|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Mon. Feb. 10th, 2014

What Are Tipping Poinits?

Understanding Abstraction & Synthesis

Global-Macro in Images: Understanding the Conclusions

| FEBRUARY | ||||||

| S | M | T | W | T | F | S |

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |

| Complete Archives |

||||||

KEY TO TIPPING POINTS |

| 1 - Risk Reversal |

| 2 - Japan Debt Deflation Spiral |

| 3- Bond Bubble |

| 4- EU Banking Crisis |

| 5- Sovereign Debt Crisis |

| 6 - China Hard Landing |

| 7 - Chronic Unemployment |

| 8 - Geo-Political Event |

| 9 - Global Governance Failure |

| 10 - Chronic Global Fiscal ImBalances |

| 11 - Shrinking Revenue Growth Rate |

| 12 - Iran Nuclear Threat |

| 13 - Growing Social Unrest |

| 14 - US Banking Crisis II |

| 15 - Residential Real Estate - Phase II |

| 16 - Commercial Real Estate |

| 17 - Credit Contraction II |

| 18- State & Local Government |

| 19 - US Stock Market Valuations |

| 20 - Slowing Retail & Consumer Sales |

| 21 - China - Japan Regional Conflict |

| 22 - Public Sentiment & Confidence |

| 23 - US Reserve Currency |

| 24 - Central & Eastern Europe |

| 25 - Oil Price Pressures |

| 26 - Rising Inflation Pressures & Interest Pressures |

| 27 - Food Price Pressures |

| 28 - Global Output Gap |

| 29 - Corruption |

| 30 - Pension - Entitlement Crisis |

| 31 - Corporate Bankruptcies |

| 32- Finance & Insurance Balance Sheet Write-Offs |

| 33 - Resource Shortage |

| 34 - US Reserve Currency |

| 35- Government Backstop Insurance |

| 36 - US Dollar Weakness |

| 37 - Cyber Attack or Complexity Failure |

| 38 - Terrorist Event |

| 39 - Financial Crisis Programs Expiration |

| 40 - Natural Physical Disaster |

| 41 - Pandemic / Epidemic |

Reading the right books?

No Time?

![]()

We have analyzed & included

these in our latest research papers!

![]()

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

TODAY'S TIPPING POINTS

TODAY'S TIPPING POINTS

| THIS WEEKS TIPPING POINTS | MACRO NEWS | MARKET | 2013 THEMES |

MONEY VELOCITY STILL A MAJOR

DEFLATIONARY PROBLEM

"BEST OF THE WEEK " |

Posting Date |

Labels & Tags | TIPPING POINT or 2013 THESIS THEME | |||||||

HOTTEST TIPPING POINTS |

Theme Groupings |

|||||||||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro |

||||||||||

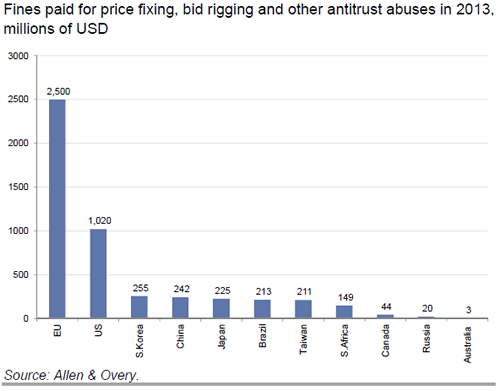

EU BANKING - Beware of EU Banks Why You Shouldn't Trust Europe In One Simple Chart 02-09-14 Goldman Sachs via ZH

While China (or Russia) are held up as the world's most corrupt among developed nations among the status-quo-huggers, it would seem there are two other nations that dominate when it comes to getting caught. Europe paid more in fines (in fact double the US and 10 times China) for price-fixing, bid-rigging, and other anti-trust abuses in 2013. So why would we believe them that 'recovery' is right around the corner?

|

02-10-14 | MACRO EU MONETARY |

4- EU Banking Crisis | |||||||

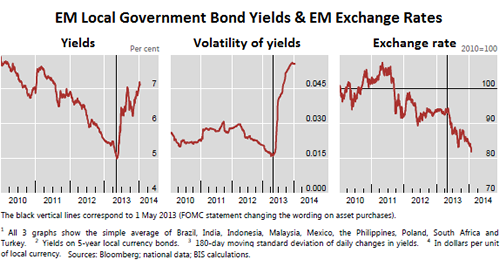

EU BANKING - Emerging Markets Aggravates Festering Problems Giant Sucking Sound? Emerging-Markets Fiasco To Topple European Banks 02-05-14 Wolf Richter - Testosterone Pit via 24hGOLD It’s not like Europe is out of the woods, after years of recession, lurching from bank bailout to country bailout, and sweeping remaining fetid matters under the rug. But its banks are now sinking deeper into an even greater morass: the emerging-markets fiasco. Since QE Infinity turned into a pipedream in early May last year when the Fed’s taper cacophony bounced around the world, it has been a volatile mess in the emerging markets that picked up steam recently with currencies, stocks, and bonds skidding. Argentina devalued. Venezuela has become a complete basket case. Turkey, which is mired in a political and democratic crisis, including a “frantic crackdown“ on the media, jacked up its interest rates to make your head spin, in a vain effort to prop up the lira. Brazil, India, Indonesia, and South Africa are flailing about to contain the ravages. China is slowing too. And what we hear is that giant sucking sound of hot money leaving. What QE giveth, the end of QE taketh away. And these already teetering European Banks are waving mysterious balance sheets whose decomposing “assets” no one is allowed to disclose, and whose sanctity no one is allowed to even doubt [read my exposé of how the French banking regulator hounded two doubting bloggers instead of investigating the banks..... Gagging Doubt: French Crackdown On French And American Bloggers Who Question Megabank Balance Sheets]. Turns out, these illustrious banks are stuck in the credit muck with loans totaling $3.4 trillion to the emerging markets (more than four times the exposure of US banks), according to analysts at Deutsche Bank. And $1.7 trillion of this malodorous debt is on the books of just six (mercifully unnamed) European banks. If a portion of those loans default.... “We think EM shocks are a real concern for 2014,” explained Matt Spick, analyst at Deutsche Bank – most likely the understatement of the century. “When currency combines with revenue slowdowns and rising bad debts, we see compounding threats to the exposed banks.” Gosh, I don’t even want to speculate which banks would topple first. And this is, according to a working paper by the Bank of International Settlements, how local-government bond yields in the emerging markets, volatility of these yields, and currencies have rattled nerves since the taper cacophony started last May (indicated by the black vertical lines). So very ugly:

The putrid smell of crisis wafts around these illustrious European banks in a number of ways. Income from capital markets and private banking activities would shrivel. The collapse of a currency would hit capital held in that country and income. As interest rates rise – they haven’t risen nearly enough yet – and as the economies begin to wobble, a portion of the $3.4 trillion in loans would default or, via pretend-and-extend, slowly decompose. Loan losses would pile up. Some would be stuffed into the bank’s basements, safely out of view, where they would be layered on top of decomposing European “assets.” Every European country has its own specialty. British banks are exposed to the tune of $518 billion in loans to the Asia-Pacific region. Spanish banks are strung out with $475 billion in Latin America. French banks have $200 billion in loans tied up in the developing economies in Europe, same as the tottering Italian banks. Each individual bank has its own nightmare. Barclays is exposed to South Africa. Spanish banks BBVA and Santander have respectively $107 billion and $132 billion in loans to Latin America on their books; half of Santander’s portion is hung up in Brazil. BBVA and Italian bank UniCredit are up to their ears into Turkey. Standard Chartered – which made over 90% of its income from Asia, Africa, and the Middle East – and HSBC are exposed to the turbulence in Indonesia and India. In anticipation, the European banking index SX7P has dropped 7.7% over the last two weeks. Is ECB President Mario Draghi also going to bail out the emerging markets with a “whatever it takes” promise, so that he won’t have to bail out his own banks manually? One thing leads to another: currency collapses and high inflation in Venezuela and Argentina, combined with chaos in Turkey, and lower growth in India and China make the emerging markets very unappetizing for the hot money – and as it flees, mere problems turn into crisis. The ensuing currency shock can trigger a credit shock. Higher rates and a wobbly economy entail loan defaults. Mess ensues. Because this is a well-established sequence in the emerging markets, the hot money, which has been through this before, is bailing out in advance. Mess ensues more quickly. These glorious European banks have 12% of their assets in the emerging markets but get about a quarter of their income from them. Business there, as Deutsche Bank analyst Spick put it, is “unusually profitable.” Hence, their reckless desire to make hay where they can while they can, as things have been tough and murky in Europe since the outbreak of the debt crisis. Now the haymaking is over. In just the week through January 29, $6.3 billion was yanked from emerging market equities, the largest outflow since August 2011. So EM stocks and bonds have been skidding, to the point where UBS CEO Sergio Ermotti himself felt like he had to intervene and put a stop to it, if only temporarily, and so he told Bloomberg today, “Short term, it looks a little bit overdone.” It helped. Emerging market stocks perked up. A deus ex machina. But many more will be needed to keep these European banks from asking taxpayers for yet another round of bailouts, and stockholders, junior bondholders, and depositors for a solid round of very popular bail-ins. The last stock-market bears have gone into hibernation, browbeaten and humiliated and ridiculed by years of brilliant rallies. Clinging to their analyses and the now silly notion that stocks should trade based on economic realities, they lost clients and money and their jobs. Read....Stocks Plunge: ‘And This Too Shall Pass,’ Or Something |

02-10-14 | MACRO EU MONETARY |

4- EU Banking Crisis | |||||||

EU BANKING - European Banks Have $3 Trillion Of Exposure To Emerging Marketss European Banks Have $3 Trillion Of Exposure To Emerging Markets 02-04-14 BI LONDON (Reuters) - European banks have loaned in excess of $3 trillion to emerging markets, more than four times U.S. lenders and putting them at greater risk if financial market turmoil in countries such as Turkey, Brazil, India and South Africa intensifies. The risk is most acute for six European banks - BBVA, Erste Bank, HSBC, Santander, Standard Chartered, and UniCredit - according to analysts. But the exposure could be a headache for the industry as a whole, just as it faces a rigorous health-check by the European Central Bank, aiming to expose weak points and restore investor confidence in the wake of the 2008 financial crisis. "We think EM (emerging markets) shocks are a real concern for 2014," said Matt Spick, analyst at Deutsche Bank. "When currency (volatility) combines with revenue slowdowns and rising bad debts, we see compounding threats to the exposed banks." The Deutsche Bank analysts said the six most exposed European banks - which they did not name - had more than $1.7 trillion of exposure to developing markets. In recent weeks, emerging market currencies have come under fire as China's growth slows and the U.S. Federal Reserve winds down its stimulus program, with investors selling developing market assets in anticipation of higher U.S. interest rates. In a bid to protect currencies, interest rates have been hiked in Turkey and elsewhere, but investors remain nervy, especially around the so-called "Fragile Five" economies of Turkey, Brazil, India, Indonesia and South Africa. An emerging markets crisis could hit banks in a variety of ways - a collapse in local currency can hurt reported earnings or capital held in the country; loan losses can jump as interest rates rise; or income from capital markets activity or private banking can fall. European banks' exposure varies from country to country. BBVA <BBVA.MC> and UniCredit <CRDI.MI> have big exposure to Turkey, Santander <SAN.MC> is most exposed to Brazil, while Standard Chartered <STAN.L> and HSBC <HSBA.L> would be hurt by problems in India and Indonesia. Barclays <BARC.L>, meantime, would be most exposed to South African problems, analysts said. However, they said the impact of apparently individual problems, such as inflation in Venezuela or lower growth in India, could quickly spread into wider concern among investors, and had already contributed to a 7 percent drop by Europe's bank index <.SX7P> in the last two weeks. The biggest risk is that a jump in interest rates sparks defaults on loans, analysts added. Often a credit shock follows or replaces a currency shock, as happened in Argentina in 1999-2002. EXPOSUREEurope's banks have cut their overseas loans since the financial crisis and substantially increased the amount of capital they hold, meaning they have a better cushion to absorb losses than in the past. But they still have about 12 percent of their assets in emerging markets, and about a quarter of their earnings come from the region as often the businesses there are "unusually profitable", Deutsche Bank's Spick said. European banks had $3.4 trillion of loans to developing countries at the end of September, according to data from the Bank for International Settlements. British banks had a $518 billion exposure to the Asia-Pacific region, Spanish banks had $475 billion of loans to Latin America, and banks in France and Italy each had $200 billion of exposure to developing economies in Europe. Among the most exposed banks, Standard Chartered makes more than 90 percent of its earnings from Asia, Africa and the Middle East, and warned in December that its 10-year record of earnings growth would likely end. BBVA had 41 billion euros ($55 billion) of exposure to Mexico - which last year made up 80 percent of group profits - and 52 billion euros of loans to South America. Santander had 132 billion euros of loans to Latin America at the end of last year, half of which were in Brazil.Brazil contributed 23 percent of group earnings last year, and the rest of Latin American contributed another 24 percent. Analysts said emerging market turmoil could also have a broader, indirect impact on revenues in investment banking and wealth management. "A significant increase in volatility in EM bonds and FX may result in volumes drying up and hence a potential for a material slowdown in EM fixed income revenues," said JPMorgan analyst Kian Abouhossein. He estimated the investment banks of HSBC and Standard Chartered each generated $2.1-2.2 billion from emerging markets, while Credit Suisse <CSGN.VX> and Deutsche Bank <DBKGn.DE> made about $1.1 billion each. (Additional reporting by Sarah White in Madrid; Editing by Mark Potter) This post originally appeared at Reuters. Copyright 2014. Follow Reuters on Twitter |

02-10-14 | MACRO EU MONETARY |

4- EU Banking Crisis | |||||||

|

||||||||||

| THESIS & THEMES | ||||||||||

|

FINANCIAL REPRESSION -The Government Has Targeted Your Retirement Savings Account When George Clooney Starts Pitching Government Bonds... 02-07-14 Simon Black of Sovereign Man blog,via ZH Last week in his State of the Union address, the President of the United States laid the groundwork for a new government program he calls “MyRA”. As he explained to the American people, this program will allow US taxpayers the ability to loan their retirement savings to the federal government (which, according to POTUS, carries ZERO risk). Given that US Treasury yields fall far below the rate of inflation, this is a big win for the government, and a big loser for the poor suckers who loan them the money. The President then hit the road, touting his one-of-a-kind program. The Treasury Secretary hit the newspapers, encouraging Americans to enroll. I can see this unfolding like a War Bonds campaign, appealing to Americans’ love of country to get them to loan their money to the government at sub-inflation yields. In Italy they’ve already used football stars in patriotic appeals to get Italians to buy government bonds. In Japan they use teenage girl bands to entice wealthy Japanese businessmen to open their wallets for government bonds. So let’s see how long it takes for George Clooney and Matt Damon to make the pitch for the MyRA program… and how long after that it becomes mandatory for all Americans. Meanwhile, the IRS is doing its part. One of the best solutions that we’ve discussed in the past to liberate your IRA from this destructive trend is to set up a particular type of self-directed IRA. But the IRS has been intentionally making it more difficult to set up these structures over the past year. Now there’s even more roadblocks. In order to set up this type of structure, it’s imperative to first obtain a tax ID number. But due to agency budget cuts, the IRS is no longer issuing tax ID numbers for domestic entities through its call center. They’re saying that now you HAVE to use the online system. This is one website that the government actually got right. The tax ID application website is fairly straightforward, and it works great. EXCEPT if you are trying to set up this type of IRA. So if you’re an individual trying to obtain a tax ID number for your new company, no problem. The online system works great. But if you punch in that you are setting up a company to be owned by your IRA (or some other entity), then suddeny the system crashes and times out. I had my staff ring up the IRS yesterday to demand an answer. After two phone calls, each with a 30+ minute wait time to reach a human being, we finally got an answer. Confirmation, actually. The agent told us that yes, in fact, the online system has been programmed to intentionally reject tax ID number applications for companies that are owned by entities like an IRA. So they have essentially eliminated the option to apply online. But they won’t let you apply over the phone either. You can apply through the mail, but that will take 30-days, according to the agent. Or by fax, provided that you first cough up all sorts of other documentation. It certainly begs the question– at a time when the President of the United States is whipping up excitement over this new program to loan the government your retirement savings, why is their tax agency putting up huge roadblocks for Americans who don’t want to become victims? |

02-10-14 | THESIS | ||||||||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - February 2nd - February 9th | ||||||||||

| RISK REVERSAL | 1 | |||||||||

| JAPAN - DEBT DEFLATION | 2 | |||||||||

| BOND BUBBLE | 3 | |||||||||

EU BANKING CRISIS |

4 |

|||||||||

| SOVEREIGN DEBT CRISIS [Euope Crisis Tracker] | 5 | |||||||||

| CHINA BUBBLE | 6 | |||||||||

| TO TOP | ||||||||||

| MACRO News Items of Importance - This Week | ||||||||||

GLOBAL MACRO REPORTS & ANALYSIS |

||||||||||

US ECONOMIC REPORTS & ANALYSIS |

||||||||||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | ||||||||||

| Market | ||||||||||

| TECHNICALS & MARKET |

|

|||||||||

| COMMODITY CORNER - HARD ASSETS | PORTFOLIO | |||||||||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | |||||||||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | |||||||||

| THESIS Themes | ||||||||||

| 2014 - GLOBALIZATION TRAP | ||||||||||

2013 - STATISM |

||||||||||

2012 - FINANCIAL REPRESSION |

||||||||||

2011 - BEGGAR-THY-NEIGHBOR -- CURRENCY WARS |

||||||||||

2010 - EXTEND & PRETEND |

||||||||||

| THEMES | ||||||||||

| FLOWS -FRIDAY FLOWS | ||||||||||

| SHADOW BANKING -LIQUIDITY / CREDIT ENGINE | ||||||||||

| CRACKUP BOOM - ASSET BUBBLE | ||||||||||

| ECHO BOOM - PERIPHERAL PROBLEM | ||||||||||

| PRODUCTIVITY PARADOX -NATURE OF WORK | ||||||||||

| SECURITY-SURVEILLANCE COMPLEX -STATISM | ||||||||||

| GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | ||||||||||

| CENTRAL PLANINNG -SHIFTING ECONOMIC POWER | ||||||||||

| STANDARD OF LIVING -EMPLOYMENT CRISIS | ||||||||||

| CORPORATOCRACY -CRONY CAPITALSIM | ||||||||||

CORRUPTION & MALFEASANCE -MORAL DECAY - DESPERATION, SHORTAGES.. |

||||||||||

| SOCIAL UNREST -INEQUALITY & A BROKEN SOCIAL CONTRACT | ||||||||||

| CATALYSTS -FEAR & GREED | ||||||||||

| GENERAL INTEREST |

|

|||||||||

| TO TOP | ||||||||||

|

||||||||||

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP