|

JOHN RUBINO'SLATEST BOOK |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Wed. Jan. 21st, 2015

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

STRATEGIC MACRO INVESTMENT INSIGHTS

2014 THESIS: GLOBALIZATION TRAP

2014 THESIS: GLOBALIZATION TRAP

NOW AVAILABLE FREE to Trial Subscribers

185 Pages

What Are Tipping Poinits?

Understanding Abstraction & Synthesis

Global-Macro in Images: Understanding the Conclusions

![]()

| JANIUARY | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | ||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 262 | 27 | 28 | 29 | 30 | 30 |

KEY TO TIPPING POINTS |

| 1 - Risk Reversal |

| 2 - Japan Debt Deflation Spiral |

| 3- Bond Bubble |

| 4- EU Banking Crisis |

| 5- Sovereign Debt Crisis |

| 6 - China Hard Landing |

| 7 - Chronic Unemployment |

| 8 - Geo-Political Event |

| 9 - Global Governance Failure |

| 10 - Chronic Global Fiscal ImBalances |

| 11 - Shrinking Revenue Growth Rate |

| 12 - Iran Nuclear Threat |

| 13 - Growing Social Unrest |

| 14 - US Banking Crisis II |

| 15 - Residential Real Estate - Phase II |

| 16 - Commercial Real Estate |

| 17 - Credit Contraction II |

| 18- State & Local Government |

| 19 - US Stock Market Valuations |

| 20 - Slowing Retail & Consumer Sales |

| 21 - China - Japan Regional Conflict |

| 22 - Public Sentiment & Confidence |

| 23 - US Reserve Currency |

| 24 - Central & Eastern Europe |

| 25 - Oil Price Pressures |

| 26 - Rising Inflation Pressures & Interest Pressures |

| 27 - Food Price Pressures |

| 28 - Global Output Gap |

| 29 - Corruption |

| 30 - Pension - Entitlement Crisis |

| 31 - Corporate Bankruptcies |

| 32- Finance & Insurance Balance Sheet Write-Offs |

| 33 - Resource Shortage |

| 34 - US Reserve Currency |

| 35- Government Backstop Insurance |

| 36 - US Dollar Weakness |

| 37 - Cyber Attack or Complexity Failure |

| 38 - Terrorist Event |

| 39 - Financial Crisis Programs Expiration |

| 40 - Natural Physical Disaster |

| 41 - Pandemic / Epidemic |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

TODAY'S TIPPING POINTS

|

Scroll TWEETS for LATEST Analysis

Read More - OUR RESEARCH - Articles Below

HOTTEST TIPPING POINTS |

Theme Groupings |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Investing in Macro Tipping Points

THESE ARE NOT RECOMMENDATIONS - THEY ARE MACRO COMMENTARY ONLY - Investments of any kind involve risk. Please read our complete risk disclaimer and terms of use below by clicking HERE |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"BEST OF THE WEEK " |

Posting Date |

Labels & Tags | TIPPING POINT or THEME / THESIS or INVESTMENT INSIGHT |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

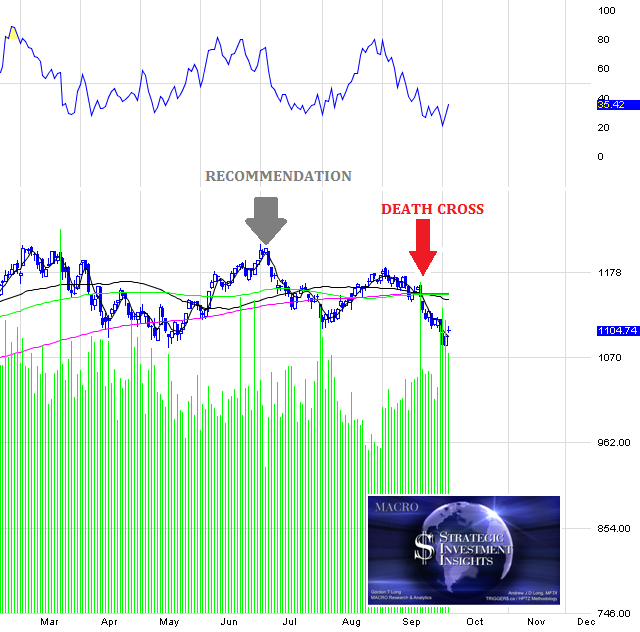

PATTERNS - Falling Earnings SPX MACRO BIA$ IS NEGATIVE FOR Q1

WHY THE SPX MACRO BIA$ IS NEGATIVE FOR Q1 1- DRAMATICALLY FALLING EARNINGS

2- WEAKENING MARGIN GROWTH

3- BOND SPREADS 4- WEAKENING BUYBACKS 5- BUSINESS CYCLE - 5 YEARS |

01-21-15 | PATTERNS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Jan 18th, 2014 - Jan 24th, 2014 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RISK REVERSAL | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| JAPAN - DEBT DEFLATION | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BOND BUBBLE | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

EU BANKING CRISIS |

4 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SOVEREIGN DEBT CRISIS [Euope Crisis Tracker] | 5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CHINA BUBBLE |

6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TO TOP | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MACRO News Items of Importance - This Week | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

GLOBAL MACRO REPORTS & ANALYSIS |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

US ECONOMIC REPORTS & ANALYSIS |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

US STANDARD OF LIVING - A 'Shadow" State of the Union A SHADOW STATE OF THE UNION Please use the following scorecard during the State of the Union to see what is mentioned, what is not and what is being done about any on the list of 27 items below.

A product of the Chicago Cook Country political apparatus It is our studied opinion that anything discussed will have almost no signficance to the American people once all the spin, happy-talk and platitudes are stripped away!

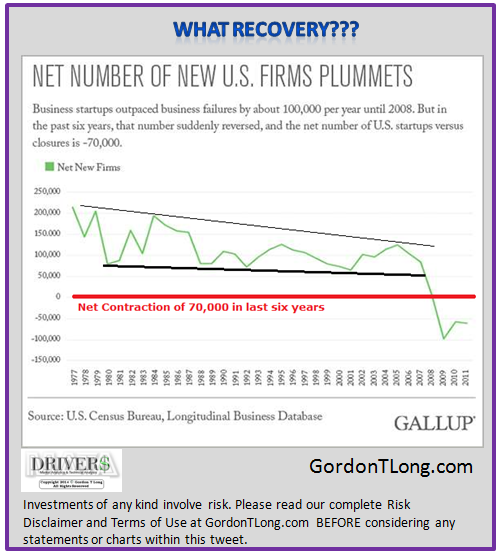

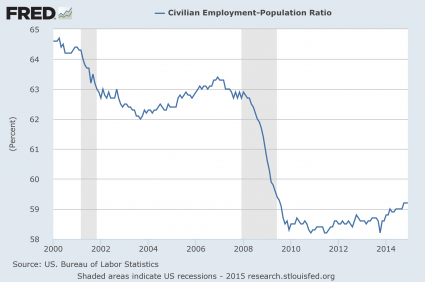

27 Facts That Show How The Middle Class Has Fared Under 6 Years Of Barack Obama 01-18-15 Michael Snyder - The Economic Collapse blog, During his State of the Union speech on Tuesday evening, Barack Obama is going to promise to make life better for middle class families. Of course he has also promised to do this during all of his other State of the Union addresses, but apparently he still believes that there are people out there that are buying what he is selling. Each January, he gets up there and tells us how the economy is “turning around” and to believe that much brighter days are right around the corner. And yet things just continue to get even worse for the middle class. The numbers that you are about to see will not be included in Obama’s State of the Union speech. They don’t fit the “narrative” that Obama is trying to sell to the American people. But all of these statistics are accurate. They paint a picture of a middle class that is dying. Yes, the decline of the U.S. middle class is a phenomenon that has been playing out for decades. But without a doubt, our troubles have accelerated during the Obama years. When it comes to economics, he is completely and utterly clueless, and the policies that he has implemented are eating away at the foundations of our economy like a cancer. The following are 27 facts that show how the middle class has fared under 6 years of Barack Obama… #1 American families in the middle 20 percent of the income scale now earn less money than they did on the day when Barack Obama first entered the White House. #2 American families in the middle 20 percent of the income scale have a lower net worth than they did on the day when Barack Obama first entered the White House. #3 According to a Washington Post article published just a few days ago, more than 50 percent of the children in U.S. public schools now come from low income homes. This is the first time that this has happened in at least 50 years. #4 According to a Census Bureau report that was recently released, 65 percent of all children in the United States are living in a home that receives some form of aid from the federal government. #5 In 2008, the total number of business closures exceeded the total number of businesses being created for the first time ever, and that has continued to happen every single year since then. #6 In 2008, 53 percent of all Americans considered themselves to be “middle class”. But by 2014, only 44 percent of all Americans still considered themselves to be “middle class”. #7 In 2008, 25 percent of all Americans in the 18 to 29-year-old age bracket considered themselves to be “lower class”. But in 2014, an astounding 49 percent of all Americans in that age range considered themselves to be “lower class”. #8 Traditionally, owning a home has been one of the key indicators that you belong to the middle class. So what does the fact that the rate of homeownership in America has been falling for seven years in a row say about the Obama years? #9 According to a survey that was conducted last year, 52 percent of all Americans cannot even afford the house that they are living in right now. #10 After accounting for inflation, median household income in the United States is 8 percent lower than it was when the last recession started in 2007. #11 According to one recent survey, 62 percent of all Americans are currently living paycheck to paycheck. #12 At this point, one out of every three adults in the United States has an unpaid debt that is “in collections“. #13 When Barack Obama first set foot in the Oval Office, 60.6 percent of all working age Americans had a job. Today, that number is sitting at only 59.2 percent… #14 While Barack Obama has been in the White House, the average duration of unemployment in the United States has risen from 19.8 weeks to 32.8 weeks. #15 It is hard to believe, but an astounding 53 percent of all American workers make less than $30,000 a year. #16 At the end of Barack Obama’s first year in office, our yearly trade deficit with China was 226 billion dollars. Last year, it was more than 314 billion dollars. #17 When Barack Obama was first elected, the U.S. debt to GDP ratio was under 70 percent. Today, it is over 101 percent. #18 The U.S. national debt is on pace to approximately double during the eight years of the Obama administration. In other words, under Barack Obama the U.S. government will accumulate about as much debt as it did under all of the other presidents in U.S. history combined. #19 According to the New York Times, the “typical American household” is now worth 36 percent less than it was worth a decade ago. #20 The poverty rate in the United States has been at 15 percent or above for 3 consecutive years. This is the first time that has happened since 1965. #21 From 2009 through 2013, the U.S. government spent a whopping 3.7 trillion dollars on welfare programs. #22 While Barack Obama has been in the White House, the number of Americans on food stamps has gone from 32 million to 46 million. #23 Ten years ago, the number of women in the U.S. that had full-time jobs outnumbered the number of women in the U.S. on food stamps by more than a 2 to 1 margin. But now the number of women in the U.S. on food stamps actually exceeds the number of women that have full-time jobs. #24 One recent survey discovered that about 22 percent of all Americans have had to turn to a church food panty for assistance. #25 An astounding 45 percent of all African-American children in the United States live in areas of “concentrated poverty”. #26 40.9 percent of all children in the United States that are living with only one parent are living in poverty. #27 According to a report that was released late last year by the National Center on Family Homelessness, the number of homeless children in the United States has reached a new all-time record high of 2.5 million. Unfortunately, this is just the beginning. The incredibly foolish decisions that have been made by Obama, Congress and the Federal Reserve have brought us right to the precipice of another major financial crisis and another crippling economic downturn. So as bad as the numbers that I just shared with you above are, the truth is that they are nothing compared to what is coming. We are heading into the greatest economic crisis that any of us have ever seen, and it is going to shock the world. I hope that you are getting ready. |

01-20-15 | US SOU |

US ECONOMY |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

SWISS PEG FAILURE - First Central Bank to Lose Control

As Bloomberg reports,

How big a problem is this? (via Goldman Sachs)

And despite the Polish Central Bank's comments that:

Here come the populist politicians to the rescue...

* * * * * * But Poland has a bigger problem than just mortgages. As Goldman Sachs goes on to explain...

* * * The Repercussions are only just starting... |

01-20-15 | MACRO MONETARY | CENTRAL BANKS |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

SWISS PEG FAILURE - First Central Bank to Lose Control The Financial System Broke Last Week 01-17-15 Phoenix Capital Research via ZH Global Central banks’ reputations are on borrowed time. ALL of the so called, “economic recovery” that began in 2009 has been based on the Central Banks’ abilities to rein in the collapse.

However, the insanity was in fact greater than this. It is one thing to bluff your way through the weakest recovery in 80+ years with empty promises; but it’s another thing entirely to roll the dice on your entire country’s solvency just to see what happens. JAPAN

BROKEN This was the “Rubicon” moment: the instant at which Central Banks gave up pretending that their actions or policies were aimed at anything resembling public good or stability. It was now about forcing reality to match Central Bankers’ theories and forecasts. If reality didn’t react as intended, it wasn’t because the theories were misguided… it was because Central Bankers simply hadn’t left the paperweight on the “print” button long enough. At this point the current financial system was irrevocably broken. We simply had yet to feel it. SWISS PEG That is, until, last week, when the Swiss National Bank lost control, breaking a promise, and a currency peg, losing an amount of money equal to somewhere between 10% and 15% of Swiss GDP in a single day, and showing, once and for all, that there are problems so big that even the ability to print money can’t fix them. Please let this sink in: a Central bank lost control last week. This will not be a one-off event. With the Fed and other Central banks now leveraged well above 50-to-1, even those entities that were backstopping an insolvent financial system are themselves insolvent. The Big Crisis, the one in which entire countries go bust, has begun. It will not unfold in a matter of weeks; these sorts of things take months to complete. But it has begun. |

01-18-15 | MACRO MONETARY | CENTRAL BANKS |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

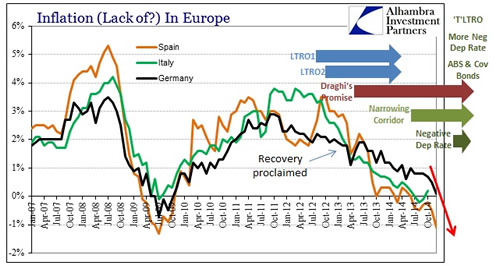

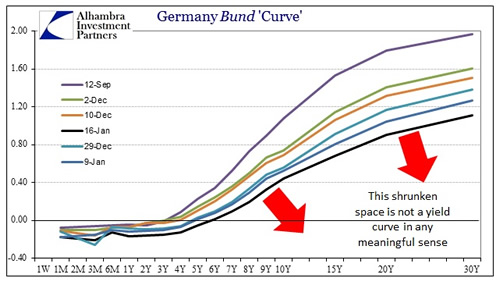

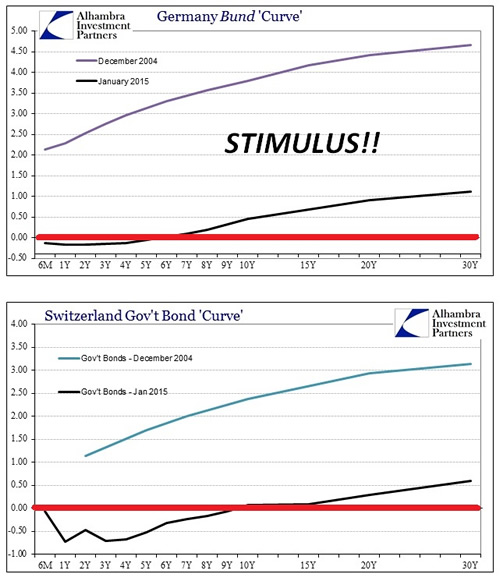

SWISS PEG FAILURE - Keynesian Central Banking Is Destroying Money And Markets The SNB's Wake-Up Call: Keynesian Central Banking Is Destroying Money And Markets 01-17-15 Jeffrey Snider of Alhambra Investment Partners via Contra Corner blog,via ZH It seems everyone was short the franc (CHF) as a matter of taking monetarism at face value. In other words, it amounted to believing the central party line about the economy and normalcy despite the fact that markets have been increasingly pessimistic about it all and actively and aggressively betting against it. Goldman Sachsis just one of many:

The only way to be surprised about the removal of the peg, or even to be short the franc in the first place, was spelled out in the first sentence, “as European growth normalized.” Being short the franc was essentially the same thing asbeing long the European economy. Given all that has transpired in the past seven or even eight months, there was no shortage of contrary indications that such an assumption was more than precarious and ultimately asymmetric against. Of course, the counter opinion is the same old “it wasn’t big enough last time but it will be this time.” In other words, the ABS, covered bond buying and negative nominal rates were just the warmup to the real QE event. Unfortunately, that is revisionist as the ECB has been taking intense monetary measures pretty steadily since the day it first announced the original OMT in the middle 2010. The only accomplishment in that time has been an internalrecalculation about “the economy” itself. Nothing about Switzerland’s financial system in the latter half of 2014 was anything like a positive interpretation on the state of the European economy. In fact, the Swiss debauchery was as much screaming about the insanity of the ECB and just how ineffective and impotent the entire practical operation was right down to the smallest detail. The most obvious interpretation of the chart below is short the recovery in not just Europe, and not just from the past two days: The utter lunacy of the ECB is reaching its inevitable end because lunacy itself cannot create economic, or even financial, normalcy. The Keynesian heart of all of this is that they fully believe redistribution can make for potent economic tonic, but redistribution is at its root a very negative factor. So monetary theory attends to that by placing what it believes are limitations upon its usage and scale; “yes, inflation is bad, but we will only be using the slightest amount.” And you can easily see exactly what that “slightest amount” gains, as instead the failure of “just a little” redistribution is but added to; and then a little more; and a little more. It doesn’t take long before the constant hold of interventionary redistribution mangles even the most basic of functions in finance – the time value of money (credit). Central bankers will talk about “term premiums” as if that mattered to them in the slightest, rather speaking about such essential market function as if a field researcher gazing upon the rudimentary research subject. The object of redistribution is to kill money as if that will make people spend for the sake of spending. Instead they only kill basic interpretations of “money” and lead that suppression toward unbridled euphoria elsewhere. Just in these most basic terms, how low do interest rates have to be suppressed in order for this all to work?Well, if you believe the IS-LM framework then it all depends on the natural rate of interest, which has been “calculated”, apparently, even more negative than it supposedly has been since 2007. To an economist, let alone a central banker, the world is but a spreadsheet with equations that need to be balanced, and if there is no economic momentum than the balancing factor must be that natural interest rate. The more the economy fails to respond to “just a little” redistribution, the more negative the “natural” rate is equalized in the regression; in programming, this is referred to as an “infinite loop.” Alan Greenspan once queried the FOMC, in mid-2003, about what might happen once the zero lower bound was reached. That thought applied only to the shortest end of the credit space, the overnight rate at which the Fed thought it could control all the rest. In other words, because Greenspan, and the rest of them worldwide, believed that they could exert tremendous influence just from an overnight rate (that turned out to be more anachronistic than anesthetic) the economy’s variability might easily be corralled. That was the primary mistake of all of this, really, in that monetary authorities far overestimated (and continue to do so) their influence and the influence of the tools they used (which were relevant in the 1970’s far, far more than the 2000’s). It seems these same central bankers, in a mad dash toward proving they have at least some control, are going to take the whole damn thing, bills to notes to bonds, down to the zero lower bound. It started in Japan and has spread now to Europe, where Germany and Switzerland (and Denmark) are seeing negative rates out to 6 or even 9 years. The zero lower bound was supposed to be a narrow and dangerous obstacle, not a universal standard. |

01-18-15 | MACRO MONETARY | CENTRAL BANKS |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Market | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TECHNICALS & MARKET |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THESIS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

2013 2014 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2011 2012 2013 2014 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THEMES | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FLOWS -FRIDAY FLOWS | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SHADOW BANKING -LIQUIDITY / CREDIT ENGINE | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ECHO BOOM - PERIPHERAL PROBLEM | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PRODUCTIVITY PARADOX -NATURE OF WORK | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STANDARD OF LIVING -EMPLOYMENT CRISIS | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CORPORATOCRACY -CRONY CAPITALSIM | THEME |  |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CORRUPTION & MALFEASANCE -MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SOCIAL UNREST -INEQUALITY & A BROKEN SOCIAL CONTRACT | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SECURITY-SURVEILLANCE COMPLEX -STATISM | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CENTRAL PLANINNG -SHIFTING ECONOMIC POWER | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CATALYSTS -FEAR & GREED | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GENERAL INTEREST |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STRATEGIC INVESTMENT INSIGHTS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

SII | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

SII | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

SII | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

SII | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TO TOP | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP

As we noted last week,

As we noted last week,