|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Weekend Apr. 12th, 2014

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

STRATEGIC MACRO INVESTMENT INSIGHTS

2014 THESIS: GLOBALIZATION TRAP

2014 THESIS: GLOBALIZATION TRAP

NOW AVAILABLE FREE to Trial Subscribers

185 Pages

What Are Tipping Poinits?

Understanding Abstraction & Synthesis

Global-Macro in Images: Understanding the Conclusions

| APRIL | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | ||

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 13 | 14 | 15 | 16 | 17 | 18 | 19 |

| 20 | 21 | 22 | 23 | 24 | 25 | 26 |

| 27 | 28 | 29 | 30 | |||

KEY TO TIPPING POINTS |

| 1 - Risk Reversal |

| 2 - Japan Debt Deflation Spiral |

| 3- Bond Bubble |

| 4- EU Banking Crisis |

| 5- Sovereign Debt Crisis |

| 6 - China Hard Landing |

| 7 - Chronic Unemployment |

| 8 - Geo-Political Event |

| 9 - Global Governance Failure |

| 10 - Chronic Global Fiscal ImBalances |

| 11 - Shrinking Revenue Growth Rate |

| 12 - Iran Nuclear Threat |

| 13 - Growing Social Unrest |

| 14 - US Banking Crisis II |

| 15 - Residential Real Estate - Phase II |

| 16 - Commercial Real Estate |

| 17 - Credit Contraction II |

| 18- State & Local Government |

| 19 - US Stock Market Valuations |

| 20 - Slowing Retail & Consumer Sales |

| 21 - China - Japan Regional Conflict |

| 22 - Public Sentiment & Confidence |

| 23 - US Reserve Currency |

| 24 - Central & Eastern Europe |

| 25 - Oil Price Pressures |

| 26 - Rising Inflation Pressures & Interest Pressures |

| 27 - Food Price Pressures |

| 28 - Global Output Gap |

| 29 - Corruption |

| 30 - Pension - Entitlement Crisis |

| 31 - Corporate Bankruptcies |

| 32- Finance & Insurance Balance Sheet Write-Offs |

| 33 - Resource Shortage |

| 34 - US Reserve Currency |

| 35- Government Backstop Insurance |

| 36 - US Dollar Weakness |

| 37 - Cyber Attack or Complexity Failure |

| 38 - Terrorist Event |

| 39 - Financial Crisis Programs Expiration |

| 40 - Natural Physical Disaster |

| 41 - Pandemic / Epidemic |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

|

Scroll TWEETS for latest Analysis

Read More - OUR RESEARCH - Articles Below

HOTTEST TIPPING POINTS |

Theme Groupings |

||||||||||||||||

|

|||||||||||||||||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro |

|||||||||||||||||

"BEST OF THE WEEK " |

Posting Date |

Labels & Tags | TIPPING POINT or THEME / THESIS or INVESTMENT INSIGHT |

||||||||||||||

|

|||||||||||||||||

|

|||||||||||||||||

MACRO WATCH - Q2 2014

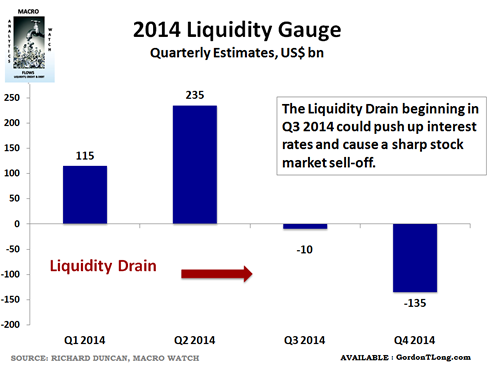

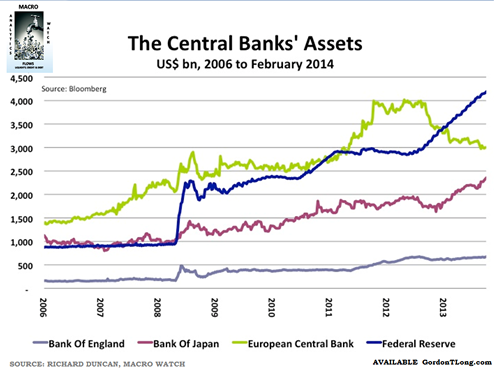

This quarter there are seven videos, (with 130 charts and slides). Here’s what they cover: 1. Treacherous Markets Ahead. I believe the stock market may be particularly tricky during the rest of this year. Liquidity will shift from being very excessive in the second quarter to being scarce in the third. Therefore, the markets could first experience a boom and then a bust. I also discuss how the Fed is likely to respond.

2. The Fed & Its Challenges. The challenges that the Fed faces over the short-term, the medium-term and the long-term are very different. Each requires a unique response. The Fed must try to prevent an asset price bubble over the next three months. During the second half of the year, it must attempt to prevent a stock market crash and recession. Over the long run, its challenge will be to continue driving the economy by pushing up asset prices, even after asset prices have become dangerously inflated. 3. Austrian Economics: Right & Wrong. No one explained the role credit plays in creating economic booms and depressions better than the Austrian Economists. In this video, I explain why it is crucial that our generation draws the right conclusions from what they taught. This one’s going to provoke some controversy. 4. What Drives Currencies? Trade imbalances, interest rate differentials, fiat money creation and central bank policy do. I discuss each of these and explain what they tell us about which way the major currencies are likely to move from here.

5. China’s Economic Crisis. China’s economic growth model is in crisis. Export-led growth is coming to an end. Investment-driven growth is unsustainable. Credit-fuelled growth is destabilizing. In this video, I explain why a sharp slowdown in China’s GDP growth is inevitable and what that will mean for the rest of the world. 6. Credit Growth Update. In this age of fiat money, credit growth drives economic growth. This video reviews the latest credit data from the Fed’s fourth quarter Flow of Funds statistics. We find that credit growth is not accelerating and will remain too weak to generate economic growth. That suggests the Fed will have to carry on driving the economy by creating money and pushing up asset prices. 7. Economic Update. The US economy weakened during the first quarter. US imports have stopped growing. The US current account deficit is correcting. In short, the driver of global economic growth has gone into reverse. That explains why the global economy is so weak.

|

04-11-14 | THEMES FLOWS | |||||||||||||||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - March 30th - April 6th, 2014 | |||||||||||||||||

| RISK REVERSAL | 1 | ||||||||||||||||

| JAPAN - DEBT DEFLATION | 2 | ||||||||||||||||

| BOND BUBBLE | 3 | ||||||||||||||||

EU BANKING CRISIS |

4 |

||||||||||||||||

| SOVEREIGN DEBT CRISIS [Euope Crisis Tracker] | 5 | ||||||||||||||||

| CHINA BUBBLE | 6 | ||||||||||||||||

SMALL BUSINESS HIRING - Small Business Confidence is a Major Problem In America

|

04-10-14 | CONFIDENCE & SENTIMENT | 7 - Chronic Unemployment | ||||||||||||||

SMALL BUSINESS HIRING - Small Business Is The Biggest Employer In America

|

04-09-14 | 7 - Chronic Unemployment | |||||||||||||||

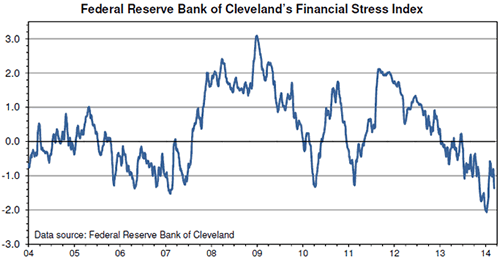

FINANCIAL STRESS - Increasing Despite Increases in Net Worth

ITS ABOUT GETTING A REAL JOB -If You Are:

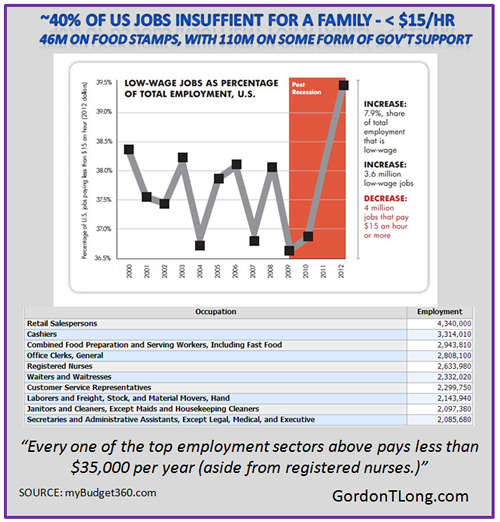

ITS ABOUT GETTING A REAL JOB -Finding Work That Pays Enough to Support a Family Is Nearly Impossible

ITS ABOUT BENEFITS - Removing the Safety Net

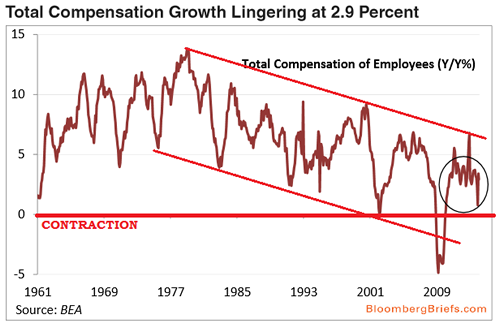

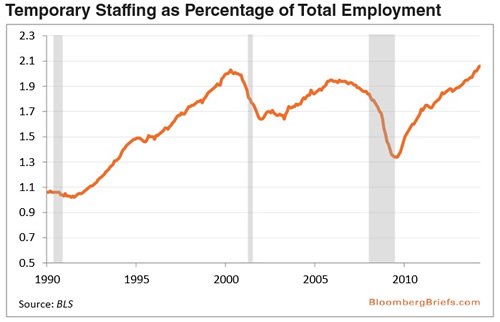

ITS ABOUT KEEPING A JOB - Part Time Nation ITS ABOUT HAVING A REAL JOB - Part Time Nation Structural job change in America. Employers not investing in employees and Low Paying Part-Time dominating. Last month's numbers were particularly vivid. The economy added 28,500 temporary-help services jobs, representing 15% of all job gains in March. The number of temp jobs has risen almost 10% in the past year, the greatest increase of any of the 150 categories tracked by the Labor Department.

WHERE THE JOBS ARE -> GOVERNMENT, HEALTHCARE OR TEACHING The number of people employed in manufacturing and construction jobs are still 12% and 20% below the pre-recession highs, respectively. However, the mining and logging industry now employs 21% more workers than it did before the recession, while the education and health industry employs 13% more people, and the business services industry employs 5% more people.

|

04-07-14 | US CATALYST EMPLOYMENT |

7 - Chronic Unemployment | ||||||||||||||

HOUSING - A Single Family Income Insufficient and In Many Cases Two Is Insufficient Even Two Middle-Class Incomes Aren’t Enough Anymore To Buy A Median Home 04-07-14 Wolf Richter www.testosteronepit.com www.amazon.com/author/wolfrichter VIA ZH As home prices have soared in cities around the country, sales have cratered. The weather has been blamed, though the weather has been gorgeous in California where sales have crashed too, even in temporary boom town San Francisco. The “lack of inventory” and other excuses have been dragged out as well. In reality, homes have gotten too expensive.... PRIVATE EQUITY, REITS & HEDGE FUNDS Even for hedge funds, private equity funds, REITs, and other forms of Big Money with access to the Fed’s limitless free juice. They’d become powerful buyers over the last two years, gobbling up vacant homes sight-unseen by the thousands, in order to get them off the closely watched for-sale list and shuffle them over to the ignored for-rent list, where they might languish undisturbed. The hope is that they might rent them out somehow and sell them later at a big fat profit, to the dumb money via a ridiculously hyped IPO. But now their business model has collapsed. “Prices have gotten to the stage where we cannot buy a house, renovate it, rent it, and still make a reasonable return,” explained Peter Rose, a spokesman for Blackstone Group, a private equity giant whose real-estate division, Invitation Homes, has grown in two short years from nothing to the largest landlord in the country with 41,000 rental single-family houses to is name. “There was a moment in time where it made sense,” Rose said. Not anymore. Blackstone already cut its purchases in California by 90% last year. It wasn’t alone. Another mega-buyer with access to nearly free money, Colony Capital, is doing the same thing. Oaktree Capital is trying to dump its portfolio of 500 homes before prices head south. “Private capital made a lot of money early, and now they’re starting to pull back,” Dave Bragg, head of Residential Research at Green Street Advisors, told the LA Times. “Home prices are up significantly, and houses are definitely less attractive.” With these mass-buyers out of the market, volumes have collapsed to a four-year low, according to Redfin, an electronic real-estate broker that covers 19 large metro areas around the country. Because, let’s face it, who can still afford to buy these homes? Forget first-time buyers, the crux of a healthy housing market. In February, they only bought 28% of the homes, down from 30% a year earlier, down from the three-decade average of 40%, and down from the mid-40% range during good times. That hapless lot has been pushed out of the market a while ago. And the middle-class household, supported by one earner? Teachers earning on average $69,300 in my beloved state of California, are facing a housing market where the median home lists for $485,000. With their salary, they can only afford a $260,000 home – or only 17.4% of the listed homes. Where exactly are all these high-income people who’re supposed to buy the remaining 82.6% of the homes? Sad fact: they don’t exist in those large numbers. In the inland areas, teachers have a better chance for being able to buy a median home. But forget it in the coastal areas. My zany city of San Francisco topped the list: exactly 0% of the homes listed were within reach of a teacher’s salary [read....California Housing Bubble: Now Even Teachers Can No Longer Afford To Buy A Home]. TWO WAGE INCOME INSUFFICIENT Turns out, even two middle-class incomes aren’t enough anymore for a median home in many cities around the country. Real wages that have stagnated for the last 25 years – thanks to that wondrous elixir of inflation – are now colliding with soaring home prices. Based on non-distressed homes listed on the Multiple Listing Service as of March 30, Redfin reports that in 40 large cities, only 10% of the homes are affordable on one median salary. It defined an affordable monthly payment as 28% or less of gross monthly income. And it found that “just 41% of homes currently for sale across 40 US cities are affordable for a family earning two median incomes.” In San Francisco, where the median home lists for nearly $1 million, and in Santa Ana in Southern Cal, only 7% of the homes were within reach of a family with 2 median salaries. In San Diego 9%, in LA 12%, in Miami 19%, in Denver 23%, in Nassau (Long Island) 24%, in Austin 32%. There are some cities where the fiasco is less pronounced. For example, in Atlanta a family with two middle-class incomes can afford 59% of the listed homes – but even there, who is going to buy the other 41% that are priced beyond the reach of two middle-class incomes?! The richest 1%? Or people who have to overextend themselves and become house-poor for years to come, assuming that another housing downturn, or a layoff, or an illness doesn’t wreck their homeowner status? And where the heck are all the high-income people who will buy the median homes when investors, speculators, and PE firms that have become the largest landlords in the country are pulling up their stakes? There aren’t that many high-income people around, and they don’t like to live in median homes. Sales are already heading south. And last time this debacle happened, prices followed soon after. So this is going to be, let’s say, an interesting scenario. And a direct consequence of the Fed’s policies that engineered an environment where Wall Street can borrow unlimited amounts for nearly free, buy all manner of assets, drive up prices, take huge risks that it then shuffles off at peak valuations to other entities, hopefully to the unsuspecting public via over-priced IPOs, toxic synthetic structured securities of the kind that blew up the banks during the financial crisis, and other shenanigans that end up getting stuffed into conservative-sounding funds that people buy for their retirement. It starts here: evictions in San Francisco hit the highest level since 2001, when the dotcom bubble was disintegrating. Everything these days gets benchmarked against the last bubbles: the dotcom bubble that blew up in 2000, the housing bubble that blew up in 2007. Read.... Bay Area Home Sales Plunge To 2008 Levels, Prices Soar |

04-08-14 | US CATALYST RESIDENTIAL |

15 - Residential Real Estate - Phase II | ||||||||||||||

RETAIL CRE - Getting Worse Fast Retail Tsunami: 16 Major Chains Closing More Stores 04-04-14 Daniel Jennings The economy appears to be in far worse shape than the major media outlets would have us believe.

The Obama administration may tell Americans the economy is recovering, but the retail industry and economic data say something very different. |

04-09-14 | US GROUPS RETAIL CRE | 20 - Slowing Retail & Consumer Sales | ||||||||||||||

| TO TOP | |||||||||||||||||

| MACRO News Items of Importance - This Week | |||||||||||||||||

GLOBAL MACRO REPORTS & ANALYSIS |

|||||||||||||||||

US ECONOMIC REPORTS & ANALYSIS |

|||||||||||||||||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||||||||||||||||

| Market | |||||||||||||||||

| TECHNICALS & MARKET |

|

||||||||||||||||

- Charts of Note SMART MONEY

EBITDA - CASHFLOW VALUATIONS - TECH PE

JAPANESE CARRY TRADE WORRIED Japanese Carry Trade reacting to accelerated JGB selling of -Y2.5T in FY 2013 with Y351B in March alone!

|

04-08-14 | CoN | |||||||||||||||

| COMMODITY CORNER - HARD ASSETS | PORTFOLIO | ||||||||||||||||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||||||||||||||||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||||||||||||||||

| THESIS | |||||||||||||||||

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|||||||||||||||

|

2013 2014 |

|||||||||||||||||

2011 2012 2013 2014 |

|||||||||||||||||

| THEMES | |||||||||||||||||

| FLOWS -FRIDAY FLOWS | THEME | ||||||||||||||||

| SHADOW BANKING -LIQUIDITY / CREDIT ENGINE | THEME | ||||||||||||||||

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||||||||||||||||

| ECHO BOOM - PERIPHERAL PROBLEM | THEME | ||||||||||||||||

| PRODUCTIVITY PARADOX -NATURE OF WORK | THEME | ||||||||||||||||

| STANDARD OF LIVING -EMPLOYMENT CRISIS | THEME | ||||||||||||||||

| CORPORATOCRACY -CRONY CAPITALSIM | THEME |  |

|||||||||||||||

CORRUPTION & MALFEASANCE -MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|||||||||||||||

| SOCIAL UNREST -INEQUALITY & A BROKEN SOCIAL CONTRACT | THEME | ||||||||||||||||

| SECURITY-SURVEILLANCE COMPLEX -STATISM | THEME | ||||||||||||||||

| GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | THEME | ||||||||||||||||

| CENTRAL PLANINNG -SHIFTING ECONOMIC POWER | THEME | ||||||||||||||||

| CATALYSTS -FEAR & GREED | THEME | ||||||||||||||||

| GENERAL INTEREST |

|

||||||||||||||||

| TO TOP | |||||||||||||||||

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP

TREACHEROUS MARKETS AHEAD

TREACHEROUS MARKETS AHEAD