|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

RECAP

Weekend Feb. 16th, 2014

What Are Tipping Poinits?

Understanding Abstraction & Synthesis

Global-Macro in Images: Understanding the Conclusions

| FEBRUARY | ||||||

| S | M | T | W | T | F | S |

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |

KEY TO TIPPING POINTS |

| 1 - Risk Reversal |

| 2 - Japan Debt Deflation Spiral |

| 3- Bond Bubble |

| 4- EU Banking Crisis |

| 5- Sovereign Debt Crisis |

| 6 - China Hard Landing |

| 7 - Chronic Unemployment |

| 8 - Geo-Political Event |

| 9 - Global Governance Failure |

| 10 - Chronic Global Fiscal ImBalances |

| 11 - Shrinking Revenue Growth Rate |

| 12 - Iran Nuclear Threat |

| 13 - Growing Social Unrest |

| 14 - US Banking Crisis II |

| 15 - Residential Real Estate - Phase II |

| 16 - Commercial Real Estate |

| 17 - Credit Contraction II |

| 18- State & Local Government |

| 19 - US Stock Market Valuations |

| 20 - Slowing Retail & Consumer Sales |

| 21 - China - Japan Regional Conflict |

| 22 - Public Sentiment & Confidence |

| 23 - US Reserve Currency |

| 24 - Central & Eastern Europe |

| 25 - Oil Price Pressures |

| 26 - Rising Inflation Pressures & Interest Pressures |

| 27 - Food Price Pressures |

| 28 - Global Output Gap |

| 29 - Corruption |

| 30 - Pension - Entitlement Crisis |

| 31 - Corporate Bankruptcies |

| 32- Finance & Insurance Balance Sheet Write-Offs |

| 33 - Resource Shortage |

| 34 - US Reserve Currency |

| 35- Government Backstop Insurance |

| 36 - US Dollar Weakness |

| 37 - Cyber Attack or Complexity Failure |

| 38 - Terrorist Event |

| 39 - Financial Crisis Programs Expiration |

| 40 - Natural Physical Disaster |

| 41 - Pandemic / Epidemic |

Reading the right books?

No Time?

![]()

We have analyzed & included

these in our latest research papers!

Our Macro Co-Host

John Rubino's Just Released Book

Our Macro Co-Host

Charles Hugh Smith's Latest Books

Our Macro Partner

Richard Duncan Latest Books

![]()

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

TODAY'S TIPPING POINTS

TODAY'S TIPPING POINTS

| THIS WEEKS TIPPING POINTS | MACRO NEWS | MARKET | 2013 THEMES |

"BEST OF THE WEEK " |

Posting Date |

Labels & Tags | TIPPING POINT or 2013 THESIS THEME | |||

|

||||||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - February 9th - February 16th | ||||||

| JAPAN - DEBT DEFLATION | 2 | |||||

| 02-15-14 | JAPAN CoN |

2 - Japan Debt Deflation Spiral | ||||

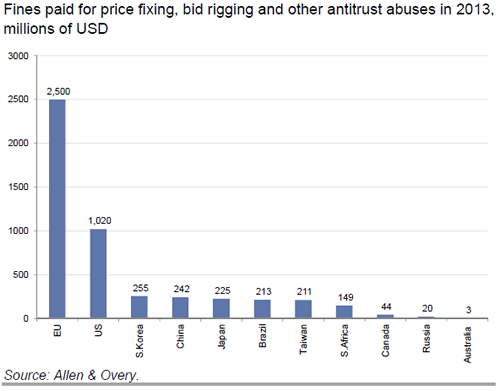

EU BANKING - Beware of EU Banks Why You Shouldn't Trust Europe In One Simple Chart 02-09-14 Goldman Sachs via ZH While China (or Russia) are held up as the world's most corrupt among developed nations among the status-quo-huggers, it would seem there are two other nations that dominate when it comes to getting caught. Europe paid more in fines (in fact double the US and 10 times China) for price-fixing, bid-rigging, and other anti-trust abuses in 2013. So why would we believe them that 'recovery' is right around the corner?

|

02-10-14 | MACRO EU MONETARY |

4- EU Banking Crisis | |||

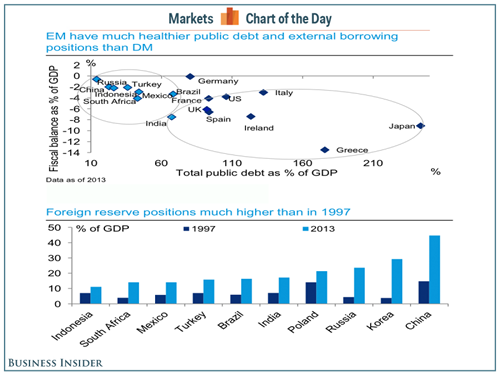

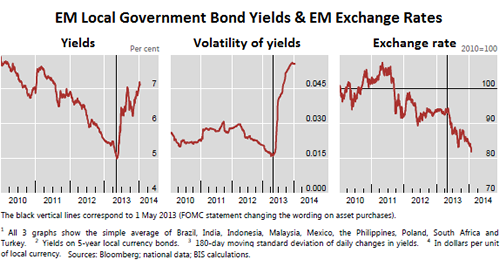

EU BANKING - Emerging Markets Aggravates Festering Problems Giant Sucking Sound? Emerging-Markets Fiasco To Topple European Banks 02-05-14 Wolf Richter - Testosterone Pit via 24hGOLD It’s not like Europe is out of the woods, after years of recession, lurching from bank bailout to country bailout, and sweeping remaining fetid matters under the rug. But its banks are now sinking deeper into an even greater morass: the emerging-markets fiasco. Since QE Infinity turned into a pipedream in early May last year when the Fed’s taper cacophony bounced around the world, it has been a volatile mess in the emerging markets that picked up steam recently with currencies, stocks, and bonds skidding. Argentina devalued. Venezuela has become a complete basket case. Turkey, which is mired in a political and democratic crisis, including a “frantic crackdown“ on the media, jacked up its interest rates to make your head spin, in a vain effort to prop up the lira. Brazil, India, Indonesia, and South Africa are flailing about to contain the ravages. China is slowing too. And what we hear is that giant sucking sound of hot money leaving. What QE giveth, the end of QE taketh away. And these already teetering European Banks are waving mysterious balance sheets whose decomposing “assets” no one is allowed to disclose, and whose sanctity no one is allowed to even doubt [read my exposé of how the French banking regulator hounded two doubting bloggers instead of investigating the banks..... Gagging Doubt: French Crackdown On French And American Bloggers Who Question Megabank Balance Sheets]. Turns out, these illustrious banks are stuck in the credit muck with loans totaling $3.4 trillion to the emerging markets (more than four times the exposure of US banks), according to analysts at Deutsche Bank. And $1.7 trillion of this malodorous debt is on the books of just six (mercifully unnamed) European banks. If a portion of those loans default.... “We think EM shocks are a real concern for 2014,” explained Matt Spick, analyst at Deutsche Bank – most likely the understatement of the century. “When currency combines with revenue slowdowns and rising bad debts, we see compounding threats to the exposed banks.” Gosh, I don’t even want to speculate which banks would topple first. And this is, according to a working paper by the Bank of International Settlements, how local-government bond yields in the emerging markets, volatility of these yields, and currencies have rattled nerves since the taper cacophony started last May (indicated by the black vertical lines). So very ugly:

The putrid smell of crisis wafts around these illustrious European banks in a number of ways. Income from capital markets and private banking activities would shrivel. The collapse of a currency would hit capital held in that country and income. As interest rates rise – they haven’t risen nearly enough yet – and as the economies begin to wobble, a portion of the $3.4 trillion in loans would default or, via pretend-and-extend, slowly decompose. Loan losses would pile up. Some would be stuffed into the bank’s basements, safely out of view, where they would be layered on top of decomposing European “assets.” Every European country has its own specialty. British banks are exposed to the tune of $518 billion in loans to the Asia-Pacific region. Spanish banks are strung out with $475 billion in Latin America. French banks have $200 billion in loans tied up in the developing economies in Europe, same as the tottering Italian banks. Each individual bank has its own nightmare. Barclays is exposed to South Africa. Spanish banks BBVA and Santander have respectively $107 billion and $132 billion in loans to Latin America on their books; half of Santander’s portion is hung up in Brazil. BBVA and Italian bank UniCredit are up to their ears into Turkey. Standard Chartered – which made over 90% of its income from Asia, Africa, and the Middle East – and HSBC are exposed to the turbulence in Indonesia and India. In anticipation, the European banking index SX7P has dropped 7.7% over the last two weeks. Is ECB President Mario Draghi also going to bail out the emerging markets with a “whatever it takes” promise, so that he won’t have to bail out his own banks manually? One thing leads to another: currency collapses and high inflation in Venezuela and Argentina, combined with chaos in Turkey, and lower growth in India and China make the emerging markets very unappetizing for the hot money – and as it flees, mere problems turn into crisis. The ensuing currency shock can trigger a credit shock. Higher rates and a wobbly economy entail loan defaults. Mess ensues. Because this is a well-established sequence in the emerging markets, the hot money, which has been through this before, is bailing out in advance. Mess ensues more quickly. These glorious European banks have 12% of their assets in the emerging markets but get about a quarter of their income from them. Business there, as Deutsche Bank analyst Spick put it, is “unusually profitable.” Hence, their reckless desire to make hay where they can while they can, as things have been tough and murky in Europe since the outbreak of the debt crisis. Now the haymaking is over. In just the week through January 29, $6.3 billion was yanked from emerging market equities, the largest outflow since August 2011. So EM stocks and bonds have been skidding, to the point where UBS CEO Sergio Ermotti himself felt like he had to intervene and put a stop to it, if only temporarily, and so he told Bloomberg today, “Short term, it looks a little bit overdone.” It helped. Emerging market stocks perked up. A deus ex machina. But many more will be needed to keep these European banks from asking taxpayers for yet another round of bailouts, and stockholders, junior bondholders, and depositors for a solid round of very popular bail-ins. The last stock-market bears have gone into hibernation, browbeaten and humiliated and ridiculed by years of brilliant rallies. Clinging to their analyses and the now silly notion that stocks should trade based on economic realities, they lost clients and money and their jobs. Read....Stocks Plunge: ‘And This Too Shall Pass,’ Or Something |

02-10-14 | MACRO EU MONETARY |

4- EU Banking Crisis | |||

EU BANKING - European Banks Have $3 Trillion Of Exposure To Emerging Marketss European Banks Have $3 Trillion Of Exposure To Emerging Markets 02-04-14 BI LONDON (Reuters) - European banks have loaned in excess of $3 trillion to emerging markets, more than four times U.S. lenders and putting them at greater risk if financial market turmoil in countries such as Turkey, Brazil, India and South Africa intensifies. The risk is most acute for six European banks - BBVA, Erste Bank, HSBC, Santander, Standard Chartered, and UniCredit - according to analysts. But the exposure could be a headache for the industry as a whole, just as it faces a rigorous health-check by the European Central Bank, aiming to expose weak points and restore investor confidence in the wake of the 2008 financial crisis. "We think EM (emerging markets) shocks are a real concern for 2014," said Matt Spick, analyst at Deutsche Bank. "When currency (volatility) combines with revenue slowdowns and rising bad debts, we see compounding threats to the exposed banks." The Deutsche Bank analysts said the six most exposed European banks - which they did not name - had more than $1.7 trillion of exposure to developing markets. In recent weeks, emerging market currencies have come under fire as China's growth slows and the U.S. Federal Reserve winds down its stimulus program, with investors selling developing market assets in anticipation of higher U.S. interest rates. In a bid to protect currencies, interest rates have been hiked in Turkey and elsewhere, but investors remain nervy, especially around the so-called "Fragile Five" economies of Turkey, Brazil, India, Indonesia and South Africa. An emerging markets crisis could hit banks in a variety of ways - a collapse in local currency can hurt reported earnings or capital held in the country; loan losses can jump as interest rates rise; or income from capital markets activity or private banking can fall. European banks' exposure varies from country to country. BBVA <BBVA.MC> and UniCredit <CRDI.MI> have big exposure to Turkey, Santander <SAN.MC> is most exposed to Brazil, while Standard Chartered <STAN.L> and HSBC <HSBA.L> would be hurt by problems in India and Indonesia. Barclays <BARC.L>, meantime, would be most exposed to South African problems, analysts said. However, they said the impact of apparently individual problems, such as inflation in Venezuela or lower growth in India, could quickly spread into wider concern among investors, and had already contributed to a 7 percent drop by Europe's bank index <.SX7P> in the last two weeks. The biggest risk is that a jump in interest rates sparks defaults on loans, analysts added. Often a credit shock follows or replaces a currency shock, as happened in Argentina in 1999-2002. EXPOSUREEurope's banks have cut their overseas loans since the financial crisis and substantially increased the amount of capital they hold, meaning they have a better cushion to absorb losses than in the past. But they still have about 12 percent of their assets in emerging markets, and about a quarter of their earnings come from the region as often the businesses there are "unusually profitable", Deutsche Bank's Spick said. European banks had $3.4 trillion of loans to developing countries at the end of September, according to data from the Bank for International Settlements. British banks had a $518 billion exposure to the Asia-Pacific region, Spanish banks had $475 billion of loans to Latin America, and banks in France and Italy each had $200 billion of exposure to developing economies in Europe. Among the most exposed banks, Standard Chartered makes more than 90 percent of its earnings from Asia, Africa and the Middle East, and warned in December that its 10-year record of earnings growth would likely end. BBVA had 41 billion euros ($55 billion) of exposure to Mexico - which last year made up 80 percent of group profits - and 52 billion euros of loans to South America. Santander had 132 billion euros of loans to Latin America at the end of last year, half of which were in Brazil.Brazil contributed 23 percent of group earnings last year, and the rest of Latin American contributed another 24 percent. Analysts said emerging market turmoil could also have a broader, indirect impact on revenues in investment banking and wealth management. "A significant increase in volatility in EM bonds and FX may result in volumes drying up and hence a potential for a material slowdown in EM fixed income revenues," said JPMorgan analyst Kian Abouhossein. He estimated the investment banks of HSBC and Standard Chartered each generated $2.1-2.2 billion from emerging markets, while Credit Suisse <CSGN.VX> and Deutsche Bank <DBKGn.DE> made about $1.1 billion each. (Additional reporting by Sarah White in Madrid; Editing by Mark Potter) This post originally appeared at Reuters. Copyright 2014. Follow Reuters on Twitter |

02-10-14 | MACRO EU MONETARY |

4- EU Banking Crisis | |||

| SOVEREIGN DEBT CRISIS [Euope Crisis Tracker] | 5 | |||||

| CHINA BUBBLE | 6 | |||||

|

|

01-15-14 | MACRO GROWTH CoN |

6 - China Hard Landing |

|||

CHINA - How The Chinese Economic Disaster Scenario Could Unfold This Is How The Chinese Economic Disaster Scenario Could Unfold 02-11-14 BI Chinese policymakers are aware that economic growth fueled by credit is unsustainable. To remedy that, they are making efforts to deflate the credit bubble. This is expected to cause the world's second largest economy to slow modestly in what's been dubbed the soft-landing scenario. In 2013, China grew 7.7%. But "government efforts to engineer a deleveraging could lead to a hard landing in China, if the policy response is misjudged," writes Societe Generale's Wei Yao. In this scenario, year-over-year growth could collapse to just 2% and global growth could be cut by up to 1.5% in the year after the hard landing. Last year, it was believed that inadequate government investment from Beijing or a sharp property market correction prompted by tight policies could trigger a crisis. Now, Yao expects the crisis could be triggered by tighter liquidity conditions, the crackdown on shadow banking, and more restrictions on local government borrowing. Here's how the crisis will unfold according to Yao: Two other events could however trigger a hard landing in China. First, the experience of 2008 showed that China is vulnerable to trade shocks. Exports contracted sharply on the back of the Lehman crisis, resulting in the loss of nearly 50 million migrant worker jobs in the two quarters after it took place. Second, and more likely, a hard landing could be triggered if well-intended deleveraging gets out of control. Officials clearly want to reduce leverage; the first sign of this was a severe liquidity squeeze in June 2013, partly engineered by policymakers. Rates have dropped since last summer, but liquidity remains tighter than in H1 2013, and credit growth has steadily decelerated, particularly in the shadow banking system. We expect further policy changes to reduce leverage. In particular, we think the banking regulator will tighten regulations further on shadow bank activities, including wealth management products (WMPs) and interbank transactions done by smaller banks to hide corporate loans. Chinese debt markets have been underpinned by the belief that the central government has the resources, the control and the willingness to stand behind all the debt extended by both the formal and the shadow banking system. Although there have been concerns about corporate bonds, trust products and bank WMPs, there have been no defaults, and investors have always been made whole. To prove that it is serious about deleveraging, however, the central government will have to allow for defaults. Even in our central scenario, we expect some financial products to default for the first time in 2014. Here it is in diagram form. |

02-12-14 | CHINA | 6 - China Hard Landing | |||

CHINA - China Orders Its Smaller Banks To Load Up On Cash As China Orders Its Smaller Banks To Load Up On Cash, Is The Biggest Ever "Unlimited QE" About To Be Unleashed? 02-10-14 Zero Hedge The Chinese new year may be over which following a last minute bailout of its insolvent Credit Equals Gold Trust product was largely uneventful, but already concerns about domestic liquidity are once again rising to the surface following reports that China’s banking regulator ordered some of the nation’s smaller lenders to set aside more funds to avoid a cash shortfall, which as Bloomberg notes signal rising concern that defaults may climb. Specifically, "China Banking Regulatory Commission branches asked some city commercial banks and rural lenders to strengthen liquidity management this year, the people said, asking not to be named as the matter is confidential. Different requirements are being instituted by province, such as quarterly stress tests, after CBRC studies last year showed increasing risks at those lenders, the people said." “Smaller banks are the weakest link of China’s financial system because their lack of a stable deposit base would force them to seek more expensive funding and offer more risky loans,” said Liu Jun, a Wuhan-based analyst at Changjiang Securities Co. “They will be hardest hit when borrowing costs are elevated and the economy slows.” The CBRC action was to be expected in the aftermath of news throughout last year, confirming that China's bad debt demons will soon be in need of a violent exorcism: "The requirements add to steps taken to protect against soured loans weighing on China’s economy, which included speeding up bad-loan writeoffs and limiting local government debt sales." Recall that as we reported previously in Big Trouble In Massive China, total losses from bad debt discharges could rise to a mind-boggling $3 trillion which would once and for all settle any debate about just how hard or soft China's "landing" (or is that lending?) would be: "The nation might face credit losses of as much as $3 trillion as defaults ensue from the expansion of the past four years, particularly by non-bank lenders such as trusts, exceeding that seen prior to other credit crises, Goldman Sachs Group Inc. estimated in August." It has gotten so bad that even China has started releasing official data confirming a very disturbing trendline -one of soaring NPLs at China listed banks. Obviously, the numbers indicated in the chart above are merely a fraction of the real state of bad loans permeating the country's financial system. One needs to merely look at the ridiculous amount of total corporate debt as a % of GDP in China - highest in the entire world - to know that this particular fable will not have a happy ending: Which is why China is rushing to proactively prepare the system to have buffers in advance of what may be a worst case scenario:

Of course, the real panic will commence once the financial turmoiling shifts from the small banks to the big ones: "China’s five biggest state-owned banks and 12 national lenders controlled more than 60 percent of the nation’s 148 trillion yuan of banking assets at the end of 2013, according to CBRC data. Other financial institutions including 144 city commercial lenders, 337 rural banks and more than 1,900 rural cooperatives owned the rest." Talk about "Too Big To Fail." Incidentally, the topic of China's inevitable financial crisis, and the open question of how it will subsequently bail out its banks is quite pertinent in a world in which Moral Hazard is the only play left. Conveniently, in his latest letter to clients, 13D's Kiril Sokoloff has this to say:

In other words, the PBOC is laying the groundwork for what developed markets would call an open-ended liquidity injection which can be use to bail out one and all banks on an a la carte basis. Or, in the parlance of our times, the biggest QE bazooka of all because with total banking assets of nearly $25 trillion, said bazooka better be ready to fire at a moment's notice. The only question is when will the market force China's central planners to demonstrate that unlike Paulson's bazooks, the one in Beijing is not a dud... |

02-12-14 | CHINA | 6 - China Hard Landing | |||

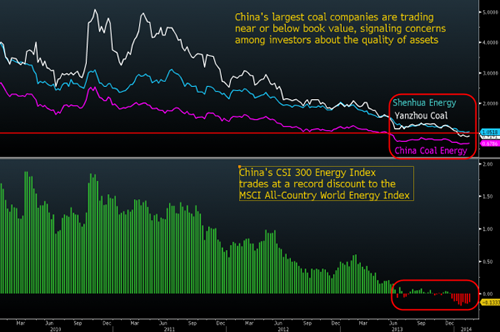

CHINA - Chinese Coal Producer Collapse a Major Shadow Banking Problem Think China's Credit Crisis Is Over? 02-11-14 Bloomberg via ZH The bailing out of the much-watched 'Credit equals Gold #1' wealth management product and safe liquidity-strewn (CNY375 billion from the PBOC) survival of the lunar new year liquidity crunch has many believing the worst is over. Though we discussed this fallacy in great depth here, the following chart of the total collapse in the largest Chinese coal producers says this is far from over. Trading at or below book values, investors are clearly signaling concerns about the quality of assets summed up perfectly by one local analyst - China's coal industry (whose loans back a massive amount of the wealth management products) is "dead." Via Bloomberg,

So, in summary, the PBOC had to bailout a 'small' wealth management product due to fears of contagion, which merely amplifies the future problems, and investors are pricing coal companies (which back a vast amount of shadow bank facilities) for major problems ahead... and the PBC had to pump CNY 375 billion in last week just to prop up the banks through the new year... But apart from that - yeah, China's credit crisis must be over because US equities are up for 3 days... |

02-12-14 | CHINA | 6 - China Hard Landing | |||

| TO TOP | ||||||

| MACRO News Items of Importance - This Week | ||||||

GLOBAL MACRO REPORTS & ANALYSIS |

||||||

| 01-15-14 | MACRO GROWTH CoN |

GLOBAL MACRO |

||||

NOW LETS LOOK AT SOME GENERAL STATISTICS 20 Signs That The Global Economic Crisis Is Starting To Catch Fire 02-15-14 Michael Snyder of The Economic Collapse blog via Zero Hedge If you have been waiting for the "global economic crisis" to begin, just open up your eyes and look around. I know that most Americans tend to ignore what happens in the rest of the world because they consider it to be "irrelevant" to their daily lives, but the truth is that the massive economic problems that are currently sweeping across Europe, Asia and South America are going to be affecting all of us here in the U.S. very soon. Sadly, most of the big news organizations in this country seem to be more concerned about the fate of Justin Bieber's wax statue in Times Square than about the horrible financial nightmare that is gripping emerging markets all over the planet. After a brief period of relative calm, we are beginning to see signs of global financial instability that are unlike anything that we have witnessed since the financial crisis of 2008. As you will see below, the problems are not just isolated to a few countries. This is truly a global phenomenon. Over the past few years, the Federal Reserve and other global central banks have inflated an unprecedented financial bubble with their reckless money printing. Much of this "hot money" poured into emerging markets all over the world. But now that the Federal Reserve has begun "tapering" quantitative easing, investors are taking this as a sign that the party is ending. Money is being pulled out of emerging markets all over the globe at a staggering pace and this is creating a tremendous amount of financial instability. In addition, the economic problems that have been steadily growing over the past few years in established economies throughout Europe and Asia just continue to escalate. The following are 20 signs that the global economic crisis is starting to catch fire... #1 The unemployment rate in Greece has hit a brand new record high of 28 percent. #2 The youth unemployment rate in Greece has hit a brand new record high of 64.1 percent. #3 The percentage of bad loans in Italy is at an all-time record high. #4 Italian industrial output declined again in December, and the Italian government is on the verge of collapse. #5 The number of jobseekers in France has risen for 30 of the last 32 months, and at this point it has climbed to a new all-time record high. #6 The total number of business failures in France in 2013 was even higher than in any year during the last financial crisis. #7 It is being projected that housing prices in Spain will fall another 10 to 15 percent as their economic depression deepens. #8 The economic and political turmoil in Turkey is spinning out of control. The government has resorted to blasting protesters with pepper spray and water cannons in a desperate attempt to restore order. #9 It is being estimated that the inflation rate in Argentina is now over 40 percent, and the peso is absolutely collapsing. #10 Gangs of armed bandits are roaming the streets in Venezuela as the economic chaos in that troubled nation continues to escalate. #11 China appears to be very serious about deleveraging. The deflationary effects of this are going to be felt all over the planet. The following is an excerpt from Ambrose Evans-Pritchard's recent article entitled "World asleep as China tightens deflationary vice"...

#12 There was a significant debt default by a coal company in China last Friday...

#13 Japan's Nikkei stock index has already fallen by 14 percent so far in 2014. That is a massive decline in just a month and a half. #14 Ukraine continues to fall apart financially...

#15 The unemployment rate in Australia has risen to the highest level in more than 10 years. #16 The central bank of India is in a panic over the way that Federal Reserve tapering is effecting their financial system. #17 The effects of Federal Reserve tapering are also being felt in Thailand...

#18 One of Ghana's most prominent economists says that the economy of Ghana will crash by June if something dramatic is not done. #19 Yet another banker has mysteriously died during the prime years of his life. That makes five "suspicious banker deaths" in just the past two weeks alone. #20 The behavior of the U.S. stock market continues to parallel the behavior of the U.S. stock market in 1929. Yes, things don't look good right now, but it is important to keep in mind that this is just the beginning. This is just the leading edge of the next great financial storm. The next two years (2014 and 2015) are going to represent a major "turning point" for the global economy. By the end of 2015, things are going to look far different than they do today. None of the problems that caused the last financial crisis have been fixed. Global debt levels have grown by 30 percent since the last financial crisis, and the too big to fail banks in the United States are 37 percent larger than they were back then and their behavior has become even more reckless than before. As a result, we are going to get to go through another "2008-style crisis", but I believe that this next wave is going to be even worse than the previous one. So hold on tight and get ready. We are going to be in for quite a bumpy ride. |

01-15-14 | MACRO-OUTLOOK RoN |

MACRO ECONOMICS |

|||

US ECONOMIC REPORTS & ANALYSIS |

||||||

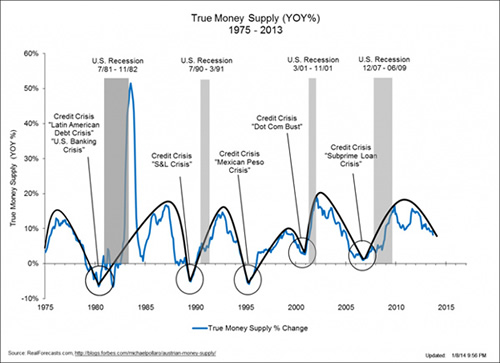

A RECESSION AHEAD - UNLESS LIQUDITY RATES INCREASED

Its pretty clear whats ahead if we look around the world! (See Global Charts Below) |

01-15-14 | US-INDICATORS-GROWTH | US ECONOMICS |

|||

A Sure Sign that an Economic Top is In, This Weekend's Barron's Front Cover |

US ECONOMICS |

|||||

| 01-15-14 | US INDICATORS GROWTH CoN |

US ECONOMICS |

||||

| 02-13-14 | US-CATALYST EMPLOYMENT |

US ECONOMICS |

||||

REAL DISPOSABLE INCOME NOW CONTRACTING |

02-13-14 | US-CATALYST-DI Real Disposable Income |

US ECONOMICS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | ||||||

MONEY VELOCITY STILL A MAJOR DEFLATIONARY PROBLEM |

02-10-14 | US MONETARY | CENTRAL BANKS |

|||

| THESIS Themes | ||||||

| 2014 - GLOBALIZATION TRAP | 2014 |  |

||||

|

STATISM - When the Future is About Working for the Central State

Barack Obama announced the hike of the minimum wage of workers under federal contracts from $7.25 to $10.10. Which got us thinking: just how disenfranchised really are Federal workers in the US? AVERAGE SALARY - Federal Employee versus US Per Capita Average salary of a Federal worker in the US and which is the average per capita income for all Americans. MEDIUM HOUSEHOLD INCOME "Chart Of The Day: What's Bad For America Is Good For... Washington, D.C." which while not providing Federal Worker data, has the median income for a resident of DC versus that of the average American. SENTIMENT & CONFIDENCE Is it any wonder that this chart then shows who knows they have it made in the sun (with Benefits, Pensions andHealthcare not included in the income charts above)!

|

||||||

|

2013 2014 |

||||||

|

FINANCIAL REPRESSION - Potential Wholesale Savings Confiscation & Enforced Redistribution Europe Considers Wholesale Savings Confiscation, Enforced Redistribution 02-12-14 Zero Hedge At first we thought Reuters had been punk'd in its article titled "EU executive sees personal savings used to plug long-term financing gap" which disclosed the latest leaked proposal by the European Commission, but after several hours without a retraction, we realized that the story is sadly true. Sadly, because everything that we warned about in "There May Be Only Painful Ways Out Of The Crisis" back in September of 2011, and everything that the depositors and citizens of Cyprus had to live through, seems on the verge of going continental. In a nutshell, and in Reuters' own words, "the savings of the European Union's 500 million citizens could be used to fund long-term investments to boost the economy and help plug the gap left by banks since the financial crisis, an EU document says." What is left unsaid is that the "usage" will be on a purely involuntary basis, at the discretion of the "union", and can thus best be described as confiscation. The source of this stunner is a document seen be Reuters, which describes how the EU is looking for ways to "wean" the 28-country bloc from its heavy reliance on bank financing and find other means of funding small companies, infrastructure projects and other investment. So as Europe finally admits that the ECB has failed to unclog its broken monetary pipelines for the past five years - something we highlight every month (most recently in No Waking From Draghi's Monetary Nightmare: Eurozone Credit Creation Tumbles To New All Time Low), the commissions report finally admits that "the economic and financial crisis has impaired the ability of the financial sector to channel funds to the real economy, in particular long-term investment." The solution? "The Commission will ask the bloc's insurance watchdog in the second half of this year for advice on a possible draft law "to mobilize more personal pension savings for long-term financing", the document said." Mobilize, once again, is a more palatable word than, say, confiscate. And yet this is precisely what Europe is contemplating:

But wait: there's more! Inspired by the recently introduced "no risk, guaranteed return" collectivized savings instrument in the US better known as MyRA, Europe will also complete a study by the end of this year on the feasibility of introducing an EU savings account, open to individuals whose funds could be pooled and invested in small companies. Because when corporations refuse to invest money in Capex, who will invest? Why you, dear Europeans. Whether you like it or not. But wait, there is still more! Additionally, Europe is seeking to restore the primary reason why Europe's banks are as insolvent as they are: securitizations, which the persuasive salesmen and sexy saleswomen of Goldman et al sold to idiot European bankers, who in turn invested the money or widows and orphans only to see all of it disappear.

Because there is nothing quite like securitizing feta cheese-backed securities and selling it to a whole new batch of widows and orphans. And topping it all off is a proposal to address a global change in accounting principles that will make sure that an accurate representation of any bank's balance sheet becomes a distant memory:

To summarize:

So, aside from all this, Europe is "fixed." The only remaining question is: why leak this now? Perhaps it's simply because the reallocation of "cash on the savings account sidelines" in the aftermath of the Cyprus deposit confiscation, into risk assets was not foreceful enough? What better way to give it a much needed boost than to leak that everyone's cash savings are suddenly fair game in Europe's next great wealth redistribution strategy. |

01-15-14 | THESIS | ||||

|

FINANCIAL REPRESSION -The Government Has Targeted Your Retirement Savings Account When George Clooney Starts Pitching Government Bonds... 02-07-14 Simon Black of Sovereign Man blog,via ZH Last week in his State of the Union address, the President of the United States laid the groundwork for a new government program he calls “MyRA”. As he explained to the American people, this program will allow US taxpayers the ability to loan their retirement savings to the federal government (which, according to POTUS, carries ZERO risk). Given that US Treasury yields fall far below the rate of inflation, this is a big win for the government, and a big loser for the poor suckers who loan them the money. The President then hit the road, touting his one-of-a-kind program. The Treasury Secretary hit the newspapers, encouraging Americans to enroll. I can see this unfolding like a War Bonds campaign, appealing to Americans’ love of country to get them to loan their money to the government at sub-inflation yields. In Italy they’ve already used football stars in patriotic appeals to get Italians to buy government bonds. In Japan they use teenage girl bands to entice wealthy Japanese businessmen to open their wallets for government bonds. So let’s see how long it takes for George Clooney and Matt Damon to make the pitch for the MyRA program… and how long after that it becomes mandatory for all Americans. Meanwhile, the IRS is doing its part. One of the best solutions that we’ve discussed in the past to liberate your IRA from this destructive trend is to set up a particular type of self-directed IRA. But the IRS has been intentionally making it more difficult to set up these structures over the past year. Now there’s even more roadblocks. In order to set up this type of structure, it’s imperative to first obtain a tax ID number. But due to agency budget cuts, the IRS is no longer issuing tax ID numbers for domestic entities through its call center. They’re saying that now you HAVE to use the online system. This is one website that the government actually got right. The tax ID application website is fairly straightforward, and it works great. EXCEPT if you are trying to set up this type of IRA. So if you’re an individual trying to obtain a tax ID number for your new company, no problem. The online system works great. But if you punch in that you are setting up a company to be owned by your IRA (or some other entity), then suddeny the system crashes and times out. I had my staff ring up the IRS yesterday to demand an answer. After two phone calls, each with a 30+ minute wait time to reach a human being, we finally got an answer. Confirmation, actually. The agent told us that yes, in fact, the online system has been programmed to intentionally reject tax ID number applications for companies that are owned by entities like an IRA. So they have essentially eliminated the option to apply online. But they won’t let you apply over the phone either. You can apply through the mail, but that will take 30-days, according to the agent. Or by fax, provided that you first cough up all sorts of other documentation. It certainly begs the question– at a time when the President of the United States is whipping up excitement over this new program to loan the government your retirement savings, why is their tax agency putting up huge roadblocks for Americans who don’t want to become victims? |

02-10-14 | THESIS | ||||

2011 2012 2013 2014 |

||||||

| THEMES | ||||||

| FLOWS -FRIDAY FLOWS | THEME | |||||

02-01-14 Richard Duncan Rich Dad

Argentina was the hardest hit. The Argentine peso fell 20% in January (and 15% in just one day). Brazil, India, Indonesia, Hungry, Russia, South Africa, and Turkey were also affected. So, here’s what happened. Most of the countries impacted import more than they export. Therefore, they must attract foreign capital to finance their trade deficits (much like a family that spends more than it earns must borrow money to finance that gap). Most of the time, it is easy for the Emerging Markets to attract plenty of foreign capital. Foreign investors are generally keen to invest in the Emerging Markets to profit from the higher interest rates and the faster rates of economic growth those economies tend to offer. After the global economic crisis began in 2008, the flow of capital into the Emerging Markets accelerated for two reasons. First, as interest rates fell to historic low levels in the developed economies, the higher interest rates on offer in the Emerging Markets became increasingly attractive. The second reason is that the Fed and the central banks of Japan, England and the Euro Zone created trillions of dollars worth of new fiat money. A significant amount of that new money found its way into the Emerging Markets. Then what went wrong? The thing that changed is that the Fed has announced that it intends to gradually reduce the amount of money it creates each month and to end its program of Quantitative Easing (i.e. money printing) altogether before the end of 2014. Last year, the Fed created $85 billion every month. In January, that was reduced to $75 billion and in February the amount will be reduced again to $65 billion. While $65 billion is still an enormous amount of money to be created in only one month, investors are looking further ahead. They sense that money will become tight later this year if the Fed continues to taper QE, as it has signaled that it will. They understand that tighter financial conditions will damage the growth prospects of the Emerging Market economies and cause asset prices there to fall. Therefore, foreign investors are taking their money out now rather than waiting around to be the last to leave the party. So, even though there is a great deal of excess liquidity in the developed economies, and even though the Fed is expected to add $65 billion more to that pool of excess liquidity in both February and March, money is fleeing the Emerging Markets; and this outflow of money is damaging the economic prospects of those countries and causing asset prices there to fall. The outflow of capital is causing the Emerging Market currencies to depreciate. With their currencies depreciating, those countries must pay more for the goods they import; and the rising cost of imports is causing inflation to increase. Consequently, the central banks in those countries are being forced to raise interest rates to combat the rising inflation. Higher interest rates, however, will cause those economies to grow more slowly. With foreign capital departing, there is generally little that the economic policymakers in those countries can do to prevent their economies from being hit. Many of them feel increasingly bitter about their helplessness in the face of global capital flows over which they have very little control. What, then, should Emerging Market investors (and the people who live in the Emerging Market countries) expect next? Unfortunately, things will probably get worse before they get better. As we have seen many times before, when the tide of global money goes out, companies and banks begin to fail. Such bankruptcies tend to exacerbate the panic, causing even more capital outflows. Panic is contagious. It tends to spread to all corners of the world before it burns itself out. So when will this Emerging Markets selloff end? I believe it will end when the Fed announces that it will stop tapering QE. I believe the Fed will make that announcement before the middle of this year. If it does not, liquidity conditions in the United States will begin to tighten and tighter liquidity will threaten to throw the US back into recession. If I am right, QE will not end in 2014. Instead, the Fed will end up creating another $500 billion to $1 trillion in 2015. If this scenario unfolds as outlined above, then foreign investors will turn keen on the Emerging Markets again by mid-year when the Fed signals it will extend QE. At that point, they will send a new flood of liquidity gushing back into the developing world. If so, asset prices there will once again surge. To me, this seems the most probable scenario. Unfortunately, a lot of damage may be inflicted on those economies (and on those who invest in those markets) between now and then.

|

02-14-14 | |||||

| SHADOW BANKING -LIQUIDITY / CREDIT ENGINE | THEME | |||||

| CRACKUP BOOM - ASSET BUBBLE | THEME | |||||

| ECHO BOOM - PERIPHERAL PROBLEM | THEME | |||||

| 01-14-14 | ECHO BOOM |

|||||

| PRODUCTIVITY PARADOX -NATURE OF WORK | THEME | |||||

| STANDARD OF LIVING -EMPLOYMENT CRISIS | THEME | |||||

| CORPORATOCRACY -CRONY CAPITALSIM | THEME |  |

||||

CORRUPTION & MALFEASANCE -MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

||||

|

DOJ Sued For Crony Justice - Presenting "A Decade of Illegal Conduct by JP Morgan Chase" 02-10-14 Zero Hedge Earlier today, the non-profit organization Better Markets did what so many others have only dreamed of doing - they sued JPMorgan. Specifically, as they disclose in the fact sheet posted on their website, they are "challenging the historic and unprecedented $13 billion settlement agreement between the U.S. Department of Justice and JP Morgan Chase (“Agreement”). Better Markets alleges in its complaint that the DOJ violated the Constitution and laws of the United States by using a mere contractual agreement to resolve claims of historic importance without subjecting the Agreement to independent judicial review. In effect, the DOJ acted as investigator, prosecutor, judge, jury, sentencer, and collector, without any check on its authority or actions, even though the amount is the largest in the 237 year history of the United States. Because the DOJ has declared its intention to use the Agreement as a “template” in future similar cases, it is imperative that the DOJ’s unlawful and secretive approach in the settlement process be subjected to judicial review." We wish them the best of luck, as in a "crony jsutice" system as corrupt as this one - perhaps best described, paradoxically enough by the fictional movie The International - where the same DOJ previously implicitly admitted it will not prosecute "systemically important" firms like JPM to the full extent of the law and instead merely lob one after another wrist slap at them to placate the peasantry, any hope for obtaining true justice is impossible. That said, the key aspects of the Better Markets lawsuit deserve attention. They are broken down as follows: For years leading up to the financial crisis of 2008, JP Morgan Chase allegedly engaged in pervasive fraud in the packaging and sale of thousands of mortgage-backed securities to investors. Those securities were stuffed with subprime loans that failed to meet applicable underwriting criteria. Employees, managers, and potentially high-level executives of JP Morgan Chase knew that the securities were riddled with toxic loans, but they allegedly concealed the truth from investors when they marketed and sold the securities. Investors lost huge but still unknown sums of money as a result of the fraud, and the bank’s illegal conduct contributed directly to the biggest financial crash since 1929 and the worst economy since the Great Depression of the 1930s. The Agreement was struck under the most extraordinary circumstances. For example—

?Notwithstanding the historic nature of the settlement, the Agreement was never subjected to judicial review, so there has been no independent evaluation of its terms. Furthermore, the vague settlement documents fail to disclose critically important information about every aspect of the deal. For example, the Agreement fails to identify or explain—

By entering the Agreement without seeking any judicial review and approval, the DOJ violated the Constitution and laws of the United States.

* * * But perhaps the most informative aspect of the lawsuit fact sheet is simply stepping back and observing the relentless illegal transgressions by Jamie Dimon's firm. Better Markets summarizes them best as follows: Highlights From A Decade of Illegal Conduct by JP Morgan Chase

Did we mention that nobody from JPM has gone to prison, and instead as of late last week, one of the biggest JPM culprits was set to become a member of the CFTC's advisory panel before the people and not the regulators, were forced to step in? Why? |

02-11-14 | |||||

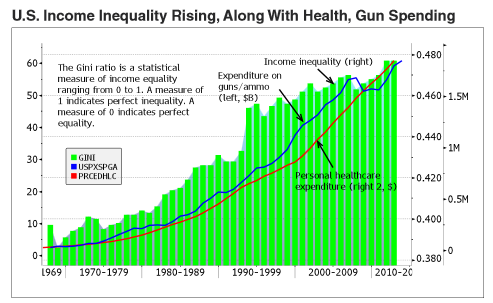

| SOCIAL UNREST -INEQUALITY & A BROKEN SOCIAL CONTRACT | THEME | |||||

| 02-11-14 | SOCIAL UNREST |

|||||

SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT Stiglitz: “Sick”! 02-10-14 Zero Hedge

Joseph Stiglitz, Nobel Laureate and Professor at Columbia University believes that:

“Soon after the global financial crisis erupted in 2008, I warned that unless the right policies were adopted, Japanese-style malaise — slow growth and near-stagnant incomes for years to come — could set in.” WRONG POLICIES The right policies have not been adopted. Financial institutions are still not doing much more than speculating, rather than investing. IMBALANCES & INEQUALITIES Imbalances are rife and inequalities abound. We hardly need to look very far to see that nothing is changing except (maybe) getting worse. Stiglitz states today in an interview with CNBC: “On both sides of the Atlantic, GDP is likely to grow considerably faster this year than in 2013. But, before leaders who embraced austerity policies open the champagne and toast themselves, they should examine where we are and consider the near-irreparable damage that these policies have caused.” Stiglitz believes that downturns in the economy come to an end at some point in time. Although perhaps, what might be true in this case is that policies have done nothing to exacerbate and render the problem almost irreparable. Economics is not clear-cut and no it can’t be made better by adding A and B and ending up with C. But, what can happen, even in simple math is that A plus B ends up with the result Z. We are right down there at the bottom with the simple math the governments have been doing. The policies that have been implemented will not and have not made the downturn in the economy shorter. They have not cushioned the landing to make it easier. Stiglitz calls the damage as a result of the policies ‘long-standing consequences’. The situation has simply got worse. We are not even at a point where we are back to levels of growth that we were seeing before 2007 and the financial crisis. The truth is the financial crisis hasn’t ever come to an end and it certainly hasn’t seen things getting any better. Whether it be in Europe or in North America, the figures speak for themselves.

The economists were either so bad at predicting the downfall of the economies in the world prior to the crash, or otherwise they did their darnedest to pull the wool over the eyes of the rest of the public (everyone but the banksters and the policy-makers; after all they were in on the secret, weren’t they?). There’s hardly anyone that would openly admit that the economy is going to get better, is there? Do people still believe that or is it all still media hype with a whole load of spin to get us to vote them back into position of power and authority so the scheming can continue? Government policies won’t change as we are so far now down the river that any amount of paddling up the proverbial creek will have little effect on what is going to be a bitter time of discontent. At one time the discontent only lasted for a winter, but, now it’s here to stay. It’s going to be a bitter winter of discontent. Long, hard and cold. The policy makers won’t change because they haven’t got an answer and they won’t change because they are still pandering to the banksters and shoring up the stock markets in the hope that there will be MOAR. The polices undertaken by the governments of the entire western world have heightened inequalities in society. Inequalities of wealth, between men and women, between the old and the young. The economies of those countries cannot right themselves because of the inequality that exists between people; the’ haves and the have-nots’ has never been a more fitting description. But, inequalities will lead to further reductions in demand. The rich get richer, hoarding their wealth and they stop spending; the poor have no money left as we listen to government leaders pontificating and vociferating about how the ‘coffers being empty’. Governments have reacted like we all watch them do when there is a tsunami, an oil-spill or an earthquake. They stand and watch from their offices and then when it’s too late they put their wellies on and hop into a helicopter to fly over the disaster zone. It’s too late now. The poor will have to get used to looking on as the rich accumulate more. The former will have to adjust their standard of living, as the ultra-high-net-worth individuals add another $2 trillion to their wealth in 2013 (up to $30 trillion now). The poor are the 90% that own just 13% of the world’s wealth. Peanuts. Why would governments take that into consideration? We don’t even go to vote these days as much as we used to. We have given up. Giving up means they have won. |

02-11-14 | US PUBLIC POLICY

THEME SOCIAL UNREST & INEQUALITY |

SOCIAL UNREST |

|||

| TO TOP | ||||||

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP

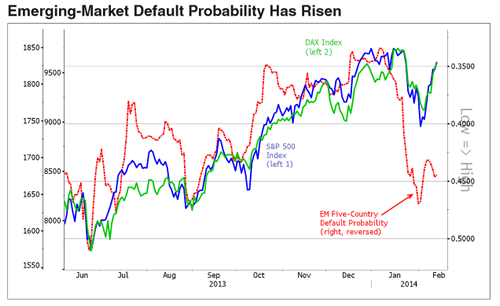

Emerging Markets went into convulsions last week as foreign capital headed for the exits. Equities and currencies took a significant hit in most of the developing economies around the world. This near panic was set off by growing concerns about the Federal Reserve’s plans to reduce Quantitative Easing (QE) in the United States.

Emerging Markets went into convulsions last week as foreign capital headed for the exits. Equities and currencies took a significant hit in most of the developing economies around the world. This near panic was set off by growing concerns about the Federal Reserve’s plans to reduce Quantitative Easing (QE) in the United States.