|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Wed. Feb. 18th , 2015

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

STRATEGIC INVESTMENT INSIGHTS

2015 THESIS: FIDUCIARY FAILURE

2015 THESIS: FIDUCIARY FAILURE

NOW AVAILABLE FREE to Trial Subscribers

174 Pages

What Are Tipping Poinits?

Understanding Abstraction & Synthesis

Global-Macro in Images: Understanding the Conclusions

![]()

| FEBRUARY | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

KEY TO TIPPING POINTS |

| 1 - Risk Reversal |

| 2 - Japan Debt Deflation Spiral |

| 3- Bond Bubble |

| 4- EU Banking Crisis |

| 5- Sovereign Debt Crisis |

| 6 - China Hard Landing |

| 7 - Chronic Unemployment |

| 8 - Geo-Political Event |

| 9 - Global Governance Failure |

| 10 - Chronic Global Fiscal ImBalances |

| 11 - Shrinking Revenue Growth Rate |

| 12 - Iran Nuclear Threat |

| 13 - Growing Social Unrest |

| 14 - US Banking Crisis II |

| 15 - Residential Real Estate - Phase II |

| 16 - Commercial Real Estate |

| 17 - Credit Contraction II |

| 18- State & Local Government |

| 19 - US Stock Market Valuations |

| 20 - Slowing Retail & Consumer Sales |

| 21 - China - Japan Regional Conflict |

| 22 - Public Sentiment & Confidence |

| 23 - US Reserve Currency |

| 24 - Central & Eastern Europe |

| 25 - Oil Price Pressures |

| 26 - Rising Inflation Pressures & Interest Pressures |

| 27 - Food Price Pressures |

| 28 - Global Output Gap |

| 29 - Corruption |

| 30 - Pension - Entitlement Crisis |

| 31 - Corporate Bankruptcies |

| 32- Finance & Insurance Balance Sheet Write-Offs |

| 33 - Resource Shortage |

| 34 - US Reserve Currency |

| 35- Government Backstop Insurance |

| 36 - US Dollar Weakness |

| 37 - Cyber Attack or Complexity Failure |

| 38 - Terrorist Event |

| 39 - Financial Crisis Programs Expiration |

| 40 - Natural Physical Disaster |

| 41 - Pandemic / Epidemic |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

TODAY'S TIPPING POINTS

|

![]() Scroll TWEETS for LATEST Analysis

Scroll TWEETS for LATEST Analysis ![]()

Read More - OUR RESEARCH - Articles Below

HOTTEST TIPPING POINTS |

Theme Groupings |

|||||||||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro |

||||||||||

"BEST OF THE WEEK " |

Posting Date |

Labels & Tags | TIPPING POINT or THEME / THESIS or INVESTMENT INSIGHT |

|||||||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

|||||||||

| STUDIES - MACRO pdf - THE 'MORAL HAZARD RISK' OF CENTRAL BANK INTERVENTION | ||||||||||

FLOWS - The impact of a liquidity bubble on Price and Risk The following chart, courtesy of Citigroup, demonstrating the liquidity cliff i.e., the impact of a liquidity bubble on price and risk, is so mindbogglingly simple, it is no wonder that virtually nobody gets it. As Citi observes, all a liquidity tsunami does for credit, as well as for equity, is to perpetuate the illusion of maximum pricing while shifting the risk curve to the point where any deviation from "perfection" - or loss of faith in the liquidity or its providers (as in central banks who in 2015 are finally going "all in") will ultimately lead to an instantaneous waterfall in price. Which also explains why lately the exchanges have all been practicing how to most efficiently shut down when the "waterfall" moment arrives. Because if there is no market, one simply can't sell. |

02-18-15 | THEMES - FLOWS

|

||||||||

DEFINITION OF 'ALPHA'

INVESTOPEDIA EXPLAINS 'ALPHA'

|

02-18-15 | RISK CANARIES |

||||||||

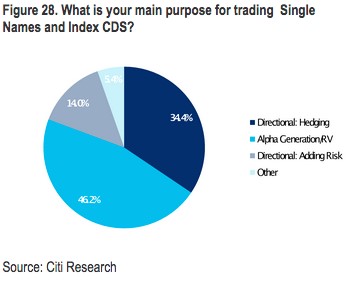

RISK - Derivatives Now Used For "Alpha Generation" Derivatives: No Longer Used For Hedging But Exclusively For "Alpha Generation" 02-14-15 Zero Hedge Maybe the pervasive “this time is always different” meme has been perpetuated to the point that the market actually believes it, or maybe it’s just old fashioned greed, but whatever the case, market participants (and this means central banks, retail investors, and everyone in between) have an extraordinary inclination towards Einsteinian insanity. Never mind, for instance, that the Fed’s attempts to “smooth out the business cycle” (breaking it in the process) have everywhere and always served only to create bigger and bigger bubbles that have led, invariably, to crashes that are ever more spectacular/devastating - what we need is more intervention by central planners bankers. Forget the fact that throughout the course of human history, minting endless amounts of fiat currency always fails - in the words of new BOJ board member Yutaka Harada, “we just need to print more money.” And certainly pay no attention (despite the tendency for these types of discrepancies to self-correct) to the divergence between the S&P and trivial things like the U.S. macro picture and/or forward earnings estimates... ... the U.S. economy is the cleanest dirty shirt and Jeremy Siegel is probably contemplating Dow 40K as we speak, so just hold your nose and buy. Given this steadfast refusal to learn from yesterday’s mistakes, it isn’t any wonder that when Citi recently surveyed 43 banks, 29 asset managers, and 31 hedge funds regarding their outlook for the credit derivatives market in 2015, the consensus was that “there seems to be plenty of room and enthusiasm to use derivatives to take leveraged risk." Phew: for a minute there it looked like leveraged risk taking with derivatives might go the way of the Dodo in the post-crisis world, making Bruno Iksil the last great example of how much fun one can have stomping around in off-the-run CDS indices with depositors’ money. It’s also comforting to know that among those Citi surveyed, the general consensus was that "...there seems to have been a shift from using derivatives as a hedging tool, to using them more for alpha generation [as] most products are now used more for adding risk and directional views." So investment professionals and sophisticated market participants are quite eager to take leveraged risk with derivatives with an eye not towards “hedging” (i.e. mitigating risk), but towards “alpha generation” and expressing “directional views” (i.e. gambling). In fact, nearly two-thirds of those surveyed listed either “alpha generation” or “adding risk” as the primary reason for trading single-name and index CDS:

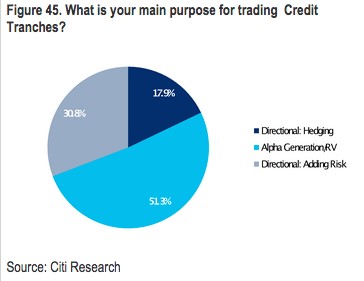

For credit tranches, the combined figure was 82%:

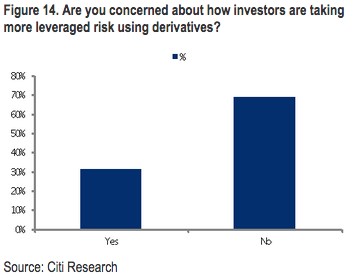

The takeaway: banks and “sophisticated” investors are increasingly eager to take leveraged risk with derivatives in order to make directional bets on credit spreads. That certainly sounds like a pre-crisis mentality to us and it naturally won’t end well if the (re)proliferation of risk-taking via these instruments manages to embed an outsized amount of counterparty risk in the system. Finally, in what surely was an effort to furnish readers with a bit of comic relief, Citi asked respondents if they “were concerned about investors taking more levered risks using derivatives” (here’s where one can gauge the extent to which those we entrust with our investments took the lessons of 2008 seriously). The results:

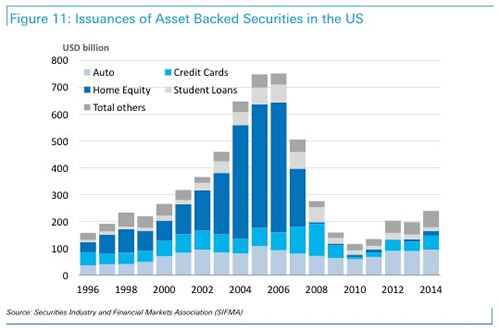

* * * Bonus chart: Other types of structured products are making a comeback as well, with ABS issuance (backed by everything from car loans to student debt) hitting its highest level since 2008: |

02-18-15 | RISK CANARIES |

||||||||

RISK - Risk Ratios Tell Us things Are Not As They Appear What Risk? "The Spoils Go To The Ignorant Only - The Fed's True Heroes" 02-16-15 Submitted by Dominique Dassault via GlobalSlant.com, via ZH Headline: Equity Risk Is Increasingly Non-Existent…By The Numbers The concept of risk for hedge fund managers is a constant concern. The only real metrics I care to focus on are

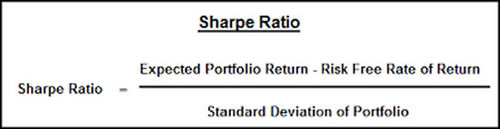

SHARPE RATIO Most clients could not care less about risk adjusted returns…but I sure do. And, as many are aware, the holy grail of risk metrics is the Sharpe Ratio [as calculated according to the title of this post]. The most interesting precept of the Sharpe Ratio, in my opinion, is that it treats volatility as random…both upside and downside volatility. No way to predict it in either direction so both directions are assigned the same discounting value. Basically, according to Bill Sharpe, all volatility is a penalty against your performance. I get it. SORTINO RATIO Still, in a perfect world, what if most of the volatility experienced by a portfolio of equities was actually favorable? So rare…if not impossible…but still at least worthy of consideration. And so the Sortino Ratio [or as I refer to it as the Gain/Pain Ratio] was born…essentially, it is exactly as the Sharpe Ratio but stratifies favored and un-favored volatility. Favorable volatility is not penalized. Unfavorable volatility is scored as a legitimate demerit. It has always seemed fairer to me. Naturally, both ratios are relevant and higher values for both measurements reflect better risk-adjusted returns. And portfolio managers realize that, no matter the ratio, both need to positive…or you are losing money. However, given full investment of capital, the Sharpe Ratio can be strongly positive yet still not offer high absolute returns. Conversely, if your Sortino Ratio is high, you are probably delivering very strong absolute returns…again, assuming full investment of capital. ************************************************************ Given all of this…What is a good numerical value for both ratios? Generally, over time, any value > 1.5 is pretty good and numbers > 2.0 are stellar. Be advised the data may vacillate, a little bit, based on the time frame used in your calculation i.e. weekly or monthly. Recently I constructed a model that required one, three and five year Sharpe Ratios for the S&P 500. I also decided to include the Sortino Ratio. Prior to the results I hypothesized that the numbers ought to be pretty impressive given the endless equity “bull” since March 2009 but I was still curious to get the exact data. Plus, a weekly price chart of the S&P 500, since 2009, visually reflects the anomaly of very limited draw-downs in the context of extremely strong returns. The calculations are as follows and as Mrs. Doubtfire once said…“Effie…Brace Yourself”. Sharpe Ratio 1 Year = 1.37 3 Year = 1.86 5 Year =1.0 Sortino Ratio 1 Year = 2.65 3 Year = 3.41 5 Year = 1.69 Collectively, these numbers are clearly impressive but even more so in that they are calculated from a passive, long only strategy. This is a hedge fund manager’s worst nightmare as, for five years, most “hedging” has proved to be only performance degrading. Furthermore, the Sortino Ratio data are nothing short of staggering. What they really say = Plenty of Gain with Very Little Pain.…and it really is unsustainable if only because it has become much too easy to generate positive returns with very little effort, pain or savvy. ************************************************************ It actually seems, at times, as though there is this mysteriously large buyer that suddenly appears whenever the equity market most “needs it”... and the subsequent buying is so aggressive and so desperate... not the style of the mostly steady “hands” I personally know. It just seems too good to be true and the Sortino Ratio numerically reflects that belief. Plus, we all know that the economic fundamentals are not as smooth as the weekly or monthly charts of the S&P 500 would suggest.

To be sure these distorting effects may be entirely assigned to The Fed... the debt monetizing, interest rate suppressing “Masters of the Universe” who always GET WHAT THEY WANT while answering to nobody. They’ve literally trounced and expectorated on the concept of “MORAL HAZARD” and, it seems, purposely reconfigured and redefined its meaning into: WE HAVE NO ECONOMIC MORALS AND THIS POSES AN ENORMOUS HAZARD TO THE PERFORMANCE OF HEDGED MONEY MANAGERS. THE SPOILS GO TO THE IGNORANT ONLY…THE FED’S TRUE HEROES. |

02-18-15 | RISK CANARIES |

||||||||

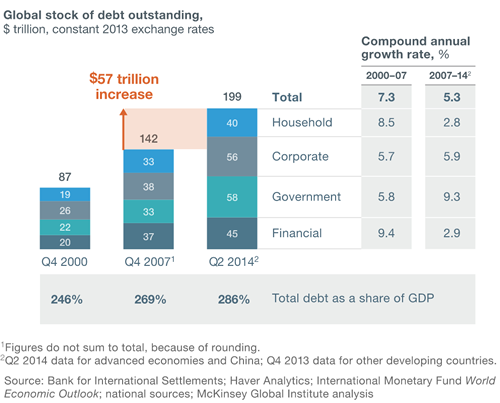

RISK - Debt increases Risk, and Risk increases Volatility When Volatility and Debt Collide 02-17-15 Capitalist Exploits via ZH A question to begin today's discussion... Which is riskier: corporate or public debt? If I lend $1,000 to my neighbour and take his bicycle worth $1,000 as collateral, which is what pawn brokers do, I have a quantifiable risk. I also have collateral which I can trust. I can see, feel and touch the bicycle. When you lend money to a business in most instances you actually have a lien over the business and its assets. Even if the business is insolvent, as a bond holder you stand in line ahead of any creditors. When you lend money to a sovereign and that sovereign finds it difficult to pay the loan back will they allow you to seize their assets in default? Can you take the president's bicycle? Which is riskier? I believe that the world in general is riskier today than at the height of the GFC. In our report on global debt we detail both household as well as sovereign debt around the world. The report provides a stark reminder of the global credit bubble and its consequences. Recently a colleague asked me why did the Swiss break the peg? The answer to that in one simple word is debt. All pegs break eventually because a peg allows for market participants to rely on an underwriter of risk. And when risk is underwritten by someone else then leverage is used, and when leverage is used risk rises. Like spirits, these two bedfellows make for a great party but a terrible hangover. So how is the world riskier today? McKinsey Global Institute recently published a report on the topic. They mention, and I quote:

Think about that for a minute and while you're thinking about that consider that the central banks are very, very close to running all out of bullets. Their predominant weapon has been manipulating the cost of capital via the interest rate market and now we have negative interest rates in Europe. I can't think of a time when the risk to capital has been greater! Now I want you to think about all this debt and consider volatility because this is where we profit from moronic bureaucrats... Debt and Volatility Debt increases risk, and risk increases volatility. As such increases in debt typically cause increases in volatility. Six months ago we were yelling from the rooftops that volatility was at extreme lows. This, on the back of understanding that at the global macro level debt was rising, and while volatility should have been rising alongside it this wasn't the case. Instead we've had a divergent relationship whereby as debt has continued to expand, volatility continued to fall. In this gap lies huge asymmetry. The positions Brad mentioned multiple times right here and which we provided in a detailed report have been screaming ahead. You can still access the report here as this party is still in its infancy. At the time we received many emails from readers saying things like "Don't you understand how much debt the US is in?" and that "The dollar can't rally and is going to collapse". Let me be clear. Firstly, we're not apologists for the clowns running policy at central banks. I think they're all idiots and I wouldn't take a job at a central bank unless I was allowed to blow it up. More importantly though, the USD and quite frankly every other currency cannot be viewed in isolation. Context is everything in order to understand global capital flows and why the USD is rallying. When in Hong Kong recently my suspicions were confirmed about the capital flowing out of China. Hong Kong is the conduit for mainland money which is also why the banks there are so flush with cash. Consider that China's debt has quadrupled from $7 trillion in 2007 to over $28 trillion. This debt has been fueled largely by real estate and shadow banking. China’s total debt now stands at 282 percent of GDP, higher than that of the United States. If I was on the mainland looking around me I'd be moving cash out as well. This, amongst other reasons, is why we're short yuan. We are entering a period of increased volatility. That volatility is going to be amplified by the gargantuan debts staring down at us. This is a topic which Brad will be discussing in depth just a few weeks from today at our next meet-up. You can get more details on nabbing one of the last remaining spots here. "In economic life and history more generally, just about everything of consequence comes from black swans; ordinary events have paltry effects in the long term." - Nassim Nicholas Taleb |

02-18-15 | RISK CANARIES |

||||||||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Feb. 15th, 2015 - Feb. 21st, 2015 | ||||||||||

| RISK REVERSAL | 1 | |||||||||

MACRO RISK - Changing Landscape Even UBS itself admitted last week that a "dislocation" in the market (which is "underestimating Grexit Risks") is necessary in order to overcome the Greek impasses. From UBS: Question: What could go wrong? As we have highlighted many times before, markets respond well to moderate growth, low inflation and supportive monetary conditions, as is now the case. But the global recovery also remains fragile and hence vulnerable to shocks. Here's what could go wrong:

And a bonus point from UBS on rates:

This supposedly excludes the #Ref! P/E Nasdaq, which is on pace to surpass its dot com 1.0 nominal record in a few weeks at most. |

02-17-15 | RISK STUDY / CANARIES |

1 - Risk Reversal | |||||||

| JAPAN - DEBT DEFLATION | 2 | |||||||||

| BOND BUBBLE | 3 | |||||||||

BOND BUBBLE - A Debt Based System The End of the Global Debt System Approaches 02-16-15 Phoenix Capital Research The 2008 Crisis was largely a banking crisis focused on securities. The REAL Crisis will hit when the bond bubble collapses. The current global monetary system is based on debt. Governments issue sovereign bonds, which a select group of large banks and financial institutions (e.g. Primary Dealers in the US) buy/sell/ and control via auctions. These financial institutions list the bonds on their balance sheets as “assets,” indeed, the senior-most assets that the banks own. The banks then issue their own debt-based money via inter-bank loans, mortgages, credit cards, auto loans, and the like into the system. Thus, “money” enters the economy through loans or debt. In this sense, money is not actually capital but legal debt contracts. Because of this, the system is inherently leveraged (uses borrowed money). Consider the following:

Bear in mind, this is just for the US. Globally the bond bubble is north of $100 trillion. And this $100 trillion has been used as collateral for a derivative market that is well north of $555 TRILLION. Again, debt is money. And at the top of the debt pyramid are sovereign bonds: US Treasuries, German Bunds, Japanese Government Bonds, etc. These are the senior most assets used as collateral for interbank loans and derivative trades. THEY ARE THE CRÈME DE LA CRÈME of our current financial system. So, this time around, when the bubble bursts, it won’t simply affect a particular sector or asset class or country… it will affect the entire system. The coming crisis will not be another 2008. It will be something much much worse. The 2008 Crisis was caused by an implosion of the Credit Default Swap market. At that time, the entire CDS market was roughly $50-60 trillion in size. The interest rate based derivatives market is TEN TIMES larger in size: north of $555 trillion. |

02-17-15 | RISK STUDY / CANARIES |

3- Bond Bubble | |||||||

EU BANKING CRISIS |

4 |

|||||||||

| SOVEREIGN DEBT CRISIS [Euope Crisis Tracker] | 5 | |||||||||

CHINA BUBBLE |

6 | |||||||||

| TO TOP | ||||||||||

| MACRO News Items of Importance - This Week | ||||||||||

GLOBAL MACRO REPORTS & ANALYSIS |

||||||||||

US ECONOMIC REPORTS & ANALYSIS |

||||||||||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | ||||||||||

| Market | ||||||||||

| TECHNICALS & MARKET |

|

|||||||||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | |||||||||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | |||||||||

| THESIS | ||||||||||

| 2014 - GLOBALIZATION TRAP | 2014 |  |

||||||||

STATE OF "STATISM" ON

|

||||||||||

|

||||||||||

|

"There is no FREEDOM without NOISE - and no STABILITY without VOLATILITY."

Excerpted from: Why I’m Not Breaking Up with America This Valentine’s Day By 02-09-15 John W. Whitehead .... why would anyone put up with a government that brazenly steals, cheats, sneaks, spies and lies, not to mention alienates, antagonizes, criminalizes and terrorizes its own citizens and then justifies it in the name of safety, security and the greater good? Why would anyone put up with militarized police officers who shoot first and ask questions later, act as if their word is law, and operate as if they are above the law? Why would anyone put up with government officials, it doesn’t matter whether they’re elected or appointed, who live an elitist lifestyle while setting themselves apart from the populace, operate outside the rule of law, and act as if they’re beyond reproach and immune from being held accountable? Unfortunately, not only do we put up with a laundry list of tyrannies that make King George III’s catalogue of abuses look like child’s play, but most actually persist in turning a blind eye to them, acting as if what they don’t see or acknowledge can’t hurt them. The sad reality, as I make clear in my book A Government of Wolves: The Emerging American Police State, is that life in America is no bed of roses. Nor are there any signs that things will get better anytime soon, at least not for “we the people,” those of us who belong to the so-called “unwashed masses”—the working class stiffs, the hoi polloi, the plebeians, the rabble, the riffraff, the herd, the peons and the proletariats. For instance, we’re still being spied on by our own government. Incredibly, while the British courts recognize that mass government surveillance of cellphone and online communications is not only illegal but violates human rights, the U.S. courts and politicians continue to pander to the government’s whims, whether or not they run afoul of the rule of law. Sen. Marco Rubio (R-Fla.) actually wants to make the NSA’s mass surveillance a permanent practice. Not only is the government unapologetic about spying on its citizens, but government agencies are using their collective surveillance data to carry out Orwellian pre-crime programs that attempt to nab “criminals” before they ever commit a crime. To do so, they have to study our social media posts, our buying habits, and where we travel to and from, and on and on. We’re still being treated like serfs working for an overlord, with little actual rights when it comes to our property, our bodies, our children or our welfare. It doesn’t really matter what the justifications are for such taxes, regulations, prohibitions and fines if they result in us having little-to-no control over how we live our lives. In Seattle, for example, even one’s trash is subject to government regulation. Residents who fail to separate out their food waste for composting are fined for each violation. We’re still bartering our freedoms away for the phantom promise of security, and we’re no safer and much less freer than we were two decades ago. First, it was the Patriot Act, which continues to sanction all manner of government intrusions into our lives, from the government tracking what cold medicine we use and how we spend our money to what we read and with whom we communicate. Then it was whole-body scanners in the airports, which were expensive, invasive and ineffective. Most recently, we’ve been subjected to a song-and-dance number about the need for body cameras on police officers to rein in abusive cops, with little said about how these surveillance cameras will be used to identify and track those in their range, or how difficult the footage will be to acquire if needed for our own defense. We’re still being fooled into thinking that politics matter and that there’s a difference between the Republicans and Democrats, when in fact, the two parties are exactly the same. As one commentator noted, both parties support endless war, engage in out-of-control spending, ignore the citizenry’s basic rights, have no respect for the rule of law, are bought and paid for by Big Business, care most about their own power, and have a long record of expanding government and shrinking liberty. Our communities are still being held hostage by militarized police. Despite the fleeting attention paid to the transformation of community police into extensions of the military, the transfer of military equipment from the federal government to localities continues unabated, with more than $28 million worth of tactical equipment distributed in the last quarter of 2014. The federal government, in conjunction with local police, has created a standing army on American soil—something those who drafted our Constitution believed would devastate our freedoms. We’re still exchanging one set of wars for another, to the delight and profit of the military industrial complex. We’ve gone from waging war against Iraq and Iran to sounding the war drums against North Korea, Syria and ISIS wherever it happens to rear its head. Every once in a while, we get tossed a bone to satisfy that gnawing, nagging hunger for something that looks and tastes like freedom, democracy and free enterprise. Political elections, town-hall meetings, awards ceremonies, sports spectacles, high-dollar lotteries, reality TV shows, morning news programs and patriotic-themed blockbuster movies: these are all the trappings of a so-called free nation without the substance (what Shakespeare referred to as a “tale told by an idiot, full of sound and fury, signifying nothing”). Indeed, Big Business, in conjunction with Big Government, have become very adept at distracting the citizenry so that “we the people” often have no clue as to the real nature of the political game being played. Temporarily assuaged, easily distracted and suffering from an appalling case of public amnesia, we fall right back into our complacency and compliance, content to turn a blind eye to blatant abuses, forgive past transgressions, and forget all of the reasons why we should be mad as hell about the state of our nation. So why do I stay? Why do any of us continue to put up with the gut-wrenching, soul-sucking, misery-drenched, demoralizing existence that is America today? Perhaps I stay because I was raised to believe that anything worth having is worth fighting for, and I believe with every fiber of my being that freedom matters. In fact, I come from a long line of Americans who understood that there is a price to be paid for freedom, whether that means standing up to the British military, sitting down in a bus seat reserved for “whites only,” or pushing back against corporations who pollute our waters and pillage our lands for profit. Perhaps I soldier on because I remember what it was like to grow up at a time when the only surveillance I had to worry about were the neighbors who reported back to my mother whenever I did something wrong, and I desperately want my grandchildren to experience that kind of carefree existence. I want them to know that there’s more to life than metal detectors, lockdowns, random searches and pre-crime units trying to nab them for a crime if they dare step out of line. Perhaps I persevere because I know that there are genuinely concerned Americans out there, including some good cops, honest politicians and pragmatic idealists, who want to pitch in and turn things around for the better. As long as there is this small but vocal minority who cares enough to stand up and speak out, then all is not completely lost. Perhaps I stick it out because I know that surveillance, overcriminalization, militarized police, power-hungry politicians and greedy corporations are not exclusive to America, and there’s nowhere you can escape to where tyranny cannot follow. No matter what you think of Ronald Reagan and his politics, he was right when he warned that, “If we lose freedom here, there is no place to escape to. This is the last stand on earth.” Most of all, perhaps I keep fighting on because I’m just not ready to give up on America. At least, not yet. In the words of that revolutionary firebrand Patrick Henry:

|

02-16-15 | THESIS | ||||||||

Obama will unleash his latest executive order, one which will set the stage for "information sharing and analysis organizations" (ISAOs) - or, in political jargon "hubs where companies share cyber threat data with each other and with the Department of Homeland Security." In regular parlance, what Obama will do is merely codify the second coming of the Patriot Act, which as Reuters put it, is "legislation to require more information-sharing and limit any legal liability for companies that share too much." In other words, the Kiss You Privacy Forever order. But don't worry: it is for your own protection. � (By clicking on the play button you agree to have your information shared with not only the NSA but Apple, AT&T, Verizon, T-Mobile, Cisco, Google, and well... everyone else) Patriot Act 2: Obama Executive Order Will Promote Sharing Of Confidential Information With Corporations 02-13-15 ZH Here come the "information sharing and analysis organizations", or ISAOs. * * * In the aftermath of the Snowden whistleblowing scandal which has now all but been forgotten, there was a brief period when it seemed the growth of the US spying apparatus would be halted if not put into reverse. Those days are long forgotten and later today Obama is expected to to sign an executive order "that aims to make it easier for the government to share classified cyberthreat information with companies." The spin, as proposed by the WSJ, is that "this will be effort designed to spur collaboration and deter hackers, the White House said." In reality what Obama's latest executive order will do, is expand the universe of entities that has access to the trove of private confidential data contained in the vast government spying apparatus, which as has been made all too clear now focuses as much on US citizens as it does on legitimate foreign threats, and further eviscerate the concept of individual privacy in the US.

Obama will sign the order shortly during a conference on cybersecurity at Stanford University in the heart of Silicon Valley. As the WSJ adds, "much could depend on whether intelligence agencies such as the National Security Agency and the Central Intelligence Agency participate in any arrangement that allows classified information to be shared with companies." Sadly, if history is any guide, the NSA, whose "safekeeping" of private US citizen data has a woeful track record, will be quite instrumental in spearheading an effort which many have dubbed the Patriot Act for the digital age. Ironically, this latest move comes as as big Silicon Valley companies "prove hesitant to fully support more mandated cybersecurity information sharing without reforms to government surveillance practices exposed by former National Security Agency contractor Edward Snowden."

The bottom line is that all Obama is really doing is not only promoting data sharing between the government and key private corporations - and one wonders just how reciprocal such sharing will be - but effectively indeminifes them from obtaining and processing such data. "Businesses are unlikely to share a lot of timely and "actionable" cyber intelligence without liability relief, said Mike Brown, a vice president with the RSA security division of EMC Corp."

Curiously one company which has no qualms about collaborating with the US government also happens to be the largest company in the world currently by market cap:

One wonder if perhaps recent leaked discoveries such as that "NSA Mocks Apple's "Zombie" Customers; Asks "Your Target Is Using A BlackBerry? Now What?" has anything do with with AAPL's willingness to engage in full-blown symbiosis with the US government. One also wonder what if anything would happen to AAPL's record sales if it were to just say no to Obama. Many questions, but one thing is clear: America's relapse into the second coming of the Patriot Act is coming fast and furious, which as some also say is par for the course for the president who, just like Bush, has now been given a blank check to send US troops not only to Iraq but any place where "ISIS operates", if only at the discretion of the Pentagon. So to summarize:

Still confused? The NSA laid it out best: |

02-16-15 | THESIS | ||||||||

|

2013 2014 |

||||||||||

2011 2012 2013 2014 |

||||||||||

| THEMES | ||||||||||

| FLOWS -FRIDAY FLOWS | THEME | |||||||||

| SHADOW BANKING -LIQUIDITY / CREDIT ENGINE | THEME | |||||||||

| CRACKUP BOOM - ASSET BUBBLE | THEME | |||||||||

| ECHO BOOM - PERIPHERAL PROBLEM | THEME | |||||||||

| PRODUCTIVITY PARADOX -NATURE OF WORK | THEME | |||||||||

| STANDARD OF LIVING -EMPLOYMENT CRISIS | THEME | |||||||||

| CORPORATOCRACY -CRONY CAPITALSIM | THEME |  |

||||||||

CORRUPTION & MALFEASANCE -MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

||||||||

| SOCIAL UNREST -INEQUALITY & A BROKEN SOCIAL CONTRACT | THEME | |||||||||

| SECURITY-SURVEILLANCE COMPLEX -STATISM | THEME | |||||||||

| GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | THEME | |||||||||

| CENTRAL PLANINNG -SHIFTING ECONOMIC POWER | THEME | |||||||||

| CATALYSTS -FEAR & GREED | THEME | |||||||||

| GENERAL INTEREST |

|

|||||||||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | ||||||||||

|

SII | |||||||||

|

SII | |||||||||

|

SII | |||||||||

|

SII | |||||||||

| TO TOP | ||||||||||

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP

Remember that equities typically offer the most risk of any asset class... not the lowest risk as the above data set suggests. Nevertheless, Yellen and Bernanke must be “psyched” as their “wealth effect” model has been so effective…actually too effective as the market distortions grow ever larger…and more market bears become contorted “road-kill”.

Remember that equities typically offer the most risk of any asset class... not the lowest risk as the above data set suggests. Nevertheless, Yellen and Bernanke must be “psyched” as their “wealth effect” model has been so effective…actually too effective as the market distortions grow ever larger…and more market bears become contorted “road-kill”.