|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Fri. July 10th, 2015

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

![]()

| JULY | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | |||

| 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 12 | 13 | 14 | 15 | 16 | 17 | 18 |

| 19 | 20 | 21 | 22 | 23 | 24 | 25 |

| 26 | 27 | 28 | 29 | 30 | ||

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar Weakness |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

TODAY'S TIPPING POINTS

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

TIPPING POINTS |

|||

Varoufakis' Stunning Accusation: Schauble Wants A Grexit "To Put The Fear Of God" Into The French Submitted by Tyler Durden on 07/10/2015 - 16:33 Submitted by Tyler Durden on 07/10/2015 - 16:33

"Schäuble is convinced that as things stand, he needs a Grexit to clear the air, one way or another. Suddenly, a permanently unsustainable Greek public debt, without which the risk of Grexit would fade, has acquired a new usefulness for Schauble. What do I mean by that? Based on months of negotiation, my conviction is that the German finance minister wants Greece to be pushed out of the single currency to put the fear of God into the French and have them accept his model of a disciplinarian

|

07-11-15 | GLOBAL RISK Geo-Politics Greece |

3 - Geo-Political Event |

Submitted by Tyler Durden on 07/10/2015 - 16:33 Varoufakis' Stunning Accusation: Schauble Wants A Grexit "To Put The Fear Of God" Into The FrenchEarlier we reported that Yanis Varoufakis, seemingly detained by "family reasons" would be unable to join his fellow parliamentarians and personally vote in what is likely the most important vote of Syriza's administration: the one in which he and his party capitulate to the Troika and vote "Yes" to the proposal he and Tsipras urged everyone to reject just one week ago. Subsequently, it was made clear what these family reasons are:

Judgment aside about his decision to take a holiday from a vote that his strategy guided Greece into, it was clear that he has Wifi on the ferry because this afternoon, While V-Fak may well have been in transit, the Guardian released an Op-Ed penned by Varoufakis titled "Germany won’t spare Greek pain – it has an interest in breaking us." Readers can read it in its entirety here but here is the punchline:

He does have a point: Recall "Forget Grexit, "Madame Frexit" Says France Is Next: French Presidential Frontrunner Wants Out Of "Failed" Euro." So perhaps making an example of the social collapse that would result from a Eurozone exit, would be seen a good lesson for French voters ahead of the 2017 French presidential elections in Schauble's mind But is Varoufakis right? Perhaps ... but also recall this from the FT in 2014 recalling Europe's first formulation of Plan Z:

Will this time Merkel risk the explosion of the Eurozone with her own actions: her biggest historic legacy? Probably not, and while Schauble has much sway, it is still Merkel's word over his. No, Varoufakis may be right about Greece being made an example of (unless he is merely trying to deflect blame from himself for putting Greece in this position and for conspicuously avoiding voting for a plan he himself derided untilt the end), but the one person who will decide the future of Greece in the Eurozone is neither Schauble nor Merkel but Mario Draghi, also known as Goldman Sachs. Because if Goldman wants more Q€, it will get more Q€. |

|||

"BEST OF THE WEEK " MOST CRITICAL TIPPING POINT & THEMES ARTICLES THIS WEEK July 5th, 2015 - July 11th, 2015 |

|||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

GEO-POLITICAL EVENT RISK - Why Greece Matters

|

07-07-15 | GLOBAL RISK Geo-Politics Greece |

3 - Geo-Political Event |

GEO-POLITICAL EVENT RISK - Why Greece Matters Submitted by Tyler Durden on 07/06/2015 17:29 -0400 "Greece Is Coming To Your Neighborhood" Marc Faber Warns

That's Marc Faber's message to all of those who may still think that Greece doesn't matter in the grand scheme of things. In an interview with Bloomberg TV, Faber talks Greece, China, and of course the Fed. On Greece:

|

07-07-15 | GLOBAL RISK Geo-Politics Greece |

3 - Geo-Political Event |

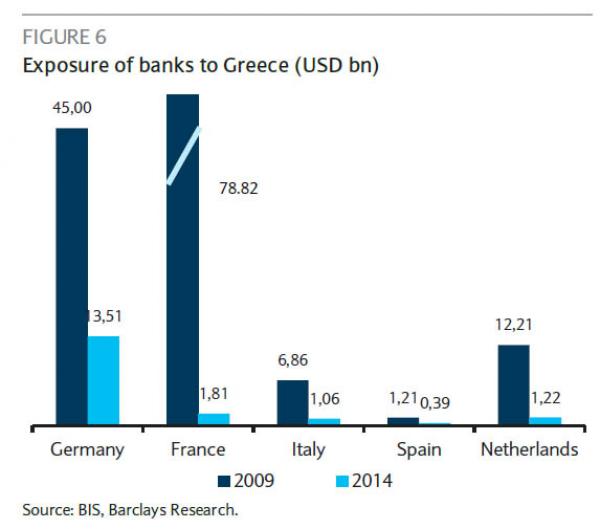

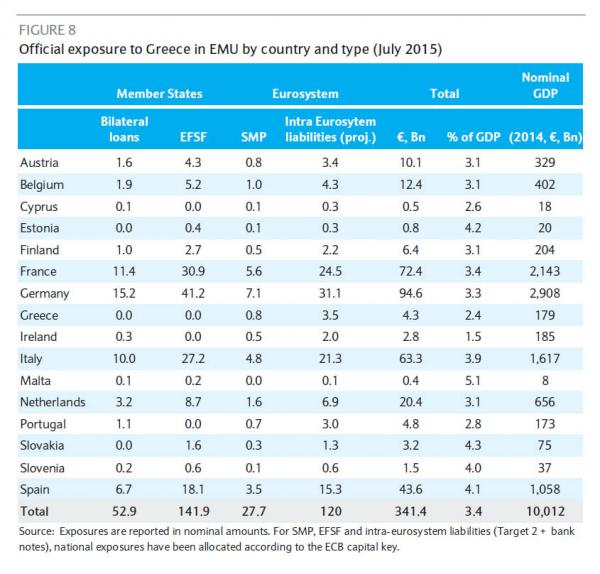

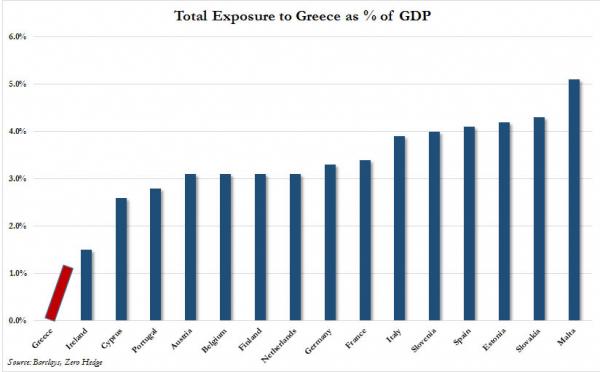

Submitted by Tyler Durden on 07/06/2015 16:37 -0400 Why Greece Matters A Lot: The Case Of Europe's Falling DominoesOver the weekend, we showed why contrary to unfounded speculation that Greece is entirely contained, there are still extensive linkages when it comes to the fallout a Grexit would reap if not directly on private commercial banks which over the years managed to offload their Greek exposure to the Europe's taxpayers.... ... but on the sovereign economies of the Eurozone as well as the ECB, at first via the EFSF, then also via the SMP, the MRO, Target 2 and so on. Overnight, Barclays took this analysis and also showed the absolute national euro exposure to Greece broken down by bailout program and also as a % of respective host nation's GDP. What it found is the following: And here is what it looks like when we redo our prior chart showing just European Grexit exposure via EFSF, to total sovereign exposure as a % of GDP. The total amount in question: €341 billion, or just about 3.4% of the €10 trillion in notional European GDP.

But wait, rules-based Europe has "firewalls" now, all laid out and proper, so there can't possibly be contagion. Only that's not true: for example, two years after introducing the OMT, the ECB still does not even have a regular term sheet laying out the rules of what the purpose of the OMT is aside to be some massive, amorphous "whatever it takes" bazooka. And as for the ECB's QE, it is all downhill from here as net issuance in Europe trickle to a halt, and the ECB risks crushing an already illiquid bond market by monetizing even more of it. Of course, it could engage in outright stock monetization but that would be the signal that the end of the current system is truly near. As for "rules-based", we'll just leave that to the ECB which just hiked Greek bank collateral effectively admitting the banks are insolvent, but not too insolvent, because now the ECB is officially and without doubt a political entity whose only purpose is to further political agenda. But that's just the beginning, and as Barclays cautions investors have largely taken the view that even if the worst case scenario did unfold, the impact on portfolios would be manageable. At this point Barclays warns that it is perfectly plausible that this Sunday’s “no” vote may not follow the benign narrative that markets have largely adopted. Below are some of the scenarios where the contagion will be worse than any algo, not to mention central banker, expects:

All of this puts into perspective today's ECB decision to raise Greek haircuts, because as Goldman noted two weeks ago, it appears to have ultimately been the ECB's intention to launch a controlled Grexit contagion, one where Europe will see a steep but not too dramatic drop in its GDP, and perhaps a triple-dip recession can be avoided once more with some new changes in the definition of what GDP is, all so Mario can pull a Kuroda from October 31, 2014 and increase the ECB's QE just so European stocks rise higher, and just as importantly, the EUR slides even more (some 7 figures according to Goldman) toward parity which make both Europe's - really Goldman's - bankers delighted when gettting their year end bonus, and keep Germany's exporters happy. As for the collateral damage, i.e., millions of broke Greeks who just lost everything, you know what they say about making a QE omelette. Curiously, the German government hasn’t published estimates of how much it could lose in case of a default, arguing that this scenario could unfold in too many different ways. However, as the WSJ reports, according to the Munich-based Ifo economic institute, total German exposure to Greece, including the loans and a host of other liabilities, at €88 billion while S&P estimates it at €91 billion. This is in line with the estimate shown above. According to Jens Boysen-Hogrefe, economist with Kiel-based institute Ifo, the hit “would hardly be noticeable for Germans." He may be right, but where he is wrong is looking at Greece as an isolated case: since Europe is, or rather was, a union, one has to evaluate the combined impact of a third of a trillion in impaired assets across the Eurozone. For the vast majority of European nations, the effect of a "write-off" of 3-4% of GDP would be sufficient to launch a depression, which would then promptly drag Germany lower as well, adverse impact (and thus quite welcome to Germany) on the EUR notwithstanding. We just hope that the ECB has done its math right and what it believes will be the contained demolition of Greece does not spiral out into an out of control tumble of dominoes, because not even a hollow "whatever it takes" threat from Draghi would offset that, especially if and when the deposit run moves from Greece to Italy, Spain and the rest of the Europe. |

|||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market | |||

| TECHNICALS & MARKET |

|

||

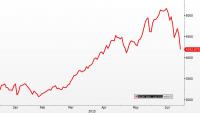

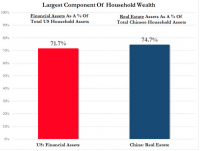

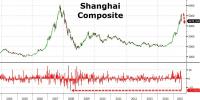

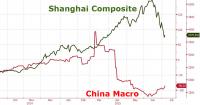

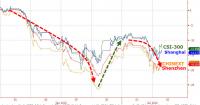

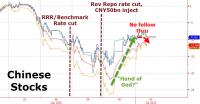

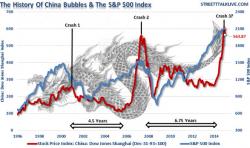

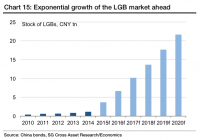

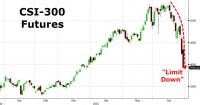

CHINESE STOCK MARKETS - 1929 In Chinese Markets China Crashes Most Since 2007 Amid "Panic Sentiment"; Over Half Stocks Suspended, PBOC Promises "Liquidity Support" Submitted by Tyler Durden on 07/07/2015 - 21:19 Submitted by Tyler Durden on 07/07/2015 - 21:19

*CHINA TRADING HALTS LEAVE 54% OF ENTIRE STOCK MARKET FROZEN, CHINA'S SHANGHAI COMPOSITE INDEX FALLS 8%, MOST SINCE 2007

|

07-08-15 | STUDY CHINA MARKETS |

STUDIES |

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||

| THEMES | |||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

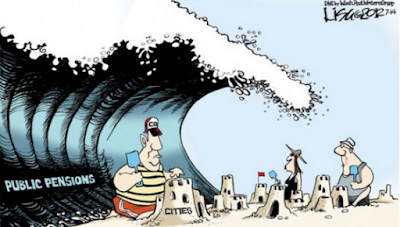

Posted by Cliff Küle at 7/09/2015 05:58:00 AM Chicago Considering a 30% Property Tax Increase To Pay Government PensionsQuestion to Martin Armstrong: With that our oldest daughter had been living in Chicago until 2 weekends ago. She decided some time back to search for a new employer and I had suggested she first sell her condo during the prime selling season and before 3Q 2015 hit. Within a few days she received a cash offer and closed on her place June 30. On her way home today she sent me this video link of Ron Emanuel considering a 30% property tax hike to help pay the huge pension deficit which, by the way Martin highlighted a few weeks back.

|

|||

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

Doug Casey's International Man Ending the Ownership of Moneyby Jeff Thomas As is now common knowledge, some of the world’s most powerful countries are insolvent due to ever-increasing sovereign debt. At this point, the economies are being held together through only one factor: continued faith in the currency by the average citizen. As soon as that faith disappears, the economies will crash. Not surprisingly, the leaders of these countries and their close associates (particularly the banks) are actively seeking means by which they can escape the effects of the crisis they have created and still retain some sort of control. For some time, I’ve predicted that one way in which they will accomplish this will be the elimination of cash, that in order to prevent a run on the banks in which the average citizen simply removes his money from the system, such a removal would be made impossible by ending the existence of bank notes. It would be replaced with an electronic currency system, so that the only “cash” that exists is a credit in a bank account. When this prediction was first suggested, it seemed to many to be both alarmist and ridiculous. Mankind has always had hard currency in some form, something physical that could be held in the hand. But with computerisation, the elimination of physical currency is possible. Banks, with the support of legislation, can require that all transactions (even the purchase of a candy bar) be electronically performed by the account holder. Once this has been achieved, two other advantages (to the bank, not to the account holder) become possible. First, paper currency can be eliminated, which assures that, no matter how bad things get, account holders can’t remove their cash from the bank and stuff it in a mattress at home, since no physical cash exists. Second, banks could then charge account holders interest for their savings accounts, since transactions could take place only through the banks. Now the concept of electronic currency is no longer the stuff of fairy tales. Most of the world’s governments have passed laws restricting the amount of cash an individual might use. Those who use cash over the designated amount are, in some cases, harassed or even investigated (generally for money laundering or drug dealing). Ecuador’s War on CashIn December 2014, Ecuador instituted its Sistema de Dinero Electrónico (SDE), the world’s first government-controlled electronic monetary system. (Other countries have electronic banking systems, but they are not state run.) And it is US-dollar based. Back in 2000, Ecuador adopted the US dollar as its official currency, dumping the sucre, which, as a result of hyperinflation, had become devalued to the point of 25,000 to one US dollar. So, the Ecuadoran government scheme will be dollar based. The system is being promoted as a new, easier way to make payments (either by card or cell phone), eliminating the need to carry cash and making it harder for thieves to steal. It is also being touted as a way to benefit the poor, although no reasons are being offered as to why this might be so. (If this were their true goal, Quito officials might instead allow for competing private-sector systems, to drive down costs.) The system is being introduced piecemeal. At present, you can pay for a taxi and some services with the SDE, as well as send money between individuals. By year’s end, it will be possible to pay your taxes with it. To date, each of the steps taken by Ecuador follow the playbook as I originally put forward. Should Ecuador continue to follow the prediction, when the SDE reaches the point that virtually everyone in the country has an account and is making the majority of their payments by either a debit card or cell phone, the government will announce that paper currency is to be eliminated. The explanation given at the time might be that cash would no longer be necessary and would be a drain on the economy. (Ecuador spends three million dollars annually replacing worn-out bills.) Sceptics both within and outside of Ecuador have suggested that the new system may simply be a way of dumping the dollar, but, if anything, the Ecuadoran government is enhanced by the continued use of the dollar. First, the dollar has allowed relatively low inflation and low interest rates. Second, the dollar is less likely to hyperinflate than a reinstated sucre. Third, the sceptics are overlooking the fact that, once the dollar is electronic only, Ecuador never need buy dollars again. The electronic dollar would be a dollar in name only. In reality, it would not exist. It would be an electronic concept. (That last bit will take some getting used to, not only in Ecuador, but worldwide.) Monkey See, Monkey DoAs Ecuador demonstrates the workability of its electronic system, I believe that neighbouring countries will jump on the bandwagon quickly. Each government will say to itself, “Government control of all monetary transactions? Where do we sign up?” An additional benefit will be the apparent stability of the US dollar. As long as the dollar holds up, governments like Ecuador (and other countries, such as Uruguay and Argentina, that use the dollar as a second currency) will gladly base deposits in dollars. So, that covers the larger, critically indebted countries, plus the Third-World countries. What of the smaller, prosperous countries whose currencies are presently sound? It’s entirely possible that smaller, more stable countries, such as Bermuda, the Cayman Islands and Hong Kong, will get on board with the electronic system. They’ll need to, in order to continue international banking. However, if their own currencies are stable, there’s no real reason for them to eliminate their own currencies for local usage. These currencies may therefore continue, although there’s the danger that either the banks (realising that they can only charge interest on deposits, not on cash kept at home) or governments (who, above all, seek control over their people and recognise monetary control as a primary control) may very well opt to eliminate paper currency. But is the loss of physical currency really such a bad thing? After all, the elimination of cash does create convenience and might just limit theft in the world to some degree. Yes, it is indeed quite a bad thing. The overriding effect that the elimination of cash will have on people will be that they will lose their freedom of monetary movement. They will be subject to government and banking surveillance of every transaction and, increasingly, will be subject to legislation that limits currency movement. Once this point is reached, governments will be free to move to a stage in which they declare that money is not the possession of the individual or company. It’s the possession of the government and the government “allows” the public to use its currency in order to conduct commerce. As such, individuals and companies had best “behave,” or they might find the privilege taken away and the money confiscated. Of course, the reader may well find this final step to be beyond the pale, even for today’s overreaching governments. Just a year ago, the very concept of a War on Cash itself was considered to be a mere fantasy, yet we are already clearly transitioning into the End of Cash. And So…And so, anyone who wishes to retain control of his own economic life will soon be facing the realisation that:

The field for such ownership is becoming increasingly limited. It consists primarily of precious metals and real estate, and even those stores of wealth are truly safe only if located in a jurisdiction that is not on the verge of insolvency and whose government is both stable and relatively benign. Such jurisdictions do exist, but “cash,” as it exists today, must be moved out of hazardous jurisdictions and converted to a safer form of wealth protection before the final legislations have been passed, making cash illegal. Editor’s Note: We’ve discovered one of the easiest and most convenient ways to own and store physical gold and silver offshore (in places like Singapore and Switzerland in a non-bank private vault). Find out how you can internationally diversify your precious metals by downloading this guide. |

07-09-15 | THEME CASHLESS SOCIETY War On Cash |

|

Submitted by Phoenix Capital Research on 07/08/2015 12:21 -0400 Systemic "Holidays" Are Coming to Banks, Money Market Accounts and More in the Weeks AheadThis morning both the NYSE broke (canceling all open orders) and China outlawed selling stocks for large investors. These two items seem completely unrelated… however, the reality is they are both based on a them we outlined back in May 2015. That theme is as follows: that as the next Crisis unfolds, it will more and more difficult to get your money out of the financial system. The reason for this concerns the actual structure of the financial system. As we’ve outlined previously, that structure is as follows:

When looking over these data points, the first thing that jumps out at the viewer is that the vast bulk of “money” in the system is in the form of digital loans or credit (non-physical debt). Put another way, actual physical money or cash (as in bills or coins you can hold in your hand) comprises less than 1% of the “money” in the financial system. Suffice to say, one of the biggest concerns for the Federal Reserve is what would happen if a significant percentage of investors decided to move into physical cash. Indeed, this is precisely what happened in 2008 when depositors attempted to pull $500 billion out of money market funds. A money market fund takes investors’ cash and plunks it into short-term highly liquid debt and credit securities. These funds are meant to offer investors a return on their cash, while being extremely liquid (meaning investors can pull their money at any time). This works great in theory… but when $500 billion in money was being pulled (roughly 24% of the entire market) in the span of four weeks, the truth of the financial system was quickly laid bare: that digital money is not in fact safe. To use a metaphor, when the money market fund and commercial paper markets collapsed, the oil that kept the financial system working dried up. Almost immediately, the gears of the system began to grind to a halt. When all of this happened, the global Central Banks realized that their worst nightmare could in fact become a reality: that if a significant percentage of investors/ depositors ever tried to convert their “wealth” into cash (particularly physical cash) the whole system would implode. As a result of this, the Fed and the regulators are looking to implement moves that would make it much harder to move money OUT of the markets and into cash. Consider the following… the SEC has actually implemented regulations to stop withdrawals from happening should another crisis occur. The regulation is called Rules Provide Structural and Operational Reform to Address Run Risks in Money Market Funds. It sounds relatively innocuous until you get to the below quote:

Also see… Government Money Market Funds – Government money market funds would not be subject to the new fees and gates provisions. However, under the proposed rules, these funds could voluntarily opt into them, if previously disclosed to investors. http://www.sec.gov/News/PressRelease/Detail/PressRelease/1370542347 In simple terms, if the system is ever under duress again, Money market funds can lock in capital (meaning you can’t get your money out) for up to 10 days. If the financial system was healthy and stable, there is no reason the regulators would be implementing this kind of reform. This is just the start of a much larger strategy of declaring War on Cash. Make no mistake, it is a full scale war that will involve regular tactics such as “breaking” the market so you cannot sell stocks… all the way up to the nuclear option: OUTLAWING physical cash altogether. |

07-09-15 | THEME CASHLESS SOCIETY War On Cash |

|

FINANCIAL REPRESSION - In A World Of Artificial Liquidity – Cash Is King In A World Of Artificial Liquidity – Cash Is KingNomi Prins: In A World Of Artificial Liquidity – Cash Is King 07-04-15 Submitted by Nomi Prins via PeakProsperity.com, Global central banks are afraid. Before Greece tried to stand up to the Troika, they were merely worried. Now it’s clear that no matter what they tell themselves and the world about the necessity or even righteousness of their monetary policies, liquidity can still disappear in an instant. Or at least, that’s what they should be thinking. The Federal Reserve and US government led policy of injecting liquidity into the US and then into the worldwide financial system has resulted in the issuance of trillions of dollars of debt, recycling it through the largest private banks, and driving rates to 0% -- or below. The combined book of debt that the Fed and European Central Bank (ECB) hold is $7 trillion. None of that has gone remotely into fixing the real global economy. Nor have the banks that have ben aided by this cheap money increased lending to the real economy. Instead, they have hoarded their bounty of cash. It’s not so much whether this game can continue for the near future on an international scale. It can. It is. The bigger problem is that central banks have no plan B in the event of a massive liquidity event. Some central bank entity leaders have admitted this. IMF chief, Christine Lagarde for instance, warned Federal Reserve Chair, Janet Yellen that potential US rate hikes implemented too soon, would incite greater systemic calamity. She’s not wrong. That’s what we’ve come to: a financial system reliant on external stimulus to survive. These “emergency” measures were supposed to have healed the problems that caused the financial crisis of 2008 -- the excessive leverage, the toxic assets wrapped in complex derivatives, the resultant credit and liquidity crunch that occurred when banks lost faith in each other. Meanwhile, the infusion of cheap money and liquidity into banks gave a select few of them more power over a greater pool of capital than ever. Stock and bond markets skyrocketed as a result of this unprecedented central bank support. QE-infinity isn’t a solution -- it’s a deflection. It’s a form of financial subterfuge that causes extra problems. These range from asset bubbles to the inability of pension and life insurance funds to source longer term less risky long-term assets like government bonds, that pay enough interest for them to meet liabilities. They are thus at risk of rapid future deterioration and more shortfalls precisely because they have nothing to invest in besides more risky stock and lower-rated bond markets. Even the latest Bank of International Settlement (BIS) 85th Annual Report revealed the extent to which global entities supervising the banking system are worried. They harbor growing fears about greater repercussions from this illusion of market health (echoing concerns I and others have been writing about for the past seven years.) The BIS, or bank for the central banks was established during the global Great Depression in 1930 in Basel, Switzerland, when bank runs on people’s deposits were the norm. The body no longer buys into zero-interest rate policy as an economic cure-all. In their words, “Globally, interest rates have been extraordinarily low for an exceptionally long time, in nominal and inflation-adjusted terms, against any benchmark. Such low rates are the remarkable symptom of a broader malaise in the global economy.” They go on to note the obvious, “The economic expansion is unbalanced, debt burdens and financial risks are still too high, productive growth too low, and the room for maneuvering in macroeconomic policy too limited. The unthinkable risks becoming routine and being perceived as the new normal.” These are troubling words coming from an organization that would have much preferred to deem central bank policies a success. Yet the BIS also states, “Global financial markets remain dependent on central banks.” Dependent is a strong word. How quickly the idea of free markets has been turned on its head. Further, the BIS says, “Central bank balance sheets remain at unprecedented high levels; and they grew even larger in several jurisdictions where the ultra low policy rate environments were reinforced with large purchases of domestic and foreign assets.” Central banks are not yet there, but rising volatility is indicative of the accelerating approach to the nowhere left to go mark from a monetary policy perspective. This, after seven years of a reckless Anti-Main Street, inequality and instability inducing, policy. Not only have the major banks been the main recipient of manufactured liquidity, they have also received consolidated access to our deposits, which they can use like hostages to negotiate future bailout situations. Elite bankers moan about the extra regulations they have had to endure in the wake of the financial crisis, while scooping up cash dispersed under the guise of stimulating the general economy. Central banks seek fresh ways to keep the party going as countries like Greece shut down banks to contain capital flight, and places like Puerto Rico and multiple states and municipalities face economic ruin. But they are clueless as to what to do. In this cauldron of instability and lack of leadership, cash is the one remaining financial possession that Main Street can translate into goods, services and security. That’s why private banks want more control over it. Banks Want Your Cash For Their Latent Emergencies One of the most inane reasons cited for restricting cash withdrawals for normal people is that they all might turn out to be drug dealers or terrorists. Meanwhile, drug-dealing-money-laundering terrorists tend to get away with it anyway, by sheer ability to use a plethora of banks and off shore havens to diffuse cash around the globe. Every so often, years after the fact, some bank perpetrators receive money-laundering fines. For average depositors though, these are excuses for a bureaucracy built upon limiting access to cash whether from an ATM (many have $500 per day limits, some have less) or an account (withdrawals above a certain level get reported to the IRS). As Charles Hugh Smith wrote at Peak Prosperity recently, there’s a difference between physical cash (the kind you can touch and use immediately) and the electronic kind, associated with your bank balance or credit card cash advance limit. If you hold it, you have it – even if keeping it in a bank means it’s probably slammed with various fees. Banks, on the other hand, can leverage your deposits or cash, even while complying with various capital reserve requirements. That’s not new. But the expanding debates about how much of your cash you get to withdraw at any given moment, is. The notion of a bail-in, or recourse to people’s deposits, is related to the idea of restricting the movement, or existence, of physical cash. Bail-ins, like any cash limitations, imply that if a bank needs emergency liquidity, your deposits are the place to find it, which has negative repercussion on your own solvency. This is exactly what the Glass-Steagall Act of 1933, coupled with the creation of the FDIC sought to avoid – banks confiscating your money at the worst possible times. The ‘war on cash’ is thus really a war on the difference between the money you can hold on to and the money the banks can take away from you. The existence of this cash debate underscores the need for a personal policy of cash extraction from the big banks. Do you have one? In Part 2: They're Coming For Your Cash we detail out the growing threats to the liquidity that sustains the modern global banking system, and why it's more crucial than ever for people to consider extracting a portion of cash from their bank accounts. As existing liquidity streams dry up (as they are beginning to around the world), increasingly desperate banks will turn to the largest and most convenient source they know of: the collective cash savings we have on deposit with them. Click here to read Part 2 of this report (free executive summary, enrollment required for full access) |

07-06-15 | THEMES | |

| FINANCIAL REPRESSION - In A World Of Artificial Liquidity – Cash Is King | 07-06-15 | THEMES |

FINANCIAL REPRESSION |

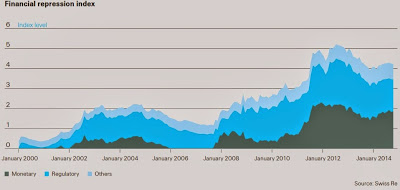

Posted by Cliff Küle at 7/05/2015 04:48:00 PM Sounding the Alarm on Financial RepressionSwiss Re video highlights the recent meeting they held with experts voicing concerns about the ongoing use of unconventional policies .. financial repression is causing financial market distortions & poses a serious risk to financial stability .. These unconventional policies have pushed institutional investors into holding government debt. As a result they have less money available for productive investment, such as infrastructure projects .. "It means that there's a global search for yield. That possibly leads to a misallocation of resources," says Douglas Flint, Group Chairman of HSBC .. Jean-Claude Trichet, Chairman of theGroup of Thirty affirms the risks. LINK HERE to the article & video Swiss Re: Financial Repression has cost U.S. Savers $470 BillionSwiss Re report highlights how artificially low interest rates have cost U.S. savers U.S.$470 Billion .. the report also explains how financial repression has exacerbated wealth/income inequality .. Swiss Re has also crafted a "Financial Repression Index" - see above .. "Looking ahead, financial repression is likely to remain a key tool for policymakers given the moderate global growth outlook and high public debt overhang. But, as outlined in this paper, financial repression comes with significant costs. Whether the costs outweigh the benefits largely depends on the ability of governments to take advantage of the low interest rate environment by implementing the right structural reforms. So far, their record for doing so has not been comforting, as also noted by the IMF .. Additional research on financial repression could be linked to the impact of an aging society on the broader economic and financial market environment and hence the optimal policy mix. Finally, a largely unexplored area is the consequence – especially longer-term – of public authorities acting as dominant players in their own bond markets. How does this affect private capital markets, and how severe are the distortions in price formation, investment decisions, allocation to productive areas and capital flows more generally?" .. the report includes a Foreward bySwiss Re Group Chief Investment Officer Guido Fürer. LINK HERE to get the report

|

|||

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

I - POLITICAL |

|||

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | THEME | ||

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MACRO w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

III-FINANCIAL |

|||

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP

We're gonna need a bigger rate cut...

We're gonna need a bigger rate cut...