|

JOHN RUBINO'SLATEST BOOK |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

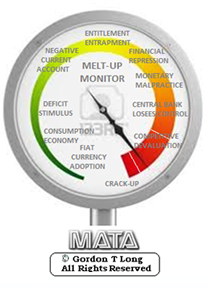

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Tue Apr. 14th, 2015

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

STRATEGIC INVESTMENT INSIGHTS

2015 THESIS: FIDUCIARY FAILURE

2015 THESIS: FIDUCIARY FAILURE

NOW AVAILABLE FREE to Trial Subscribers

174 Pages

What Are Tipping Poinits?

Understanding Abstraction & Synthesis

Global-Macro in Images: Understanding the Conclusions

![]()

| APRIL | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | |||

| 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 12 | 13 | 14 | 15 | 16 | 17 | 18 |

| 19 | 20 | 21 | 22 | 23 | 24 | 25 |

| 26 | 27 | 28 | 29 | 30 | ||

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar Weakness |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

TODAY'S TIPPING POINTS

|

![]() Scroll TWEETS for LATEST Analysis

Scroll TWEETS for LATEST Analysis ![]()

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro |

|||

|

|

Posting Date |

Labels & Tags | TIPPING POINT or THEME / THESIS or INVESTMENT INSIGHT |

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

| NOTION - Are Lending Institutions on "Lock Down"? | |||

COLLAPSING CREDIT - Public & Corporations Unable to Secure More Credit "There Are Big, Big Problems" - The Shocker Crushing The Economy Revealed 04-13-15 Zero Hedge We are grateful to Alexander Giryavets at Dynamika Capital for pointing us to something which is far more troubling than even the Atlanta Fed's collapse in Q1 GDP tracking: namely the latest Credit Managers Index for the month of March which "deteriorated significantly over the last two months and current readings stand at the recessionary levels not seen since 2008." To be sure, we have previously shown the collapse in consumer debt as reported by the Fed, which as we noted, just suffered its worst month for revolving credit since December 2010 and explains "why the consumer has literally gone into hibernation - it has nothing to do with the weather, and everything to do with the unwillingness to "charge" purchases, which in turn is a clear glimpse into how the US consumer sees their financial and economic future."

It turns out it may not have been just a matter of demand: apparently something very dramatic has been happening in February and especially in March. Instead of spoiling the punchline, we will leave it to the National Association of Credit Managers to explain what happened: From the latest NACM Credit Managers Index:

You mean it wasn't the weather? "As was the case last month, the majority of the damage was seen in the service sector and this month it is going to be hard to blame it all on the weather or some other seasonal factor." Ok, good to know that we were correct in mocking all those "economisseds" who say the recent collapse in seasonally-adjusted (as in adjusted for the seasons... such as winter) data was due to the, well, winter, a winter in which 3 of 4 months were hotter than average! So what is going on? Well, nothing short of another recession it appears.

Of course, in a world in which the only economic growth comes as a result of new credit entering the economy (as opposed to Fed reserves being stuck in the S&P), the only thing that matters is how easy it is to get credit into the hands of those who need it. As it turns out it has never been more difficult to get credit. No really! According to the CMI, the Rejections of Credit Applications index just crashed the most ever, surpassing even the credit crunch at the peak of the Lehman crisis. This can be seen on the chart below. And without any new credit entering the economy, a recession is all but assured. More details on what may be the most critical and completely underreported indicator for the US economy. The report continues, with such a dire narrative that one wonders how it passed through the US Ministry of Truth's propaganda meter:

For those who enjoy tables, here it is: Just in case there was still confusion about what is truly going on when one strips away the daily "S&P500 is at all time highs" propaganda and iWatch infomercials, here is some more doom and gloom from the source:

And the stunner:

No other commentary necessary.

|

04-14-15 | US CONSUMPTION | 25 - Public Sentiment & Confidence |

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - April 12th, 2015 - Apr. 18th, 2015 | |||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 1 | ||

| CHINA BUBBLE | 2 | ||

| JAPAN - DEBT DEFLATION | 3 | ||

| BOND BUBBLE | 4 | ||

EU BANKING CRISIS |

5 |

||

| SOVEREIGN DEBT CRISIS [Euope Crisis Tracker] | 6 | ||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market | |||

| TECHNICALS & MARKET |

|

||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

FINANCIAL REPRESSION - Negative, long-term effects of massive Money Printing American Thinker posted essay emphasizes the negative, long-term effects of massive money printing through quantitative easing (QE) & of the zero interest rate policy (ZIRP) .. it's all about the financial repression of interest rates - the thinking being that if this were not done, the pain of allowing the free markets to determine interest rates would be unbearable - "One need only imagine the bipartisan political panic were the interest paid by the U.S. federal government on its debt to double or triple, squeezing out hundreds of billions of dollars of spending on military and social programs. It is becoming ever more obvious to ever more people that sustaining these 'financial repression' policies is making economies ever more comatose; ever less dynamic. Exactly when the accumulating long-term economic damage becomes more onerous to central bankers and politicians than the short-term damage of ending QE and ZIRP can’t be known. But that inflection point will come, desired or not; willed or not. It is not avoidable." If the world’s central bankers are successful in pursuit of their short-term goals by the use of Quantitative Easing (QE) and Zero Interest Rate Policy (ZIRP) -- winning the race to the bottom in currency devaluation to the cheers of economically dogmatic, faux-literate media -- these bankers can’t then avoid being failures over the intermediate and longer terms in the race to attract productive, job creating investment. This appeared on April 10 in ZeroHedge.com:

There is no argument now that what has been and is currently missing from the global economic recovery is private market investment in the means of production -- land, building, equipment, productivity-related technology, and software. Attempts in the last 7 years by governments to tax, print, borrow, and regulate their way to prosperity are ever more clearly the reason that this private market investment has been and is being delayed, deferred and cancelled. No sane corporate manager invests long term into a currency that is being persistently undercut by official doctrines -- QE and ZIRP -- nor into an economy undermined by unpredictable waves of regulation and potentially confiscatory tax regimes. This cause and effect is now being denied only by the most dogmatic of progressive ideologues and blindest “social economists”. Despite the obvious, the central bank of every major country on the planet currently has one or both of these programs in force. The U.S. Fed has, to it credit, ended QE. It is clear, however, that ending ZIRP is going to be a difficult and painful process. And there are more than a few smart observers who think ZIRP will never voluntarily end in the U.S. -- nor in Japan, nor in Europe. Their judgment is that the pain of allowing the free markets to retake control of the level of interest rates of intermediate and long maturity bonds, called ending ‘financial repression’, will prove unbearable. One need only imagine the bipartisan political panic were the interest paid by the U.S. federal government on its debt to double or triple, squeezing out hundreds of billions of dollars of spending on military and social programs. It is becoming ever more obvious to ever more people that sustaining these 'financial repression' policies is making economies ever more comatose; ever less dynamic. Exactly when the accumulating long-term economic damage becomes more onerous to central bankers and politicians than the short-term damage of ending QE and ZIRP can’t be known. But that inflection point will come, desired or not; willed or not. It is not avoidable. Michael Booth, often posting and commenting as Cato, lectured in finance and economics at the Univ. of Texas, and worked for 20 years as an independent contractor and managerial trainer on financial topics in the technology industry. |

04-13-15 | THESIS | |

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

I - POLITICAL |

|||

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | G | THEME | |

| - - CORPORATOCRACY - CRONY CAPITALSIM | THEME |  |

|

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MACRO w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

III-FINANCIAL |

|||

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP