|

JOHN RUBINO'SLATEST BOOK |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Fri. Jan. 2nd, 2015

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

STRATEGIC MACRO INVESTMENT INSIGHTS

2014 THESIS: GLOBALIZATION TRAP

2014 THESIS: GLOBALIZATION TRAP

NOW AVAILABLE FREE to Trial Subscribers

185 Pages

What Are Tipping Poinits?

Understanding Abstraction & Synthesis

Global-Macro in Images: Understanding the Conclusions

![]()

| DECEMBER | ||||||

| S | M | T | W | T | F | S |

| 30 | 1 | 2 | 3 | 4 | 5 | 6 |

| 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| 14 | 15 | 16 | 17 | 18 | 19 | 20 |

| 21 | 22 | 23 | 24 | 25 | 26 | 27 |

| 28 | 29 | 30 | 31 | 1 | 2 | 3 |

KEY TO TIPPING POINTS |

| 1 - Risk Reversal |

| 2 - Japan Debt Deflation Spiral |

| 3- Bond Bubble |

| 4- EU Banking Crisis |

| 5- Sovereign Debt Crisis |

| 6 - China Hard Landing |

| 7 - Chronic Unemployment |

| 8 - Geo-Political Event |

| 9 - Global Governance Failure |

| 10 - Chronic Global Fiscal ImBalances |

| 11 - Shrinking Revenue Growth Rate |

| 12 - Iran Nuclear Threat |

| 13 - Growing Social Unrest |

| 14 - US Banking Crisis II |

| 15 - Residential Real Estate - Phase II |

| 16 - Commercial Real Estate |

| 17 - Credit Contraction II |

| 18- State & Local Government |

| 19 - US Stock Market Valuations |

| 20 - Slowing Retail & Consumer Sales |

| 21 - China - Japan Regional Conflict |

| 22 - Public Sentiment & Confidence |

| 23 - US Reserve Currency |

| 24 - Central & Eastern Europe |

| 25 - Oil Price Pressures |

| 26 - Rising Inflation Pressures & Interest Pressures |

| 27 - Food Price Pressures |

| 28 - Global Output Gap |

| 29 - Corruption |

| 30 - Pension - Entitlement Crisis |

| 31 - Corporate Bankruptcies |

| 32- Finance & Insurance Balance Sheet Write-Offs |

| 33 - Resource Shortage |

| 34 - US Reserve Currency |

| 35- Government Backstop Insurance |

| 36 - US Dollar Weakness |

| 37 - Cyber Attack or Complexity Failure |

| 38 - Terrorist Event |

| 39 - Financial Crisis Programs Expiration |

| 40 - Natural Physical Disaster |

| 41 - Pandemic / Epidemic |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

TODAY'S TIPPING POINTS

|

Scroll TWEETS for LATEST Analysis

Read More - OUR RESEARCH - Articles Below

HOTTEST TIPPING POINTS |

Theme Groupings |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Investing in Macro Tipping Points

THESE ARE NOT RECOMMENDATIONS - THEY ARE MACRO COMMENTARY ONLY - Investments of any kind involve risk. Please read our complete risk disclaimer and terms of use below by clicking HERE |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"BEST OF THE WEEK " |

Posting Date |

Labels & Tags | TIPPING POINT or THEME / THESIS or INVESTMENT INSIGHT |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

BOND BUBBLE - Prices Continue to Rise as Yields Fall. WE HAVE BEEN OF THE BELIEF & ARGUED FOR 5 YEARS NOW THAT THE 10Y UST RATES ARE HEADED FOR <1% BEFORE THE END OF 2018

LONG TERM The aftershocks of coming off the Gold Stnadard in August 1971 resulted in unprecented rates which the Volker Fed and the Reagan Administration gained control of. No one to this day has been able to satisfactorially explain how this was done and in such as manner as to sustain the continuous drop has seen below. What is noticeable is how controlled and managed the drop has been over a long period of time, following a very clear regression channel and trading boundary conditions (blue channel). INTERMEDIATE TERM Since the 2008 Financial Crisis which ushered in various forms of Quantitative Easing (QE), Fed Policy has resulted in lower rates with each and evey intervention iteration.

SHORT TERM TAPER has reduced the 13 Week ROC of the Fed's Balance Sheet, strengthened the US$ and weakened the 10Y UST yield.

FALSE PERCEPTIONS LATER TODAY OUT OF RUNWAY! LATER TODAY UST DICTATES GLOBAL RATES TOMORROW POLITICAL COVER TOMORROW

|

01-02-15 | CoN PATTERNS DRIVERS |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Dec 28th, 2014 - Jan 3rd ,2014 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Market | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TECHNICALS & MARKET |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

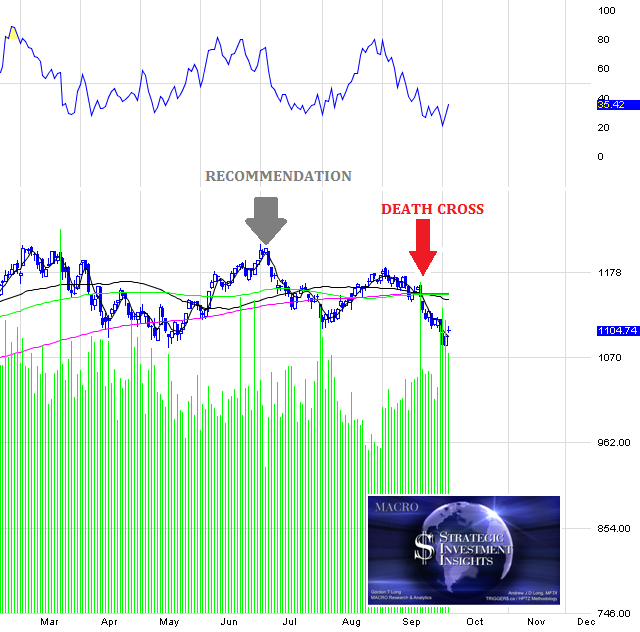

RISK REVERSAL

MINIMALLY MAYBE A SHORT TERM SCARE? IS OUR "M" TOP REAL DEFLATION SCARE LEG ABOUT TO HAPPEN?

BUT NOT TO WORRY THE COMING SCARE WILL ALLOW EVEN MORE DRACONIAN CENTRAL BANK ACTIONS!

|

12-30-14 | CoN PATTERNS RISK |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THESIS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

2013 2014 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

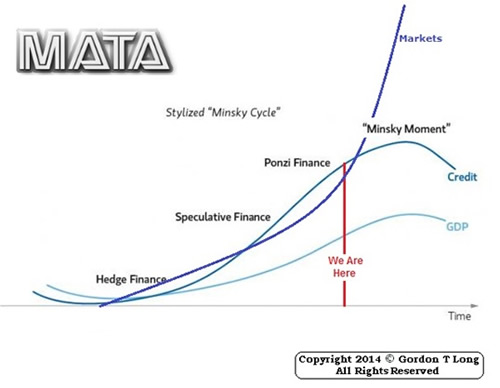

FINANCIAL REPRESSION - Misplaced Central Banking Policies Lead to their Demise Below are two articles by my Co-Host at MACRO - Charles Hugh Smith that we will discuss in an upcoming MACRO video. OUR MESSAGE: How Central Banks Unknowingly Create Their Achilles Heel: Deflation

THE OIL SHOCK IS YOUR FIRST SIGN! Central Banks by creating 'Excessive' INFLATION actually sow their eventual destruction by creating DEFLATION

CONCLUSION EASY CREDIT CREATES EXCESS SUPPLY & DEMAND WHICH EVENTUALLY REACH EQUILIBRIUM

SHRINKING AGGREGATE DEMAND THEN REDUCES COMMODITY PRICES WHICH LEADS TO COLLAPSING COLLATERAL VALUES THE GLOBALIZATION TRAP

Central Banks Create Deflation, Not Inflation (December 9, 2014) Financial and risk bubbles don't pop in a vacuum--all the phantom collateral constructed with mal-invested free money for financiers will also implode.

Central Banks' 2% Plan to Impoverish You (December 11, 2014) The 2% target is low enough that the household frogs in the kettle of hot water never realize they're being boiled alive because the increase is so gradual.

|

12-29-14 | THESIS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TO TOP | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP