|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Wed. Apr. 6th , 2016

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

![]()

| APRIL | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | |||||

| 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 10 | 11 | 12 | 13 | 14 | 15 | 16 |

| 17 | 18 | 19 | 20 | 21 | 22 | 23 |

| 24 | 25 | 26 | 27 | 28 | 29 | 30 |

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| NEW - Stagflation - Slow Growth & Personal Inflation |

| 20 - US Dollar |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Poorly Regulated Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

|

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

"BEST OF THE WEEK " MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

| Market - WEDNESDAY STUDIES | |||

| STUDIES - MACRO pdf | |||

TECHNICALS & MARKET |

04-06-16 |

||

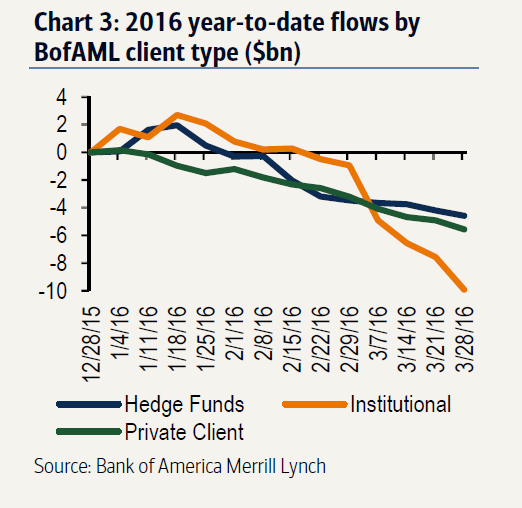

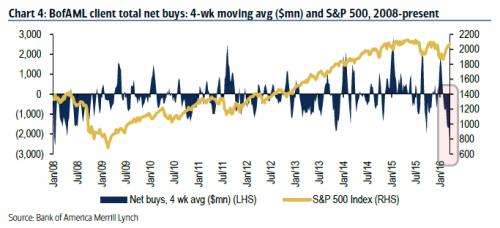

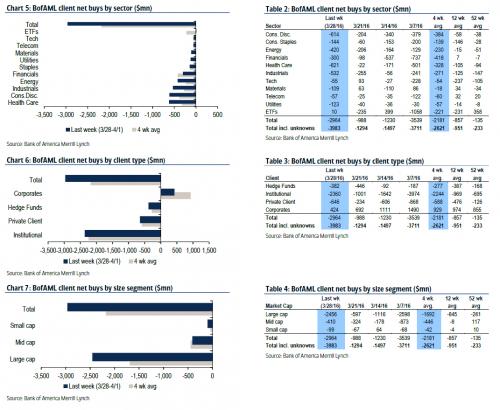

'Everything Is Being Sold'Smart Money Selling Soars,Now In 10th Straight Week"Still No Confidence In The Rally" - that's the title of the latest weekly BofA report looking at the buying and selling by its smart money clients (institutional clients, private clients and hedge funds), which finds that not only were sales by this group of clients last week the largest since September, and the fifth-largest in our data history, but this was the 10th consecutive week of selling as absolutely nobody believed this fakest of fake "rebounds" in recent history. From BofA:

This can be seen in the chart below, where it becomes obvious that while the last two market dips in August and January were aggressively bought, this time nobody, well, buys it. In fact, the 4 week average selling has been the greatest almost on record. More troubling, buybacks are slowing down fast: "Buybacks by corporate clients decelerated to their lowest levels since the comparable week at the end of 4Q. April has historically been one of the seasonally lightest months for buybacks by our clients after October and July (see chart below)." And while previously, smart money at least had a preference to one or more sectors which they bought as they dumped everything else, this week that was not the case: "everything is being sold."

The central banks will have to try harder to restore confidence. Wait, what's that, the harder they try to restore confidence that all is well, the less confidence there is? Oh... |

|||

TIPPING POINTS, STUDIES, THESIS, THEMES & SII COVERAGE THIS WEEK PREVIOUSLY POSTED - (BELOW) |

|||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Apr 3rd, 2016 to April 9th, 2016 | |||

| TIPPING POINTS - This Week - Normally a Tuesday Focus | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

NEW - Stagflation - Slow Growth & Personal Inflation |

04-05-16 | NEW - Stagflation - Slow Growth & Personal Inflation |

|

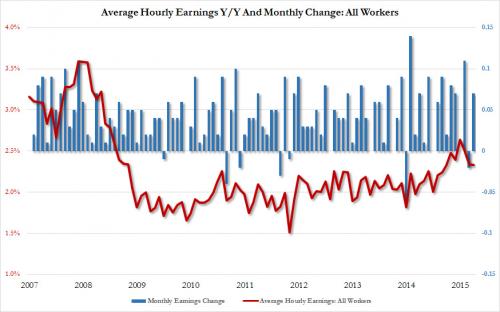

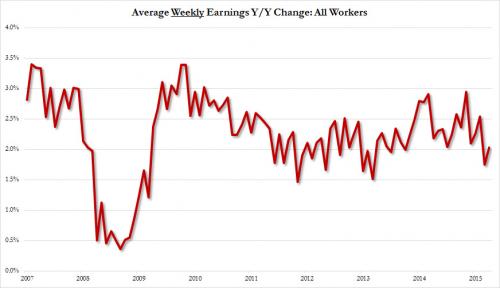

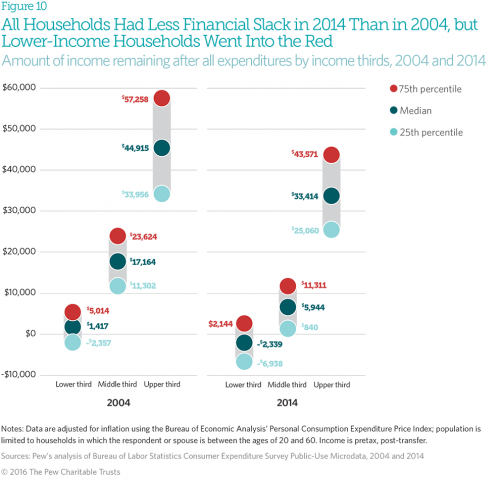

The Next Big Problem:"Stagflation Is Starting To ShowAcross The Economy"In the past few months, the Bureau of Labor Statistics has gone out of its way to show that U.S. worker compensation is finally rising. There is one problem with that: while that may be true on an hourly basis... ... on a weekly basis, the picture is vastly different. What is happening is that weekly wage growth have gone nowhere in years, but because the average hours worked per week has declined and today hit a 2 year low of 34.4, it translates into more money per hour worked. But let's assume that wages, or at least the perception thereof, is indeed rising - is this helping the average American? Well, as we showed earlier this week, the net "after expense" income of average Americans measured in real dollars has declined from $17K in 2004 to $6,000 in 2014 because as wages have declined dramatically, expenses have surged. In fact, according to the recent Pew study, by 2014, median income had fallen by 13 percent from 2004 levels, while expenditures had increased by nearly 14 percent, As such a 2.5%, or 3.5% or even 10% increases in wages will not manage to offset the surging expenditures, mostly on rent. All of this you will never see discussed in a sellside research report, which instead relies on the basic hourly earnings headline numbers. Instead, you will see charts like this from Wells Capital's Jim Paulsen. And yet, even the analysts who are only looking at the most rudimentary data are now warning that a new problem is emerging for the US economy, a problem which is always present whenever wages are rising, while overall economic growth is stalling (as it is currently according to the Atlanta Fed with a 0.7% Q1 GDP) and corporate profits are about to plunge by the most since the financial crisis: stagflation. In a note earlier today, Deutsche Bank laid out the following ominous warning:

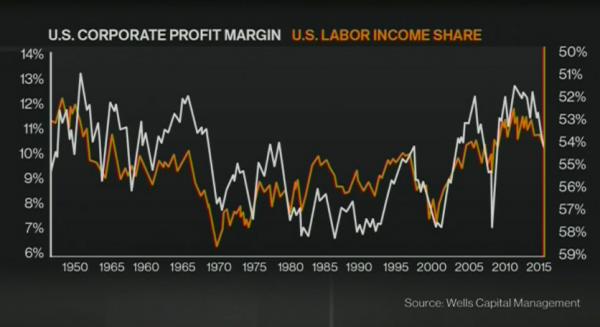

What Deutsche Bank is referring to is the following chart which shows the explicit and inverse correlation between corporate profits and employee wages. What it demonstrates clearly is that if indeed labor income, i.e., wages, are rising, then profit margins have no choice but to fall even more; this means that if the stock market wishes to continue rising even higher it will only achieve this with margin expansion, which however can only be achieved by even more Fed intervention and more stimulative inflation, which then pushes wages even higher generating a self-defeating feedback loop.

This is something we touched upon early in January when we made an observation on small business operating margins, namely that "If Companies Are Telling The Truth, Profit Margins Are About To Collapse The Most In The 21st Century." Which brings us to the following Bloomberg TV interview with Wells Fargo's Jim Paulsen in which the otherwise jovial permabull focuses on only one thing: the rising threat of stagflation. This is what he said:

... At this point we would like to interject that while we love the strawman argument that real wages are "growing fast" as much as the next guy, the reality is that this is bullshit as the previously shown chart from Pew has demonstrated: whether Americans are spending for more items, or actual prices are soaring, the consumer's net income as shown below, has plunged. Anyway, back to Paulsen who then says this:

Can this scenario tip us into a recession Paulsen is asked, his answer: "it's possible. I am concerned that the Fed is so dovish in the face of rising core inflation." Which means that now that the "very serious economists" are talking about it, get ready to hear much more about the "threat of stagflation" for the US economy, a threat which the Fed is powerless to defeat unless it is willing to launch another market crash.

|

|||

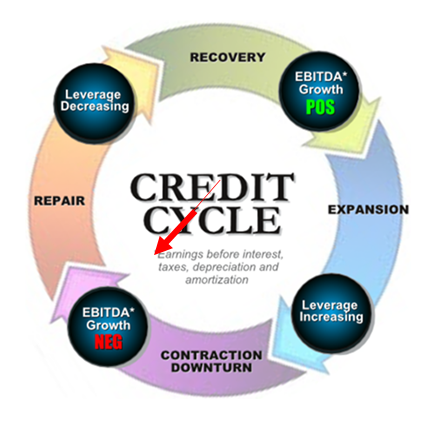

Why JPMorgan Believes:Central Banks Can No Longer Save The DayIn recent weeks, JPMorgan has turned decidedly sour on the US equity market: one month ago, on March 3, JPM announced that "for the first time this cycle", it has gone underweight stocks.

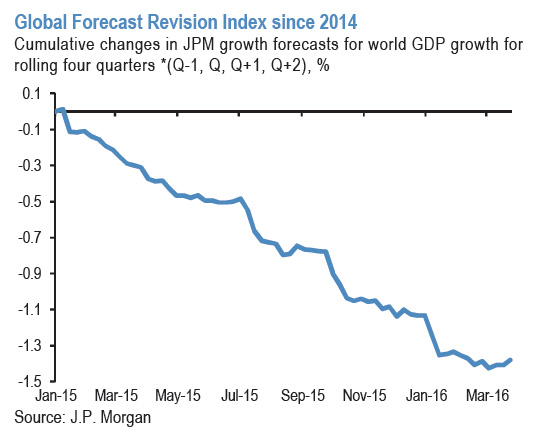

To be sure, the continued bounce since the JPM call has not been exactly reassuring of the forecast's accuracy. However, what is surprising is that when faced with unpalatable price action, sellside researchers usually flip their call quickly. Not in this case, because in a surprisingly candid piece released overnight, JPM's Jan Loeys doubles down, and after asking rhetorically "Can central banks really save the day, or cycle?", his answer is no. In fact, after saying now is the time to sell stocks, JPM's head of global asset allocation is now even far more concerned about the over economy where his biggest concern is that central banks are powerless to stop the "collapsing productivity growth." Loeys begins as follows:

And here is why JPM's explanation why central banks are now powerless to stop the ongoing global contraction:

This is something we noted last night when we noted the increasing prevalence of warnings about an upcoming US stagflation. It is also what is most troubling to JPM.

* * * But perhaps most amusing was the following Freudian slip in the JPM piece:

Then why bring it up... and if you don't, who does |

|||

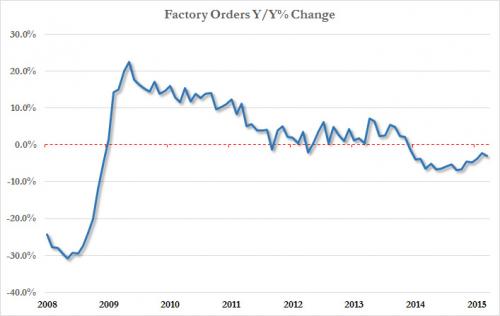

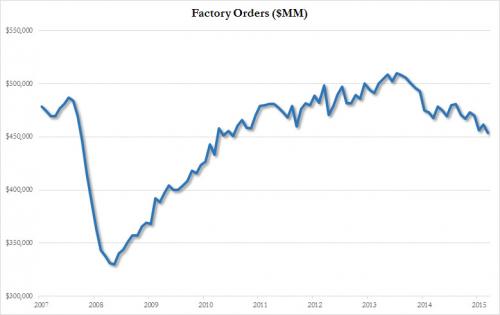

Manufacturing Recession Deepens:Factory Orders Drop To Five Year Low;16 Consecutive DeclinesIn 60 years, the US economy has not suffered a 16-month continuous YoY drop in Factory orders without being in recession. Moments ago the Department of Commerce confirmed that this is precisely what the US economy did, when factory orders not only dropped for the 16th consecutive month Y/Y, after declining 1.7% from last month... ... but at $454 billion for the headline number, this was the lowest print since the summer of 2011. Market reaction: stocks rebound on the news and are now well in the green

|

|||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market - WEDNESDAY STUDIES | |||

| STUDIES - MACRO pdf | |||

TECHNICALS & MARKET |

|

||

| COMMODITY CORNER - AGRI-COMPLEX | |||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

|

2016 | THESIS 2016 |  |

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

Chris Casey: “COST-PUSH INFLATION ISANOTHER KEYNESIAN CONCEPT THE FEDBELIEVES IN –They’re Wrong!”FRA Co-founder Gordon T. Long is joined by Christopher P. Casey in discussing the decrease in oil price and its potential effect on the global economy.

COST PUSH INFLATION

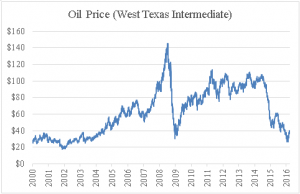

It used to be that minor shifts in the oil price had profound impact on the economy, but that isn’t the case right now. Oil went from about $25 in 2003 to $140 in 2008, back down to $30 in late 2008, and $140 a couple of years ago. But have we ever seen a price level that rose or decreased according to the oil prices over the last fifteen years? The answer is no. The issue is that the Federal Reserve does believe in cost-push inflation, and they do think that deflation could be caused by lower oil prices.

There’s a possibility that this could spike interest rates, or mitigate a downfall in interest rates. STATE OF THE OIL MARKETS

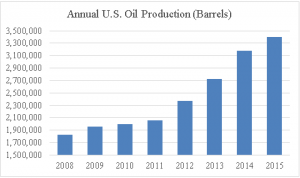

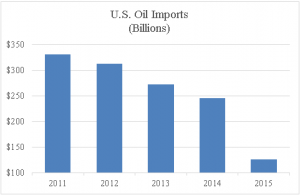

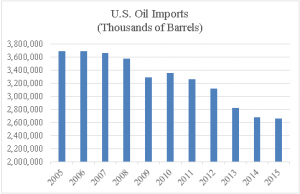

Lower energy prices used to be considered good for the economy, since people have more money to spend. But that’s going toward servicing debt; it’s not actually consumption, it’s going toward debt payments. There are also some real dangers that aren’t being discussed by mainstream media. Oil production has increased about 85% since 2008, but what isn’t mentioned is how oil imports have decreased. It’s down from approximately 12% of total imports to 5% today, not just in Dollar terms but overall volume. T

SAUDIA ARABIA PEG The Riyadh is pegged to the US Dollar at 3.75 Riyadh to the US Dollar, but their economy is under strain and their deficit is staggering. In any fixed exchange rate, the only way to keep it is through manipulation of the currency market by active buying and selling of Riyadh and US Dollars, but that is only making them go bankrupt faster. This could ultimately affect US interest rates as well. OIL SUPPLY & DEMAND

FEDERAL RESERVE’S MISCONCEPTIONS Regarding the nature of growth, history shows that the key is a high level of savings and decreasing government intervention. Another is the idea of deflation being bad; for example, the US experienced experienced two 30-40 year periods where the price level fell by half, but it was also the greatest period of growth in US history. The Federal Reserve also has misconceptions about inflation’s impact on unemployment, and interest rates, which could cause a banking crisis. ADVICE FOR INVESTORS If people believe that the oil market will create a banking crisis in the future, then they need to look at assets outside of the banking system. Gold and silver should absolutely be considered as part of their portfolio since it’s much safer than a number of currencies, as it has alternative value. Farmland is also an excellent inflation hedge and pays a dividend, unlike precious metals.

Abstract by: Annie Zhou: [email protected] Video Editing by: Min Jung Kim <[email protected]

|

|||

|

2013 2014 |

|||

2011 2012 2013 2014 |

|||

I - POLITICAL |

|||

CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM

MACRO MAP - EVOLVING ERA OF CENTRAL PLANNING

|

G | THEME | |

| - - CRISIS OF TRUST - Era of Uncertainty | G | THEME | |

CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION - RESENTMENT. |

US | THEME PAGE |  |

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | G | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MA w/ CHS |

|

| 01-08-16 | THEME | MA w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MA w/ CHS |

III-FINANCIAL |

|||

|

FLOWS - Capital, Liqudity & Credit Flows

|

MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | 12-31-15 | THEME | |

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

|||

|

SII |  |

|

|

SII |  |

|

|

SII |  |

|

|

SII |  |

|

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP