|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Wed. Oct. 28th, 2015

Follow Our Updates

onTWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

ARCHIVES

| OCTOBER | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | ||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | 31 |

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar Weakness |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic | 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?We have analyzed & included

these in our latest research papers Macro videos!

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

TODAY'S TIPPING POINTS

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

| Market - WEDNESDAY STUDIES | |||

| TECHNICALS & MARKET |

|

||

| STUDIES - MACRO pdf | |||

Q3 EARNINGS IBM Tumbles After Disclosing SEC Investigation Into Its Revenue Recognition Submitted by Tyler Durden on 10/27/2015 - 13:57 Submitted by Tyler Durden on 10/27/2015 - 13:57

In August 2015, IBM learned that the SEC is conducting an investigation relating to revenue recognition with respect to the accounting treatment of certain transactions in the U.S., U.K. and Ireland. The company is cooperating with the SEC in this matter. Twitter Slides After Beating Earnings But Missing On Active Users, Guiding Below Expectations Submitted by Tyler Durden on 10/27/2015 - 16:20 Submitted by Tyler Durden on 10/27/2015 - 16:20

While we await the full Twitter slidedeck presentation, here are the key results as they come in. Apple Beats On Sales And EPS, Misses iPhone, iPads Sales, China Slows Down: The Quarter In ChartsSubmitted by Tyler Durden on 10/27/2015 - 16:52

|

10-28-15 | STUDIES | |

Oct. 25, 2015 8:11 p.m. ET

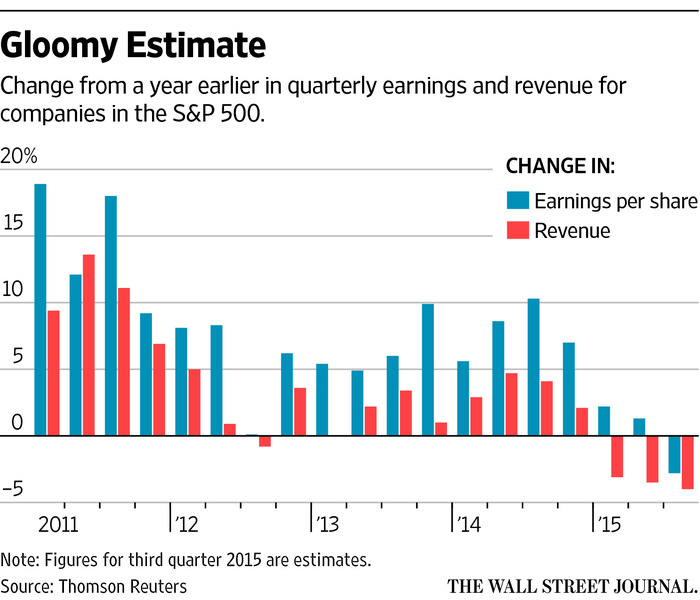

U.S. Companies Warn of Slowing EconomyBig firms to post first decline in both earnings and sales since the recession

Quarterly profits and revenue at big American companies are poised to decline for the first time since the recession, as some industrial firms warn of a pullback in spending. From railroads to manufacturers to energy producers, businesses say they are facing a protracted slowdown in production, sales and employment that will spill into next year. Some of them say they are already experiencing a downturn. “The industrial environment’s in a recession. I don’t care what anybody says,” Daniel Florness, chief financial officer of Fastenal Co., told investors and analysts earlier this month. A third of the top 100 customers for Fastenal’s nuts, bolts and other factory and construction supplies have cut their spending by more than 10% and nearly a fifth by more than 25%, Mr. Florness said. Caterpillar Inc. last week reduced its profit forecast, citing weak demand for its heavy equipment, and 3M Co., whose products range from kitchen sponges to adhesives used in automobiles, said it would lay off 1,500 employees, or 1.7% of its total, as sales growth sagged for a wide range of wares. The weakness is overshadowing pockets of growth in sectors such as aerospace and technology. Industrial companies are being buffeted on multiple fronts. The slump in energy prices has gutted demand for drilling equipment and supplies. Economic expansion is slowing in China and major emerging markets such as Brazil, which U.S. companies have relied on for sales growth. And the dollar’s strength also has eroded overseas profits. The drag on earnings and sluggish growth projections for next year come as the Federal Reserve considers raising interest rates for the first time in nine years, and could add momentum to those in favor of postponing any rate increase until next year. Profit and revenue are falling in tandem for the first time in six years, with a third of S&P 500 companies reporting so far. Analysts expect the index’s companies to book a 2.8% decline in per-share earnings from last year’s third quarter, according to Thomson Reuters. Sales are on pace to fall 4%—the third straight quarterly decline. The last time sales and profits fell in the same quarter was in the third period of 2009. At some companies, foreign-currency effects hurt results significantly. Consumer-products maker Kimberly-Clark Corp. predicted that currency swings would slash earnings by 25% this year, while Johnson & Johnson said that the dollar’s moves would reduce sales growth by almost 7 percentage points this year, even without further fluctuations. This week, another third of the S&P 500 are expected to report their results, including such giants as Apple Inc., United Parcel Service Inc. and Exxon Mobil Corp. Much of the anticipated decline stems from the hard-hit energy industry, where sales are expected to drop by more than a third from a year earlier and profits are likely to plummet 65%, Thomson Reuters says, based on analysts’ estimates. Basic-materials companies face a 17% drop in profits, and industrial sales are expected to decline more than 5%.  United Technologies Corp., which makes Otis elevators and Carrier air conditioners, said it expects profits to be flat or down in three of its four operating segments next year, despite strength in its U.S. operations. Chief Financial Officer Akhil Johri told investors last week that the Otis division’s sales in China fell 19% in the third quarter as commercial construction slumped. Other companies voiced similar concerns. “If you look at kind of the broad industrial-production index, you see industrial production sequentially coming down,” said Fredrik Eliasson, chief sales and marketing officer at railroad operator CSX Corp. CSX is scaling back some operations in response to declining coal shipments as power plants switch fuels, eliminating nearly 500 jobs in Corbin, Ky., and Erwin, Tenn. In the current quarter, the company plans to reduce its average head count by 2% from the third-quarter level. U.S. manufacturing production rose in September at its slowest pace in more than two years, the Institute for Supply Management reported earlier this month. Economic activity at 11 industries tracked by the group contracted during the month, while just seven reported growth. Meantime, manufacturers told ISM that customer inventories remained high, contributing to a slowdown in new orders. Some investors and analysts worry that companies accustomed to boosting earnings by cutting costs, repurchasing shares and refinancing debt will soon have to face the reality of worsening sales. “The ability of corporations to take a 1% to 2% revenue line [gain] and turn it into 5% to 6% profit growth is waning,” said Charlie Smith, chief investment officer of Fort Pitt Capital Group. “They’ve run out of rabbits to pull out.” Still, cost-cutting continues. Companies from Twitter Inc. and Biogen Inc. to Wal-Mart Stores Inc. and Monsanto Co. have announced job cuts in recent weeks. That could boost the U.S. unemployment rate, which ended September at 5.1%, its lowest point since April 2008. “Things are definitely a bit shakier than they were several months ago,” said Joseph LaVorgna, chief U.S. economist at Deutsche Bank. But, he added, “the U.S. is fundamentally in decent shape.” Indeed, low fuel prices have boosted U.S. car sales and buoyed airlines’ results, and the U.S. construction market remains robust. And, even among manufacturers, the aerospace industry is doing well. Technology giants Amazon.com Inc. and Microsoft Corp. posted strong results on Thursday, as did Google parent Alphabet Inc. Such strength suggests that the broader economy is unlikely to succumb to the industrial sector’s gloom, especially given robust profit margins, said Jeremy Zirin, chief U.S. equity strategist for wealth management at UBS. “The broad mosaic of data suggests that the U.S. economy is still doing OK,” Mr. Zirin said. “This isn’t a very bullish view, it’s just saying things aren’t as bad as feared.” Others worry that the slowdown is spreading to consumer businesses. Wal-Mart recently warned its sales this year are likely to be flat, down from projection of as much as 2% growth, and cut its earnings forecast for next year as it raises wages. The retailer blamed the strong dollar for the weakening sales growth. And truckload carriers have warned that they aren’t witnessing the usual uptick in retailer demand as the holiday season approaches, thanks to stubbornly high inventories, said Alex Vecchio, a transportation analyst at Morgan Stanley. “Transportation companies are typically a leading indicator, and our data is not good,” Mr. Vecchio said.

|

|||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Oct 25th, 2015 - Oct 31st, 2015 | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

China Unleashes The Jingoist Rhetoric: "If U.S. Ships Stop, We Should Lock Them By Fire-Control Radar" Submitted by Tyler Durden on 10/27/2015 - 19:14 Submitted by Tyler Durden on 10/27/2015 - 19:14

"In face of the US harassment, Beijing should deal with Washington tactfully and prepare for the worst. This can convince the White House that China, despite its unwillingness, is not frightened to fight a war with the US in the region, and is determined to safeguard its national interests and dignity. Beijing ought to carry out anti-harassment operations. We should first track the US warships. If they, instead of passing by, stop for further actions, it is necessary for us to launch electronic interventions, and even send out warships, lock them by fire-control radar and fly over the US vessels." Furious China Summons U.S. Ambassador, Slams Obama Decision To "Threaten Peace" With Warship Challenge Submitted by Tyler Durden on 10/27/2015 - 08:25 Submitted by Tyler Durden on 10/27/2015 - 08:25

Update: CHINA SUMMONS U.S. AMBASSADOR OVER SOUTH CHINA SEA PATROL: CCTV "The behavior of the U.S. warship threatened China’s sovereignty and national interest, endangered the safety of the island’s staff and facilities, and harmed the regional peace and stability."

|

10-27-15 | 3 | |

GEO-POLITICAL EVENT

|

10-27-15 | 3 | |

|

Submitted by Tyler Durden on 10/26/2015 It's On: Obama Sends Destroyer To Chinese Islands, China Vows Military ResponseUpdate: According to reports in on Monday evening, the USS Lassen has indeed sailed within 12 nautical miles of China's islands in the Spratlys. As WSJ notes, "an American defense official confirmed Monday that the U.S. Navy ship navigated through the waters around at least one of the land masses to which China lays claim within the Spratly chain of islands in the South China Sea, crossing an area that China maintains is part of its sovereign territory." WSJ also reiterates that this isn't likely to be a one-off event. As noted below, most "experts" believe that in order for this to be effective from a deterrence standpoint, the US will need to step up the patrols, presumably in an effort to prove to Beijing that the Pentagon is "serious", whatever that means in this context. The ball is now squarely in China's court. The PLA has already promised to "stand up and use force" in the event its territorial sovereignty is violated. The question now is whether Beijing will back down and concede that "sovereignty" somehow means something different with regard to the islands than it does with respect to the mainland or whether Xi will stick to his guns (no pun intended) and take a pot shot at a US destroyer. Earlier: For anyone who might still be somehow unaware, the US is currently in a superpower staring match with both Russia and China. The conflict in Syria has put Moscow back on the geopolitical map (so to speak), creating an enormous amount of tension with Washington whose regional allies have been left to look on in horror as Russian airstrikes and an Iranian ground incursion dash hopes of ousting President Bashar al-Assad. Meanwhile, in The South China Sea, Beijing has built 3,000 acres of new sovereign territory atop reefs in the Spratlys and although the reclamation effort itself isn’t unique, the scope of it most certainly is and Washington’s friends in the South Pacific are crying foul. Beijing has continually insisted that it doesn’t intend to use the islands as military outposts, but the construction of runways and ports seems to tell a different story and so, Washington felt compelled to check things out over the summer by sending a Poseidon spy plane complete with a CNN crew to the area. Once the PLA spotted the plane the situation escalated quickly with the Chinese Navy telling US pilots to “Go Now!” After that, an intense war of words developed with Defense Secretary Ash Carter insisting that the US would sail and fly anywhere it pleased and Beijing assuring the US that sailing within 12 nautical miles of the islands would prompt a harsh response from the PLA. For weeks, the US was rumored to have been planning a freedom of navigation exercise in the Spratlys which, as we’ve pointed out several times this month, amounts to sailing by the islands just to see if China will shoot. Now, according to CNN, Obama has given the green light and the ships may sail within 24 hours:

It's also worth noting that should the US manage to get away with this without sparking a shooting war with the Chinese, it now looks as though Washington is leaning toward making this a regular patrol. Here's a bit of color from Reuters out over the weekend:

(USS Lassen) Here are the latest visuals from Subi and Mischief (the two islands mentioned above): Not to put too fine a point on it, but this borders on the insane. Here we have both Washington and Beijing risking an outright military confrontation over what amount to a couple of sandcastles and while there's probably some truth to the contention that China has plans for the islands that go beyond growing plants, building lighthouses, and raising pigs, it's not as though the PLA is going to invade The Philippines so at the end of the day, this looks like another example of what Vladimir Putin recently suggested is evidence that the world is losing its collective mind.

|

|||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market | |||

| TECHNICALS & MARKET |

|

||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||

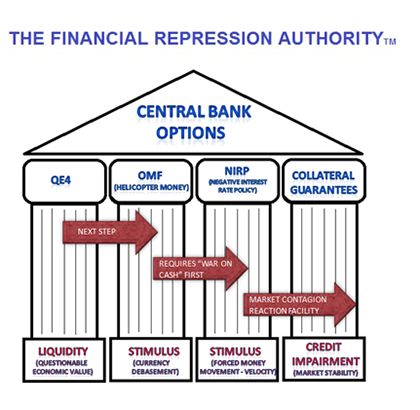

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

FINANCIAL REPRESSION INVESTING BASED ON THE AUSTRIAN SCHOOL OF ECONOMICS FRA Co-Founder Gordon T. Long discusses the Austrian School of Economics with John Butler and how its methodologies can be applied to the current global economy. John Butler has 18 years’ experience in the global financial industry, having worked for European and US investment banks in London, New York and Germany. Prior to launching the Amphora Commodities Alpha Fund he was Managing Director and Head of the Index Strategies Group at Deutsche Bank in London, where he was responsible for the development and marketing of proprietary, systematic quantitative strategies for global interest rate markets. Prior to joining DB in 2007, John was Managing Director and Head of European Interest Rate Strategy at Lehman Brothers in London, where he and his team were voted #1 in the Institutional Investor research survey. In addition to other research, he publishes the Amphora Report newsletter which appears on several major financial websites THE AUSTRIAN SCHOOL OF ECONOMICS “It is the no free lunch school of economics.” The Austrian school believes that economics systems are ultimately information systems. Some of those systems use information more efficiently and effectively than others, and in particular systems of which authorities of various kinds meddle with the market. Authorities may do this by extracting capital from the market via tax rates or even by manipulating the money of that market through some sort of artificial interest rate policy. “From the Austrian schools point of view, anything that impedes the free price information flow of an economic system will result in a sub optimal economic outcome.” Without the rule of law, without the ability to strongly enforce property rights, without the ability to prosecute fraud, and various other legal frameworks; the Austrian economic model cannot work. “Our goal is to make sure economic information flows as efficiently as possible within a solid legal structure.” HOW THE AUSTRIAN SCHOOL CAN BE APPLIED IN INVESTING Austrianism teaches us that the future is unpredictable. The economy is made up of the billions of people in the world, with each person making transactions almost every day. Each decision is an individual’s choice, and each decision, even the decision not to spend your money has some effect on the economy. “Austrian school provides you a way to identify distortions, a powerful way that is caused by a fiscal and monetary policy set such as interest rate or fiscal policy manipulation. Austrians are able to look at these policies and be able to see how they are impacting the investment environment. This gives you a sense of where the distortions are. In theory you get an idea of where you should be overweight and underweight from an investor’s point of view.” CURRENT EVENTS AMPHORA IS FOCUSED ON “Currently we are seeing a general overvaluation of risky assets that has been caused by truly an unprecedented set of highly expansionary monetary and fiscal policies throughout most of the world.” Income growth has not kept up; assets are expensive relative to incomes. So the correct strategy is not simply to short assets, which is dangerous; but if indeed they do look for ways to stimulate aggregate demand more directly rather than through the banking system. The correct strategies to have today are those that will perform if incomes begin to catch up to asset prices, it could be asset prices declining towards incomes or vice versa. It is impossible to know which one is going to happen, but it is highly likely looking forward that a conversion of the two will happen. POSSIBILITY OF NEGATIVE NOMINAL INTEREST RATES “Policy makers have become almost pathological; they have a relentless attitude to make their policies work.” “Problem with this is, once you get to this point, you can no longer question your original set of assumption. Austrian school of economics knows that the original sets of Keynesian assumptions that have gone into forming this unconventional and aggressive policy mix are themselves flawed. We are on this course where if it were left to run itself, policy makers will operation in these counter-productive directions because they will not question whether their assumptions are wrong.” “Banning cash will prevent people from making even the simplest transaction in their own neighborhoods; it will lead to complete riot and chaos.” “Putting a ban on cash is a terrible idea. It is terrible for them and for the economy as a whole. Sadly, with the way things are going, policy makers are going to teach everyone a very hard lesson about blindly accept anything the bureaucracy tells you to do.” CENTRAL BANKS ROLE IF ASSET CORRECTION OCCURRED “If you do get a major correction in asset markets that causes collateral problems in financial markets, the policy makers are out of options. The only thing they could do is begin capital controls” Prevent investors being able to freely liquidate or withdraw funds from their existing investments. This of course is very anti-capitalist, very inti-market. It goes directly against everything that a free enterprise economy should stand for; but when you follow these policies you will eventually get to a dead end. Abstract written by Karan Singh [email protected]

LELAND MILLER Talks QUALITY OF CHINA'S ECONOMIC REPORTING FRA Co-Founder Gordon T. Long interviews Leland miller, the president of the china beige book international and discusses financial repression in the context of the Chinese economy. He describes himself as a Lifelong china watcher who decided to do something about the complete lack of data in china. “One of the things that the china beige book plans to do is to give people a real picture of not just the growth dynamics, but also the labor market, the credit dynamics, the macro implications of Chinese growth, indications of future Chinese demand, implications of commodity markets around the world, we try to give the people a much better picture on what’s actually happening instead of just relying on official data and press release”. FINANCIAL REPRESSION Leland describes the Chinese reform as a reversal of financial repression and this repression in the context of the Chinese economy is the oppression of consumers and households by state organizations through its economic systems. “It means reversing this long time economic model, where the state will profit through the economic system at the expense of the consumers and household, and one of the things that the new leadership is intent on doing in order to create consumption is to empower consumers, so they spend more and stop empowering state organizations which are fuelling the overcapacity and the massive debt bubble”. What should investor know about china? He explains the biggest misconception concerning the Chinese economy is believing the GDP tells you much about how china is doing. “It is a broad, blunt indicator that doesn’t measure productive growth or credit dynamics”. On some of the challenges of getting reliable data in china, Leland explains that he and his team had to ask Chinese firms and consumers on ground what is happening in the country, and set up a number of polling units across sectors in order to get reliable and accurate information. Economic trends in china “For years we have been talking about the Chinese slowdown; it’s inevitable, despite the fact that the economy has been slowing”. He goes on to explain that although the market sentiment has gone from optimism to “Armageddon” in recent months, the actual data is at odds with these sentiments. As a result of china’s economic slowdown, there is great vulnerability among emerging markets. Now, the reason for this is that for years these markets have relied on china’s demand without factoring the likelihood of a decline or certainty of a decline in china’s demand. On China’s view of America, Leland has this to say “The Chinese look at America as a model that they are interested in taking pieces from; they like the dynamism of the economy and the global status. On one hand, they see us as a model to learn a lot of things from but also as a serious threat that is looking to constrain their inevitable and ultimate rise”. Abstract written by chukwuma uwaga [email protected]

|

10-26-15 | THESIS | |

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

I - POLITICAL |

|||

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | THEME | ||

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MACRO w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

| STANDARD OF LIVING - SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

III-FINANCIAL |

|||

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

TO TOP