of our debt, the U.S. government has also accumulated more than 200 trillion dollarsin unfunded liabilities. So where in the world will all of that money come from? #89 The greatest damage that quantitative easing has been causing to our economy is the fact that it is destroying worldwide faith in the U.S. dollar and in U.S. debt. If the rest of the world stops using our dollars and stops buying our debt, we are going to be in a massive amount of trouble. #90 Over the past several years, the Federal Reserve has been monetizing a staggering amount of U.S. government debt even though Ben Bernanke once promised that he would never do this. #91 China recently announced that they are going to quit stockpiling more U.S. dollars. If the Federal Reserve was not recklessly printing money, this would probably not have happened. #92 Most Americans have no idea that one of our most famous presidents was absolutely obsessed with getting rid of central banking in the United States. The following is a February 1834 quote by President Andrew Jackson about the evils of central banking…

#93 There are plenty of possible alternative financial systems, but at this point all 187 nations that belong to the IMF have a central bank. Are we supposed to believe that this is just some sort of a bizarre coincidence? #94 The capstone of the global central banking system is an organization known as the Bank for International Settlements. The following is how I described this organization in a previous article…

#95 The borrower is the servant of the lender, and the Federal Reserve has turned all of us into debt slaves. #96 Debt is a form of social control, and the global elite use all of this debt to dominate all the rest of us. 40 years ago, the total amount of debt in our system (all government debt, all business debt, all consumer debt, etc.) was sitting at about 2 trillion dollars. Today, the grand total exceeds 56 trillion dollars. #97 Unless something dramatic is done, our children and our grandchildren will be debt slaves for their entire lives as they service our debts and pay for our mistakes. #98 Now that you know this information, you are responsible for doing something about it. #99 Congress has the power to shut down the Federal Reserve any time that it would like. But right now most of our politicians fully endorse the current system, and nothing is ever going to happen until the American people start demanding change. #100 The design of the Federal Reserve system was flawed from the very beginning. If something is not done very rapidly, it is inevitable that our entire financial system is going to suffer an absolutely nightmarish collapse. |

02-26-15 | US MONETARY | US ECONOMICS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | ||||||

| Market | ||||||

| TECHNICALS & MARKET |

|

|||||

| STUDIES POTENTIAL TO SPOOK THE MARKETS | ||||||

RISK - Excessive but Doesn't Mean Markets Are Bout To Fall THE POTENTIAL TO SPOOK THE MARKETS EARNINGS REVISIONS FORWARD VALUATIONS Highest Forward 12-Month P/E Ratio for S&P 500 since 2004 02-20-15- FactSet

The Last 3 Times This Happened, Stocks Rolled Over 02-24-15 Zero Hedge

|

02-25-15 | STUDIES POTENTIAL TO SPOOK MARKETS

Ca |

||||

| A SIX YEAR BULL RUN COMING TO AN END IN 2ND HALF 2015? | ||||||

REMEMBERING - This Reminds Me of 1987 & 2000 A SIX YEAR BULL RUN COMING TO AN END IN 2ND HALF 2015?

The bad news threatening to capsize what’s shaping up to a roughly seven-year bull-market run in U.S. equities. Here are the 10 risks investors fret about the most:

|

02-25-15 | STUDY REMINDS ME OF 1987 & 2000 |

||||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | |||||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | |||||

| THESIS | ||||||

| 2014 - GLOBALIZATION TRAP | 2014 |  |

||||

|

2013 2014 |

||||||

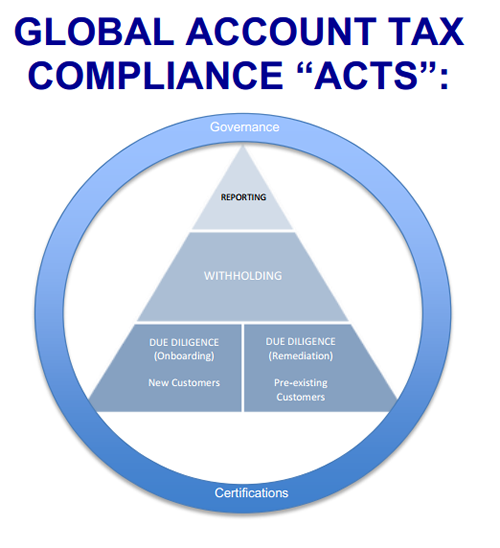

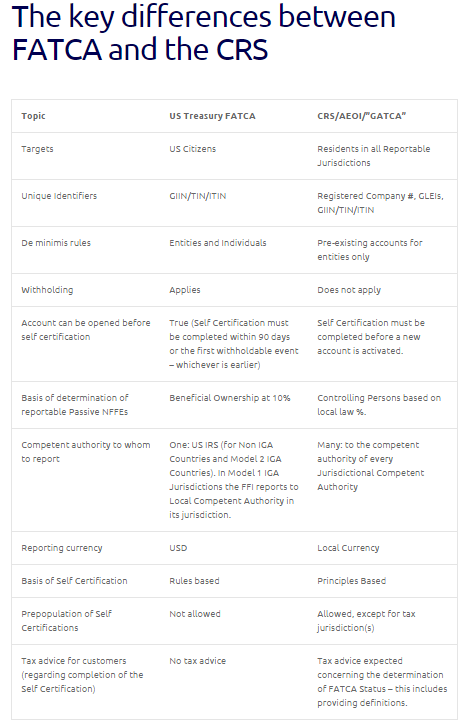

FIRST FATCA - Next GATCA "This a modern day "Doomsday" Book, the same as William the Conqueror Implemented in 1066 after conquering England. He needed to know where the wealth was so he could tax it" "This is Not Really About Tax There are Easier Ways to Solve Tax Tracking - Its about a Common Reporting Standard. Its about the ability to track Capital" "FATCA is a decoy for the Common Reporting Standard" "There is an incredibly aggressive urgency of implementation - an unprecedentedly quick agreement between 57 governments"

Why? Either to Tax it , Expropriation it or Control Its Free Movement

"Era of Banking Secrecy is Over!" "A Complete Misunderstanding by Banks" NEW ACRONYMS IN THE ERA OF FINANCIAL REPRESSION

THE ROAD AHEAD: FATCA, IGAS AND THE CRS The costs of FATCA Compliance will be USD 1 to 2 trillion worldwide. The bulk of these costs will be incurred in the customer outreach required to obtain the required documentation. There will also be considerable customer backlash to FATCA and the documentation it requires. In the age of social media this matters, if this sounds like hyperbole please have a look at this URL At a most basic level FATCA, the IGAs and the CRS are about making tax part of standard KYC/AML procedures and then reporting, for tax purposes, to those jurisdictions, in which the account holder has tax residence or citizenship.

EVERYTHING YOU NEED TO KNOW ABOUT GATCA / FATCA

|

02-23-15 | THESIS | ||||

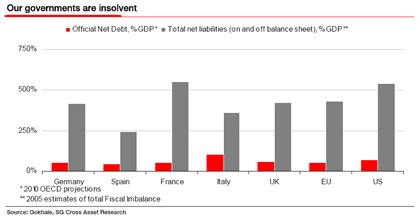

GRAHAM SUMMERS on Financial Repression "QE was never meant to create jobs or generate economic growth… it was a desperate ploy by Central Banks to put a floor under the bond market so rates wouldn’t rise. ... It’s also why Central Banks have kept interest rates at zero or even negative. They cannot afford to have rates rise. In the US, every 1% increase in interest rates means between $150-$175 billion more in interest payments on our debt per year. As Dylan Grice from Societe General notes: when you include unfunded liabolities, this problem is endemic throughout the Western world and has been for years.

|

02-23-15 | THESIS | ||||

2011 2012 2013 2014 |

||||||

| THEMES | ||||||

| FLOWS -FRIDAY FLOWS | THEME | |||||

| SHADOW BANKING -LIQUIDITY / CREDIT ENGINE | THEME | |||||

| CRACKUP BOOM - ASSET BUBBLE | THEME | |||||

| ECHO BOOM - PERIPHERAL PROBLEM | THEME | |||||

| PRODUCTIVITY PARADOX -NATURE OF WORK | THEME | |||||

| STANDARD OF LIVING -EMPLOYMENT CRISIS | THEME | |||||

| CORPORATOCRACY -CRONY CAPITALSIM | THEME |  |

||||

CORRUPTION & MALFEASANCE -MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

||||

| SOCIAL UNREST -INEQUALITY & A BROKEN SOCIAL CONTRACT | THEME | |||||

| SECURITY-SURVEILLANCE COMPLEX -STATISM | THEME | |||||

| GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | THEME | |||||

| CENTRAL PLANINNG -SHIFTING ECONOMIC POWER | THEME | |||||

| CATALYSTS -FEAR & GREED | THEME | |||||

| GENERAL INTEREST |

|

|||||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | ||||||

|

SII | |||||

|

SII | |||||

|

SII | |||||

|

SII | |||||

| TO TOP | ||||||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP